Financial planning fees vary dramatically across the industry, with costs ranging from $100 per hour to over $10,000 annually depending on your needs and advisor type.

We at Davies Wealth Management believe transparency around financial plan cost helps you make informed decisions about your investment future. Understanding fee structures and what drives pricing differences puts you in control of your financial planning budget.

Which Fee Structure Works Best for You?

Financial advisors use three primary fee models, each with distinct advantages and drawbacks. Hourly rates typically range from $200 to $400 per hour. This structure suits clients who need specific advice on limited topics. The average session costs $268 per hour, but you pay only for time used. This model works well for young professionals or those with straightforward financial situations who want targeted guidance without ongoing commitments.

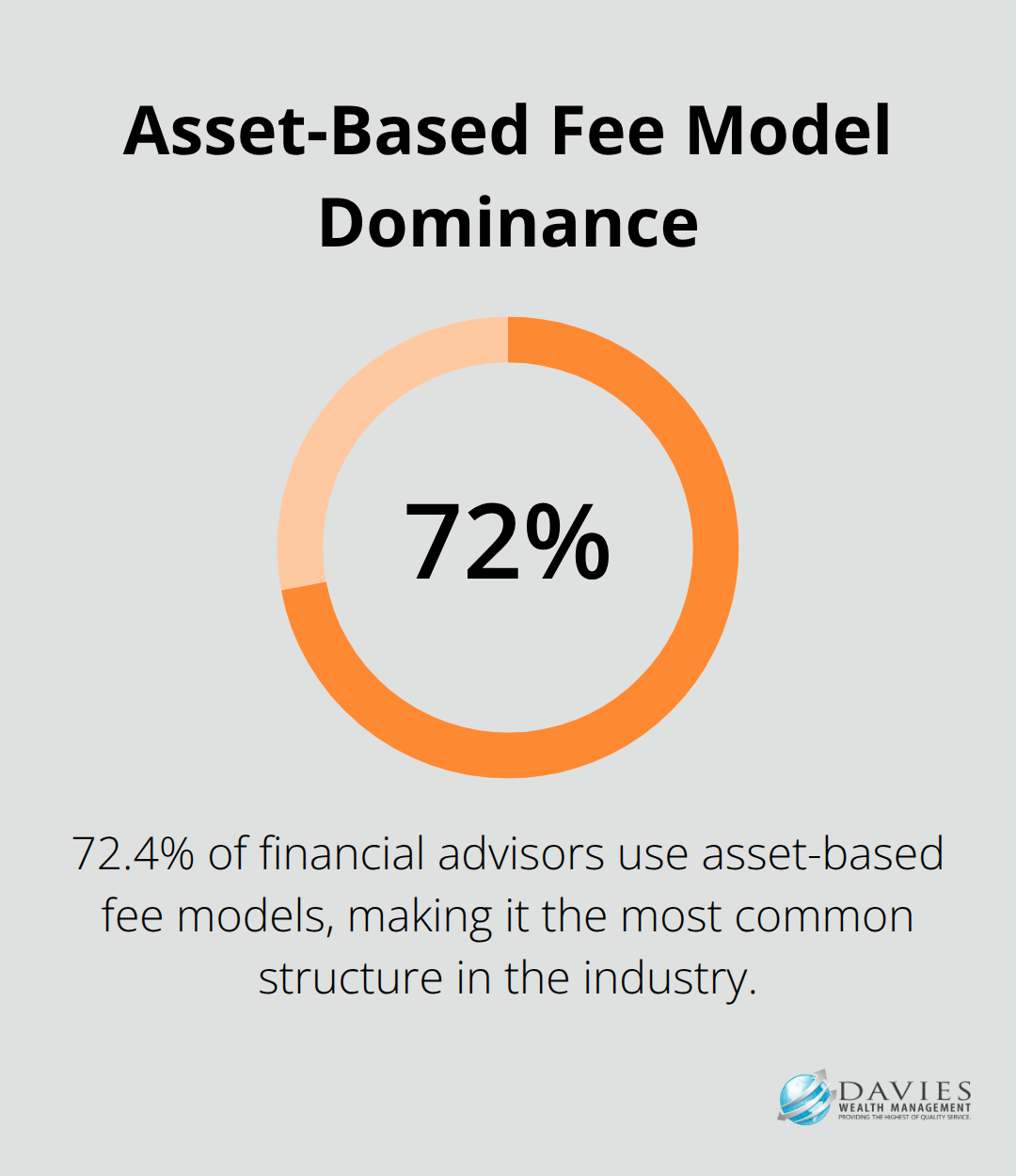

Asset-Based Management Fees Dominate the Industry

Asset-based fees represent the most common structure, with 72.4% of advisors using this model according to industry research. These fees range from 0.25% to 2% annually, with the median around 1% of assets under management. On a $500,000 portfolio, expect to pay $5,000 yearly. This structure aligns advisor incentives with your portfolio growth, but costs increase as your wealth grows. Financial advisors who use this model typically provide comprehensive investment management and regular portfolio monitoring.

