Florida's reputation as a retirement haven is well-earned. With no state income tax, year-round sunshine, and countless recreational opportunities, it's no wonder that nearly 1,000 people move to the Sunshine State every day. However, beneath this appealing surface lies a complex financial landscape that can trap even well-prepared retirees in costly mistakes.

After working with hundreds of Florida retirees at Davies Wealth Management, I've identified five critical errors that consistently derail retirement income plans. These mistakes can cost you tens of thousands of dollars: or more: over your retirement years. The good news? They're entirely preventable with proper planning and awareness.

Mistake #1: Drastically Underestimating Healthcare Costs

Healthcare expenses represent one of the largest and least predictable costs in retirement, yet most retirees significantly underestimate their impact. A recent survey revealed that 72% of adults age 50 or older fear their retirement costs will spiral out of control, with two-thirds believing a single health-related issue could devastate their finances for years.

The reality is sobering: Medicare covers far less than most people expect. Original Medicare typically covers only about 80% of approved medical costs, leaving you responsible for the remaining 20%: which has no annual cap. For a major surgery or extended hospital stay, this 20% can quickly reach tens of thousands of dollars.

In Florida, where many retirees relocate without established healthcare networks, costs can escalate even further. Out-of-network providers, travel expenses for specialized care, and the premium costs associated with living in popular retirement destinations all contribute to higher-than-expected healthcare spending.

Consider this example: A healthy 65-year-old couple retiring in Florida today should expect to spend approximately $300,000 on healthcare costs throughout retirement: not including long-term care. Factor in potential long-term care needs, and that figure can easily double.

Smart Solution: Build a dedicated healthcare reserve fund separate from your general retirement savings. Plan for healthcare costs to increase at roughly 6-7% annually: significantly higher than general inflation. Consider a Health Savings Account (HSA) if you're still working, as these offer triple tax advantages for healthcare expenses.

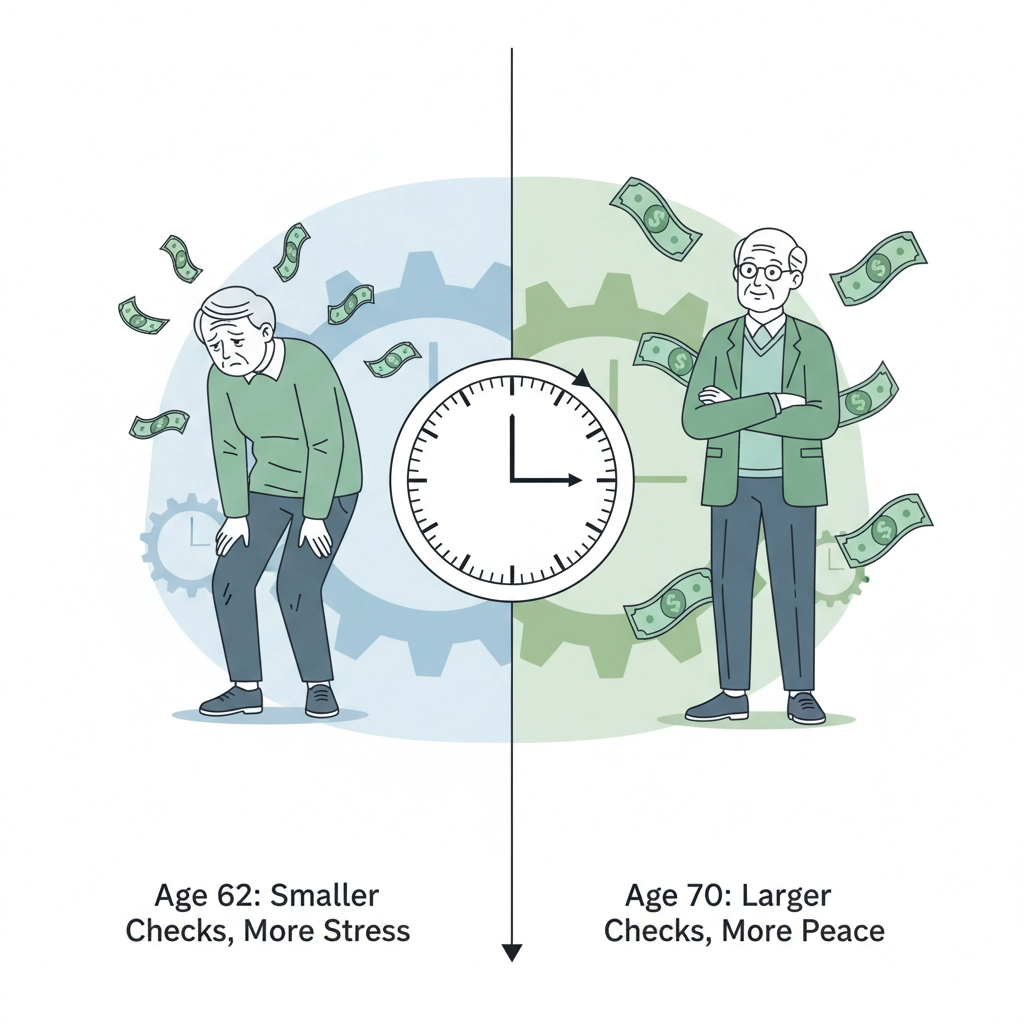

Mistake #2: Claiming Social Security at the Wrong Time

Social Security timing represents one of the most consequential decisions you'll make in retirement, yet many Florida retirees claim benefits without fully understanding the long-term implications. The temptation to start benefits at age 62: the earliest possible age: can be strong, especially when relocating to Florida seems to require immediate cash flow.

