At Davies Wealth Management, we understand that mastering financial planning skills is essential for long-term financial success.

In this post, we’ll describe two examples of important things that financial planning skills encompass: budgeting and investment planning.

These fundamental skills form the backbone of a solid financial strategy, enabling you to manage your money effectively and grow your wealth over time.

How to Master Budgeting for Financial Success

Track Your Cash Flow

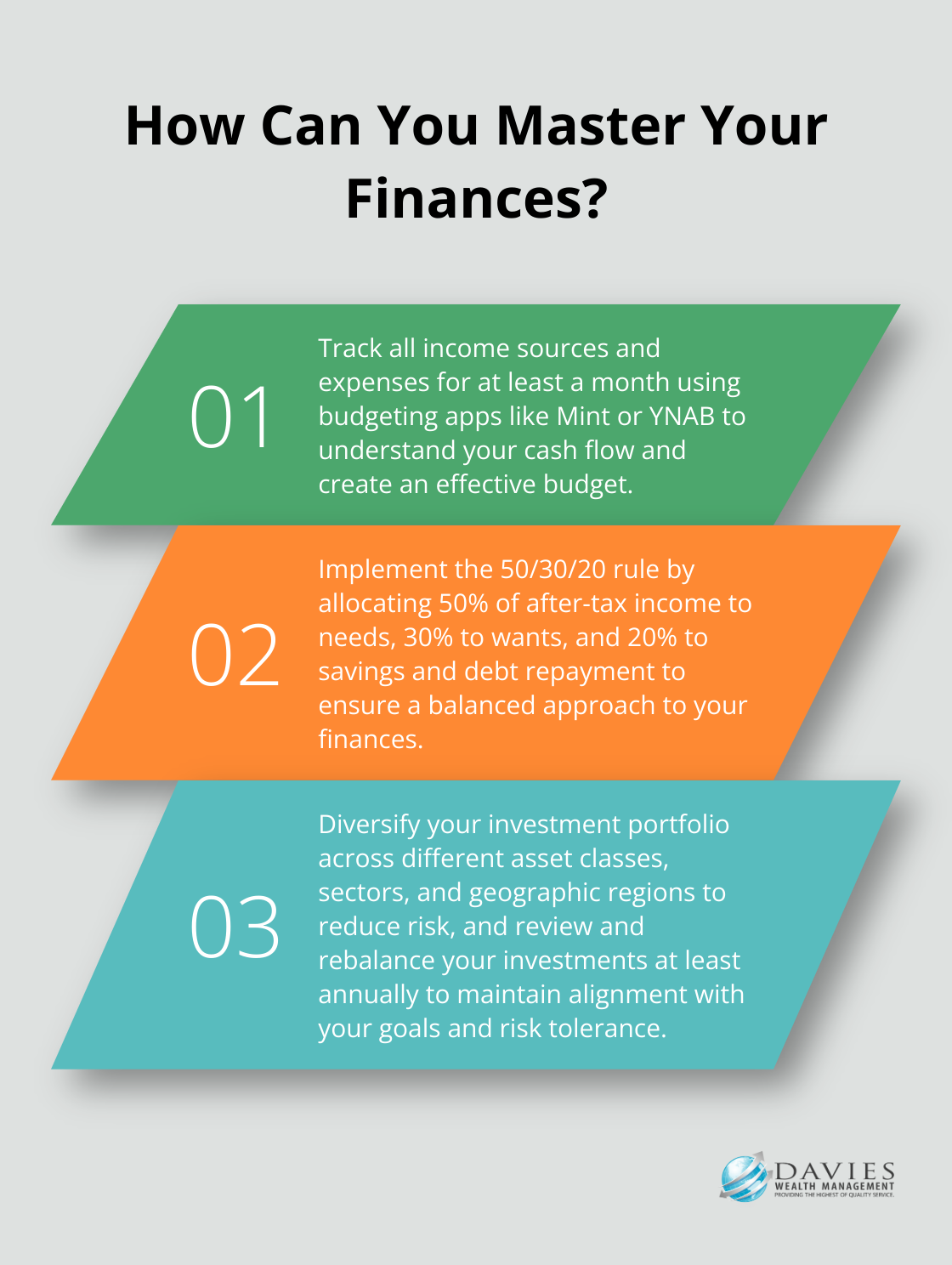

The first step in creating a budget requires you to understand your cash flow. Start by tracking all your income sources and expenses for at least a month. This includes everything from your salary to that daily coffee purchase. Many people find that budgeting apps like Mint or YNAB (You Need A Budget) simplify this process significantly.

