Stuart’s wealthy investors face unique opportunities that most people never access. Private equity, venture investing, and alternative assets can generate exceptional returns for those with substantial capital.

We at Davies Wealth Management see clients regularly asking about these high-stakes investment strategies. The potential rewards are significant, but the risks demand careful planning and professional guidance.

What Makes High-Risk Strategies Worth Pursuing?

Private equity investments require minimum commitments of $250,000 to $1 million, but the rewards justify this barrier. Private equity has shown strong performance over extended periods, compared to public markets. Venture capital shows even stronger performance for those who accept illiquidity periods of 7-10 years. The key lies in access to top-tier funds through established networks and proven track records.

Direct Real Estate and Commodity Exposure

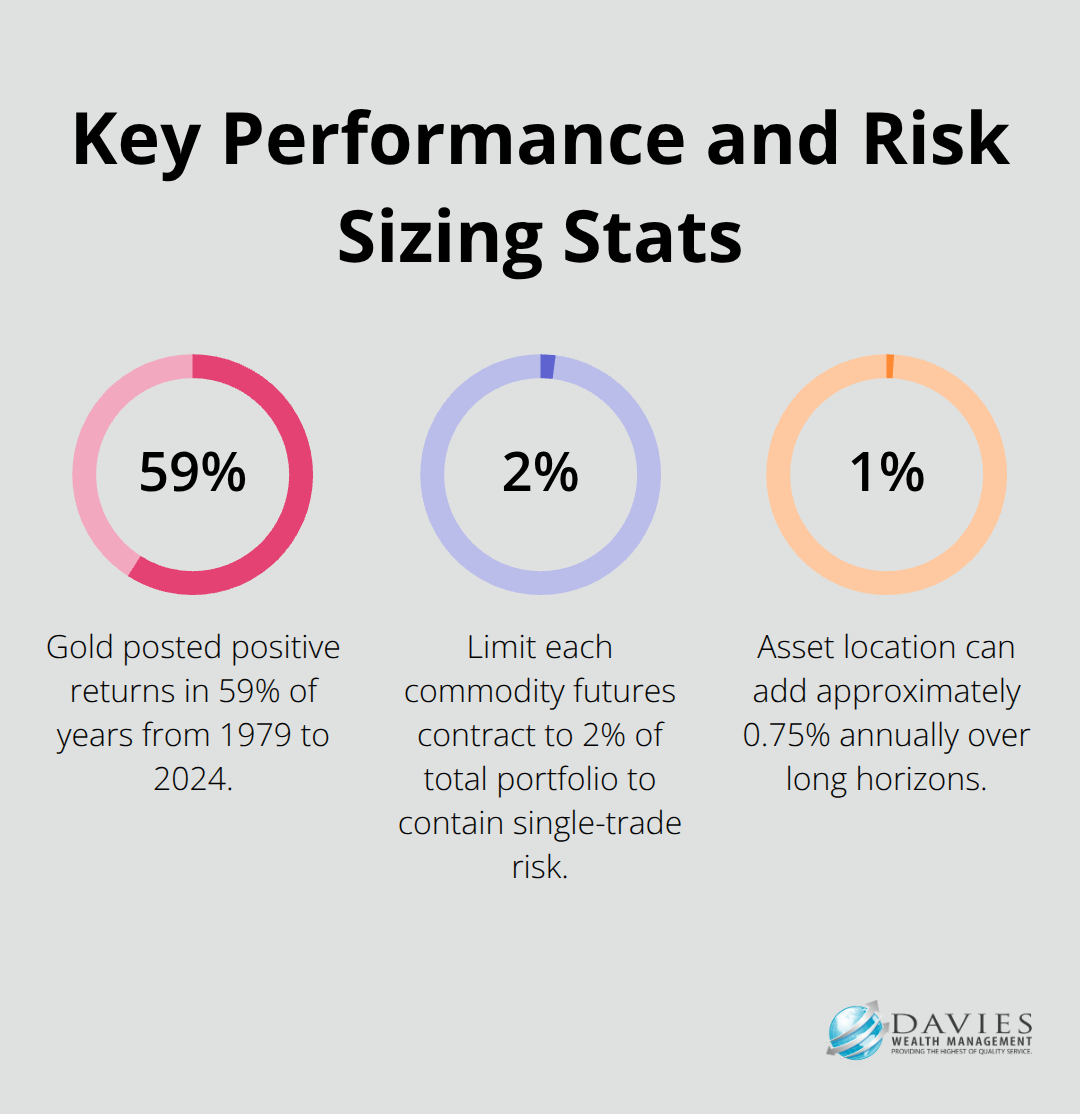

Commercial real estate syndications offer wealthy investors direct ownership stakes in premium properties with potential returns of 12-18% annually. Commodity investments through direct ownership or specialized funds provide inflation protection that traditional portfolios lack. Gold has shown positive returns in 59% of years between 1979 and 2024, while agricultural commodities have shown resilience during economic uncertainty. These alternatives require substantial capital but offer portfolio diversification that public markets cannot match.

