At Davies Wealth Management, we’re witnessing a seismic shift in our industry. Artificial Intelligence (AI) is transforming wealth management, offering unprecedented opportunities for growth and efficiency.

AI investing is no longer a futuristic concept; it’s here, and it’s revolutionizing how we manage portfolios, serve clients, and navigate complex regulatory landscapes. This blog post explores the game-changing impact of AI on wealth management and what it means for investors.

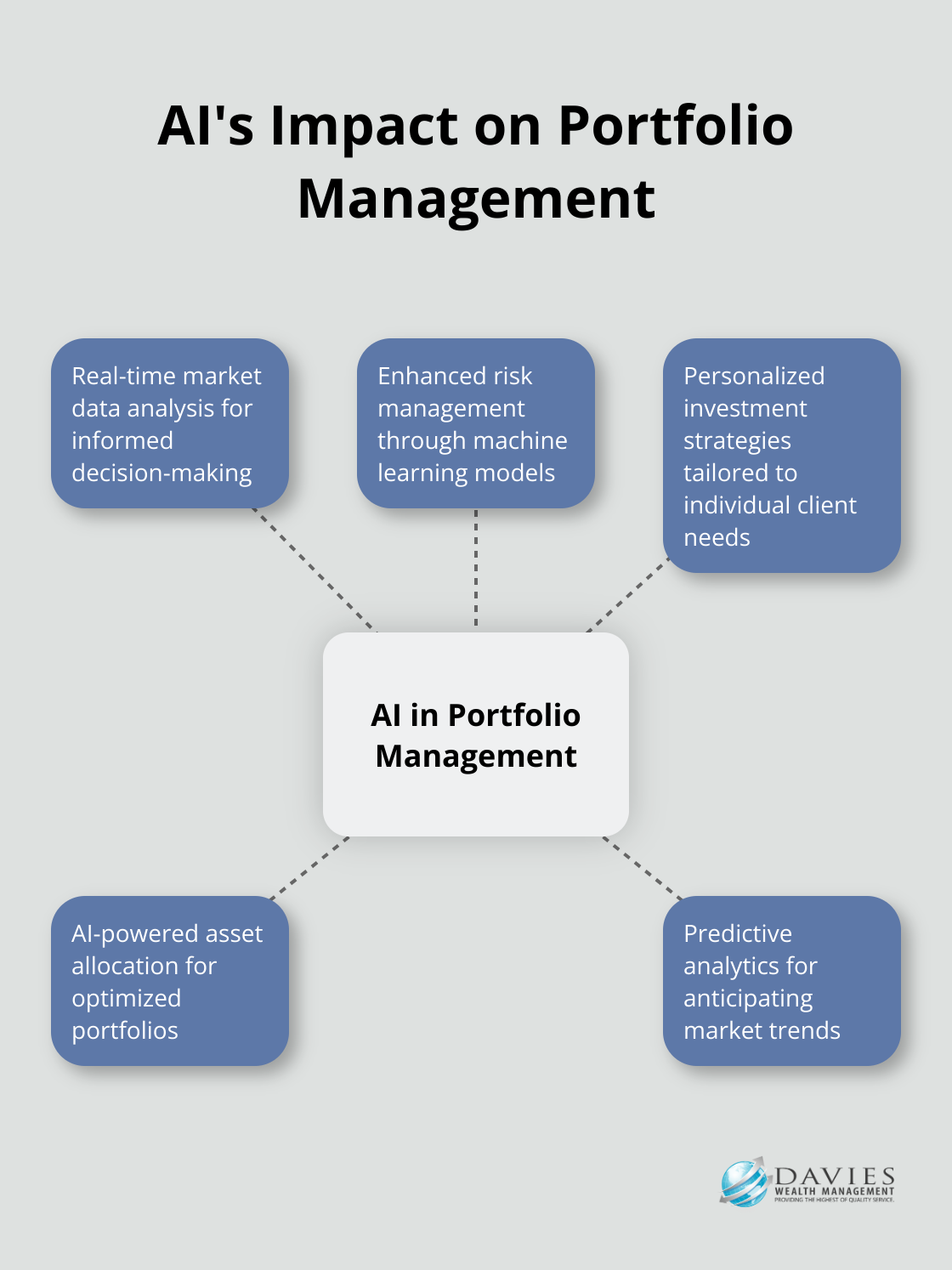

How AI Optimizes Investment Portfolios

AI transforms portfolio management at an unprecedented scale. This technology fundamentally changes how investment strategies are approached for clients.