Set Realistic Financial Goals

After you have a clear picture of your cash flow, it’s time to set realistic financial goals. These could range from building an emergency fund to saving for a down payment on a house. Be specific and attach timelines to your goals. For example, try to save $10,000 for an emergency fund within 12 months.

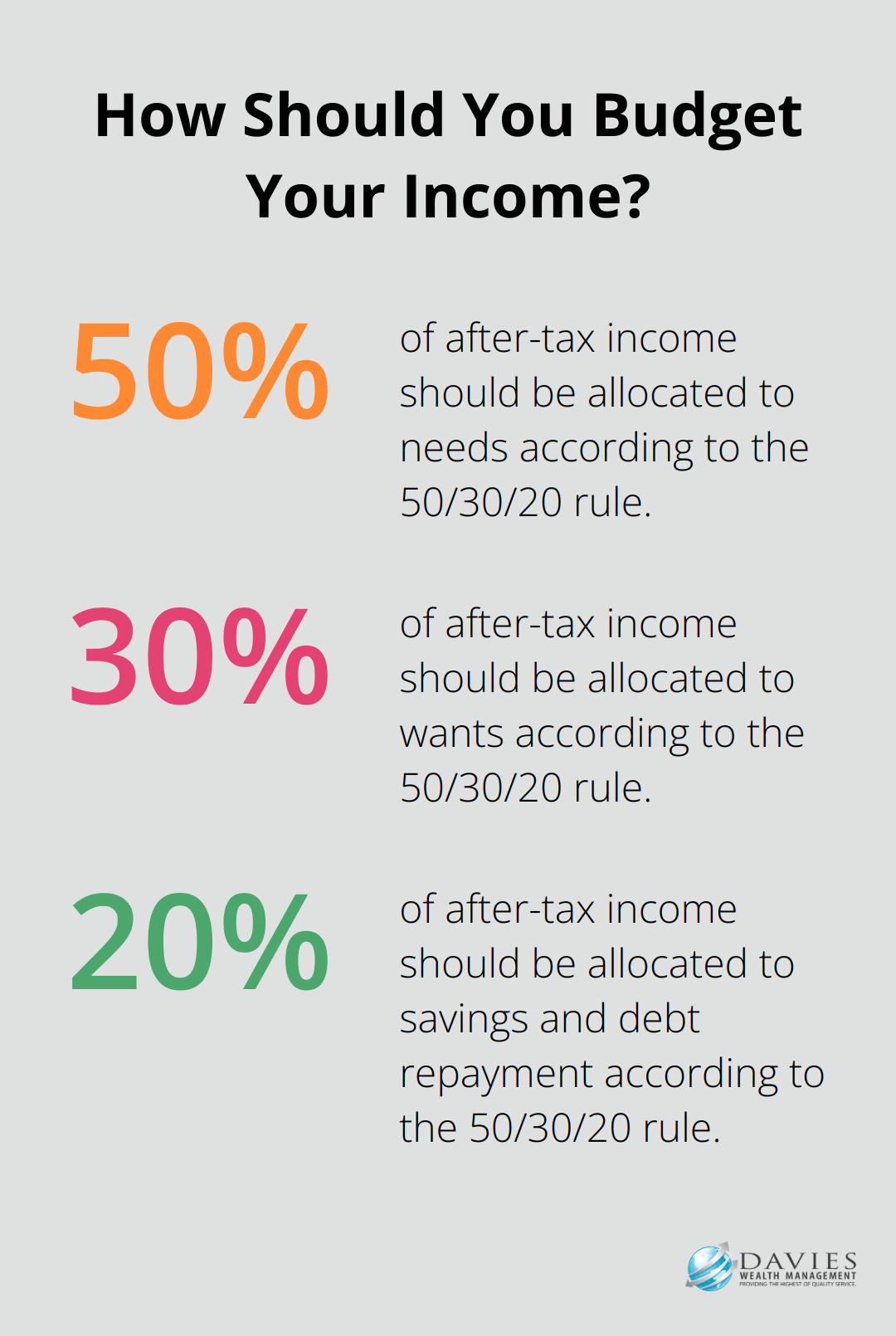

Implement the 50/30/20 Rule

A practical budgeting technique is the 50/30/20 rule. This approach suggests you allocate 50% of your after-tax income to needs (like housing and groceries), 30% to wants (entertainment and non-essential purchases), and 20% to savings and debt repayment. This balanced approach ensures you address all aspects of your financial life.