Leveraged Trading Opportunities

Options strategies like covered calls and cash-secured puts generate additional income from existing stock positions. Professional traders who use 2:1 leverage in forex markets can amplify returns, though this demands sophisticated risk management systems. Futures contracts on commodities and indices allow position sizes that would be impossible with cash purchases alone. Research on commodity trading shows systematic approaches have been studied extensively, though performance varies significantly based on strategy implementation and risk management protocols.

Access Requirements and Capital Thresholds

Wealthy investors face different barriers than retail participants when they enter these markets. Private equity funds typically screen for accredited investor status and net worth minimums of $1 million or more. Real estate syndications often require $50,000 to $500,000 minimum investments per deal. Commodity trading accounts demand substantial margin requirements that can exceed $100,000 for meaningful position sizes. These thresholds exist because sophisticated strategies require both financial capacity and risk tolerance that matches the potential volatility.

The next step involves careful evaluation of your risk tolerance and how these high-reward strategies fit within your overall portfolio allocation.

How Should Wealthy Investors Structure Their High-Risk Portfolios?

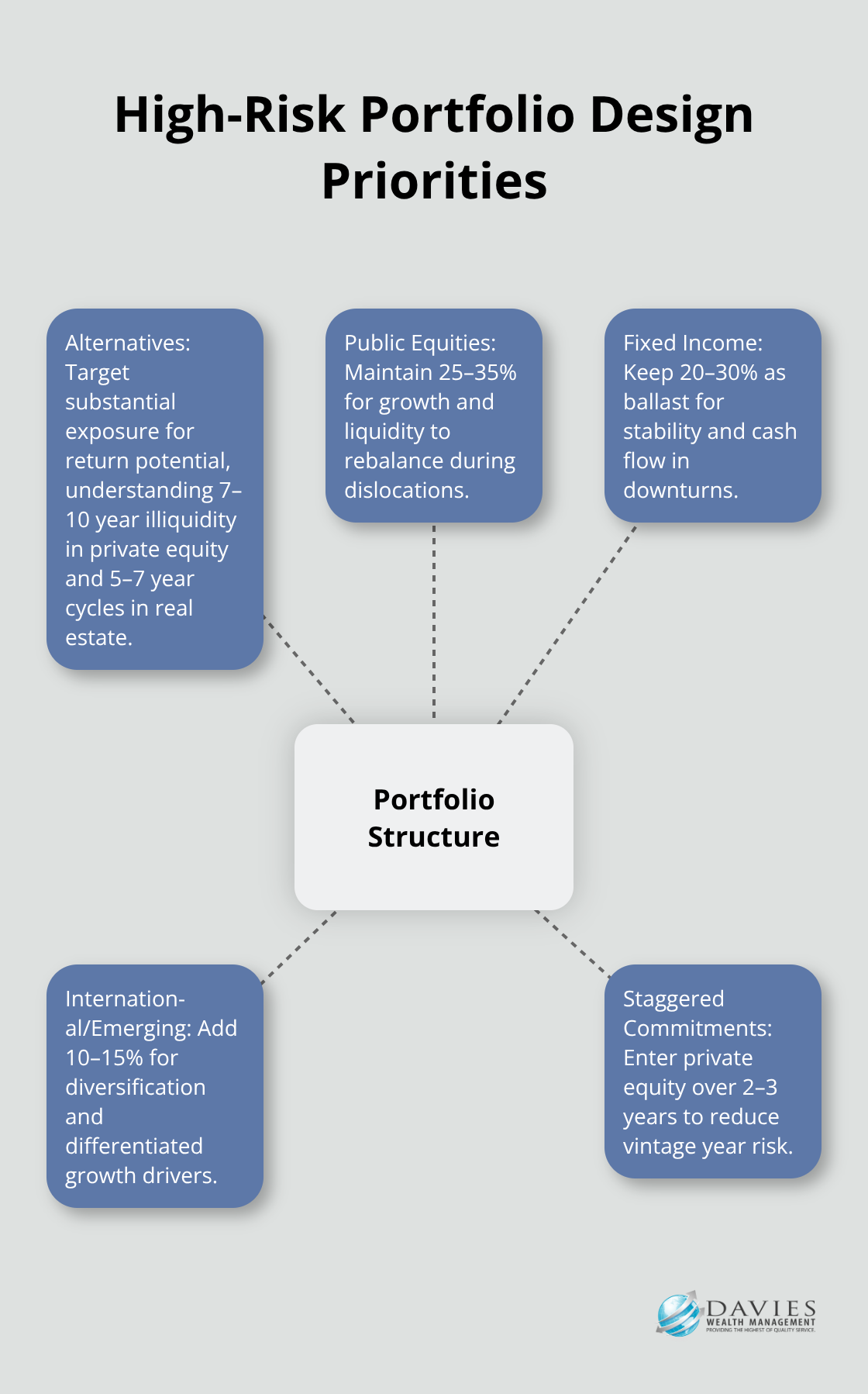

Wealthy investors must approach portfolio construction with mathematical precision rather than emotional reactions. Research from Yale’s endowment model shows optimal allocation for high-net-worth individuals includes 30-40% alternative investments, 25-35% public equities, and 20-30% fixed income. This differs dramatically from traditional 60/40 portfolios that retail investors follow.

