Stuart, Florida presents compelling alternative investments beyond traditional stocks and bonds. The city’s strategic coastal location and growing economy create multiple pathways for portfolio diversification.

We at Davies Wealth Management see significant potential in Stuart’s real estate market, emerging business sectors, and favorable economic conditions. These opportunities align with current market trends toward localized investment strategies.

Real Estate Investment Opportunities in Stuart

Waterfront Properties and Marina Developments

Stuart’s waterfront properties command premium prices with marina developments that deliver consistent rental yields between 6-8% annually. Condos in Mariner Cay currently list from $329,900 to $549,900, while waterfront homes appreciate at rates 15-20% higher than inland properties.

Marina slips rent for $300-500 monthly and create steady income streams for property owners. These waterfront assets provide both appreciation potential and immediate cash flow (particularly attractive in today’s market environment).

Commercial Real Estate in Downtown Stuart

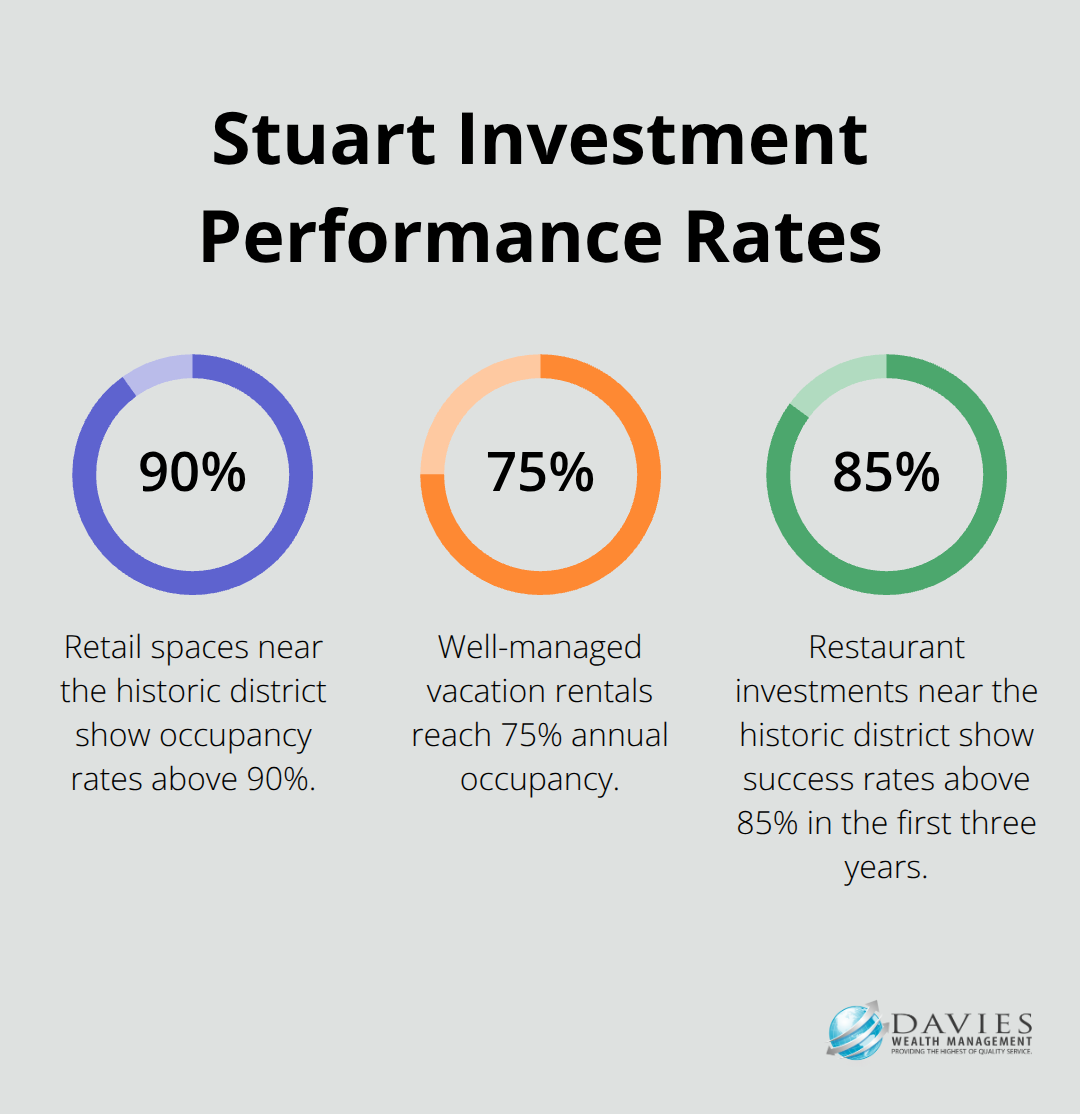

Downtown Stuart commercial real estate benefits from strong tourism activity, with retail spaces near the historic district that show occupancy rates above 90%. Office spaces target remote workers and see strong demand as Florida’s zero state income tax attracts professionals who relocate from high-tax states.