Review and Adjust Regularly

Your budget isn’t set in stone. Life changes, and so should your budget. Review your budget monthly and make adjustments as needed. Did you get a raise? Increase your savings rate. Unexpected expense? See where you can cut back temporarily.

Avoid Common Pitfalls

Several common budgeting mistakes can derail your financial plans. One is underestimating irregular expenses (like car maintenance or holiday gifts). Another is setting unrealistic expectations, which leads to frustration and abandonment of the budget. Be honest with yourself about your spending habits and make gradual changes for lasting success.

Mastering the art of budgeting takes time and practice, but it’s a skill that pays dividends throughout your life. These strategies will help you build a solid financial foundation. As you become more proficient in budgeting, you’ll find yourself ready to tackle more advanced financial planning tasks, such as investment planning. Let’s explore how you can grow your wealth through smart investment strategies in the next section.

How to Grow Your Wealth Through Smart Investing

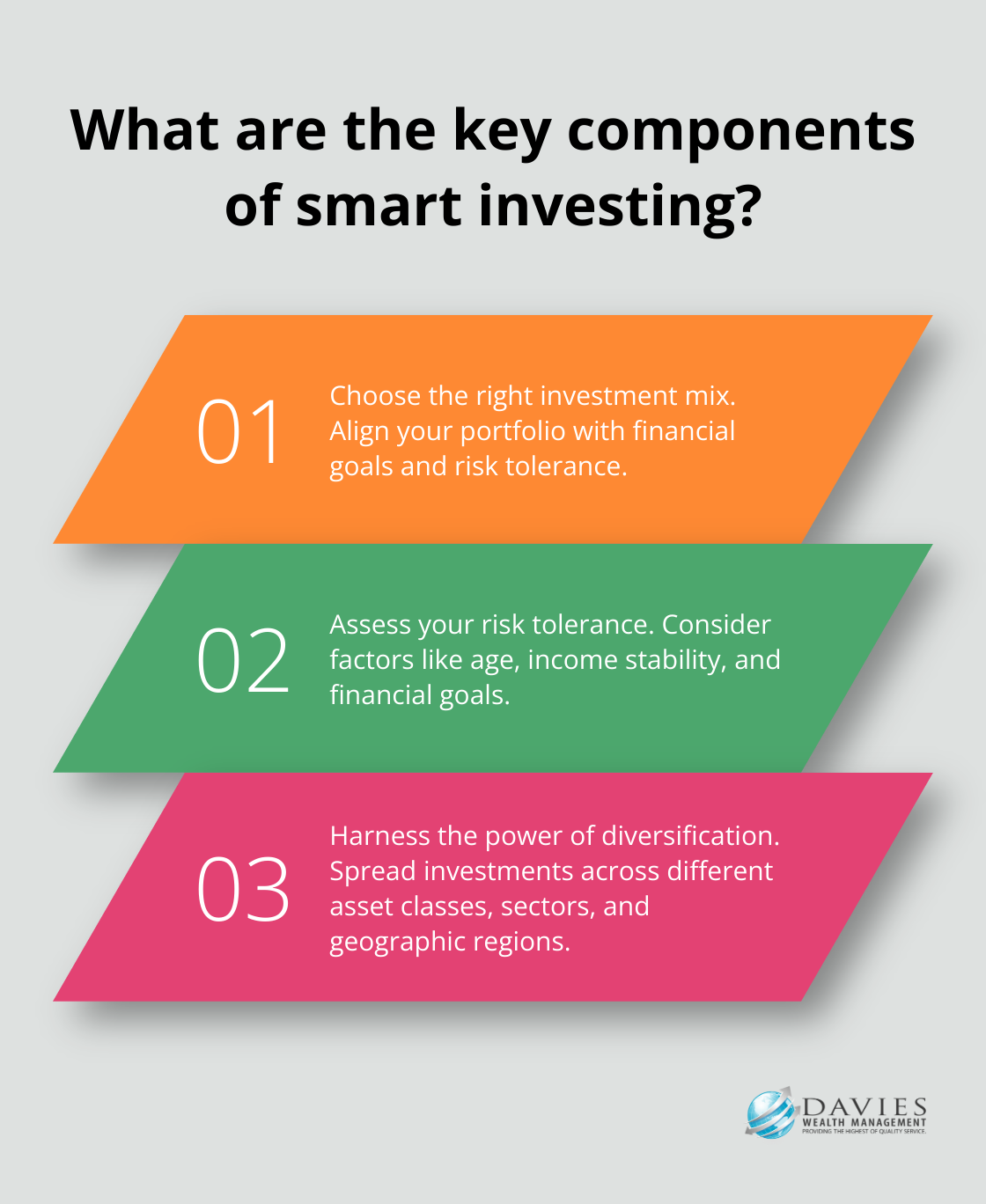

Choose the Right Investment Mix

The first step in investment planning requires you to understand your options. Stocks, bonds, real estate, and mutual funds are common choices, each with its own risk-reward profile. For example, stocks have historically offered higher returns but come with greater volatility. Bonds, on the other hand, typically provide more stable (but lower) returns.

