At Davies Wealth Management, we believe that wealth diversification goes beyond traditional stocks and bonds. The financial landscape is evolving, offering investors a wide array of unconventional opportunities to grow and protect their wealth.

In this post, we’ll explore alternative investments, tangible assets, and emerging opportunities that can add unique dimensions to your portfolio. These options may provide potential for higher returns and reduced overall risk, but they also come with their own set of challenges and considerations.

Exploring Alternative Investments: Beyond the Mainstream

At Davies Wealth Management, we recommend our clients to look beyond traditional investment vehicles to truly diversify their portfolios. Alternative investments can offer unique opportunities for wealth growth and risk mitigation. Let’s explore some of these options in detail.

Real Estate Investment Trusts (REITs)

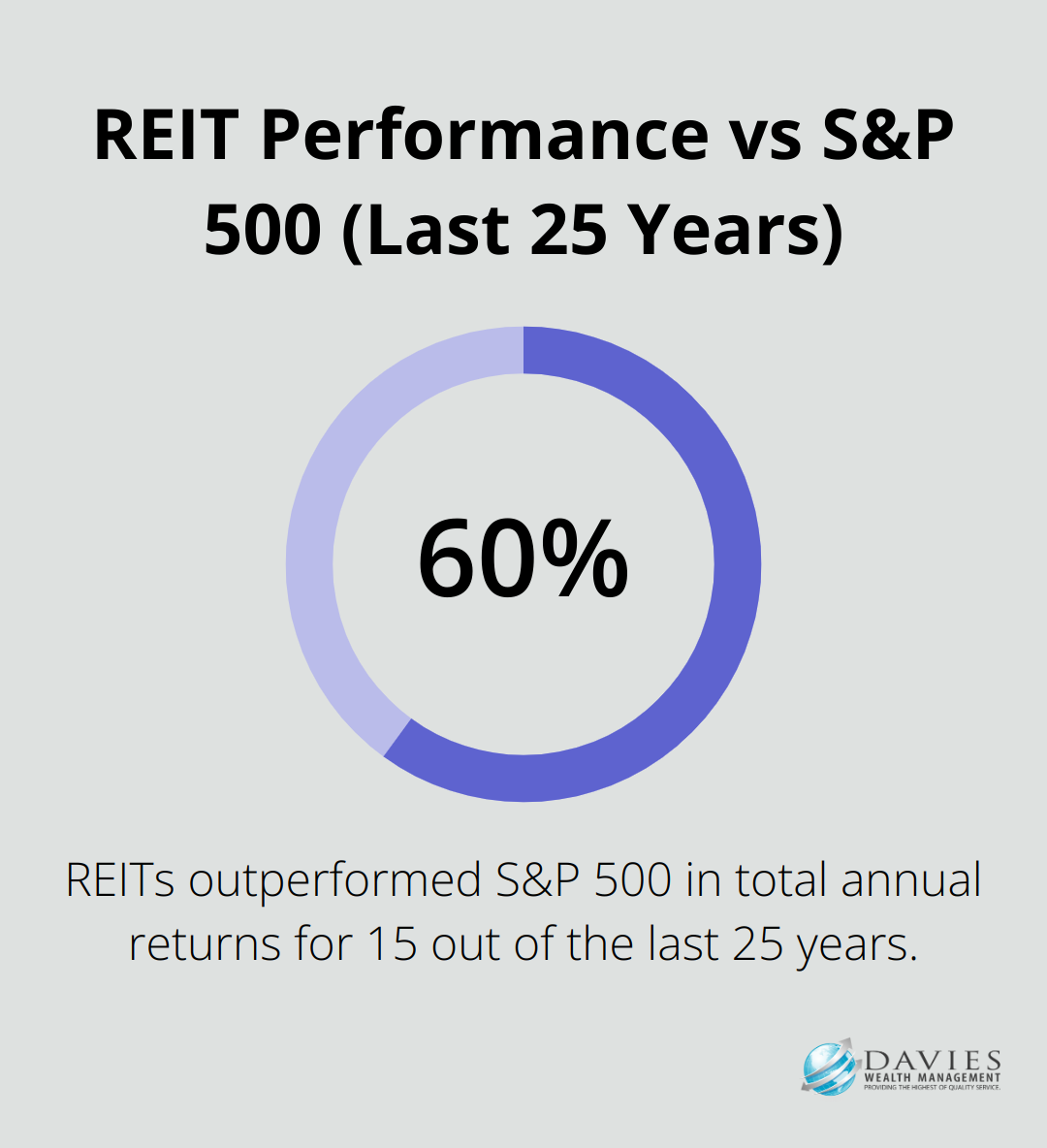

REITs provide an excellent way to invest in real estate without the hassle of property management. They offer steady income through dividends and potential for capital appreciation. The National Association of Real Estate Investment Trusts reports that REITs have outperformed the S&P 500 in total annual returns for 15 out of the last 25 years. Different types of REITs (equity, mortgage, or hybrid) carry varying levels of risk and potential returns.

Commodities and Precious Metals

Commodities, including precious metals like gold and silver, can serve as a hedge against inflation and currency fluctuations. The World Gold Council reports that gold has delivered an average annual return of 10.6% since 1971. However, commodity prices can be volatile, influenced by factors such as geopolitical events, weather conditions, and supply chain disruptions. We advise our clients to limit their commodity exposure to no more than 5-10% of their total portfolio.

Private Equity and Venture Capital

For accredited investors seeking potentially higher returns, private equity and venture capital can be attractive options. These investments allow you to participate in the growth of private companies before they go public. PitchBook’s performance insights provide analysis of private fund returns, PME benchmarks, and strategy comparisons. However, these investments typically require substantial capital commitments and have long lock-up periods (often 7-10 years).

Hedge Funds and Managed Futures

Hedge funds employ various strategies to generate returns regardless of market conditions. They can provide portfolio diversification and potentially higher returns, but also come with higher fees and less transparency. Managed futures focus on trading futures contracts across different asset classes. The BarclayHedge CTA Index, which tracks managed futures performance, has shown a compound annual growth rate of 6.3% over the past 30 years.