Retainer Arrangements Offer Predictable Costs

Annual retainer fees range from $2,500 to $9,200 based on service complexity. This structure provides unlimited access to your advisor and comprehensive planning services. Retainer arrangements work best for clients with complex financial situations that involve multiple income sources, business ownership, or estate planning needs. Many advisors combine retainer fees with reduced asset-based charges (creating hybrid models that balance ongoing service with investment management).

Flat Fee Plans for Specific Projects

Flat fee arrangements typically cost $1,000 to $3,000 for comprehensive financial plans. This one-time payment covers plan creation but excludes ongoing management or updates. Flat fees work well for clients who want a roadmap but prefer to implement strategies themselves. Some advisors waive planning fees if you hire them for subsequent investment management services.

Several factors beyond fee structure affect your total costs, which we’ll explore in the next section.

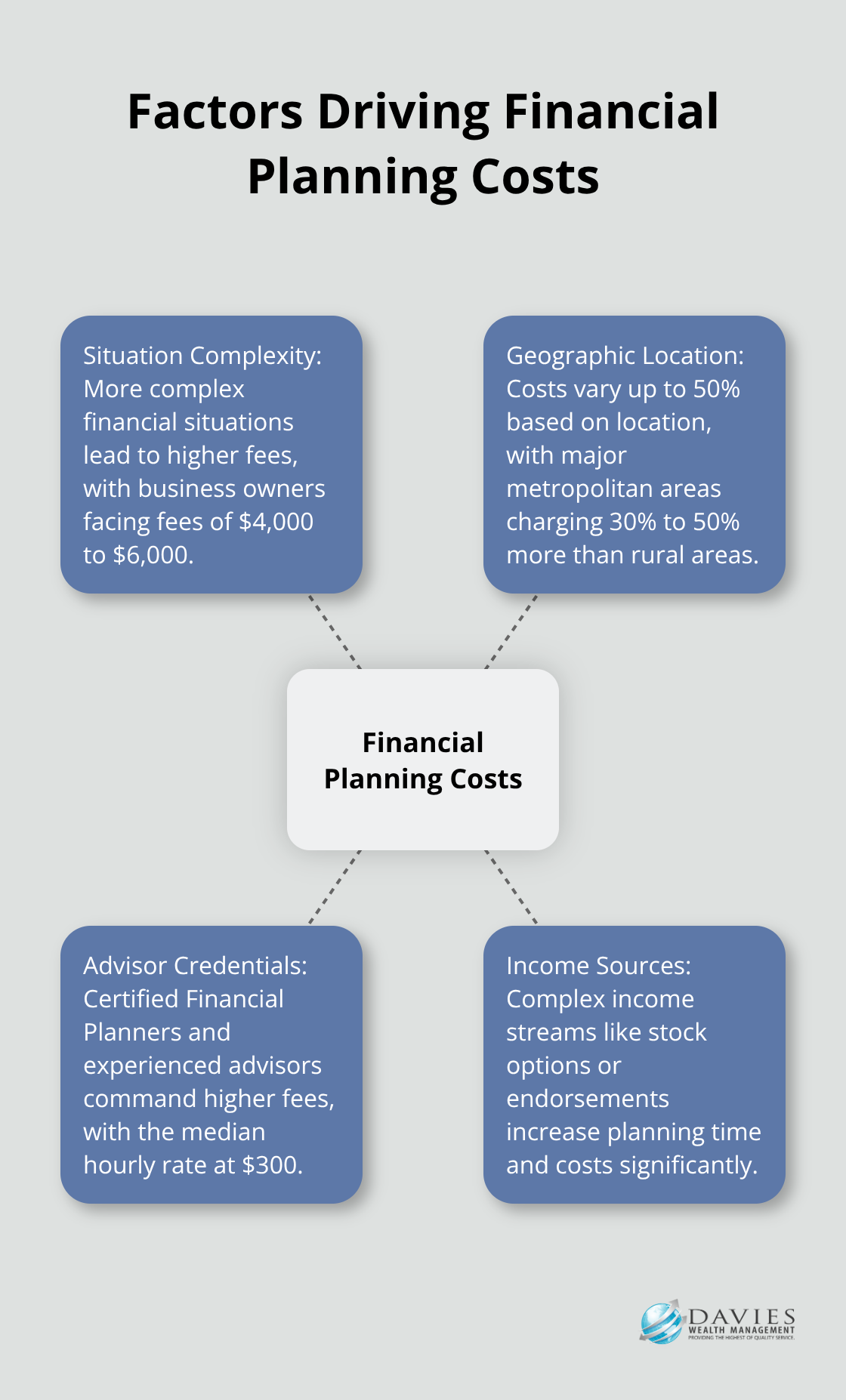

What Drives Financial Planning Costs

Your financial situation complexity directly impacts pricing more than any other factor. Advisors charge higher fees for clients with multiple income streams, business ownership, or international assets according to Kitces Research. A single professional with straightforward investments pays around $2,400 for comprehensive planning, while business owners with complex tax situations face fees that reach $4,000 to $6,000.

Complex Income Sources Increase Fees Substantially

Professional athletes and high earners with endorsement income, deferred compensation, and multi-state tax obligations require specialized expertise that commands premium pricing. Stock options, restricted stock units, and executive compensation packages add layers of complexity that increase planning time from the standard 11.9 hours to 20+ hours. These situations demand advisors who understand intricate tax implications and can navigate sophisticated financial structures (making specialized knowledge worth the premium cost).

Geographic Location Creates 50% Price Variations

Financial planning costs vary dramatically by location, with advisors in major metropolitan areas who charge 30% to 50% more than rural counterparts. New York and San Francisco advisors average $350 per hour compared to $200 in smaller markets according to the Bureau of Labor Statistics. Annual retainer fees reach $12,000 in expensive coastal cities while similar services cost $5,000 in the Midwest. This price difference reflects local cost of living, competition levels, and client affluence rather than service quality differences.

Advisor Credentials Command Higher Fees

Certified Financial Planner professionals charge premium rates, with the median hourly fee for financial advisors at $300 according to recent data. Advisors with 20+ years experience command $1,000 more for comprehensive plans compared to those with under five years. Advanced certifications like Chartered Financial Analyst or Personal Financial Specialist justify premium fees through specialized knowledge that basic practitioners cannot provide.

These cost factors work together to determine your total investment in professional financial guidance, but understanding what services you receive for these fees helps evaluate the true value proposition.

