At Davies Wealth Management, we understand the importance of portfolio diversification in today’s dynamic financial landscape. Alternative investments have emerged as a powerful tool for investors seeking to enhance returns and manage risk.

In this post, we’ll explore various alternative investment options and their potential benefits for your portfolio. We’ll also discuss how these non-traditional assets can complement your existing investment strategy and provide a hedge against market volatility.

Understanding Alternative Investments

Defining Alternative Investments

Alternative investments represent financial assets that exist outside the realm of conventional investment categories (stocks, bonds, and cash). These non-traditional assets have gained significant traction among investors who seek to diversify their portfolios and potentially boost returns.

Alternative investments encompass a broad spectrum of assets, from tangible items (real estate and commodities) to complex financial instruments (hedge funds and private equity). These investments possess unique characteristics that distinguish them from traditional assets. They often exhibit lower liquidity, which means they can’t be easily traded on public markets. Additionally, they typically require higher minimum investments and may fall under different regulatory frameworks.

Types of Alternative Investments

The alternative investment landscape offers a diverse and ever-evolving array of options. Some popular types include:

- Real Estate Investment Trusts (REITs): These vehicles allow investors to gain exposure to real estate without direct property ownership.

- Private Equity: This involves investing in private companies or acquiring public companies to take them private.

- Hedge Funds: These employ various strategies to generate returns, often with the goal of outperforming traditional market indices.

- Commodities: This category includes physical goods such as gold, oil, and agricultural products.

- Cryptocurrencies: Digital currencies (like Bitcoin) have emerged as potential alternative investments.

Comparing Alternatives to Traditional Investments

Alternative investments often exhibit different behavior patterns compared to traditional assets, which can enhance portfolio diversification. For instance, during the 2008 financial crisis, many alternative investments (particularly managed futures) performed well while stocks experienced significant declines.

