Stuart, Florida offers unique opportunities for building substantial wealth through strategic financial planning and smart investment choices. The difference between those who achieve financial success and those who struggle often comes down to developing the right wealth mindset.

We at Davies Wealth Management have observed how local residents transform their financial futures by adopting proven wealth-building strategies. This guide reveals the mental frameworks and practical approaches that create lasting prosperity in our vibrant coastal community.

What Mental Shifts Create Millionaire-Level Wealth

The Numbers Game Mindset

Wealthy individuals think in percentages and compound returns rather than dollar amounts. Research shows that Americans believe they need an average of $5.3 million in net worth to be financially successful, demonstrating how millionaires focus on specific wealth targets rather than vague financial goals. Stuart entrepreneurs like Stuart Arnold, founder of Auto Trader, exemplify this approach when they view every business decision through return on investment calculations. Arnold’s success stems from his understanding that a 15% annual return doubles wealth every 4.8 years, which makes time their most valuable asset.

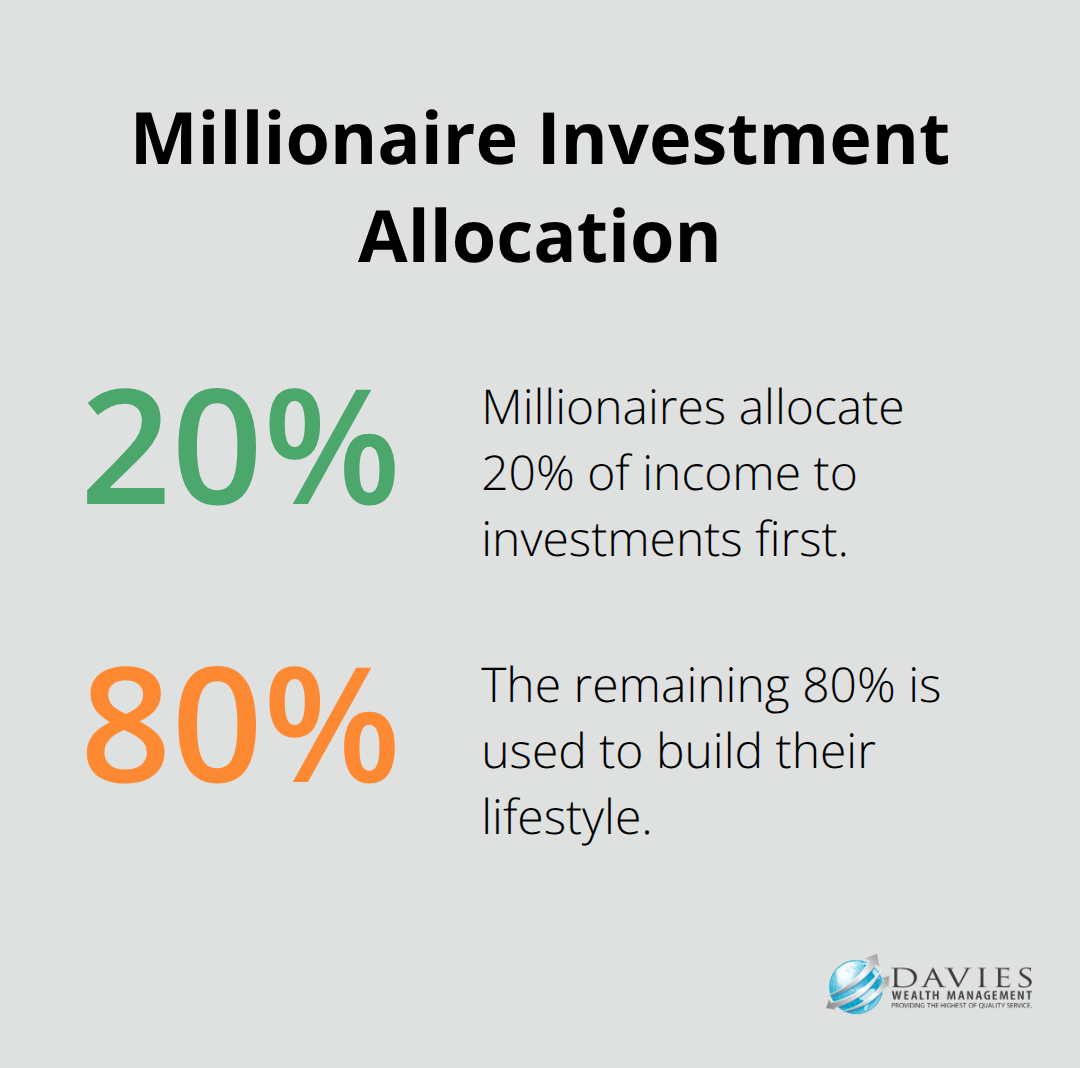

This mathematical approach extends to risk assessment. Millionaires allocate exactly 20% of income to investments first, then build lifestyles around the remaining 80%. The National Endowment for Financial Education reports that individuals with higher financial literacy earn 25% more over their lifetime. Smart money managers in Stuart calculate opportunity costs for every major purchase and ask whether that $50,000 luxury car could generate $150,000 in returns over five years through strategic investments instead.

The Scarcity Programming Problem

The biggest wealth killer remains emotional spending driven by fear-based thoughts. Research reveals that financial decisions are heavily influenced by psychological factors rather than purely logical analysis. Successful Stuart residents break this pattern when they automate their wealth-building systems. They set up automatic transfers to investment accounts, which removes emotional decision-making from the equation entirely.

Most people sabotage wealth accumulation through lifestyle inflation and status competition. Data shows that many Americans don’t have adequate emergency savings, yet spend freely on status symbols. Millionaire-minded individuals flip this script when they live below their means while their investments compound. They understand that appearing wealthy and being wealthy represent opposite strategies (choosing invisible assets over visible consumption every time).