The historic district’s walkable layout attracts businesses that serve both tourists and locals. Property owners in this area enjoy stable tenant relationships and consistent foot traffic throughout the year.

Vacation Rental and Short-Term Rental Properties

Vacation rentals in Stuart generate average nightly rates of $180-250 during peak season, with annual occupancy rates that reach 75% for well-managed properties. Short-term rental licenses remain accessible compared to restrictive markets like Miami Beach (where regulations severely limit new permits).

Properties within walking distance of beaches or downtown command 30% higher rental premiums. The marine economy concentrated in Port Salerno drives demand for investor properties, as seventy percent of Martin County’s marine industry operates from this area.

Smart investors target properties near Stuart’s healthcare sector expansion. Martin Health System’s growth creates housing demand for medical professionals and specialists who visit the area regularly.

These real estate fundamentals set the stage for Stuart’s next investment frontier: the city’s emerging business sectors that capitalize on its coastal advantages.

Emerging Business and Startup Investment Sectors

Marine and Boating Industry Companies

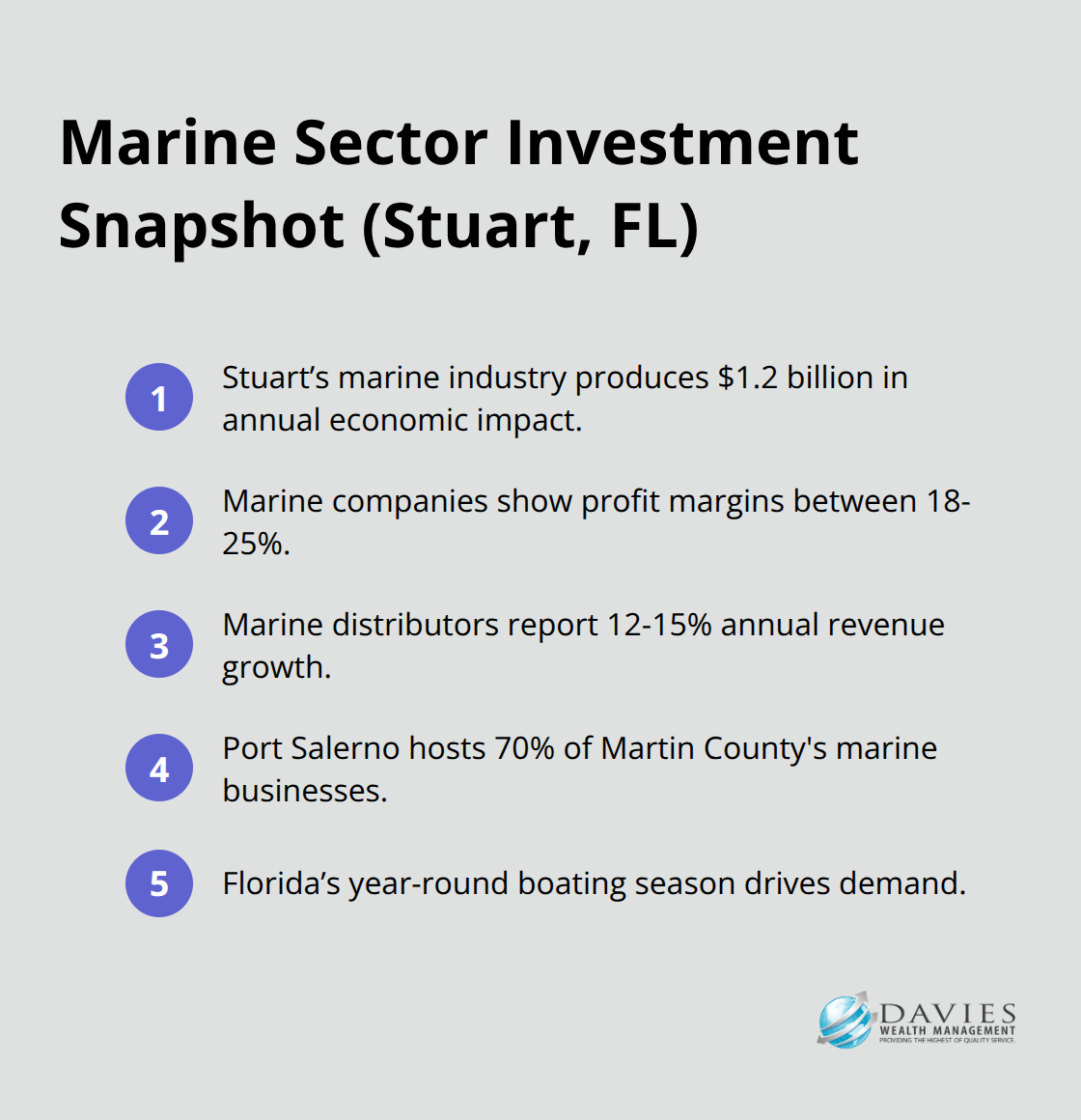

Stuart’s marine and boating industry produces over $1.2 billion in annual economic impact, which makes it the most profitable sector for business investments. Companies that manufacture boat accessories, marine electronics, and eco-friendly fishing equipment show profit margins between 18-25%.

Port Salerno hosts 70% of Martin County’s marine businesses. This concentration creates opportunities for investors who target supply chain companies, boat repair services, and marina management firms. Marine equipment distributors in this area report annual revenue growth of 12-15% (driven by Florida’s year-round boating season and rising boat ownership rates).

Tourism and Hospitality Ventures