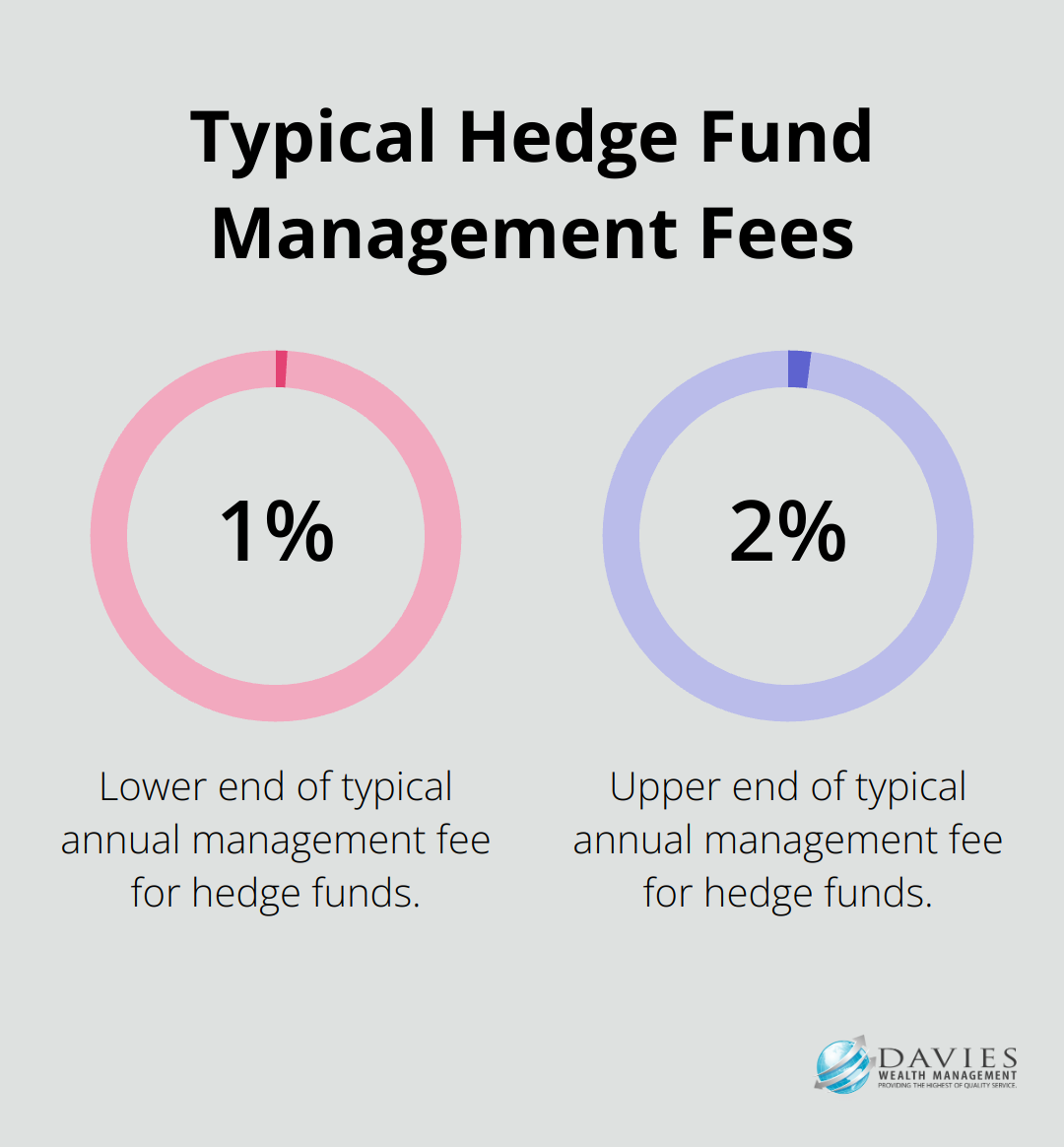

However, investors should note that alternative investments typically come with higher fees. For example, hedge funds often charge an annual management fee, typically between 1–2% of the net asset value (NAV) of the fund. They may also impose longer lock-up periods, restricting investors from withdrawing their money for a set duration.

The Role of Alternative Investments in Portfolio Strategy

Alternative investments can play a valuable role in a well-diversified portfolio when used judiciously. They offer the potential to enhance returns and manage risk by providing exposure to assets that may not correlate strongly with traditional markets.

For investors considering alternative investments, it’s essential to understand their unique characteristics, potential benefits, and associated risks. Professional guidance can prove invaluable in navigating this complex landscape and determining the appropriate allocation for individual investment goals.

As we explore the benefits of alternative investments in portfolio diversification, we’ll examine how these non-traditional assets can complement existing investment strategies and provide a hedge against market volatility.