These mental frameworks form the foundation, but successful wealth builders in Stuart also develop specific daily habits that reinforce their millionaire mindset through consistent action.

What Daily Habits Build Stuart Wealth

Morning Money Rituals That Work

Successful Stuart entrepreneurs start each day with financial clarity through specific morning routines. Stuart Arnold, founder of Auto Trader, works from noon to night but begins his productive hours by reviewing investment portfolios and market positions. The Global Entrepreneurship Monitor shows Florida maintains entrepreneurial activity among adults, and local millionaires consistently check three key metrics before 10 AM: net worth progression, cash flow from investments, and upcoming tax obligations.

These individuals spend exactly 30 minutes each morning analyzing their financial dashboard rather than consuming news or social media. They track every expense through apps like Mint or YNAB, which allows them to identify spending patterns that drain wealth potential. This systematic approach creates accountability and prevents the lifestyle inflation that destroys 70% of lottery winners within five years.

Strategic Local Investment Focus

Stuart’s real estate market offers concrete wealth-building opportunities with median listing prices at $435,000. Smart investors target Old Palm City and Historic Downtown Stuart neighborhoods where properties generate 8-12% annual returns through rental income. The Florida Chamber of Commerce reports that 90% of business leaders attribute growth to innovation and adaptability.

Stuart millionaires diversify beyond real estate into local business partnerships and private lending opportunities. Alternative investments constitute 35% of family office portfolios nationally, and Stuart residents access these through local investment groups that meet monthly at the Stuart Yacht Club and Sailfish Point. Tax-loss harvesting contributes up to 0.35% in annual after-tax returns according to Vanguard research (making Florida’s zero state income tax a significant advantage for wealth creation strategies).

High-Value Connection Strategies

Networking with Stuart’s high net worth community requires strategic positioning rather than casual socializing. The Kauffman Foundation research shows the importance of capital access for startups, and local millionaires connect through specific venues: charity events at the Elliott Museum, business roundtables at the Martin County Chamber of Commerce, and private investment seminars.