AI-Powered Asset Allocation

AI algorithms analyze vast amounts of market data in real-time, surpassing human capabilities. These systems identify patterns and trends that might escape the human eye, leading to more informed asset allocation decisions. The collaboration between AI and human analysis enhances forecasting capabilities, especially in predicting market trends during disasters.

Machine Learning for Risk Management

Machine learning models revolutionize risk assessment in wealth management. These models detect fraudulent transactions in real-time, preventing financial losses and safeguarding customer data.

Personalized Investment Strategies

AI is changing how wealth management works. It helps firms serve more clients with less staff, cutting costs and boosting profits. By considering factors such as risk tolerance, financial goals, and even social media activity, AI creates highly tailored investment strategies.

Human Oversight and AI Integration

While AI offers tremendous benefits, human oversight remains essential. Many wealth management firms (including Davies Wealth Management) leverage AI to enhance their services, but always combine it with their team’s expertise and personal touch. This approach ensures that clients (including professional athletes with unique financial needs) receive the most comprehensive and tailored wealth management solutions possible.

The Future of AI in Portfolio Management

As AI continues to evolve, we can expect even more sophisticated applications in portfolio management. From predictive analytics that anticipate market shifts to AI-driven sustainable investing strategies, the potential for innovation seems limitless. However, the key to success will lie in striking the right balance between technological advancement and human judgment.

The optimization of investment portfolios through AI marks just the beginning of this technological revolution in wealth management. Next, we’ll explore how AI enhances the client experience with cutting-edge tools and personalized recommendations.

