Stuart families face unique opportunities in Florida’s tax-friendly environment for preserving and transferring generational wealth. With no state income tax and favorable estate planning laws, local families can maximize their legacy building potential.

We at Davies Wealth Management see many families struggle with timing and communication during wealth transfer planning. The right strategies can save thousands in taxes while strengthening family bonds across generations.

What Drives Stuart’s Wealth Transfer Activity?

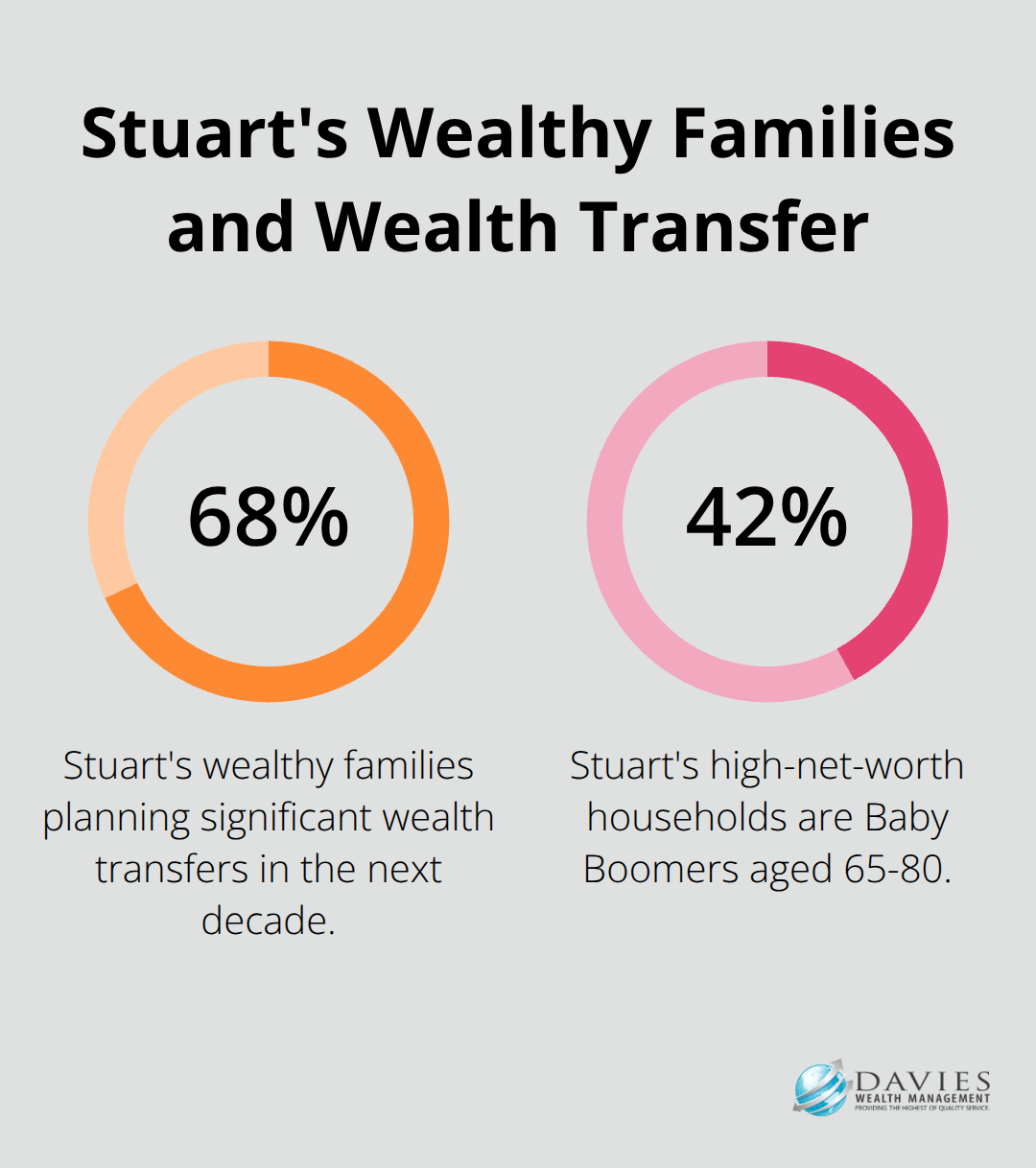

Stuart’s affluent families control over $2.8 billion in investable assets according to recent wealth management studies, with 68% of these families planning significant wealth transfers within the next decade. The demographics reveal a compelling story: Baby Boomers aged 65-80 represent 42% of Stuart’s high-net-worth households, while their Gen X and Millennial children often reside in higher-tax states like New York and California. This geographic split creates both opportunities and complications for transfer plans.

