At Davies Wealth Management, we understand that legacy planning goes beyond financial assets. It’s about preserving your values, protecting your loved ones, and making a lasting impact.

Comprehensive estate planning is the cornerstone of creating a meaningful legacy that endures for generations. This process involves careful consideration of your wishes, strategic asset protection, and thoughtful distribution of your wealth.

Why Estate Planning Matters

Estate planning forms a critical component of financial management that many people overlook. Proper estate planning can significantly impact wealth preservation and ensure a smooth transition of assets.

Safeguarding Your Legacy

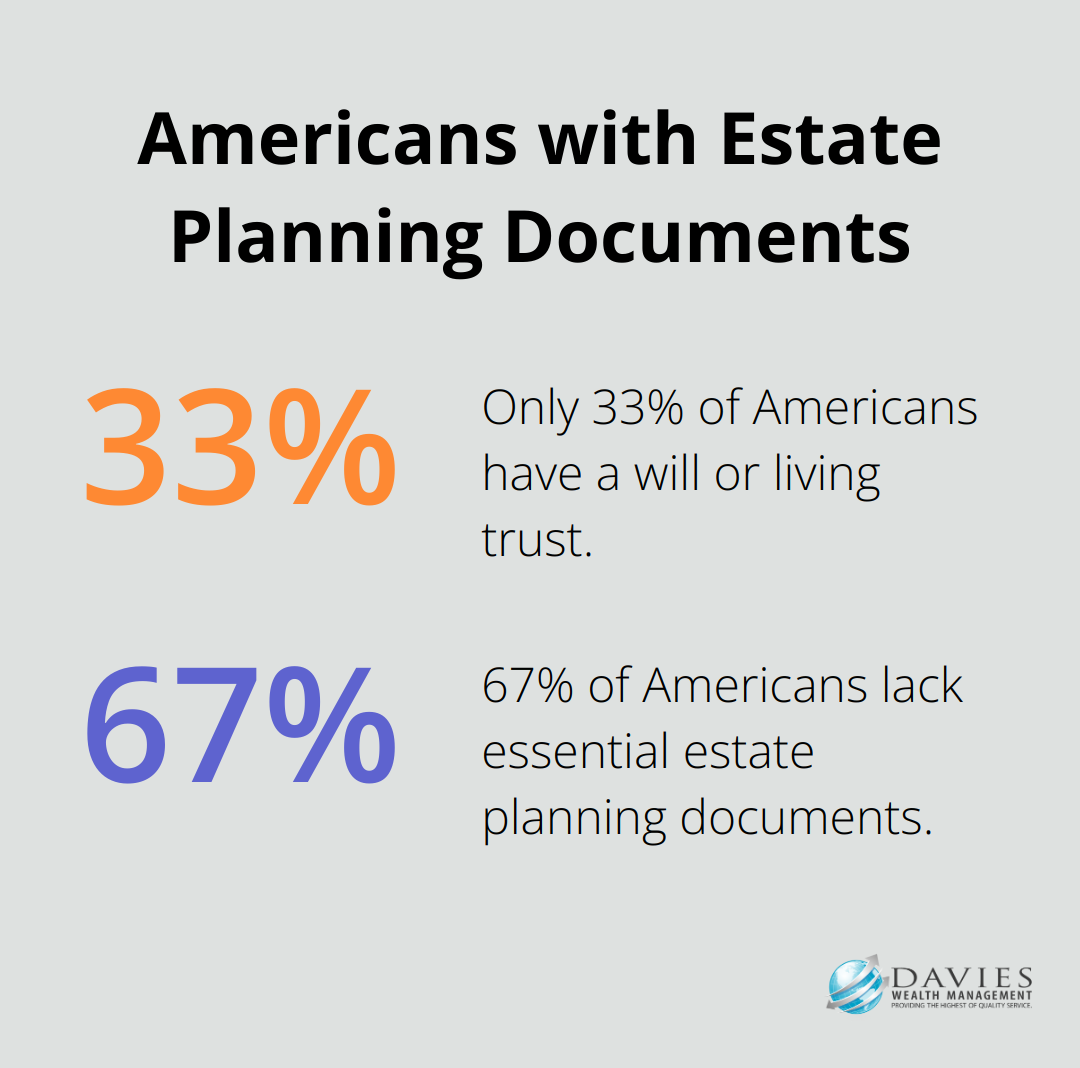

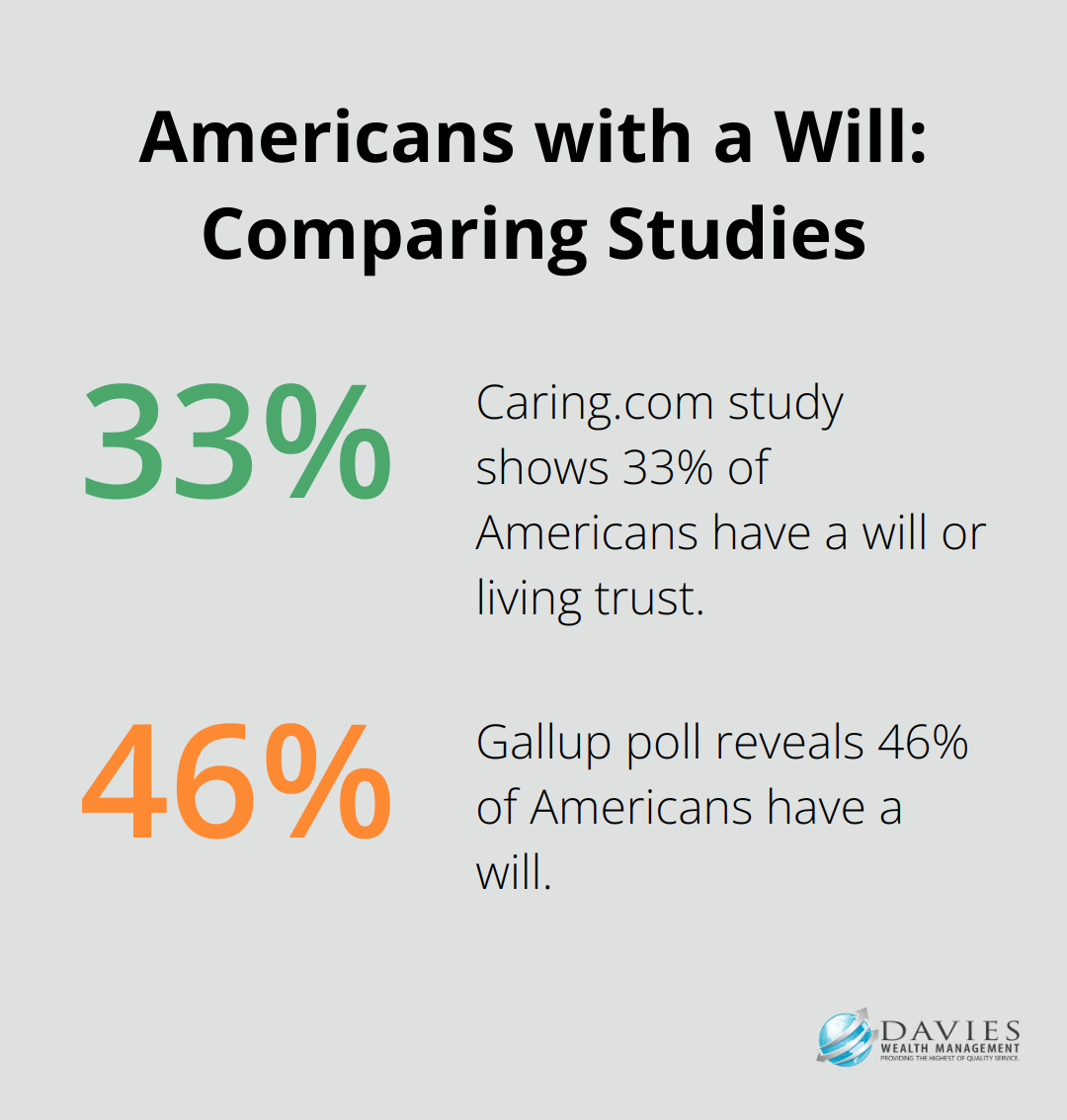

Estate planning extends beyond wealth distribution; it safeguards your legacy. Without a solid plan, your assets may not be distributed according to your wishes. A study by Caring.com revealed that only 33% of Americans have a will or living trust. This lack of planning can result in family disputes, unnecessary legal costs, and even the loss of assets to unintended beneficiaries.

Protecting Your Loved Ones

One of the primary benefits of estate planning is the protection it offers to your beneficiaries. If you have minor children, an estate plan allows you to name a guardian who will care for them in your absence. Moreover, you can set up trusts to manage assets for beneficiaries who may not be ready to handle large sums of money responsibly.

Minimizing Tax Implications

Estate planning also plays a significant role in minimizing tax burdens. While the federal estate tax exemption is quite high, many states have their own estate or inheritance taxes with much lower thresholds. A well-structured estate plan can help reduce these tax liabilities, ensuring more of your wealth goes to your chosen beneficiaries rather than to the government.

Tailoring Plans for Unique Situations

Each individual’s financial situation is unique, especially for professional athletes or high-net-worth individuals who may have complex financial circumstances. A comprehensive estate plan should address these specific needs and reflect your values and wishes for future generations.

As we move forward, let’s explore the key components that make up a robust estate plan, ensuring you have all the necessary tools to protect your assets and secure your legacy.