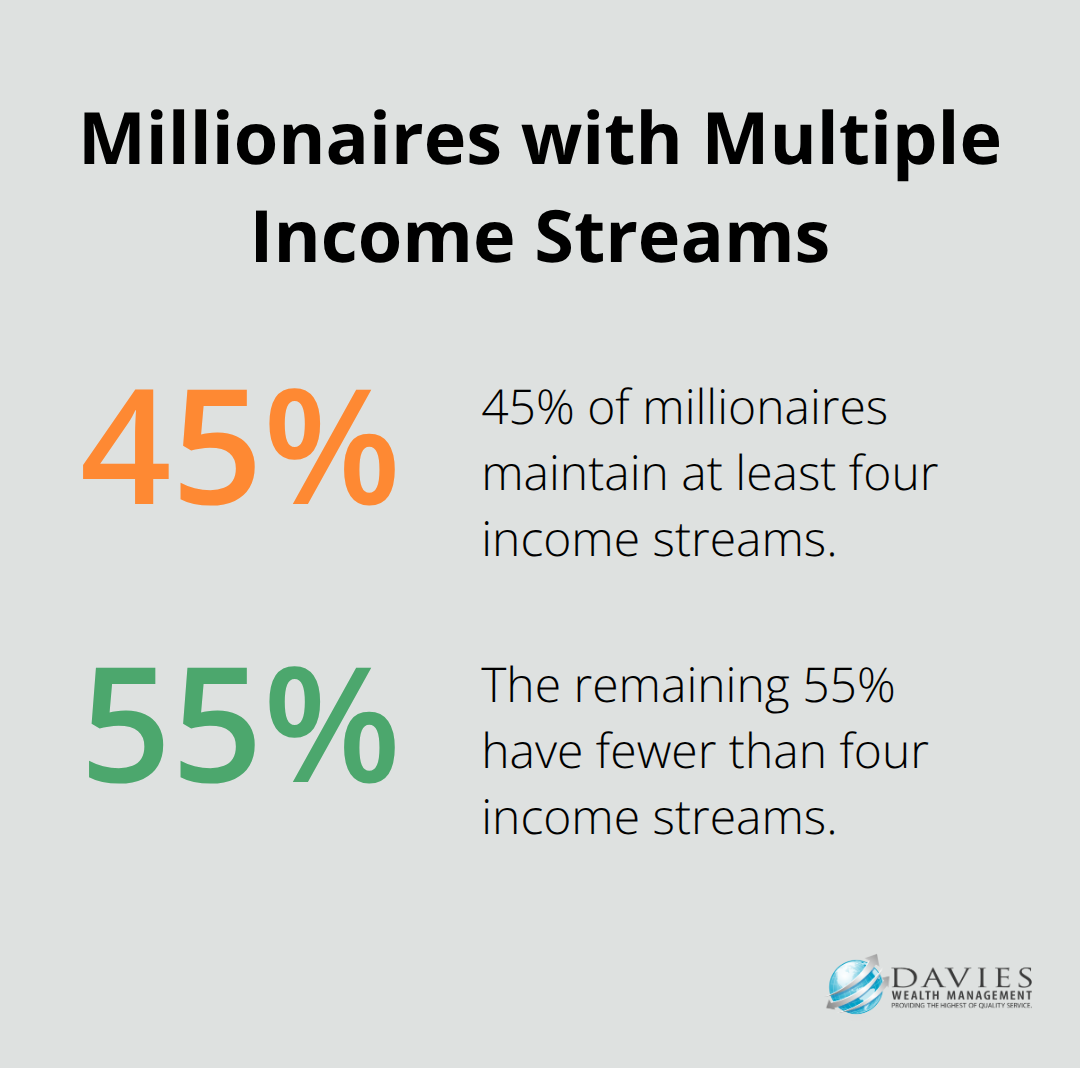

These individuals understand that 45% of millionaires maintain at least four income streams, so they actively seek partnership opportunities with established entrepreneurs. Professional athletes who relocate to Stuart for tax advantages create unique networking opportunities (as they often need specialized financial planning services and local business investments). The key strategy involves offering value first through expertise or connections rather than asking for favors, which builds authentic relationships that generate long-term wealth opportunities.

