Stuart retirees face unique financial challenges that can derail their golden years. From Florida’s rising healthcare costs to complex Social Security timing decisions, local residents often stumble into costly mistakes.

We at Davies Wealth Management see these retirement strategies errors repeatedly across Martin County. The good news? Most pitfalls are completely avoidable with proper planning.

What Retirement Mistakes Cost Stuart Residents the Most?

The Late Starter’s Financial Reality

Stuart residents who delay retirement savings until their 40s face a harsh mathematical reality. A 25-year-old who saves $300 monthly will accumulate approximately $1.4 million by age 65 (assuming a 7% annual return). The same person who starts at 40 must save $1,100 monthly to reach identical results. 20% of adults ages 50+ have no retirement savings. This delay proves particularly devastating for Martin County families who face Florida’s rising living costs.

Florida’s Healthcare Cost Shock

Healthcare expenses blindside Florida retirees more than residents in most other states. The average 65-year-old retiring today could spend $172,500 on health care in retirement. Florida’s lack of state income tax attracts retirees, but Medicare supplement insurance costs run 15-20% higher than the national average. Long-term care in Martin County averages $4,500 monthly for assisted living, while skilled nursing reaches $8,200 monthly. Most Stuart residents grossly underestimate these figures and budget only $2,000-3,000 annually for healthcare.

Social Security Timing Errors

Many Americans make timing errors when claiming Social Security benefits, which costs them thousands in lifetime income. Stuart residents who claim at 62 receive 25% less monthly than those who wait until full retirement age. Delays until age 70 increase benefits by 32% beyond full retirement age. A Stuart resident entitled to $2,000 monthly at full retirement age loses $500 monthly when they claim early. This totals $120,000 over 20 years of retirement.

These costly mistakes compound over time and create financial stress that could have been avoided. The next step involves understanding how Stuart residents can sidestep these common pitfalls through strategic planning and local expertise.

How Do Stuart Residents Stop These Financial Mistakes?