Your investment mix should align with your financial goals and risk tolerance. If you’re young and save for retirement, you might opt for a stock-heavy portfolio to maximize growth potential. As you near retirement, a shift towards more conservative investments like bonds can help protect your wealth.

Assess Your Risk Tolerance

Risk tolerance plays a key role in investment planning. It’s the degree of variability in investment returns that you can withstand. Factors that influence risk tolerance include your age, income stability, and financial goals.

A practical way to assess your risk tolerance is to consider how you’d react to a significant market downturn. If a 20% drop in your portfolio would cause you severe stress, a more conservative investment approach might suit you better.

Harness the Power of Diversification

Diversification serves as a key strategy for managing investment risk. When you spread your investments across different asset classes, sectors, and geographic regions, you can potentially reduce the impact of poor performance in any single area.

For instance, instead of investing all your money in a single stock, consider a mix of stocks from various industries, along with bonds and perhaps some real estate investments. This approach can help smooth out your returns over time and reduce overall portfolio volatility.

Review and Rebalance Your Portfolio Regularly

Your investment journey doesn’t end once you’ve created your portfolio. Regular review and rebalancing are essential to ensure your investments remain aligned with your goals and risk tolerance.

Try to review your portfolio at least annually. During this review, assess whether your investments perform as expected and if your financial situation or goals have changed. If certain investments have grown disproportionately, consider rebalancing by selling some of the overweight assets and reinvesting in underweight areas.

Investment planning can be complex, especially for those with unique financial situations (like professional athletes). A tailored investment strategy that accounts for specific challenges and opportunities can make a significant difference. Whether you look to build long-term wealth or manage a sudden influx of income, professional guidance can help you navigate the investment planning process and make informed decisions for your financial future. As we move forward, let’s explore how budgeting and investment planning work together to create a comprehensive financial strategy.