These daily habits create the foundation for wealth accumulation, but they must be supported by sophisticated financial planning strategies that maximize tax advantages and investment returns available to Florida residents.

What Financial Strategies Work Best in Stuart

Florida Tax Advantages That Actually Matter

Florida residents gain immediate wealth-building advantages through zero state income tax, but most people fail to maximize this benefit properly. High earners could potentially save thousands of dollars annually compared to states like California or New York. This money compounds dramatically when investors direct it systematically into wealth-building vehicles.

Smart Stuart residents convert these tax savings into Roth IRA conversions during lower-income years, which creates tax-free retirement income streams. The IRS statistical tables show that strategic tax planning becomes essential as income increases. Florida residents can convert traditional retirement accounts to Roth accounts without state tax penalties (a massive advantage over high-tax states).

Stuart investors also utilize 529 education savings plans, which grow tax-free and withdraw tax-free for qualified education expenses. These plans create generational wealth transfer opportunities that compound over decades.

Stuart Real Estate Investment Fundamentals

Stuart’s investment property market offers concrete returns with median prices around $345,000 and typical market duration of 96 days. Properties in Old Palm City and Historic Downtown Stuart provide rental opportunities in a market where average rent is $2,600, which significantly outperforms stock market averages.

Investment-grade properties near waterfront areas command premium rents from seasonal residents and retirees who relocate from high-tax states. The National Association of Realtors reports real estate investments average 10% annual returns. Stuart’s proximity to beaches and excellent schools creates consistent tenant demand year-round.

Mobile homes with land ownership provide lower-cost entry points into real estate investment. These properties often require 20-30% less capital than traditional properties while they generate similar cash flow percentages.

Multiple Income Stream Development

Stuart’s economy supports diverse income generation through business partnerships, private lending, and service-based ventures that target affluent retirees and seasonal residents. Local entrepreneurs successfully operate boat maintenance services, property management companies, and financial consulting practices that generate $100,000-$300,000 annually.

The Florida Chamber of Commerce data shows that 90% of business growth comes from innovation and adaptability. This makes Stuart’s tourism and marine industries prime targets for side businesses that scale quickly.

Professional athletes who relocate to Stuart create opportunities for specialized services like personal training, equipment maintenance, and event planning. Private lending to local real estate investors generates 8-15% annual returns with asset-backed security (providing both income and principal protection).

Local Investment Group Access

Stuart investment groups provide access to commercial real estate syndications typically reserved for accredited investors. These groups meet monthly at venues like the Stuart Yacht Club and Sailfish Point, where members share deal flow and partnership opportunities.