Start Your Retirement Timeline at Age 30

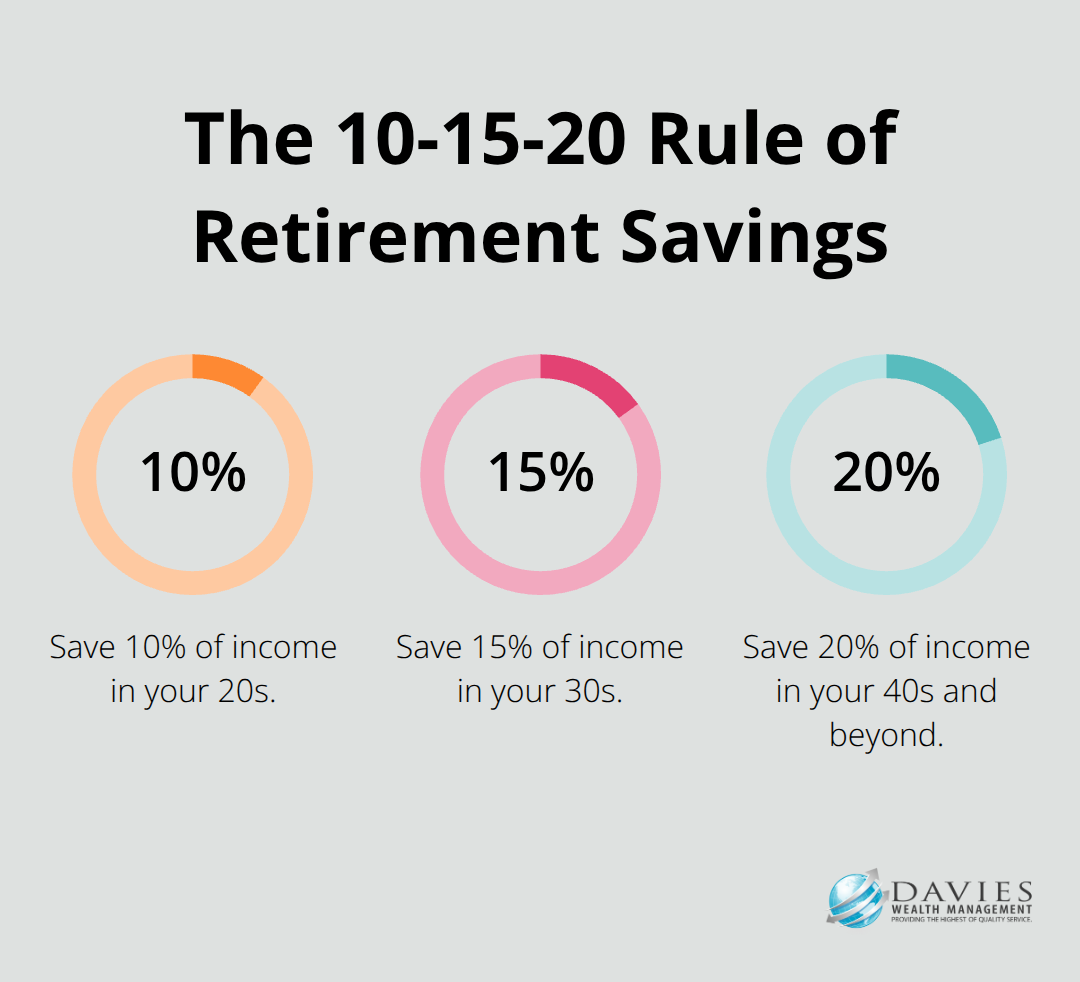

Stuart residents must begin retirement planning at age 30 to avoid the late starter penalty. Financial experts recommend the 10-15-20 rule: save 10% of income in your 20s, 15% in your 30s, and 20% in your 40s and beyond. A 30-year-old Stuart resident who earns $75,000 should contribute $11,250 annually across all retirement accounts. This approach builds approximately $2.1 million at age 65 with a 7% return. The timeline should include specific milestones: $100,000 saved at age 35, $300,000 at 45, and $750,000 at 55. Martin County residents who follow this schedule avoid the financial stress that forces many Florida retirees to work past age 70.

Build Your Emergency Fund to $50,000 Minimum

Florida residents face unique emergency expenses that other states avoid: hurricane damage, repairs from floods, and seasonal income fluctuations in tourism-dependent areas. Stuart residents should maintain $50,000 in emergency funds, significantly higher than the traditional 3-6 months of expenses. This amount covers hurricane evacuation costs, temporary housing, and property repairs that insurance may not fully cover. High-yield savings accounts currently offer 4.5-5.2% annual returns (making them practical for emergency funds). The Federal Reserve Bank of St. Louis reports that families with adequate emergency savings are 70% less likely to tap retirement accounts during financial crises.

Choose Florida-Focused Financial Advisors

Stuart residents need advisors who understand Florida’s specific tax advantages and retirement challenges. Florida has no state income tax, but property taxes in Martin County average 0.89% of assessed value, higher than many retirement destinations. Local advisors understand homestead exemptions that provide $25,000 savings for property owners who apply. They also know Florida’s asset protection laws, which shield primary residences and retirement accounts from creditors (national advisory firms often miss these state-specific strategies). Financial consultants can provide advice on budgeting, investments, and insurance while understanding these overlooked opportunities that can save Florida retirees hundreds of thousands over retirement.

Smart retirement strategies go beyond basic planning and emergency funds. Stuart residents who master Florida’s unique tax advantages and income diversification create the strongest foundation for their golden years.

What Makes Florida Perfect for Stuart Retirees?