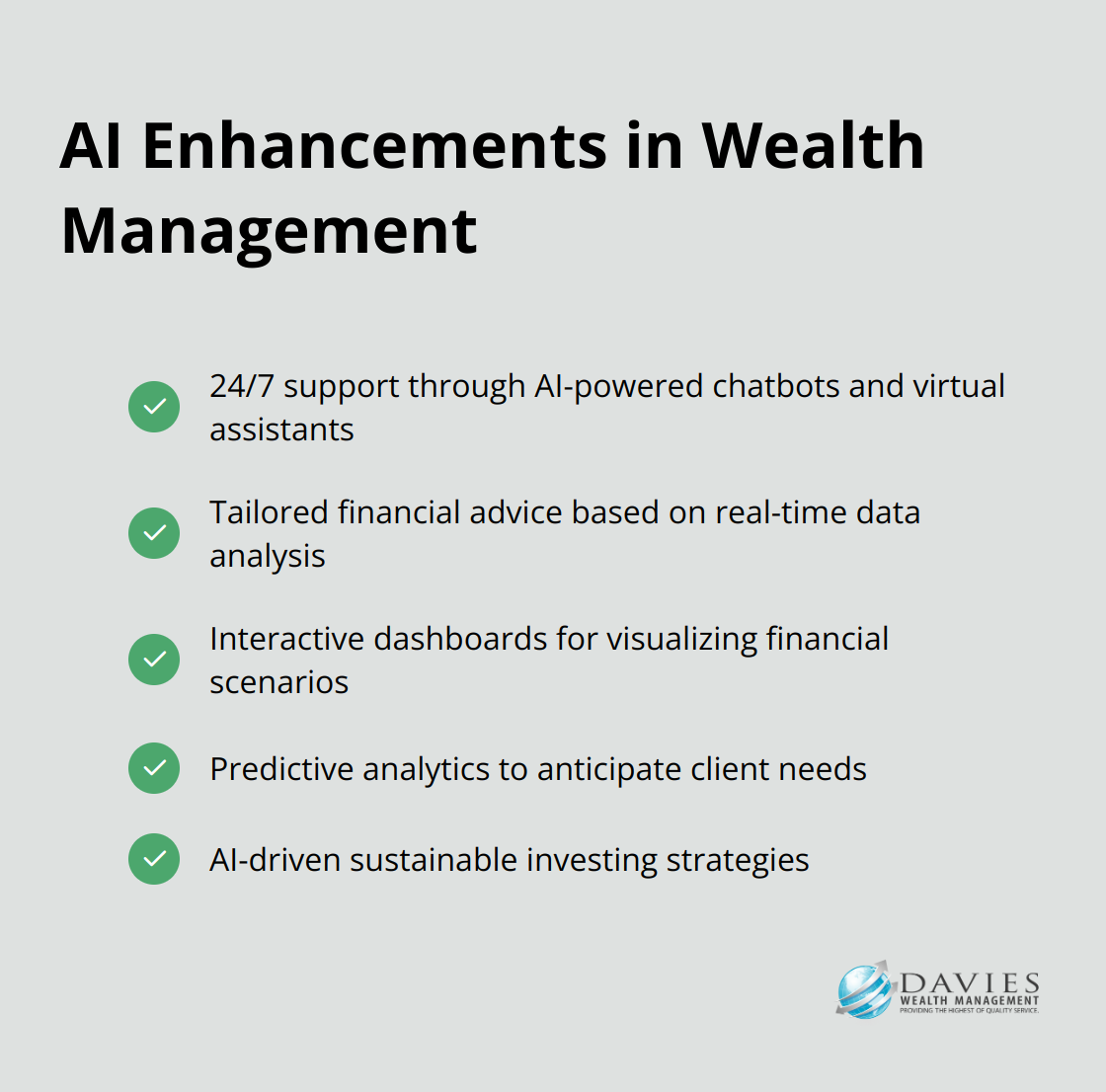

How AI Enhances Your Wealth Management Experience

AI-powered tools revolutionize the client experience in wealth management. These innovations offer practical solutions that make managing wealth easier, more intuitive, and more personalized than ever before.

24/7 Support at Your Fingertips

AI-powered chatbots and virtual assistants now provide 24/7 support, offering instant responses to queries about account balances, transaction histories, and basic financial advice. This constant availability ensures clients receive support whenever they need it, regardless of business hours.

Tailored Financial Advice in Real-Time

AI algorithms analyze financial data, spending patterns, and investment goals to generate personalized recommendations. This technology allows wealth managers to offer more targeted advice, helping clients make informed decisions about their wealth.

Visualizing Your Financial Future

Interactive dashboards powered by AI bring financial data to life. These tools allow clients to visualize complex financial scenarios, test different investment strategies, and see the potential long-term impact of their decisions.

The Human Touch in AI-Enhanced Wealth Management

While AI enhances many aspects of wealth management, it doesn’t replace human expertise. The most effective wealth management strategies combine cutting-edge AI tools with deep financial knowledge to provide a service that’s both high-tech and high-touch. This approach proves particularly valuable for professional athletes (whose unique financial situations often require nuanced, personalized strategies that AI alone can’t fully address).

The Future of AI in Client Experience

As AI continues to evolve, we can expect even more sophisticated applications in wealth management. From predictive analytics that anticipate client needs to AI-driven sustainable investing strategies, the potential for innovation seems limitless. The next frontier in AI’s impact on wealth management lies in its ability to enhance compliance and risk management processes, ensuring not only better client experiences but also safer and more secure financial practices.

How AI Safeguards Your Wealth

AI revolutionizes compliance and risk management in wealth management, offering unprecedented protection for assets. This cutting-edge technology transforms how financial institutions detect fraud, maintain regulatory compliance, and assess market risks.

Spotting Fraud Before It Happens

AI-powered fraud detection systems now detect fraudulent activities with remarkable accuracy. These systems analyze patterns in transaction data, flagging suspicious activities that might escape human notice. AI-powered fraud detection systems significantly reduce false positives while improving operational efficiency.

Staying Ahead of Regulatory Changes

Keeping up with ever-changing financial regulations challenges wealth management firms. AI systems excel at monitoring regulatory updates across multiple jurisdictions, ensuring compliance in real-time. AI-powered compliance tools can significantly increase efficiency by automating repetitive tasks.