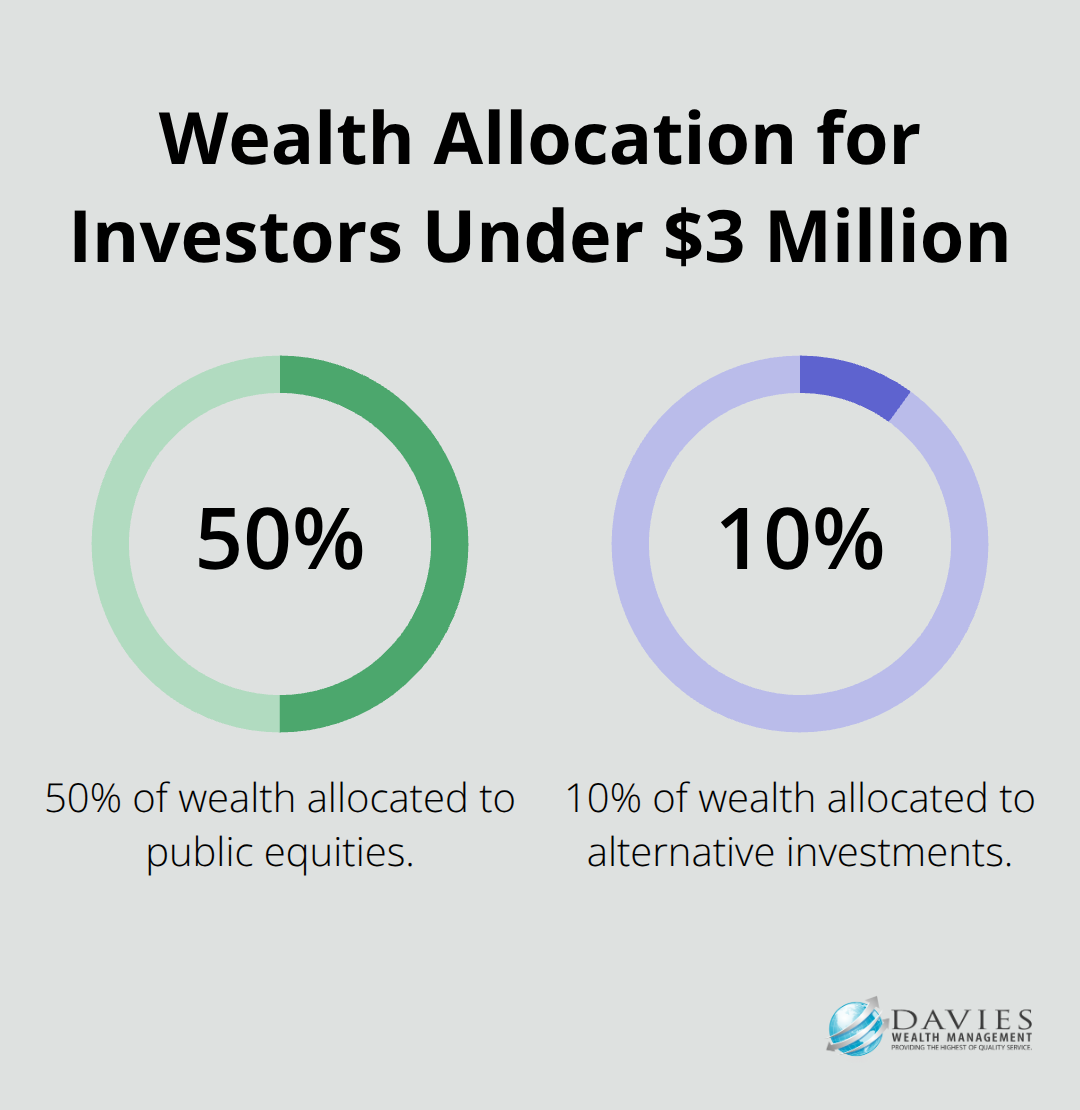

Investors with less than three million in total wealth allocate roughly half of their portfolio to public equities and less than ten percent to alternatives, and Stuart residents access these through local networks that focus on marine industry businesses, seasonal rental properties, and service companies that cater to high-net-worth retirees.

Tax-loss harvesting contributes up to 0.35% in annual after-tax returns according to Vanguard research. Florida’s zero state income tax amplifies these benefits significantly compared to other states.

Final Thoughts

Your wealth mindset transformation starts with three immediate actions. Automate 20% of your income into investment accounts before lifestyle expenses consume available capital. Join Stuart’s investment groups at the Martin County Chamber of Commerce to access deal flow typically reserved for accredited investors.

Stuart residents possess unique advantages through Florida’s zero state income tax and access to diverse investment opportunities from real estate to marine industry partnerships. The median property price of $345,000 creates accessible entry points for rental income generation. Local networks connect you with successful entrepreneurs who maintain multiple income streams.

We at Davies Wealth Management help Stuart residents navigate these opportunities through comprehensive wealth management solutions that address investment management and tax-efficient strategies. Success requires consistent daily habits rather than sporadic efforts (track expenses through automated systems and review investment performance weekly). Florida’s entrepreneurial ecosystem ranks among the nation’s top performers, which makes Stuart an ideal location for wealth creation through strategic financial planning.

Leave a Reply