Estate planning in Stuart, Florida is a critical step in securing your family’s future and protecting your hard-earned assets. At Davies Wealth Management, we understand the unique challenges and opportunities that come with estate planning in this tax-friendly state.

Our comprehensive approach addresses everything from wills and trusts to power of attorney and healthcare directives, tailored to Florida’s specific laws and regulations. We’re here to help you navigate the complexities of estate planning, ensuring your legacy is preserved for generations to come.

Why Estate Planning Matters in Stuart

Protecting Your Legacy

Estate planning in Stuart, FL is not just for the wealthy or elderly. It’s an essential step for anyone who wants to protect their assets and secure their family’s future. At Davies Wealth Management, we’ve observed how proper estate planning can significantly impact people’s lives.

One of the primary reasons estate planning is so important in Stuart is the protection it offers to your assets and loved ones. Without a solid plan, your hard-earned wealth could be at risk. For example, in Florida, if you die without a will (intestate), the state decides how your assets are distributed. This may not align with your wishes and could leave your family in a difficult position.

Maximizing Tax Benefits

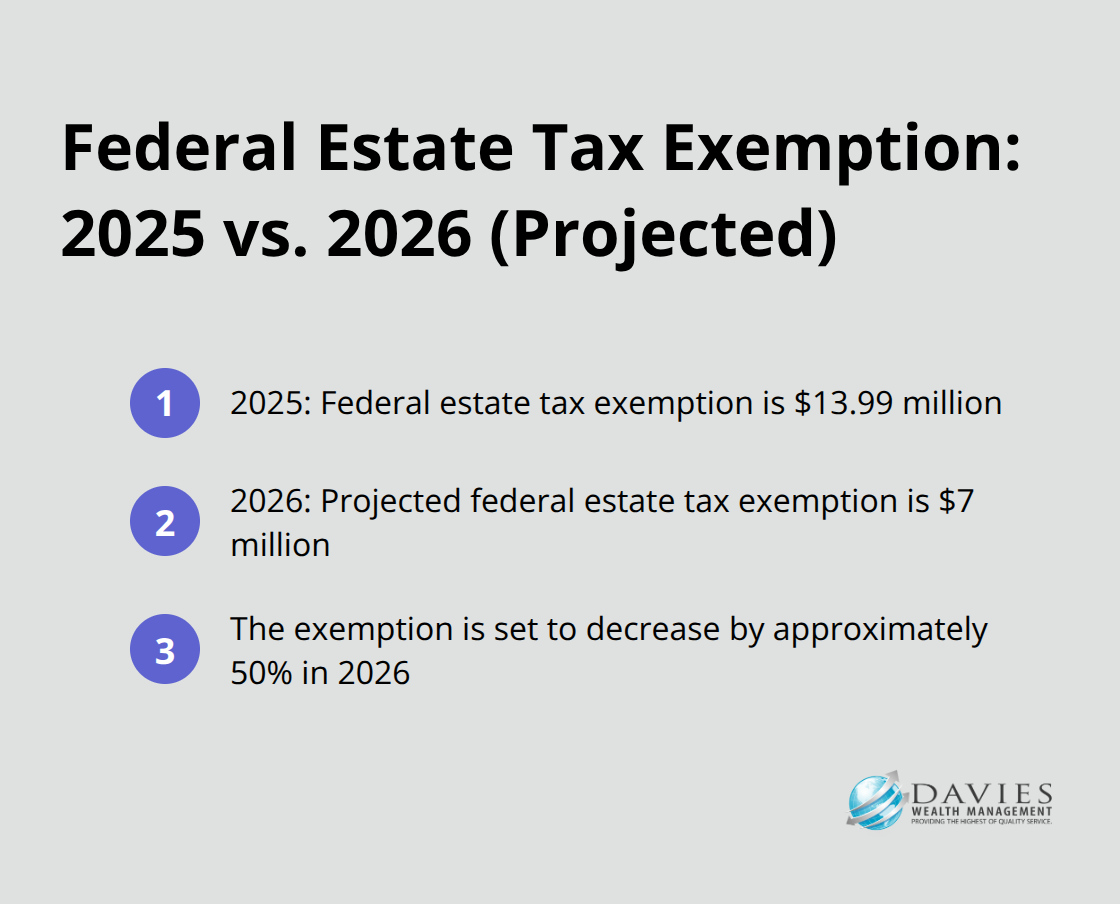

Florida is known for its tax-friendly environment, especially for retirees. The state has no income tax and no estate tax, which is a significant advantage. However, federal estate taxes may still apply to larger estates. In 2025, the federal estate tax exemption is set at $13.99 million for individuals. Couples making joint gifts can double that amount. Proper planning can help you maximize these exemptions and potentially save your heirs millions in taxes.

Avoiding Probate

One of the most compelling reasons for estate planning in Stuart is to avoid probate. Probate is the legal process of validating a will and distributing assets, which can be time-consuming and expensive. In Florida, probate can take up to three months for simple estates, up to one year for standard formal administrations, and two or more years for complex cases. Setting up trusts and other estate planning tools can ensure your assets are transferred to your beneficiaries quickly and efficiently, bypassing the probate process altogether.

Tailoring Your Plan

Every individual’s situation is unique, and estate planning should reflect that. Your plan should consider factors such as:

- Family dynamics (e.g., blended families, special needs dependents)

- Business ownership

- Charitable intentions

- Retirement goals

- Healthcare preferences

A well-crafted estate plan addresses all these aspects, ensuring your wishes are carried out and your loved ones are protected.

Planning for Incapacity

Estate planning isn’t just about what happens after you pass away. It also includes provisions for managing your affairs if you become incapacitated. This involves creating documents such as:

- Durable Power of Attorney

- Healthcare Proxy

- Living Will

A durable POA allows the agent to begin managing affairs on your behalf as soon as the document is created – and remains in effect if you become incapacitated. These documents ensure that your financial and medical decisions are made according to your wishes, even if you’re unable to communicate them yourself.

As we move forward, it’s important to understand the key components that make up a comprehensive financial plan. Let’s explore the essential elements that will help you secure your legacy and protect your loved ones.

Building Your Estate Plan Foundation

Wills and Trusts: The Cornerstones of Your Plan

A will forms the most basic and essential estate planning document. It outlines how you want your assets distributed after your death and names an executor to manage your estate. In Florida, a valid will must be in writing and signed by you and two witnesses. Without a will, the state will distribute your assets according to Florida’s intestacy laws, which may not align with your wishes.

Trusts offer more flexibility and control. A revocable living trust allows you to manage your assets during your lifetime and specify how they should be distributed after your death. Trusts can help avoid probate, potentially saving your beneficiaries time and money. By the end of 2025, the exemption will be drastically reduced, which could impact anyone with substantial assets. Taking action now is crucial to preserve your assets.

Power of Attorney and Healthcare Directives: Planning for Incapacity

A durable power of attorney (POA) is essential for managing your financial affairs if you become incapacitated. This document allows you to appoint someone to make financial decisions on your behalf. In Florida, a POA must be signed by you and two witnesses, and it must be notorized to be valid.

Healthcare directives, including a living will and healthcare proxy, ensure your medical wishes are respected if you’re unable to communicate them yourself. A living will outlines your preferences for end-of-life care, while a healthcare proxy designates someone to make medical decisions for you. These documents can prevent family disputes and ensure your healthcare wishes are followed. As an alternative to a health care surrogate, or in addition to, you might want to designate a durable power of attorney.

Beneficiary Designations and Asset Titling: Often Overlooked Details

Beneficiary designations on accounts like life insurance policies, retirement accounts, and bank accounts supersede instructions in your will. You should review and update these designations regularly, especially after major life events (such as marriage, divorce, or the birth of a child).

Asset titling is another critical aspect of estate planning. How your assets are titled can affect how they’re transferred after your death. For example, assets held in joint tenancy with rights of survivorship will automatically pass to the surviving owner, bypassing probate.