Why Alternative Investments Matter

Enhancing Returns in Low-Yield Environments

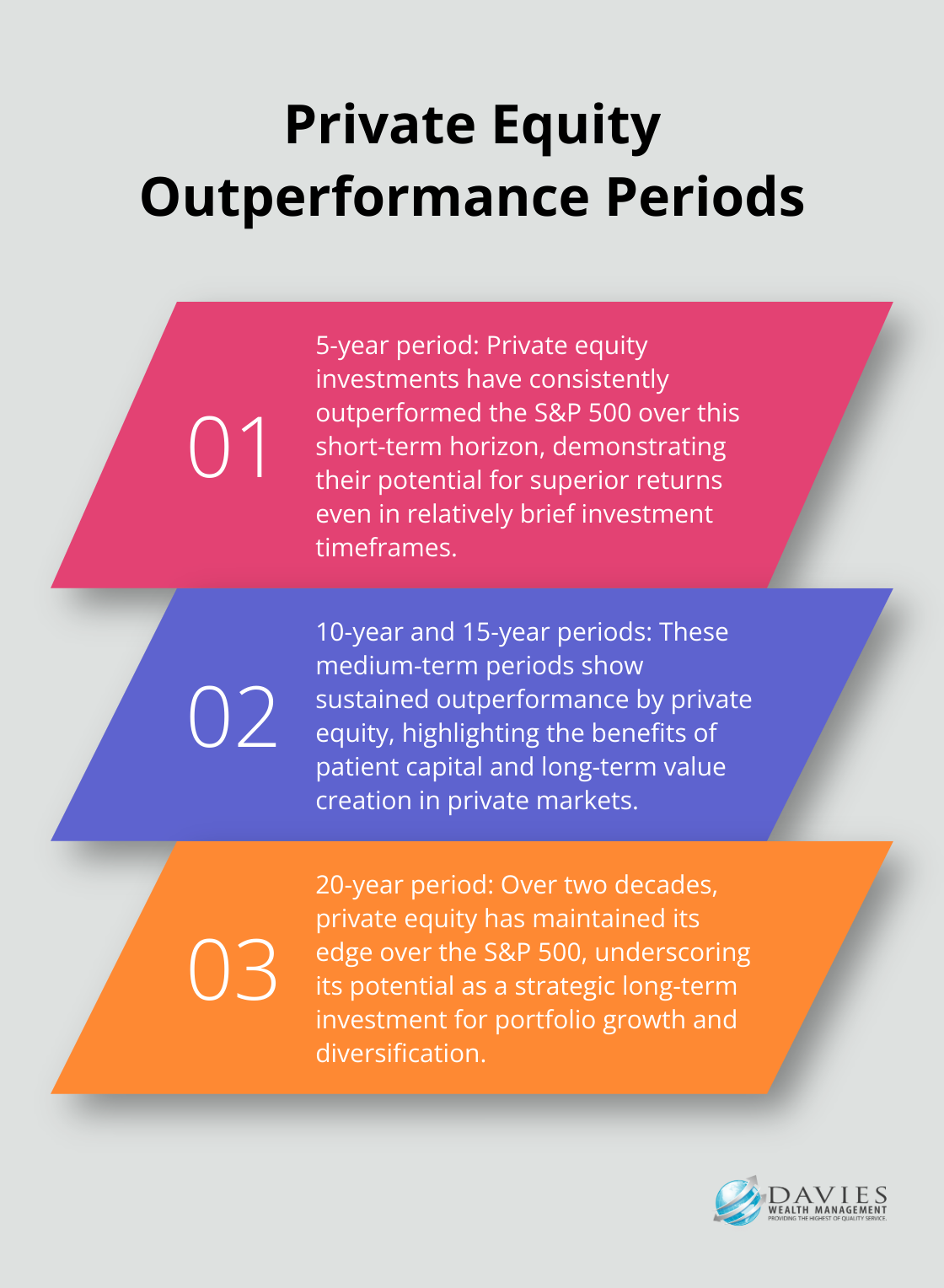

In today’s low-interest-rate climate, traditional fixed-income investments often fail to generate meaningful returns. Alternative investments can fill this gap. Private equity investments have outperformed the S&P 500 over the past 5-, 10-, 15-, and 20-year periods.

Mitigating Portfolio Volatility

One of the most significant advantages of alternative investments is their potential to reduce overall portfolio volatility. This stems from their low correlation with traditional asset classes. Private infrastructure, for example, offers a unique combination of income generation, inflation protection, and low correlation to traditional assets.

Protecting Against Inflation

With inflation concerns on the rise, alternative investments can serve as an effective hedge. Real assets like real estate and commodities often appreciate in value during inflationary periods. Gold prices have fluctuated over the past century, reaching lows in the 1970s and inflation-adjusted highs in the early ’80s.

Accessing Unique Opportunities

Alternative investments provide access to opportunities not available in public markets. Private equity allows investors to participate in the growth of promising startups before they go public. In 2020, the median time to IPO for venture-backed companies was 6.8 years (PitchBook), giving early investors a significant advantage.

Customizing Risk-Return Profiles

Different alternative investment strategies can tailor a portfolio’s risk-return profile. Hedge funds employ various strategies ranging from conservative to aggressive. This flexibility allows investors to fine-tune their exposure based on their risk tolerance and investment goals.

Alternative investments offer numerous benefits, but they also come with their own set of risks and complexities. It’s essential to work with experienced professionals who can guide you through the selection and integration of these assets into your portfolio. In the next section, we’ll explore some popular alternative investment options and how they can contribute to a well-diversified portfolio.

Exploring Popular Alternative Investment Options

Real Estate Investment Trusts (REITs)

REITs provide investors with a method to invest in real estate without direct property ownership. These trusts often concentrate on specific sectors such as office buildings, apartments, or shopping centers. REITs have outperformed the S&P 500 in certain periods, making them an attractive option for many investors.