Here's what early claiming costs you: If your full retirement age is 67 and you claim at 62, your monthly benefit is permanently reduced by 30%. For someone entitled to $2,000 monthly at full retirement age, early claiming drops that to $1,400: a $600 monthly reduction that lasts for life.

The math becomes even more compelling when you consider delayed retirement credits. For every year you delay claiming beyond your full retirement age until age 70, your benefit increases by approximately 8%. That same $2,000 monthly benefit grows to $2,640 if you wait until 70: a difference of $14,880 annually compared to claiming at 62.

Smart Solution: Develop a claiming strategy that considers your health, financial needs, and spousal benefits. For married couples, advanced strategies like "claim and invest" can maximize household Social Security income. If you need income before your optimal claiming age, consider tapping other retirement accounts first while allowing Social Security to grow.

Mistake #3: Ignoring Tax Planning in a "Tax-Free" State

Florida's lack of state income tax creates a dangerous misconception: that retirement income planning doesn't require sophisticated tax strategies. This assumption can prove extremely costly as you navigate federal taxes, Medicare premiums, and Required Minimum Distributions (RMDs).

Different retirement accounts face vastly different tax treatment. Traditional IRAs and 401(k)s generate ordinary income tax when withdrawn, while Roth accounts provide tax-free income. The sequence in which you tap these accounts can dramatically impact your lifetime tax burden and Medicare costs.

Consider Medicare's Income-Related Monthly Adjustment Amounts (IRMAA). If your modified adjusted gross income exceeds certain thresholds, your Medicare Part B and Part D premiums increase substantially. For 2024, individuals with income above $103,000 pay IRMAA surcharges that can add over $4,000 annually to their Medicare costs.

Poor withdrawal sequencing can inadvertently push you into higher tax brackets or trigger IRMAA penalties. For example, taking large traditional IRA distributions to fund a major purchase might increase your Medicare premiums for the following year.

Smart Solution: Develop a tax-efficient withdrawal strategy that considers your total tax picture. This might involve taking some traditional account distributions in lower-income years, managing Roth conversions to stay within optimal tax brackets, and coordinating withdrawals with Social Security timing. Working with a financial advisor experienced in retirement income planning can help you navigate these complexities effectively.

Mistake #4: Living Without a Comprehensive Income Plan

Many retirees approach their golden years with what I call "hope-based planning": hoping their savings will last without a structured strategy for generating consistent income. This approach works until it doesn't, often leaving retirees scrambling to adjust their lifestyle when markets decline or unexpected expenses arise.

A comprehensive retirement income plan addresses several critical components: identifying all income sources, establishing withdrawal strategies, planning for inflation, and preparing for market volatility. The traditional "4% rule" serves as a starting point, but your personal situation likely requires a more nuanced approach.

Your income plan should account for Florida-specific considerations: potential property tax increases in popular retirement areas, hurricane-related expenses not fully covered by insurance, and the tendency for retirees to increase spending in their early retirement years as they pursue new activities and travel opportunities.

Smart Solution: Create a detailed income plan that maps your expenses against guaranteed income sources like Social Security and pensions, then develops strategies for covering the gap through investment withdrawals. Consider creating separate "buckets" for different time horizons: immediate needs, medium-term goals, and long-term growth. This approach, detailed in our comprehensive guide on financial planning components, can provide both stability and flexibility.

Mistake #5: Mismanaging Required Minimum Distributions

Once you reach age 73, the IRS requires you to take annual distributions from traditional retirement accounts, regardless of whether you need the money. These Required Minimum Distributions (RMDs) represent a significant planning challenge that many retirees handle poorly.

The penalties for RMD mistakes are severe: if you fail to take your full required distribution, the IRS penalizes you 25% of the shortfall amount (reduced to 10% if corrected within two years). Miss a $10,000 RMD, and you'll owe $2,500 in penalties: plus you still need to take the distribution and pay regular income taxes.

Beyond penalties, RMDs can create unwanted tax consequences. Large RMDs might push you into higher tax brackets, trigger IRMAA surcharges, or affect the taxation of your Social Security benefits. Many retirees find themselves taking larger distributions than they need, paying unnecessary taxes, and disrupting their carefully planned withdrawal strategies.

Smart Solution: Begin RMD planning well before age 73. Consider Roth conversions in lower-income years to reduce future RMD requirements. Develop a distribution calendar that spreads RMDs throughout the year to provide better cash flow management. For those who don't need RMD income immediately, explore qualified charitable distributions, which can satisfy RMD requirements while supporting causes you care about.

Moving Forward with Confidence

Avoiding these five costly mistakes requires proactive planning and ongoing attention to changing circumstances. Florida's attractive retirement environment can inadvertently mask the complexity of retirement income planning, leading to complacency that proves expensive over time.

The key is developing a comprehensive strategy that addresses your unique situation while remaining flexible enough to adapt as circumstances change. Whether you're already retired in Florida or planning your move to the Sunshine State, taking time to address these common pitfalls now can save you significant money and stress throughout your retirement years.

For more insights on creating a robust financial plan, consider exploring our 5-year financial planning guide or learning about estate planning basics to protect your legacy.

Remember, retirement planning isn't a one-time event: it's an ongoing process that requires regular review and adjustment. The mistakes outlined here are entirely preventable with proper planning and professional guidance when needed.

Leave a Reply