Tourism and hospitality ventures benefit from Stuart’s share of Florida’s $23.3 billion annual beach tourism revenue. Eco-tourism businesses that focus on manatee tours, fishing charters, and kayak rentals produce average annual revenues of $180,000-$350,000 for single-operator businesses.

Restaurant investments near the historic district show success rates above 85% within their first three years. This compares favorably to the national restaurant failure rate of 60%. The historic district’s walkable layout and consistent foot traffic support these higher success rates.

Technology and Remote Work Businesses

Technology and remote work businesses capitalize on Florida’s zero state income tax advantage. Software development firms that relocate to Stuart report 20-30% cost savings compared to traditional tech hubs like San Francisco or New York.

Co-working spaces that target remote professionals achieve occupancy rates of 80-90%. These facilities charge $200-400 monthly per desk while they maintain low overhead costs in Stuart’s affordable commercial real estate market (where office space costs significantly less than major metropolitan areas).

These business investment opportunities thrive because of specific economic factors that make Stuart an attractive destination for both entrepreneurs and established companies. Successful ventures require proper financial planning and understanding of market volatility to navigate changing economic conditions.

Local Economic Factors Drive Investment Growth

Stuart’s population surged 18% between 2020 and 2024, with over 6,200 new residents who bring significant capital and investment opportunities. The median household income of new arrivals exceeds $89,000, compared to $62,000 for existing residents. This demographic shift creates immediate demand for housing, retail services, and professional businesses that smart investors target.

Retirees comprise 42% of new residents, but professionals aged 35-55 represent the fastest growth segment at 38% annually. These professionals often relocate from high-tax states and seek investment opportunities that leverage Florida’s tax benefits.