While these alternative investments can enhance portfolio diversification, they also require thorough due diligence and a clear understanding of their complexities. As we move forward, let’s explore another exciting realm of unconventional investments: tangible assets. These physical investments can add a unique dimension to your portfolio and potentially provide a hedge against market volatility.

It’s worth noting that venture investing is becoming increasingly popular among ultra-high-net-worth individuals for its potential to offer higher returns and increased portfolio diversification.

Tangible Assets as Wealth Diversifiers

At Davies Wealth Management, we often recommend our clients consider tangible assets as part of their diversification strategy. These physical investments can provide a hedge against market volatility and inflation while potentially offering substantial returns. Let’s explore some compelling options in this space.

The Art of Investing in Fine Art

Fine art has been a topic of interest in the art and finance industry. The Deloitte Art & Finance Report serves as a barometer for emerging trends and sentiment in this sector, highlighting developments in the art market.

For those interested in art investment, we suggest starting with established artists or emerging talents with strong potential. Platforms like Masterworks allow fractional ownership in blue-chip artworks, making this asset class more accessible. However, it’s important to understand that art is a long-term investment, often requiring 5-10 years to realize significant returns.

Liquid Gold: The Rise of Whiskey Investments

Whiskey investments have gained significant traction in recent years. Historically, whisky has delivered impressive returns, often outperforming traditional investments. For instance, a bottle of Macallan 1926 has shown remarkable appreciation.

For those looking to invest, we recommend focusing on limited edition releases from renowned distilleries or bottles from closed distilleries. The Rare Whisky 101 Index provides valuable insights into market trends. However, proper storage is crucial to maintain value, and authentication is vital to avoid counterfeits.

Revving Up Returns with Classic Cars

Classic cars can be both a passion and a lucrative investment. The HAGI Top Index, which tracks rare classic car prices, has shown an average annual return of 12.5% over the past decade. However, this market requires extensive knowledge and careful selection.