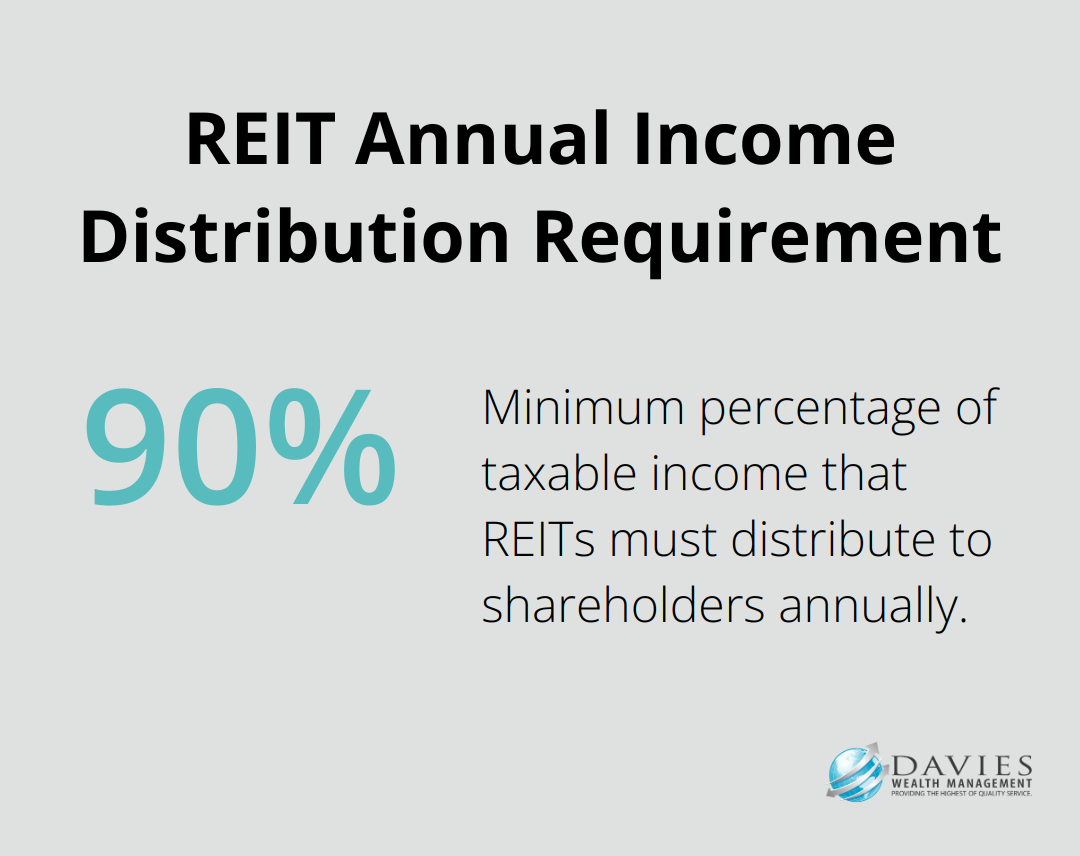

REITs must distribute at least 90% of their taxable income to shareholders annually, potentially providing a steady income stream. However, different types of REITs carry varying levels of risk. Mortgage REITs (which invest in property mortgages) tend to exhibit more volatility than equity REITs (which own and operate income-producing real estate).

Private Equity and Venture Capital

Private equity and venture capital investments offer high return potential but also come with increased risk and reduced liquidity. These investments typically involve purchasing stakes in private companies or funding startups with growth potential.

PitchBook data shows that the median holding period for private equity investments was 4.9 years in 2020. This extended investment horizon can result in significant returns for patient investors. Cambridge Associates provides performance benchmark reports for private investments.

These investments often require substantial minimum contributions and may subject investors to lock-up periods. Investors should thoroughly understand the terms and potential risks before committing capital to private equity or venture capital funds.

Hedge Funds

Hedge funds use various strategies to generate returns, often aiming to outperform traditional market indices. They can provide valuable diversification benefits due to their low correlation with traditional assets. However, hedge funds typically charge higher fees, including a management fee and a performance fee (often referred to as “2 and 20”).

The strategies employed by hedge funds can range from relatively conservative to highly aggressive. This flexibility allows investors to adjust their exposure based on their risk tolerance and investment goals. However, the complexity of these strategies requires careful consideration and expert guidance.

Commodities

Commodities, including precious metals, agricultural products, and energy resources, can serve as a hedge against inflation and currency fluctuations. Gold, for instance, has historically been viewed as a safe-haven asset during economic uncertainty.

Gold investment can be influenced by various key drivers, and its performance has evolved in recent years. This demonstrates the potential of commodities as a long-term investment and diversification tool.

Investors should note that commodity prices can be volatile and influenced by various factors, including geopolitical events, weather conditions, and global economic trends. Therefore, a well-considered approach to commodity investment is essential.

Final Thoughts

Alternative investments offer powerful tools for portfolio diversification, enhancing returns and managing risk in today’s financial landscape. These non-traditional assets provide unique benefits that complement traditional strategies, potentially mitigating volatility and hedging against inflation. However, investors must approach alternative investments with caution, as they often involve higher fees, reduced liquidity, and complex risk profiles.

Professional guidance proves invaluable when navigating the intricate world of alternative investments. Our team at Davies Wealth Management specializes in helping individuals, families, and businesses integrate these assets into their portfolios. We provide personalized advice to ensure alignment with long-term financial objectives.

Alternative investments can play a significant role in your wealth management strategy, whether you’re a seasoned investor or a professional athlete. With the right approach and expert guidance, these non-traditional assets can help build a resilient portfolio designed to weather various market conditions. Contact Davies Wealth Management to explore how alternative investments can enhance your financial future.

Leave a Reply