Your risk capacity increases with wealth, but your risk tolerance remains personal. Investors with $5 million portfolios can withstand 20-30% drawdowns that would devastate smaller accounts. Professional athletes often allocate 45% to alternatives during peak earning years, then shift toward preservation as careers wind down.

Asset Class Distribution for Maximum Returns

Alternative investments should never exceed 50% of total portfolio value, regardless of wealth level. Private equity performs best with 7-10 year hold periods, while real estate syndications show optimal returns over 5-7 year cycles. Commodity exposure through direct ownership or specialized funds should represent 5-10% maximum allocation.

International diversification across emerging markets adds another 10-15% allocation opportunity. The key lies in staggered entry timing across different asset classes. Enter private equity commitments over 2-3 years rather than lump sum investments. This approach smooths out vintage year risk and provides better overall returns.

Timeline Management for Wealth Preservation

High-risk strategies require 10-15 year investment horizons minimum. Investors under 45 can maintain higher risk allocations because time allows recovery from market downturns. Those within 10 years of retirement should limit alternatives to 25% of total assets (though liquidity needs matter more than age or wealth level).

Maintain 6-12 months of expenses in liquid assets before you commit capital to illiquid alternatives. Rebalance annually for public markets but alternatives require 3-5 year evaluation cycles due to their illiquid nature.

Risk Assessment Beyond Net Worth

Portfolio stress tests reveal how different allocation models perform during market crises. The 2008 financial crisis showed that portfolios with alternative investments tend to have low correlations to both stocks and bonds. However, liquidity constraints during that period forced many investors to sell at unfavorable prices.

Your investment timeline determines risk capacity more than current wealth levels. A 35-year-old with $2 million can take more risk than a 55-year-old with $10 million who needs income within five years.

These allocation strategies work best when you implement proper risk management tools and maintain strict discipline during market volatility.

How Do You Protect High-Risk Investments From Major Losses?

Wealthy investors who chase high returns without proper protection systems face catastrophic losses that can take decades to recover. Professional risk management separates successful high-risk investors from those who lose fortunes during market downturns.

Stop-Loss Systems for Liquid Positions

Stop-loss orders work poorly for illiquid alternatives like private equity, but trailing stops on public positions can limit losses to 15-20% before automatic exits trigger. Options strategies provide better downside protection through put spreads that cost 2-3% of position value but cap losses at predetermined levels. Professional traders use these tools systematically rather than emotionally.

Protection Techniques for Alternative Assets

Diversification across vintage years in private equity reduces sequence risk by 40-60% compared to single-year commitments. Real estate syndications require cash flow analysis that assumes 20% vacancy rates and 15% expense increases to stress-test deals properly. Commodity positions demand position sizes that never exceed 2% of total portfolio per contract to prevent single trades from causing significant damage.

Currency hedging for international investments costs 1-2% annually but eliminates foreign exchange risk that can destroy returns during dollar strength periods. These costs represent insurance premiums that wealthy investors pay to protect substantial positions.

Due Diligence Protocols That Prevent Disasters

Private equity funds require analysis of management track records across multiple economic cycles (not just bull markets). Real estate syndications demand independent property appraisals and market rent studies before you commit capital. Commodity trading requires understanding of storage costs, delivery mechanisms, and seasonal price patterns that affect returns.

Professional investors spend 40-60 hours on due diligence per major investment decision. This time investment prevents the costly mistakes that destroy wealth faster than any market crash.

Tax-Optimized Exit Strategies

Tax-loss harvesting in taxable accounts can generate 0.5-1.5% additional annual returns through systematic realization of losses. Qualified opportunity zones allow capital gains deferrals until 2026 and permanent exclusion of gains from zone investments held over 10 years. Asset location strategies that place tax-inefficient investments in retirement accounts while keeping tax-efficient holdings in taxable accounts can add 0.75% annual return enhancement over 20-year periods.

Private placement life insurance structures can shelter investment gains from taxation entirely for ultra-high-net-worth investors with $5 million plus in investable assets.

Final Thoughts

High-risk strategies offer Stuart’s wealthy investors exceptional opportunities that traditional portfolios cannot match. Private equity, venture investing, and alternative assets generate superior returns for those with substantial capital and proper risk management systems. The data proves that wealthy investors who allocate 30-40% to alternatives while they maintain proper diversification consistently outperform traditional 60/40 portfolios.

Success in these markets requires mathematical precision rather than emotional decisions. Wealthy investors must implement systematic approaches to risk management through stop-loss systems, thorough due diligence, and tax-optimized strategies. Professional guidance becomes essential when investors navigate these complex landscapes (the difference between catastrophic losses and exceptional returns often comes down to proper portfolio construction and exit strategies).

We at Davies Wealth Management help individuals, families, and businesses achieve their financial goals through comprehensive wealth management solutions. Our expertise in complex portfolio management provides the specialized knowledge needed to balance aggressive growth strategies with long-term wealth preservation. The path to exceptional returns exists, but it demands professional expertise, substantial capital, and unwavering discipline during market volatility.

Leave a Reply