We advise our clients to focus on rare models with historical significance or limited production runs. Brands like Ferrari, Porsche, and certain American muscle cars have shown consistent appreciation. Maintenance, storage, and insurance costs can be substantial (impacting overall returns), so it’s essential to factor these into your investment calculations.

As we explore these tangible assets, it’s clear they offer unique opportunities for portfolio diversification. However, they also come with their own set of challenges and considerations. In the next section, we’ll shift our focus to emerging investment opportunities that are reshaping the financial landscape and offering new avenues for wealth creation.

Emerging Opportunities: Innovative Avenues for Wealth Creation

At Davies Wealth Management, we constantly search for innovative investment opportunities to enhance our clients’ portfolios. The financial landscape evolves rapidly, presenting new avenues for wealth creation and diversification. Let’s explore some of these emerging opportunities and their potential impact on your investment strategy.

Cryptocurrency and Blockchain Revolution

Cryptocurrency and blockchain technology have disrupted traditional finance, offering new ways to invest and transfer value. This research explores the impact of cryptocurrency on traditional financial markets, with a focus on how banking systems, payment methods, and market dynamics are affected.

However, cryptocurrency investments come with high volatility and regulatory uncertainties. We advise our clients to approach this asset class cautiously, typically allocating no more than 1-5% of their portfolio to cryptocurrencies. It’s important to understand the technology, market dynamics, and potential risks before investing.