Florida’s Tax Advantage Transforms Transfer Strategy

Florida’s zero state income tax and no state estate tax give Stuart families a massive head start over their northern counterparts. A $10 million estate transfer in Stuart saves approximately $1.2 million compared to New York’s 16% state estate tax. Local families consistently use annual gifts to maximize the federal lifetime exemption per person. The step-up in basis at death eliminates capital gains on appreciated assets, which makes Florida residency worth an average of $340,000 in tax savings for estates over $5 million. Smart families establish Florida domicile early and document their residency carefully to lock in these benefits.

Business Succession Leads Local Transfer Methods

Stuart’s entrepreneurial families overwhelmingly favor Family Limited Partnerships and business succession trusts over traditional estate plans. Marine industry businesses, real estate holdings, and professional practices represent 73% of local wealth transfer cases. These families use valuation discounts through FLPs to transfer business interests at reduced gift tax values, often achieving 20-30% discounts on fair market value transfers.

Multi-State Complications Create Planning Challenges

The geographic spread of Stuart families across state lines introduces complex tax considerations that require sophisticated coordination. Children who live in California (with its 13.3% top tax rate) or New York face different inheritance tax implications than Florida residents. These multi-state dynamics make proper estate planning tools even more valuable for preserving family wealth across generations.

Which Tools Actually Work for Stuart Wealth Transfer?

Irrevocable Life Insurance Trusts Dominate Local Strategy

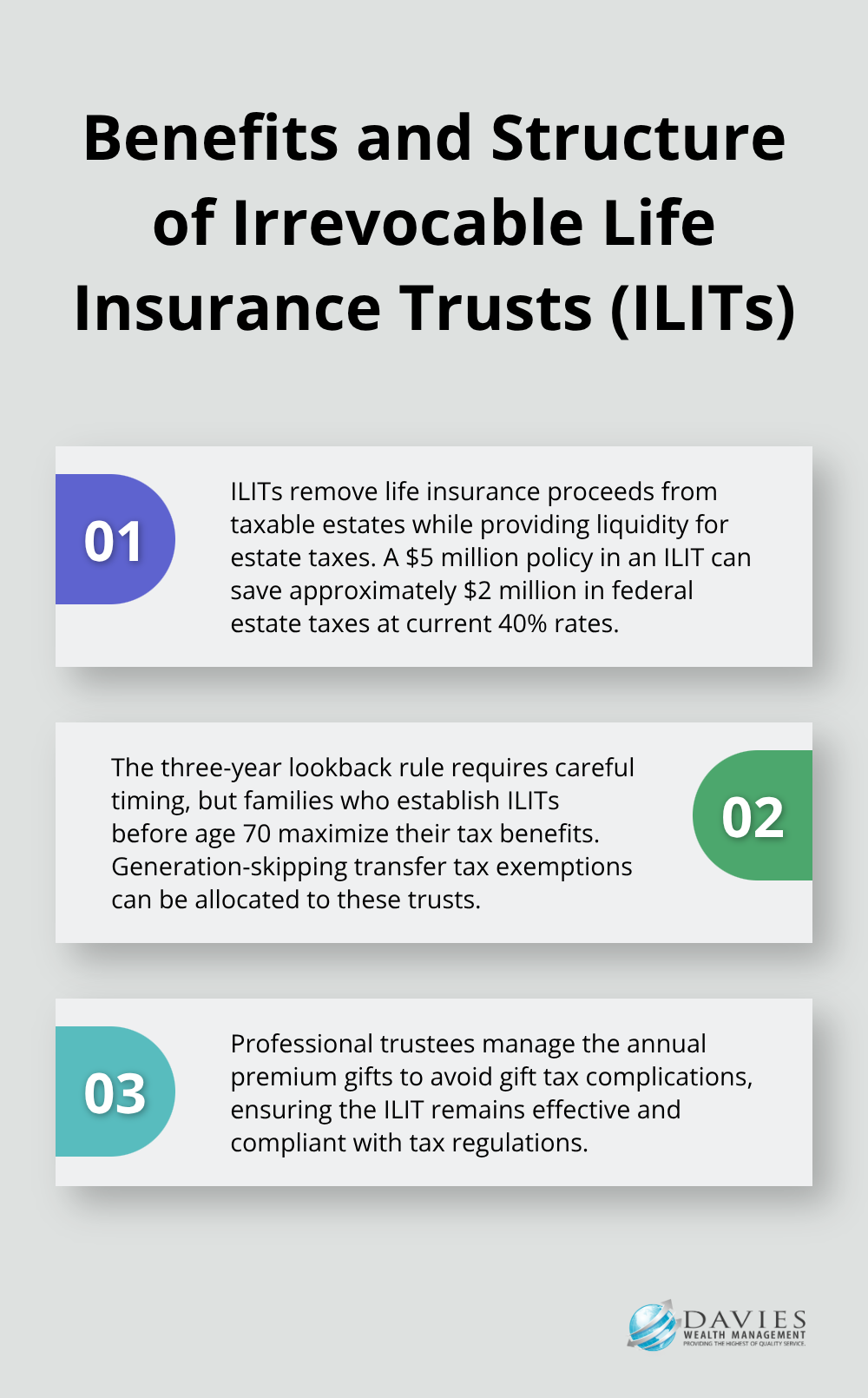

Stuart families choose Irrevocable Life Insurance Trusts over traditional estate plans because the numbers prove their effectiveness. ILITs remove life insurance proceeds from taxable estates while they provide liquidity for estate taxes. A $5 million life insurance policy in an ILIT saves Stuart families approximately $2 million in federal estate taxes at current 40% rates.

