Estate planning is a cornerstone of effective wealth management. At Davies Wealth Management, we’ve seen how a well-crafted estate plan can protect assets, minimize taxes, and ensure a lasting legacy.

Yet, many individuals overlook this critical aspect of financial planning, leaving their wealth vulnerable to unnecessary risks and complications.

In this post, we’ll explore the key components of estate planning and why it’s essential for everyone, from everyday investors to professional athletes.

What Is Estate Planning?

Estate planning forms the backbone of effective wealth management. It encompasses more than just drafting a will; it’s a comprehensive strategy to manage and distribute assets during life and after death. At Davies Wealth Management, we’ve observed how proper estate planning safeguards wealth, minimizes taxes, and aligns legacies with clients’ wishes.

The Pillars of a Solid Estate Plan

A robust estate plan includes several key components:

- Will or Living Trust: These documents dictate how assets should be distributed.

- Power of Attorney: This allows a trusted individual to make financial and medical decisions if you become incapacitated.

- Healthcare Directives: A living will outlines preferences for medical treatment in various scenarios.

- Beneficiary Designations: Often overlooked, these designations on retirement accounts and life insurance policies bypass probate and ensure assets go to intended recipients.

- Advanced Tools: For substantial estates, irrevocable trusts offer additional tax benefits and asset protection.