Building Your Estate Plan Foundation

At Davies Wealth Management, we understand the importance of a well-structured estate plan in securing your financial legacy. Our experience shows how a comprehensive plan provides peace of mind and protects assets for future generations. Let’s explore the essential components that form the foundation of a robust estate plan.

Wills and Trusts: Cornerstones of Asset Protection

Wills and trusts form the bedrock of any estate plan. A will outlines your asset distribution wishes after death, while trusts offer enhanced flexibility and control over asset management and distribution. A Gallup poll reveals that only 46% of Americans have a will, leaving many estates vulnerable to intestate succession laws.

For high-net-worth individuals (including professional athletes), we often recommend establishing a revocable living trust. This powerful tool allows for seamless asset management during your lifetime and efficient transfer upon death, avoiding the often lengthy and public probate process.

Power of Attorney and Healthcare Directives: Planning for the Unexpected

Life’s unpredictability necessitates incapacity planning. A durable power of attorney allows you to designate someone to manage your financial affairs if you become unable. Healthcare directives (including a living will and healthcare power of attorney) ensure respect for your medical wishes if you can’t communicate them yourself.

An American Bar Association study found that only 29% of Americans have a living will. This gap leaves many families struggling with difficult decisions during already stressful times. We advise our clients to address these issues proactively, regardless of age or health status.

Asset Titling and Beneficiary Designations: Often Overlooked, Always Important

Proper asset titling and beneficiary designations play a critical role in ensuring asset distribution according to your wishes. These designations typically supersede instructions in your will, making them a powerful tool in your estate planning arsenal.

Outdated beneficiary designations can lead to unintended consequences (such as ex-spouses receiving retirement accounts or life insurance payouts). Regular review of these designitions becomes essential, especially after major life events like marriage, divorce, or the birth of a child.

Business Succession Planning: Ensuring Continuity

For business owners, succession planning becomes a vital component of estate planning. A well-crafted succession plan ensures business continuity and can significantly impact its value. Edward Jones found that while nearly two-thirds of business owners (64%) have prepared a business succession plan, 16% feel unprepared for their succession.

We work closely with business owners to develop comprehensive succession strategies. These plans often involve a combination of buy-sell agreements, life insurance policies, and trusts to facilitate a smooth transition and minimize potential conflicts among heirs or business partners.

As we move forward, let’s examine effective strategies to maximize the impact of your estate plan and create a lasting legacy that aligns with your values and goals.

Maximizing Your Estate Plan’s Impact

Regular Reviews and Updates

Life changes, and your estate plan should adapt accordingly. Major life events such as marriages, divorces, births, deaths, or significant changes in assets can all affect the effectiveness of your plan. We suggest a review of your estate plan at least every three to five years (or more frequently if significant life events occur).

These reviews should focus on beneficiary designations for retirement accounts and life insurance policies. These designations typically supersede instructions in your will, making them vital components of your overall plan. The U.S. Supreme Court case of Egelhoff v. Egelhoff (2001) underscored this importance, ruling that an ex-spouse received pension benefits because the deceased had not updated the beneficiary designation after their divorce.