Infrastructure Projects Create Value

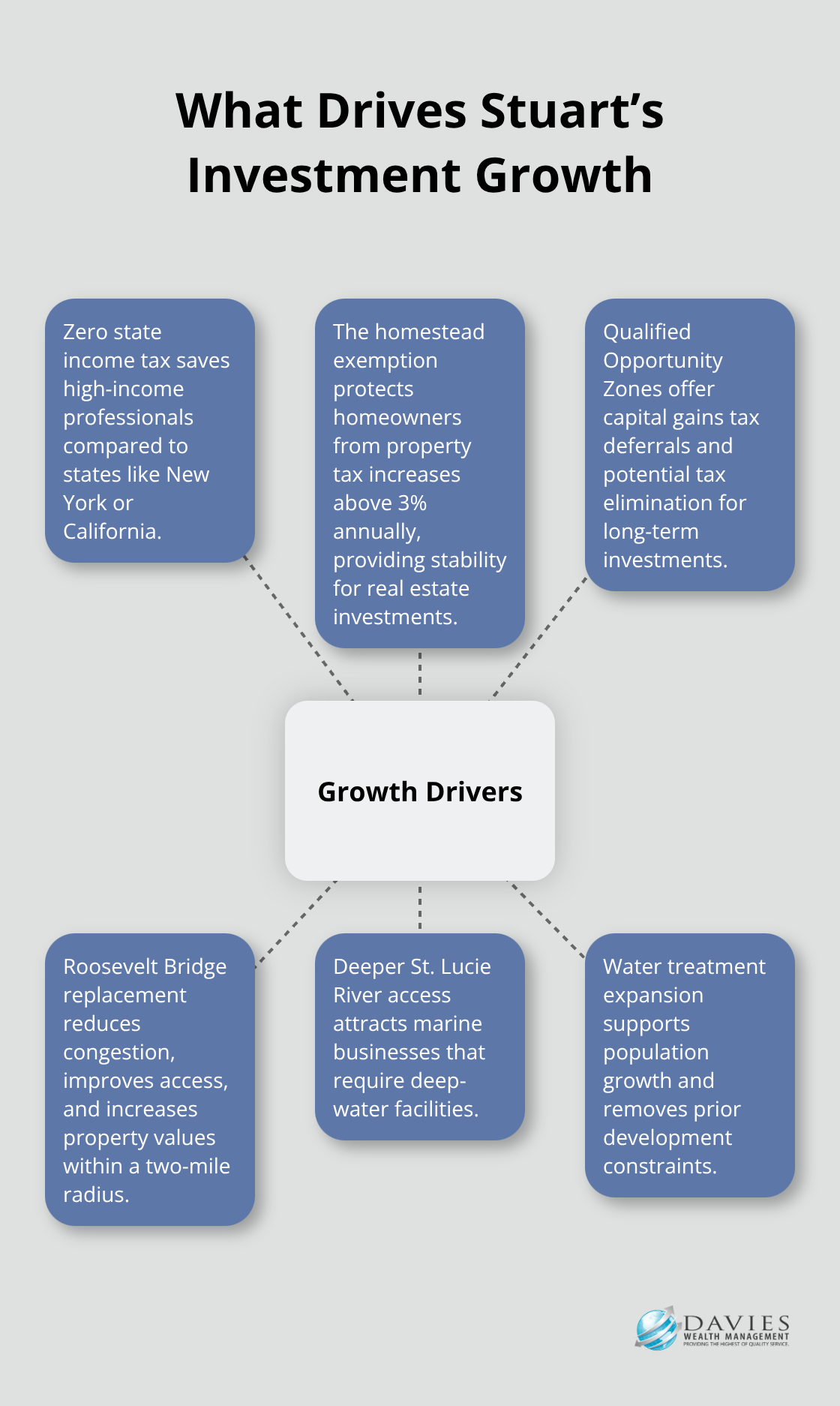

The Roosevelt Bridge replacement project connects Stuart to Palm City and increases property values within a two-mile radius. Construction completion will reduce traffic congestion and improve access to downtown Stuart’s commercial district.

The St. Lucie River project adds depth for larger vessels and attracts marine businesses that require deep-water access. Martin County’s water treatment facility expansion supports population growth and removes development constraints that previously limited new construction.

These infrastructure investments create immediate opportunities for commercial real estate near project sites (particularly for retail and office developments).

Tax Structure Drives Business Formation

Florida’s zero state income tax saves high-income professionals significant amounts annually compared to states like New York or California. New business registrations in Martin County increased in 2024, with most new companies formed by out-of-state entrepreneurs.

The homestead exemption protects primary residences from property tax increases above 3% annually, which provides stability for real estate investments. Stuart’s Qualified Opportunity Zones offer capital gains tax deferrals and potential tax elimination for long-term investments.

Business owners who establish operations in these zones access both state and federal tax advantages that significantly improve investment returns (making Stuart particularly attractive for entrepreneurs and established companies seeking wealth protection strategies).

Final Thoughts

Stuart delivers exceptional alternative investments that surpass traditional market options. Waterfront properties produce 6-8% annual yields while marina developments provide steady cash flow streams. Commercial real estate achieves 90% occupancy rates in the historic district, and vacation rentals reach 75% annual occupancy with nightly rates between $180-250.

The marine industry’s $1.2 billion economic impact creates profitable business opportunities with profit margins of 18-25%. Technology companies that relocate to Stuart report cost savings of 20-30% compared to major tech hubs. Population growth of 18% since 2020 drives demand across all investment sectors (particularly in real estate and hospitality ventures).

Florida’s zero state income tax and Qualified Opportunity Zones provide significant tax advantages for investors. Infrastructure projects like the Roosevelt Bridge replacement increase property values within two-mile radiuses. We at Davies Wealth Management help clients navigate these unique opportunities through personalized investment strategies that build long-term financial security.

Leave a Reply