Debunking Estate Planning Myths

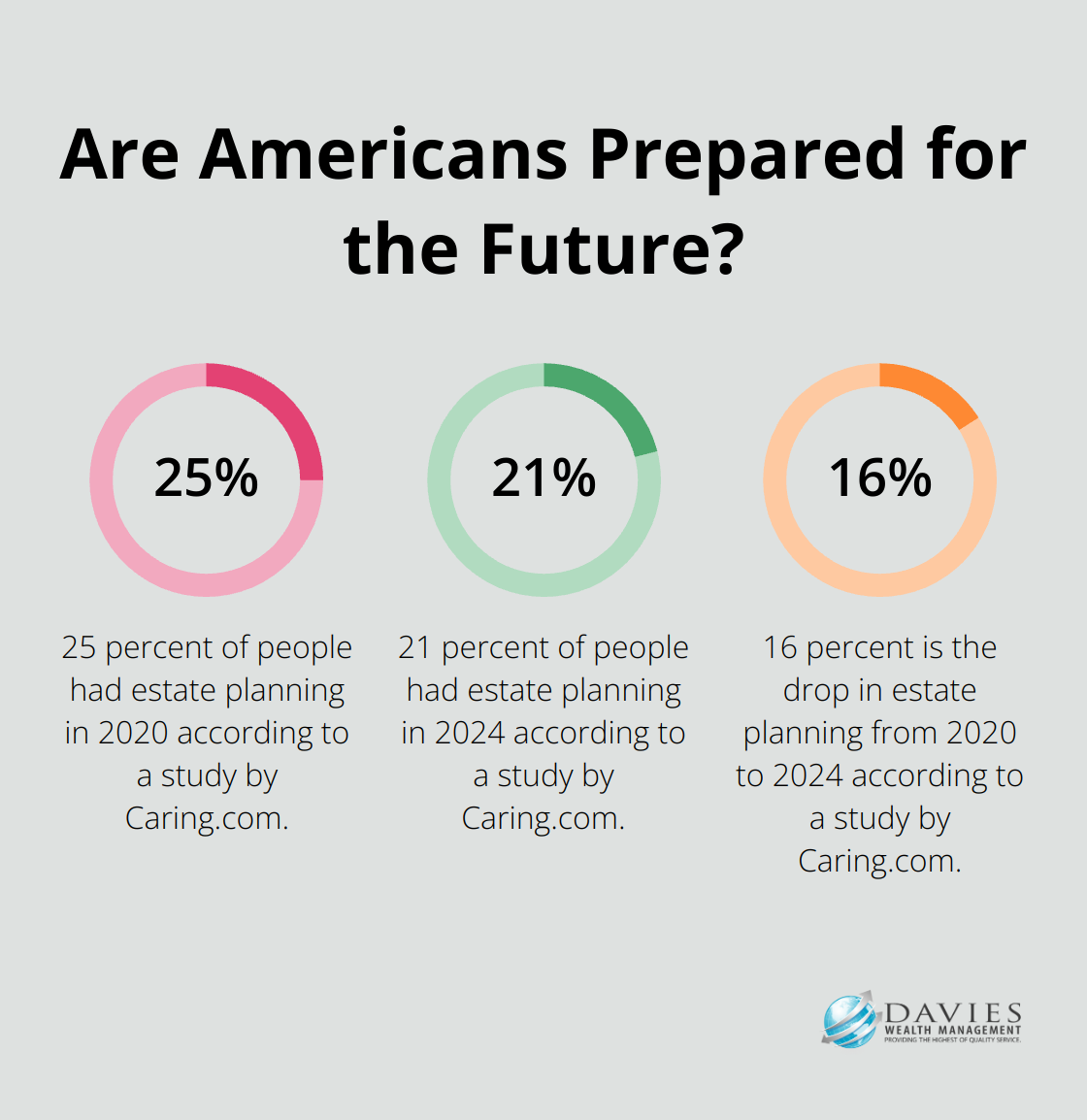

Many people believe estate planning only benefits the wealthy. This dangerous misconception leaves even modest estates vulnerable to lengthy probate processes, potentially depleting assets meant for heirs. A study by Caring.com found that estate planning has decreased from 25 percent in 2020 down to 21 percent in 2024, a 16 percent drop.

Another myth suggests estate planning is a one-time event. In reality, it requires regular reviews and updates. Life changes (marriages, divorces, births, or significant financial shifts) necessitate adjustments to your plan. At Davies Wealth Management, we recommend annual reviews to ensure estate plans remain aligned with current situations and goals.

The Cost of Inaction

Failure to plan can result in severe consequences:

- Asset Distribution: Without proper documentation, state laws (rather than your wishes) may dictate asset distribution.

- Family Disputes: Lack of clear instructions can lead to conflicts among heirs.

- Unnecessary Taxes: Poor planning may result in avoidable tax burdens.

- Guardian Appointments: Courts might appoint guardians for minor children that you wouldn’t have chosen.

The probate process can be lengthy and expensive. A well-structured estate plan helps avoid or minimize these costs, preserving more wealth for beneficiaries.

Tailored Solutions for Diverse Needs

Estate planning isn’t one-size-fits-all. Professional athletes, for example, face unique challenges due to their complex financial arrangements. Individuals with modest estates also benefit from tailored plans that protect their assets and ensure their wishes are respected.

As we move forward, we’ll explore essential estate planning tools and strategies that can help you secure your financial legacy. These tools provide the foundation for a comprehensive wealth management approach, regardless of your current financial status or future goals.

Essential Estate Planning Tools and Strategies

Estate planning forms the foundation of effective wealth management. Understanding key tools can help you create a robust plan to protect and transfer your wealth effectively.

Wills and Trusts: Types and Benefits

Wills and trusts serve as fundamental components of estate planning. A will outlines how you want your assets distributed after death. Trusts, on the other hand, can manage assets during your lifetime and beyond. Revocable living trusts allow you to maintain control of your assets while alive and provide for smooth asset transfer upon death, avoiding probate.