Peer-to-Peer Lending: Alternative Banking

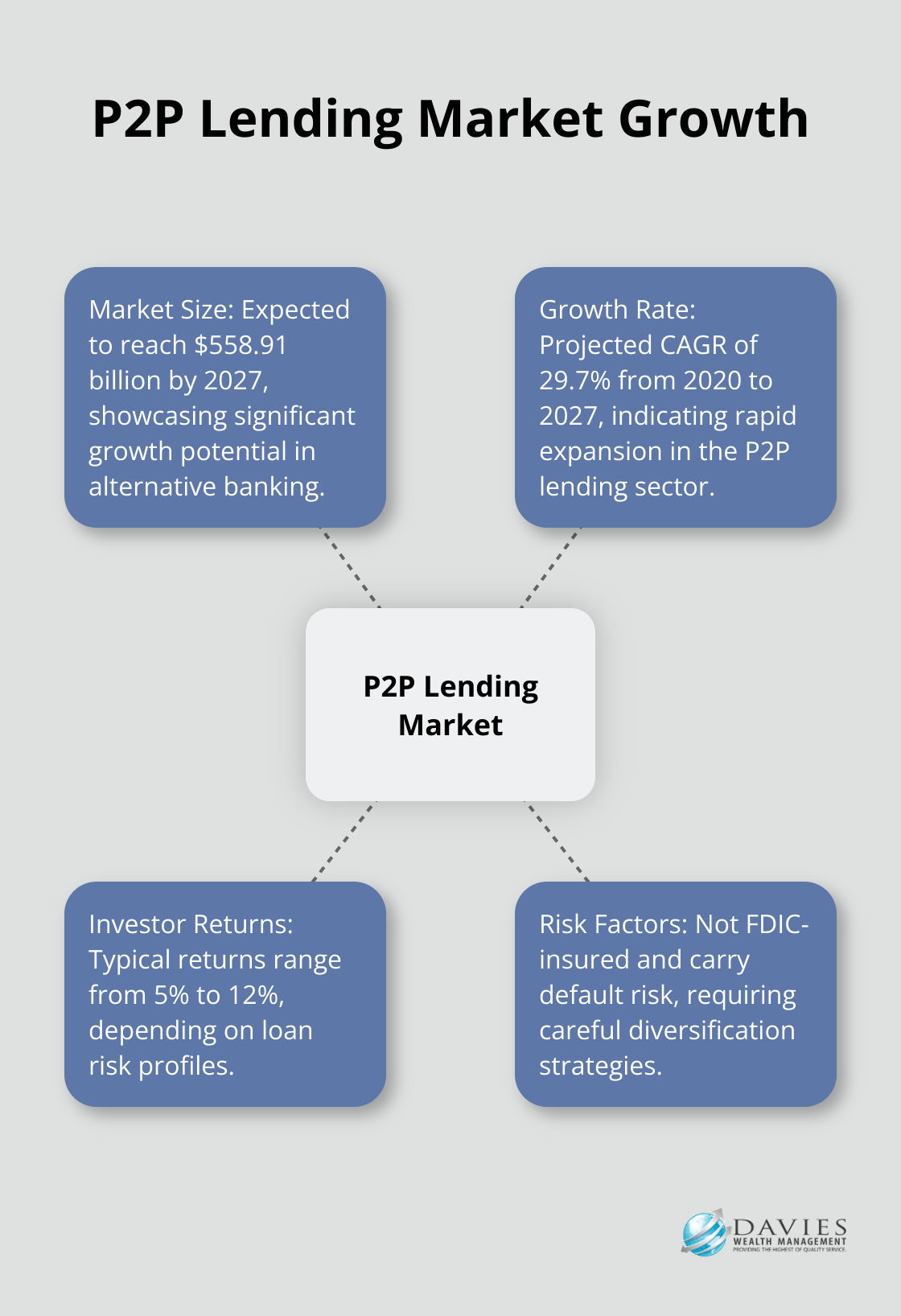

Peer-to-peer (P2P) lending platforms have gained traction as an alternative to traditional banking. These platforms connect borrowers directly with lenders, often offering higher returns than traditional savings accounts. According to a report by Allied Market Research, the global P2P lending market is expected to reach $558.91 billion by 2027, growing at a CAGR of 29.7% from 2020 to 2027.

Investors can typically expect returns ranging from 5% to 12%, depending on the risk profile of the loans. However, these investments are not FDIC-insured and carry the risk of default. We recommend diversifying across multiple loans and platforms to mitigate risk.

Green Investments: Profitable Planet Protection

Environmental investments, including carbon credits and renewable energy projects, gain momentum as the world shifts towards sustainability. The voluntary carbon market, where companies and individuals can offset their carbon emissions, is expected to grow from $300 million in 2018 to $50 billion by 2030 (according to McKinsey & Company).

Investors can participate in this market through carbon credit ETFs or by investing in companies focused on renewable energy and sustainable technologies. These investments not only offer potential financial returns but also contribute to environmental conservation efforts.

Farmland and Timber: Natural Wealth Growth

Farmland and timber investments provide a unique opportunity to diversify into real assets with low correlation to traditional markets. Recent research has focused on econometrically measuring the temporal behavior of the risk-return relationship between farm-related investments and the stock market.

Timber investments have also shown steady growth over the years. These investments can provide a hedge against inflation and offer potential for long-term capital appreciation.

Investors can access these markets through REITs, ETFs, or direct ownership. However, direct ownership requires significant capital and expertise in land management. We recommend thorough research of specific regions and crop types before investing in farmland, and understanding the long-term nature of timber investments.

Final Thoughts

Wealth diversification extends beyond traditional stocks and bonds. Alternative investments, tangible assets, and emerging opportunities offer unique potential for portfolio growth and risk mitigation. These unconventional investment avenues come with their own challenges and complexities, which require thorough research and expert advice.

At Davies Wealth Management, we emphasize the importance of a balanced approach to wealth diversification. Our team of financial advisors can provide personalized guidance tailored to your financial goals and risk tolerance. We take into account your individual financial situation, long-term objectives, and risk appetite to create a truly diversified portfolio.

Davies Wealth Management offers a personalized approach to each client’s financial strategy. We help you navigate the complex world of wealth diversification and build a robust financial future (whether you’re a professional athlete, business owner, or individual seeking financial security). Our experienced professionals are ready to assist you in creating an investment portfolio that aligns with your unique needs and goals.

Leave a Reply