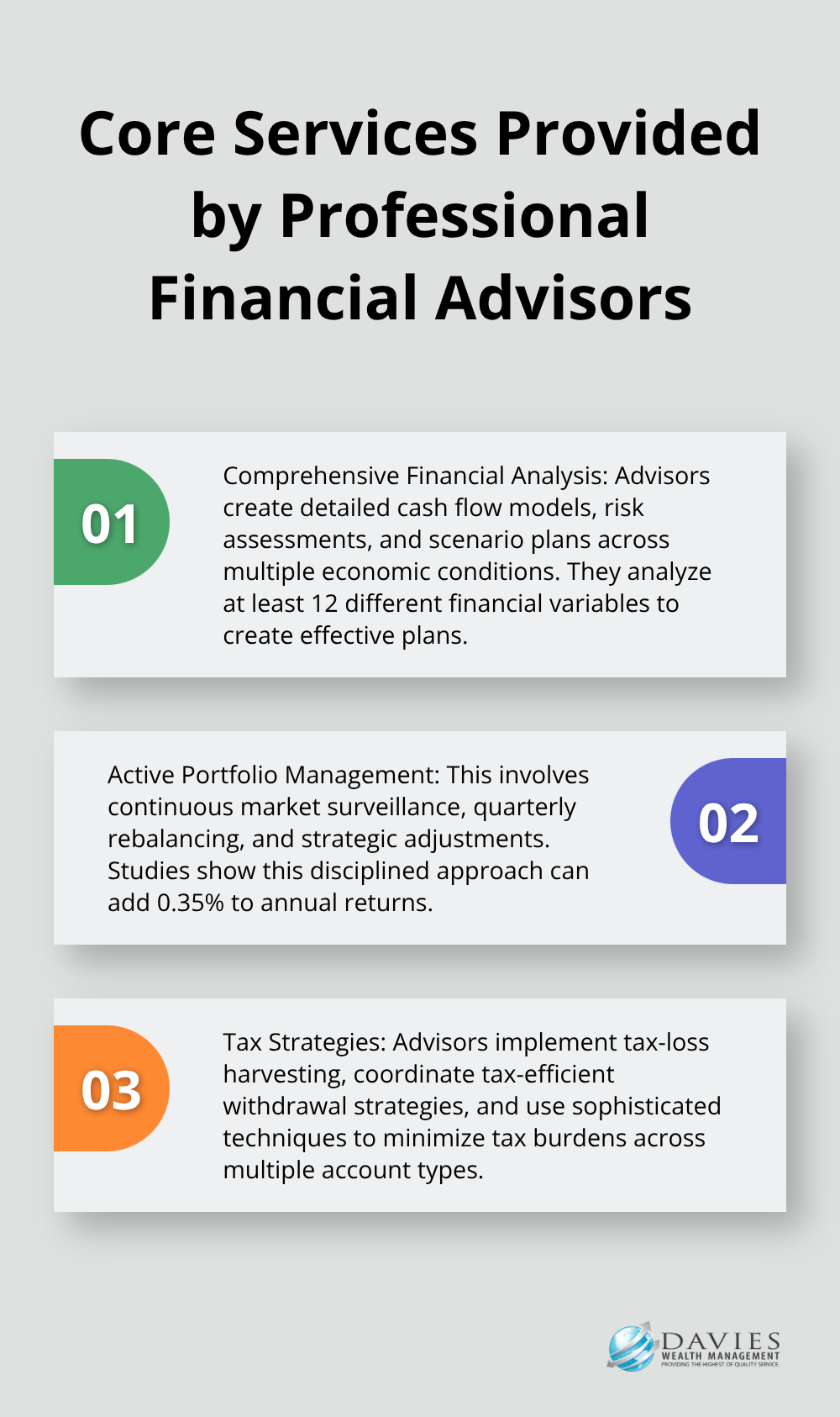

What Does Your Fee Actually Buy

Professional financial advisors deliver three core services that justify premium fees, though quality and depth vary dramatically between firms. Comprehensive financial analysis requires detailed work that includes cash flow models, risk assessments, and scenario plans across multiple economic conditions. The Financial Planning Association reports that effective plans analyze at least 12 different financial variables (debt-to-income ratios, savings rates, and investment allocations). Top advisors create Monte Carlo simulations that test your plan against thousands of different market scenarios to identify potential failure points before they occur.

Comprehensive Analysis Goes Beyond Basic Budgets

This analysis extends far beyond basic budgets to include detailed projections for education costs, career transitions, and unexpected expenses that could derail your financial goals. Professional planners examine your complete financial picture and create strategies that adapt to changing circumstances. They identify gaps in your current approach and recommend specific actions to optimize your financial position.

Portfolio Management Demands Constant Attention

Active portfolio management involves continuous market surveillance, rebalancing activities, and strategic adjustments that individual investors rarely execute effectively. Professional managers monitor your investments daily and rebalance portfolios quarterly to maintain target allocations. Studies show this disciplined execution can add 0.35% to annual returns through systematic approach.

Tax Strategies Generate Measurable Savings