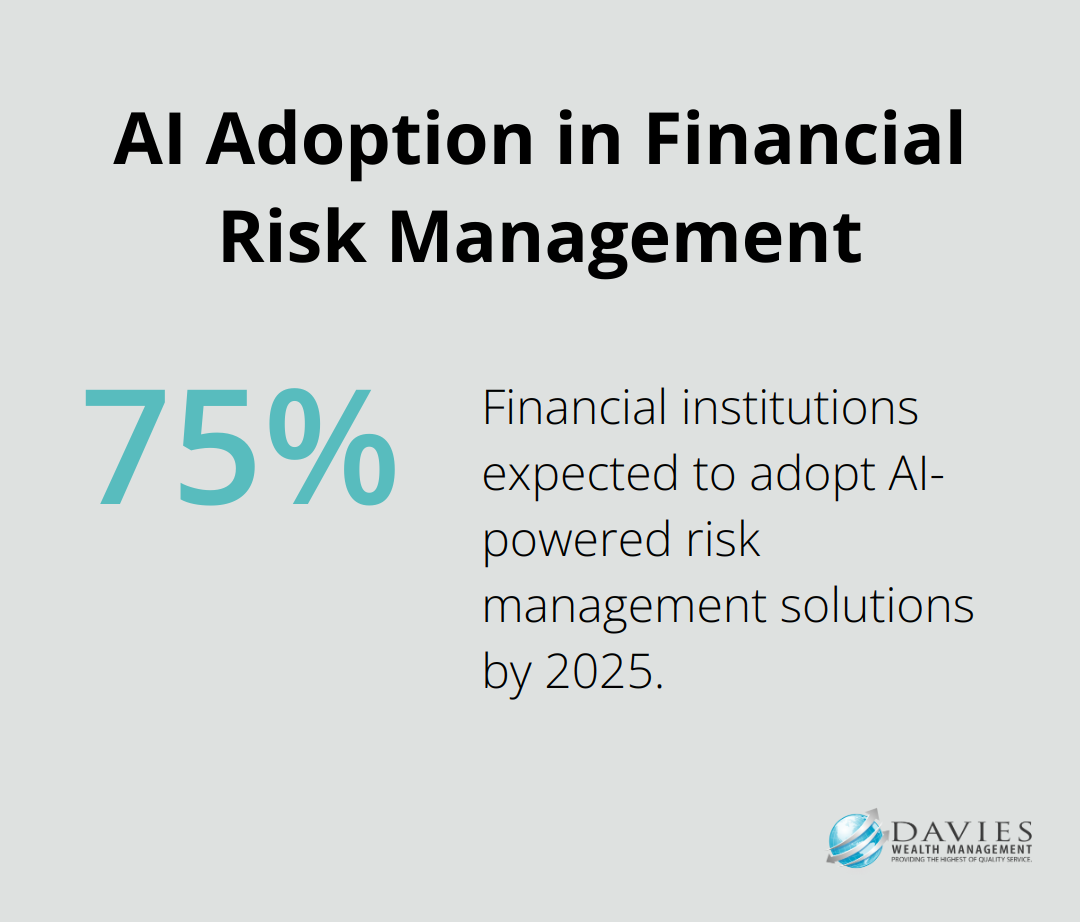

Predicting Market Risks

AI’s predictive capabilities transform market risk assessment. These systems analyze vast amounts of data from various sources, including economic indicators, geopolitical events, and social media sentiment, to forecast potential market risks. 75% of financial institutions are expected to adopt AI-powered risk management solutions by 2025.

Protecting Professional Athletes’ Wealth

For professional athletes, whose careers often involve high-risk, high-reward financial situations, these AI-powered risk management tools provide particularly valuable protection. AI technologies offer robust safeguards against market volatility and financial fraud, helping athletes secure their financial future beyond their playing years.

The Human-AI Balance

While AI brings immense benefits to compliance and risk management, human oversight remains essential. The most effective approach combines AI’s analytical power with human expertise to create a comprehensive risk management strategy. This balance ensures that wealth management firms can leverage the best of both worlds: AI’s data processing capabilities and human judgment.

Final Thoughts

AI investing has transformed wealth management, bringing unprecedented efficiency, personalization, and risk management. The future promises even more sophisticated AI applications, including refined predictive analytics and AI-driven sustainable investing strategies. AI will likely democratize wealth management services, making them accessible to a broader audience.

Human expertise remains irreplaceable in wealth management. The most effective strategies will blend AI’s analytical power with the nuanced understanding and empathy that only human advisors can provide. This balance proves particularly crucial when dealing with complex financial situations, such as those faced by professional athletes.

At Davies Wealth Management, we leverage cutting-edge AI tools to enhance our services, always combining them with our team’s expertise and personal touch. This approach allows us to offer comprehensive, tailored wealth management solutions that address the unique needs of each client. We commit to helping our clients navigate their financial journeys with confidence, now and in the future.

Leave a Reply