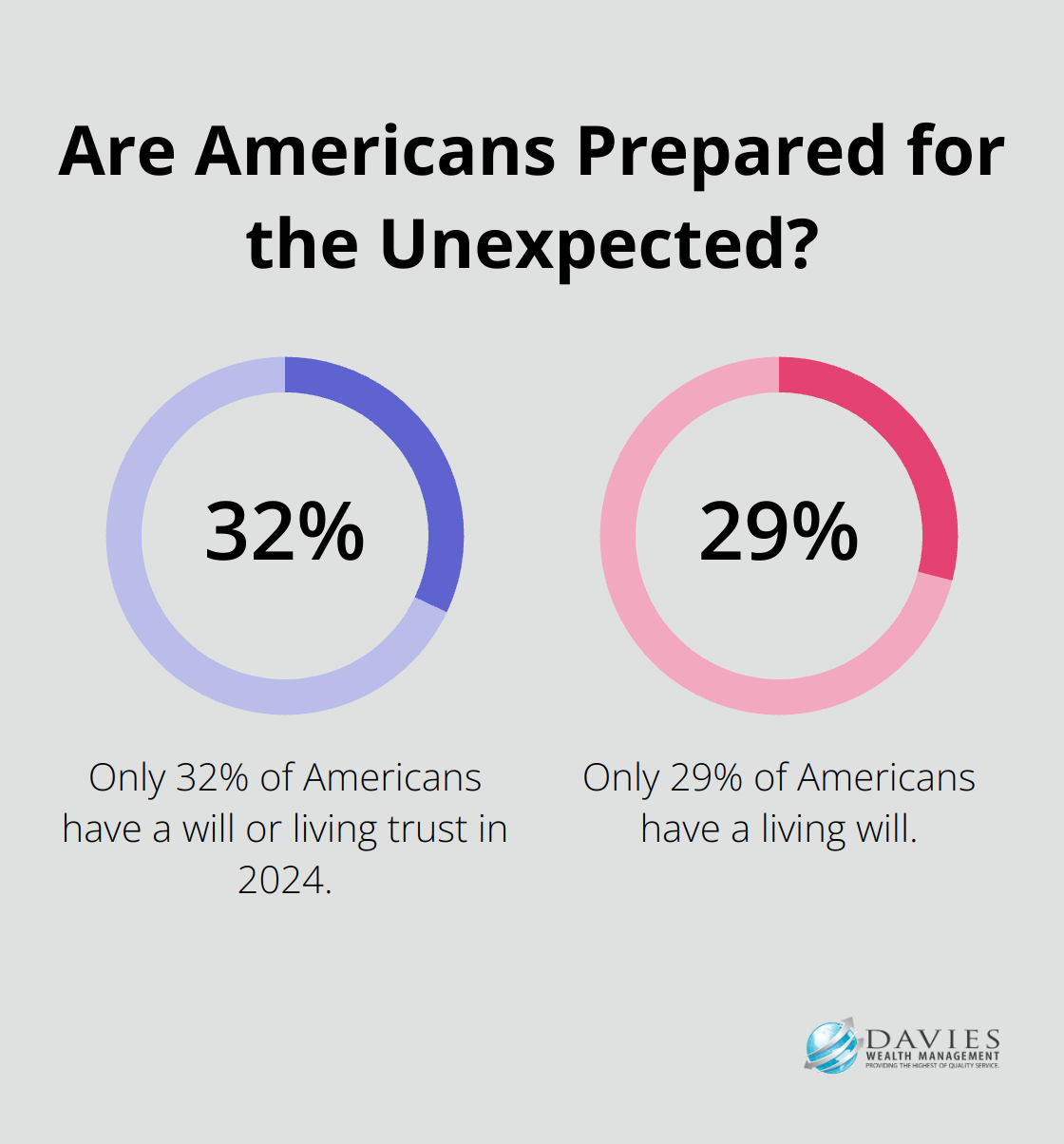

A 2024 Caring.com survey revealed that only 32% of Americans have a will or living trust in 2024, a 6% decline from the previous year. This low number leaves many estates vulnerable to state intestacy laws, which may not align with individual wishes.

Power of Attorney and Healthcare Directives

A durable power of attorney grants someone the authority to manage your financial affairs if you become incapacitated. Healthcare directives (including a living will and healthcare power of attorney) ensure your medical wishes are respected if you can’t communicate them yourself.

An American Bar Association study found that only 29% of Americans have a living will. This gap leaves many families unprepared for medical emergencies, potentially leading to conflicts and unwanted treatments.

Beneficiary Designations and Asset Titling

Beneficiary designations on retirement accounts, life insurance policies, and other assets supersede instructions in a will. Regular reviews and updates of these designations are essential. Asset titling (such as joint ownership with rights of survivorship) can also impact how assets transfer upon death.

A common mistake involves outdated beneficiary designations. For example, an ex-spouse might still be listed as a beneficiary on a life insurance policy, leading to unintended consequences.

Tax-Efficient Gifting Strategies

Gifting can reduce estate taxes while supporting loved ones or charitable causes. For 2025, the annual gift tax exclusion allows you to give up to $13,990 per recipient without incurring gift tax.

For larger estates, advanced strategies like grantor retained annuity trusts (GRATs) or charitable remainder trusts can provide significant tax benefits. These tools require careful planning and professional guidance to implement effectively.

Estate planning requires ongoing attention and regular reviews. Annual assessments help ensure your plan remains aligned with your goals and current laws. As we move forward, we’ll explore how estate planning applies to specific groups, such as professional athletes, who face unique financial challenges.

Estate Planning for Professional Athletes

Unique Financial Challenges

Professional athletes face distinct financial challenges that require specialized estate planning strategies. This study aimed to look at both reasons for why professional athletes are going broke but also how a financial advisor can impact this problem.