Tax-loss harvesting provides significant savings for high earners through strategic loss offsetting against capital gains. Professional advisors coordinate tax-efficient withdrawal strategies and implement sophisticated techniques that minimize your tax burden across multiple account types (401k, IRA, and taxable accounts).

Estate Planning Preserves Generational Wealth

Estate planning services include trust structures, beneficiary designations, and tax-efficient wealth transfer strategies that can save families hundreds of thousands in estate taxes. Advanced planners coordinate with tax professionals and attorneys to implement sophisticated strategies like charitable remainder trusts and generation-skipping trusts that preserve wealth across multiple generations while minimizing tax obligations.

Final Thoughts

Financial plan cost ranges from $200 per hour for basic consultations to $12,000 annually for comprehensive retainer services. Most clients pay between $2,400 for standalone plans and $5,000 yearly for management services. These numbers reflect the complexity of your situation rather than arbitrary price decisions.

Value evaluation requires you to look beyond price tags to measurable outcomes. Professional advisors who generate tax savings through strategic plans, prevent costly investment mistakes, and optimize portfolio performance often pay for themselves. The key question becomes whether potential savings and improved returns justify the advisory fees (especially for complex financial situations).

Geographic location, advisor credentials, and service complexity drive the biggest price variations. Urban markets command premium rates while rural advisors offer competitive prices for similar services. We at Davies Wealth Management help clients navigate these decisions through comprehensive wealth management solutions that address complex financial challenges.

Leave a Reply