Synergizing Budgeting and Investing

Create an Investment-Friendly Budget

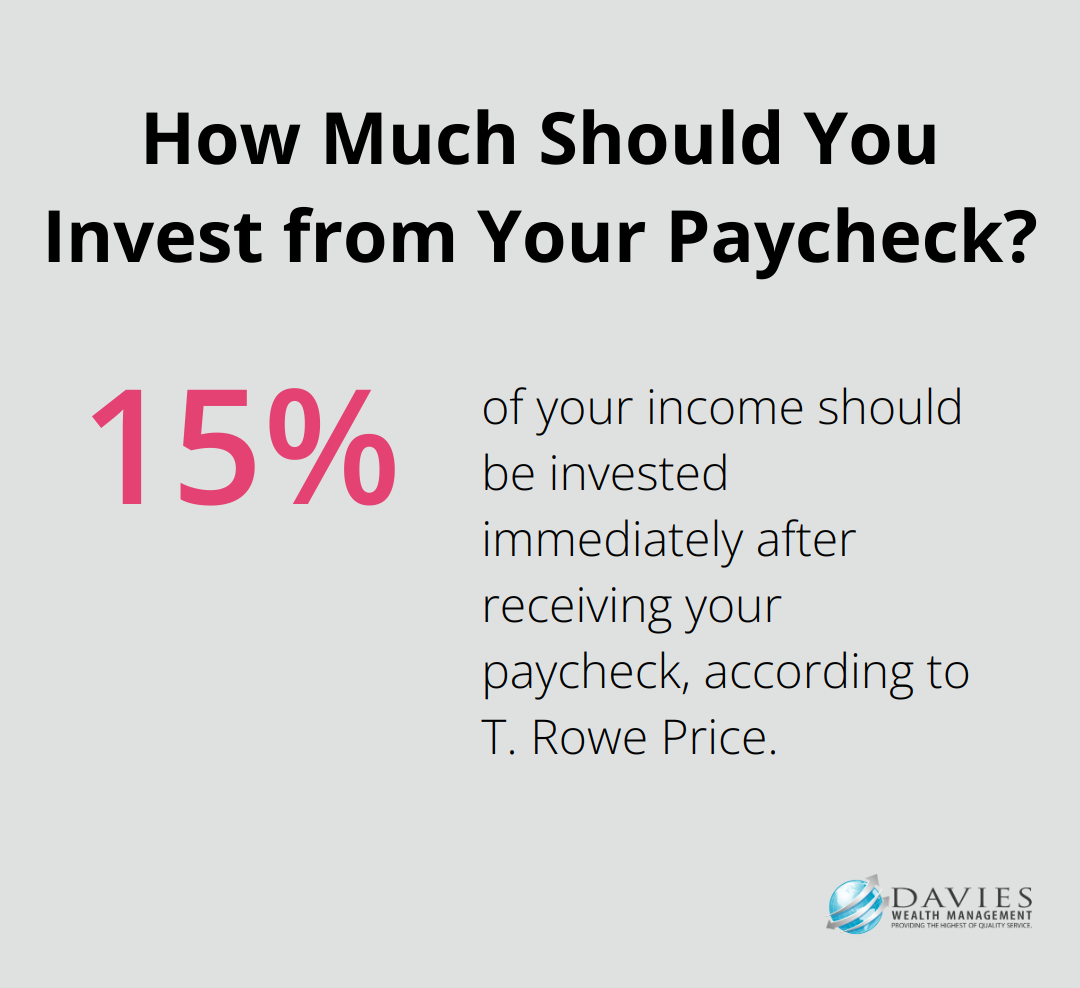

The first step to harmonize your budget with your investment goals is to treat investing as a non-negotiable expense. Allocate a portion of your income for investments, just as you would for rent or groceries. This approach, often called “paying yourself first,” ensures consistent contributions to your investment portfolio.

For example, if you aim to invest 15% of your income, transfer this amount to your investment account immediately after receiving your paycheck. This strategy eliminates the temptation to spend that money elsewhere and capitalizes on the power of dollar-cost averaging.

Balance Short-Term and Long-Term Financial Goals

While long-term investing builds wealth, addressing short-term financial needs is equally important. Your budget should reflect a balance between these priorities.

For short-term goals (1-3 years), allocate funds to high-yield savings accounts or short-term bond funds. These options offer better returns than traditional savings accounts while maintaining liquidity.

For mid-term goals (3-10 years), consider a mix of bonds and conservative stock investments. Long-term goals (10+ years) can typically withstand more risk, allowing for a higher allocation to stocks or other growth-oriented investments.

Navigate the Debt-Investment Tightrope

Balancing debt repayment with investment growth challenges many individuals. While focusing solely on debt elimination before investing might seem logical, this approach can cost valuable time in the market.

Instead, consider a dual approach. Prioritize high-interest debt (such as credit card balances) for aggressive repayment. For lower-interest debts (like mortgages), maintain regular payments while also investing. This strategy allows you to benefit from potential market gains while managing your debt responsibly.

For instance, if you have an extra $500 monthly after essential expenses, you might allocate $300 to debt repayment and $200 to investments. Adjust these figures based on your specific debt interest rates and investment opportunities.

Adapt Your Strategy to Life Changes

Your financial plan should evolve as your life circumstances change. Regular reviews of your budget and investment strategy ensure they remain aligned with your current situation and future goals.

Major life events (such as marriage, having children, or changing careers) often necessitate adjustments to your financial plan. These changes might involve reallocating funds between different investment vehicles, adjusting your debt repayment strategy, or modifying your savings goals.

Seek Professional Guidance

Integrating budgeting and investing strategies can be complex, especially for those with unique financial situations. A tailored financial strategy that accounts for specific challenges and opportunities can make a significant difference.

Whether you look to build long-term wealth or manage a sudden influx of income, professional guidance can help you navigate the financial planning process and make informed decisions for your future. Davies Wealth Management offers expertise in creating comprehensive financial strategies that align with individual goals and circumstances.

Final Thoughts

Financial planning skills encompass two important aspects: budgeting and investment planning. These fundamental skills enable effective money management and long-term wealth growth. Budgeting provides control over your financial life, while investment planning supports wealth accumulation and long-term security.

The integration of these skills creates a powerful synergy for financial success. A well-crafted budget supports investment goals, and smart investment decisions accelerate progress towards financial objectives. This combination enhances overall financial health and brings you closer to your goals.

We at Davies Wealth Management encourage you to implement these essential financial planning skills today. Financial planning is an ongoing process, and it’s never too late to start. With dedication and the right guidance, you can take control of your financial future and work towards the life you envision.

Leave a Reply