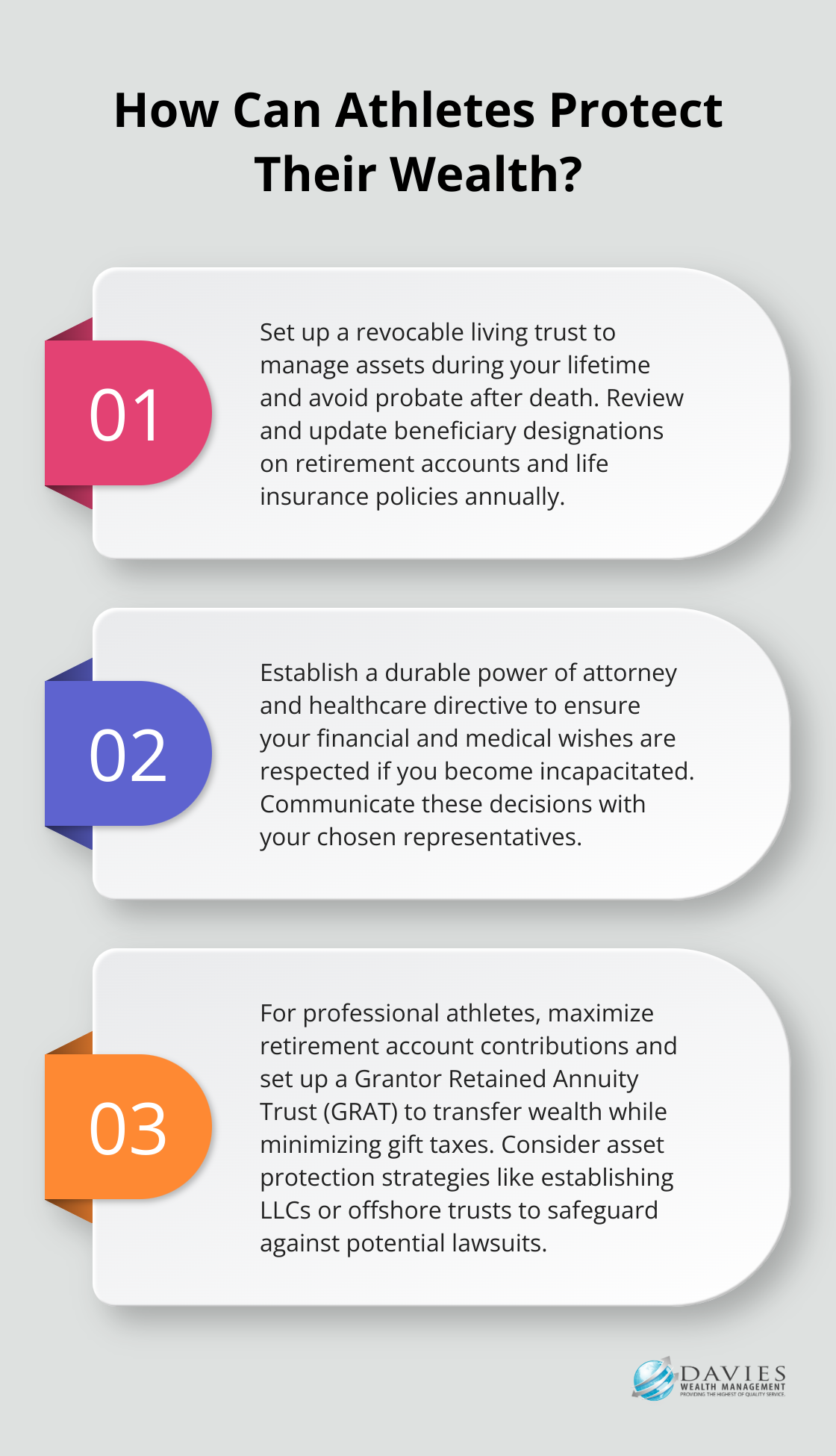

Maximizing Short-Term Earnings

To address the short career spans and fluctuating income, athletes should maximize retirement account contributions and establish trusts to manage wealth over the long term. A Grantor Retained Annuity Trust (GRAT) can effectively transfer wealth while minimizing gift taxes, particularly useful for athletes with large signing bonuses or endorsement deals.

Asset Protection Strategies

Professional athletes often become targets for lawsuits. Asset protection is a set of legal strategies designed to safeguard an individual’s or entity’s assets from potential risks and liabilities. These structures separate personal assets from business ventures, reducing overall risk. In some cases, offshore trusts in jurisdictions with strong asset protection laws provide additional security (though this strategy requires careful navigation of complex legal and tax requirements).

Planning for Post-Career Financial Stability

Many athletes struggle financially after retirement. To combat this issue, athletes should develop diverse investment portfolios and create passive income streams. Real estate investments, for instance, can provide steady cash flow after an athlete’s playing days end.

Importance of Regular Reviews

The financial landscape for professional athletes can change rapidly. New contracts, endorsement deals, or injuries can significantly impact an athlete’s financial situation. Quarterly reviews of estate plans ensure they remain aligned with current circumstances and goals. These reviews also allow for adaptation to changes in tax laws or regulations that may affect athletes’ financial strategies.

Final Thoughts

Estate planning forms the cornerstone of effective wealth management. It protects assets, minimizes taxes, and ensures a lasting legacy for future generations. Professional advisors play a vital role in creating tailored strategies that align with specific needs and goals (including those of professional athletes).

Davies Wealth Management specializes in comprehensive estate planning and wealth management solutions. We offer personalized strategies designed to secure your financial future and provide peace of mind for you and your loved ones. Our expertise extends to serving clients with unique financial challenges, ensuring their legacy remains protected.

Take action on your estate plan today. Davies Wealth Management stands ready to guide you through the process, offering expert advice tailored to your situation. Your financial legacy deserves nothing less than professional guidance and personalized strategies to protect and grow your wealth for generations to come.

Leave a Reply