The three-year lookback rule requires careful timing, but families who establish ILITs before age 70 maximize their tax benefits. Generation-skipping transfer tax exemptions can be allocated to these trusts (allowing wealth to benefit multiple generations without additional tax erosion). Professional trustees manage the annual premium gifts to avoid gift tax complications.

Grantor Retained Annuity Trusts Beat Traditional Gifts

GRATs outperform standard annual gifts when structured properly for assets that appreciate. Stuart families use GRATs for real estate and business interests that generate consistent returns above the IRS Section 7520 rate. The current hurdle rate means assets that appreciate faster than this rate transfer tax-free to beneficiaries.

A two-year GRAT with $2 million in real estate can transfer $400,000 in growth without gift tax consequences. Families create new trusts every two years to maximize this strategy through rolling GRATs. Family Limited Partnerships combined with GRATs achieve valuation discounts of 25-35% on transferred interests, which multiplies the tax savings for Stuart’s entrepreneurial families.

Spousal Lifetime Access Trusts Provide Maximum Flexibility

SLATs give married couples access to transferred assets while they capture estate tax benefits. One spouse gifts $13.61 million to a SLAT that benefits the other spouse and children. The non-donor spouse can receive distributions for health, education, maintenance, and support needs.

This strategy works particularly well for Stuart families with children in high-tax states because trust income can be distributed to beneficiaries in lower tax brackets. Professional trustees prevent reciprocal trust doctrine issues that could invalidate the tax benefits. The flexibility makes SLATs attractive for families who want wealth transfer benefits without complete asset control loss.

These sophisticated trust strategies require careful coordination with business succession plans and multi-state tax considerations that many Stuart families face.