Florida’s Zero Income Tax Advantage

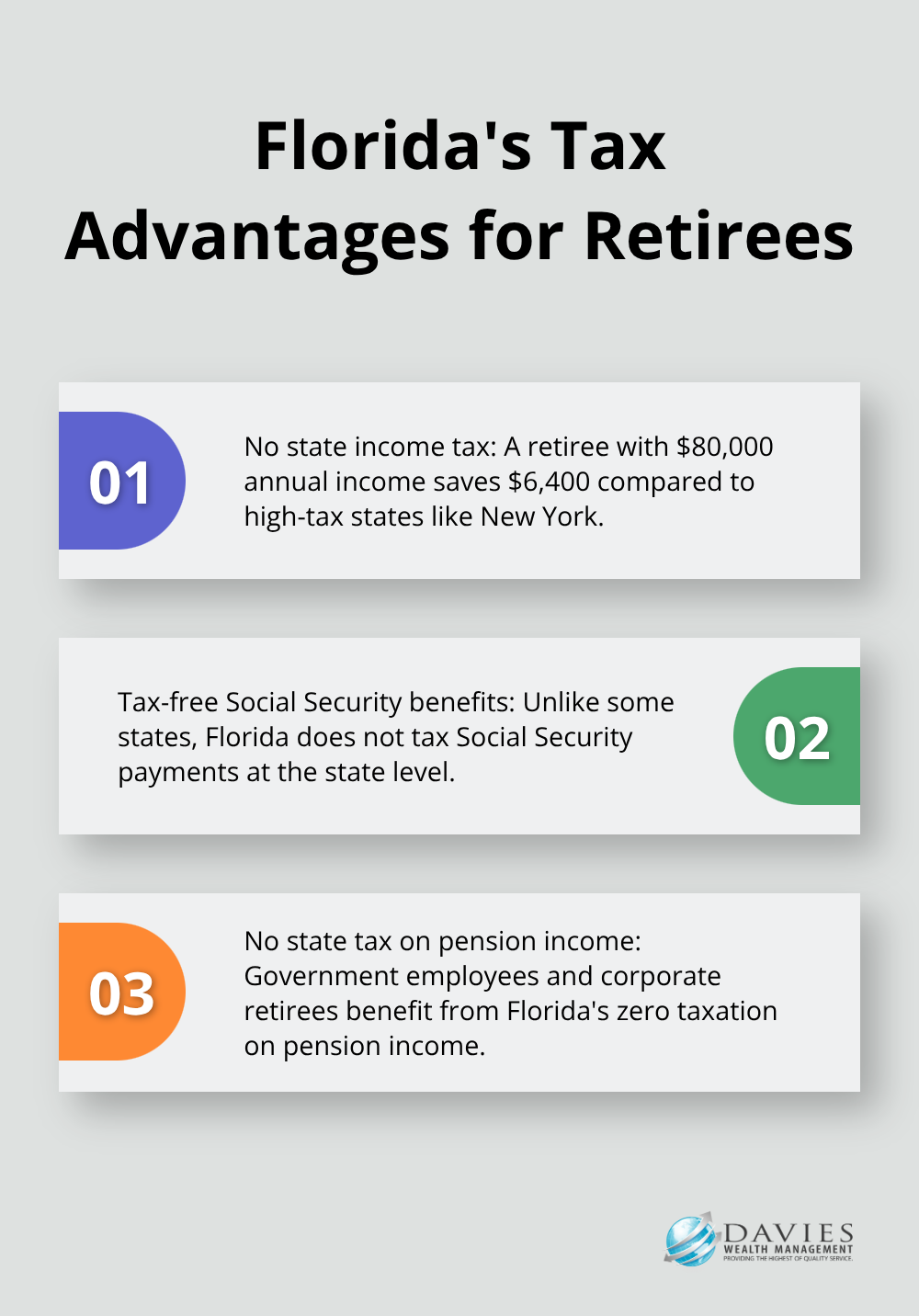

Stuart retirees who structure their income correctly save thousands annually through Florida’s tax-free status. A retiree with $80,000 annual income would pay $6,400 in state taxes in New York but zero in Florida. The savings compound when retirees convert traditional IRAs to Roth IRAs without state tax penalties. Florida residents can execute $100,000 Roth conversions and pay only federal taxes, while residents in high-tax states face combined rates that exceed 40%. Smart Stuart retirees time these conversions during low-income years or spread them across multiple years. Social Security benefits remain completely tax-free at the state level, unlike other states that tax these payments. Pension income also escapes state taxation, which makes Florida particularly attractive for government employees and corporate retirees.

Long-Term Care Costs in Martin County

Martin County’s long-term care costs demand aggressive advance plans rather than hopes that Medicare covers everything. Private homes in Stuart average $8,200 monthly while assisted facilities cost $4,500 monthly according to Genworth’s 2024 Cost of Care Survey. Long-term care insurance premiums for a 55-year-old Stuart resident range from $2,400-4,800 annually but cover 70% of future care costs. Health Savings Accounts provide triple tax advantages for long-term care: deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses (including long-term care premiums after age 65). Stuart residents should maintain separate investment accounts specifically for care costs and target $300,000-500,000 in dedicated funds. Home equity lines of credit secured against Florida properties offer additional options since Florida’s homestead exemption protects primary residences from most creditors.

Income Sources Beyond 401k Plans

Stuart retirees who depend solely on traditional retirement accounts face unnecessary tax concentration and withdrawal limits. Taxable investment accounts provide unlimited access without age restrictions or required minimum distributions. Municipal bonds from Florida issuers generate tax-free interest at both federal and state levels and currently yield 3.8-4.2% for investment-grade securities. Real Estate Investment Trusts focused on Florida properties provide monthly dividends that average 6-8% annually while they offer inflation protection through property appreciation. Dividend-focused stock portfolios generate quarterly income streams that adjust for inflation over time (unlike fixed annuity payments). Stuart residents should target 40% of retirement income from sources outside traditional retirement accounts to maximize flexibility and minimize tax burdens during their golden years.

Final Thoughts

Stuart retirees who execute proper retirement strategies avoid the costly mistakes that destroy financial security. Early savers who start at age 30, maintain $50,000 emergency funds, and maximize Florida’s tax advantages create substantial wealth preservation. Healthcare costs become manageable when residents budget $172,500 for medical expenses and secure long-term care coverage early.

Professional guidance proves invaluable for Stuart residents who want to navigate Florida’s unique opportunities and challenges. Local advisors understand homestead exemptions, Roth conversion strategies, and Martin County’s specific care costs (which save thousands annually). These insights prevent expensive timing errors with Social Security benefits and optimize tax-efficient withdrawal strategies.

Your next step involves a partnership with experienced professionals who specialize in Florida retirement planning. We at Davies Wealth Management provide comprehensive wealth management solutions tailored to Stuart residents’ specific needs. Our personalized approach addresses investment management, tax-efficient strategies, and estate planning to secure your financial future throughout retirement.

Leave a Reply