Reviewing your estate plan at regular intervals helps ensure that your wishes are followed and that your beneficiaries receive proper care after your passing. With careful planning and professional guidance, you can create a comprehensive estate plan that protects your assets and secures your legacy for generations to come.

[A hub and spoke chart showing key components of an estate plan that need regular review is inserted here]

As we move forward, it’s important to consider the unique aspects of estate planning in Stuart, FL. The next section will explore how local laws and regulations can impact your estate planning strategy.

How Stuart’s Unique Environment Shapes Estate Planning

Florida’s Distinct Estate Planning Laws

Estate planning in Stuart, Florida presents unique challenges and opportunities due to the state’s specific laws. Florida protects homestead property from creditors, which safeguards your primary residence from claims, even after death. This protection, however, can complicate matters when you want to leave your home to someone other than your spouse or minor children.

Florida’s elective share statute also impacts estate distribution. This law grants a surviving spouse the right to claim a percentage of the deceased spouse’s elective estate, regardless of the will’s contents. Estate planners must account for this provision to ensure their clients’ wishes are honored.

Tax Benefits for Retirees in Stuart

Stuart attracts retirees partly due to Florida’s tax-friendly environment. The absence of state income tax and estate tax allows retirees to potentially save thousands each year. However, federal estate taxes still apply to larger estates. As of 2025, the federal estate tax exemption stands at $13.99 million per individual (projected to be $7 million in 2026 unless Congress intervenes).

To maximize these tax benefits, consider strategies such as:

- Gifting assets during your lifetime

- Setting up irrevocable trusts

- Utilizing annual gift tax exclusions

These methods can reduce the size of your taxable estate while still providing for your beneficiaries.

Planning for Snowbirds and Part-Time Residents

Many Stuart residents split their time between Florida and another state, which complicates estate planning. If you’re a snowbird, you may need to maintain estate planning documents in both states. It’s important to ensure these documents remain consistent and comply with the laws of both jurisdictions.

Establishing Florida as your primary residence offers significant tax advantages. However, you must meet specific requirements to claim Florida domicile, including:

- Obtaining a Florida driver’s license

- Registering to vote in Florida

- Spending at least 183 days per year in the state

[A checkmark list showing the requirements for claiming Florida domicile is inserted here]

Protecting Retirement Assets in a Tax-Friendly State

Stuart’s tax-friendly environment extends to retirement assets. Florida doesn’t tax distributions from retirement accounts, which can significantly impact your long-term financial planning. This benefit allows retirees to potentially keep more of their hard-earned savings.

To fully leverage this advantage, consider:

- Roth IRA conversions (which can be especially beneficial in a no-income-tax state)

- Strategic withdrawals from various retirement accounts

- Exploring Florida-specific retirement savings vehicles

Addressing Healthcare and Long-Term Care Planning

Florida’s large retiree population means healthcare and long-term care planning are critical components of estate planning in Stuart. The state offers various programs and resources for seniors, but it’s essential to incorporate these considerations into your overall estate plan.

Key aspects to address include:

- Long-term care insurance options

- Medicaid planning strategies

- Advanced healthcare directives tailored to Florida law

Final Thoughts

Estate planning in Stuart, Florida protects your financial legacy and safeguards your loved ones. The tax-friendly environment offers numerous advantages, but navigating Florida’s specific laws requires expert guidance. A comprehensive estate plan ensures asset distribution according to your wishes, minimizes tax implications, and avoids potential legal complications.

Stuart residents face unique challenges in estate planning, including considerations for snowbirds and part-time residents. Protecting retirement assets, addressing healthcare needs, and leveraging Florida’s tax advantages are essential components of a well-crafted plan. These factors underscore the importance of tailored estate planning strategies for individuals in this distinctive locale.

Davies Wealth Management understands the intricacies of estate planning Stuart Florida. Our team provides personalized solutions tailored to your unique circumstances, offering comprehensive financial planning services. We invite you to contact us today to schedule a consultation and discover how our approach can help you secure your financial future and protect your legacy for generations to come.

Leave a Reply