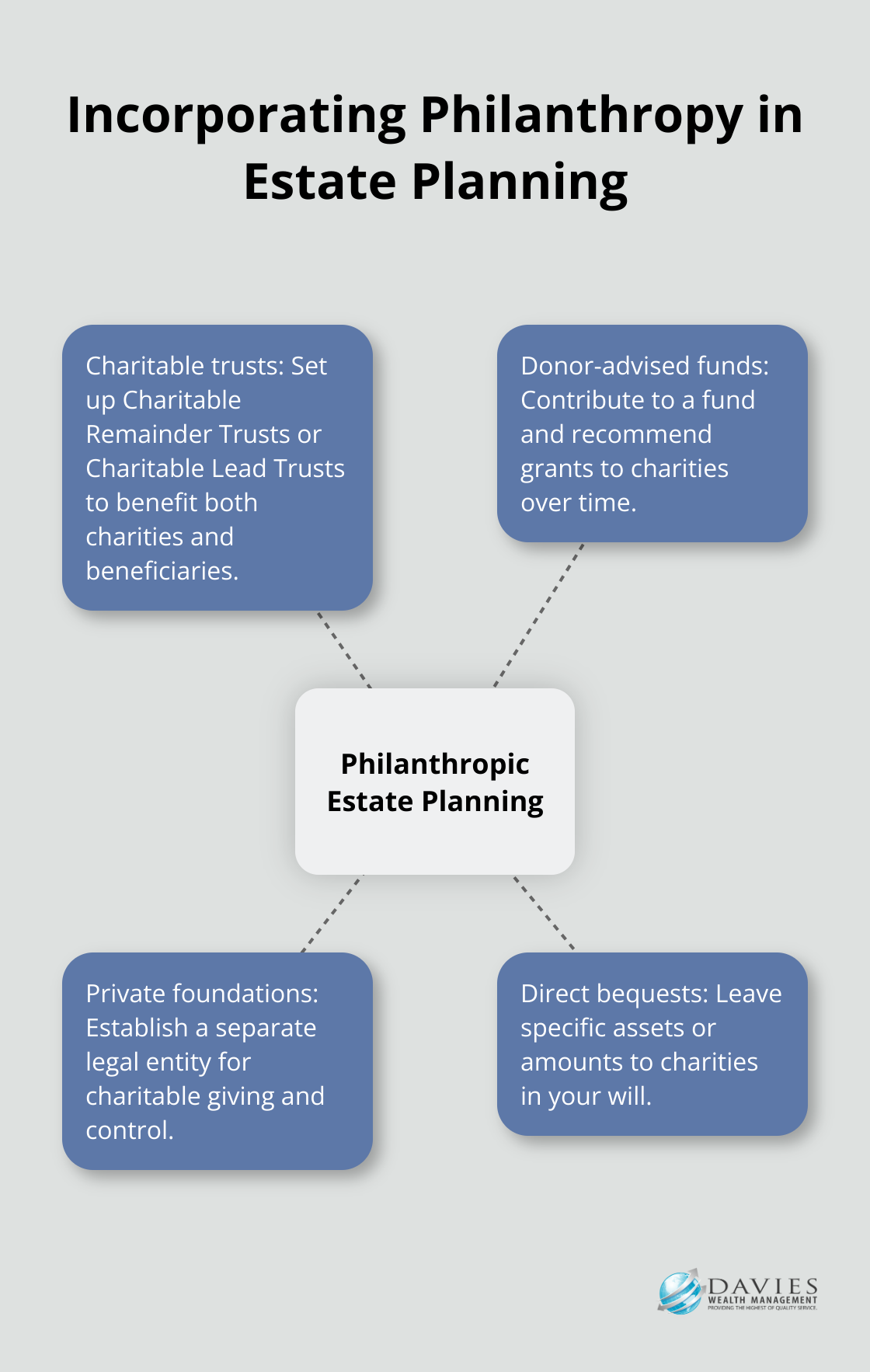

Incorporating Philanthropy

Charitable giving serves as a powerful tool in estate planning. It allows you to support causes you care about while potentially reducing your tax burden. You can incorporate philanthropy into your estate plan through various methods:

- Charitable trusts (e.g., Charitable Remainder Trusts or Charitable Lead Trusts)

- Donor-advised funds

- Private foundations

- Direct bequests in your will

Each option offers unique benefits and considerations. For example, a Charitable Remainder Trust can provide income to you or your beneficiaries for a set period, with the remainder going to your chosen charity. This structure can offer both income tax deductions and estate tax benefits.

Addressing Family Dynamics

Family conflicts can disrupt even the most carefully crafted estate plans. To reduce potential disputes:

- Communicate your intentions clearly with family members

- Consider using a professional mediator for difficult conversations

- Use tools like discretionary trusts to provide flexibility in asset distribution

- Document your reasoning for specific decisions in your estate plan

For high-net-worth individuals or those with complex family situations, a “letter of wishes” can accompany your will. This non-binding document provides context and explanation for your decisions, potentially reducing misunderstandings and conflicts among beneficiaries.

Professional Guidance

Estate planning involves complex legal and financial considerations. Working with experienced professionals can help you navigate these complexities and create a robust plan tailored to your unique situation. A team of advisors, including financial planners, attorneys, and tax professionals, can provide comprehensive guidance on:

- Tax-efficient wealth transfer strategies

- Asset protection techniques

- Business succession planning

- Charitable giving options

Professional advisors stay current with changing laws and regulations, ensuring your estate plan remains effective and compliant. They can also help you balance competing priorities and make informed decisions that align with your overall financial goals and values.

Final Thoughts

Comprehensive estate planning empowers individuals to create a lasting legacy beyond financial assets. It provides peace of mind, ensures respect for your wishes, and protects loved ones from unnecessary stress and potential conflicts. Regular reviews and updates to your estate plan keep pace with life’s changes and evolving legal landscapes.

Legacy planning requires careful consideration of your values, goals, and the unique needs of your beneficiaries. Incorporating philanthropy into your plan allows you to support causes close to your heart while potentially reducing tax burdens. Addressing family dynamics proactively prevents disputes and ensures clear understanding of your intentions.

The complexities of estate planning underscore the importance of working with experienced professionals who provide tailored strategies. At Davies Wealth Management, we specialize in creating personalized estate plans that align with your unique goals and circumstances. Contact our team today to start crafting your comprehensive estate plan and secure your legacy for future generations.

Leave a Reply