Why Stuart Families Fail at Wealth Transfer

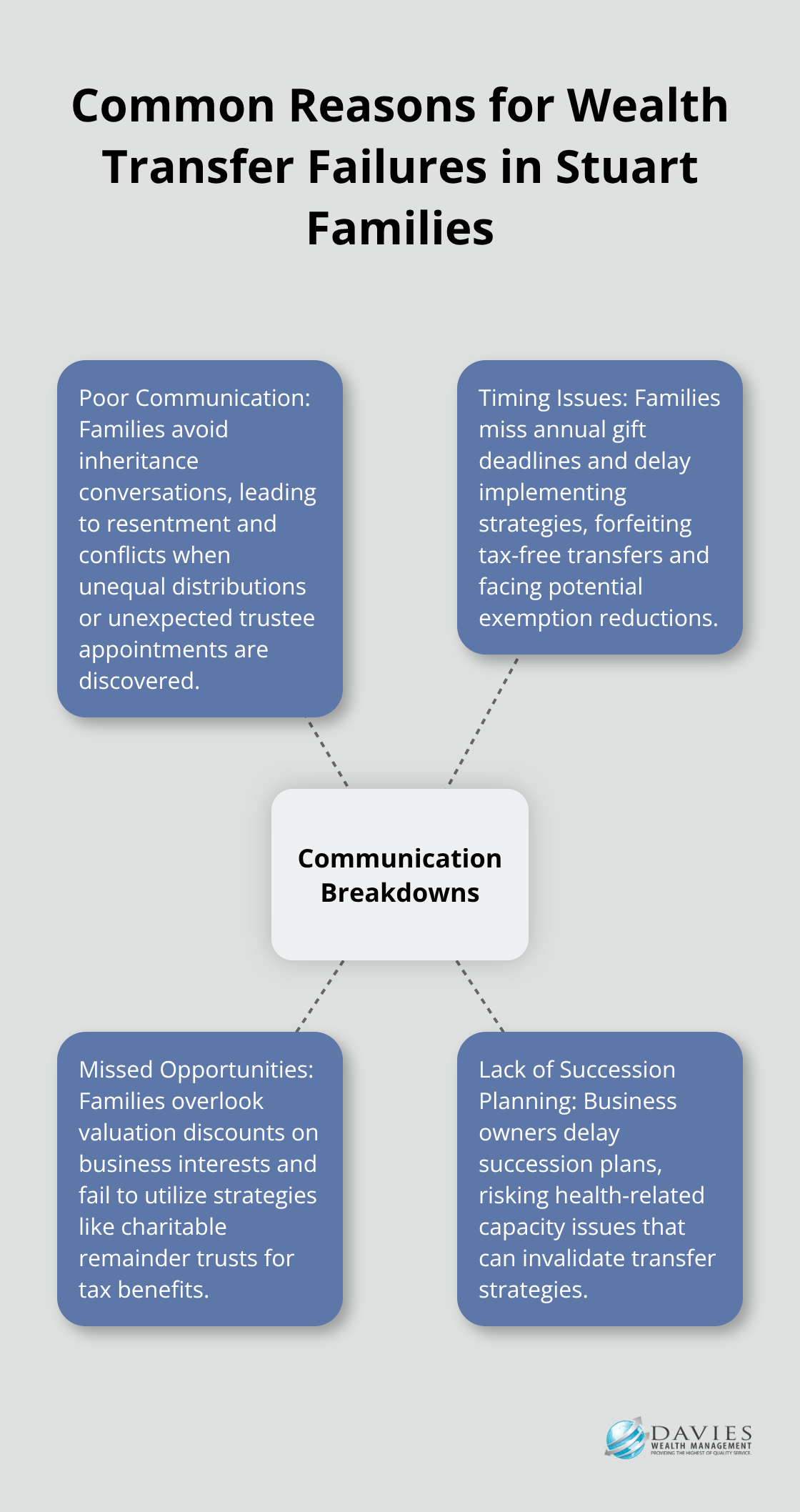

Stuart families lose approximately $847 million annually through preventable wealth transfer mistakes according to Florida Trust Association data, with communication breakdowns being a major factor in failed transfers. The pattern repeats consistently: parents delay difficult conversations until health crises force rushed decisions, children receive unexpected inheritances without preparation, and families discover tax opportunities only after deadlines pass. Professional mediators report that 78% of family wealth disputes stem from assumptions rather than explicit discussions about inheritance expectations and family business roles.

Poor Communication Destroys Family Unity

Wealthy Stuart families avoid inheritance conversations until medical emergencies force hasty decisions that satisfy no one. Parents assume children understand family values and business operations without explicit instruction, while adult children make career and residence decisions without knowledge of future inheritance responsibilities. The silence creates resentment when children discover unequal distributions or unexpected trustee appointments after parents pass away.

Family business succession fails most often when parents never communicate their vision for company leadership transitions. Children who work in the business assume they will inherit control, while siblings who pursued other careers expect equal ownership stakes. These conflicts destroy both family relationships and business value when disputes reach litigation.

Timing Destroys Tax Benefits

The December 31st annual gift deadline catches Stuart families repeatedly unprepared, forfeiting $18,000 per recipient in tax-free transfers each year. Families who wait until November to implement strategies often cannot complete valuations and legal documentation in time. Generation-skipping transfer tax exemptions worth $13.99 million per person expire unused because families postpone decisions until the current exemption potentially drops to $6 million in 2026.

Business owners who delay succession plans past age 70 face health-related capacity issues that invalidate sophisticated transfer strategies. Emergency sale situations generate massive tax bills and destroy decades of business value when families lack proper succession frameworks.

Gift Tax Opportunities Slip Away Permanently

Stuart families routinely miss valuation discounts on family business interests because they gift cash instead of discounted partnership units (losing 25-35% transfer efficiency annually). The step-up in basis strategy gets ignored when families hold appreciated real estate personally rather than transfer it through generation-skipping trusts that preserve the tax benefit for multiple generations.

Charitable remainder trusts remain underutilized despite their ability to provide immediate income tax deductions while removing assets from taxable estates. This strategy proves particularly valuable for families with significant real estate appreciation in Stuart’s growing market, yet most families never explore these options until after optimal transfer windows close.

Final Thoughts

Stuart families hold extraordinary advantages for wealth transfer through Florida’s tax-friendly environment, yet success demands deliberate action and professional guidance. The $2.8 billion in local investable assets represents tremendous opportunity, but only families who communicate openly and plan strategically will preserve their legacies effectively. The window for maximum federal exemptions closes rapidly as 2026 approaches.

Families who implement ILITs, GRATs, and SLATs before exemption reductions can save millions in estate taxes. Business owners must begin succession plans while they maintain full capacity and can structure optimal valuation discounts through Family Limited Partnerships. Communication failures destroy more family wealth than market downturns or poor investment decisions (parents who engage children in inheritance discussions early create stronger family unity and better-prepared heirs).

We at Davies Wealth Management help families navigate sophisticated trust strategies while they maintain the flexibility needed for changing circumstances. Our approach addresses the complex multi-state tax considerations many Stuart families face. The families who act decisively with professional guidance will capture the full benefits of Florida’s wealth transfer advantages.

Leave a Reply