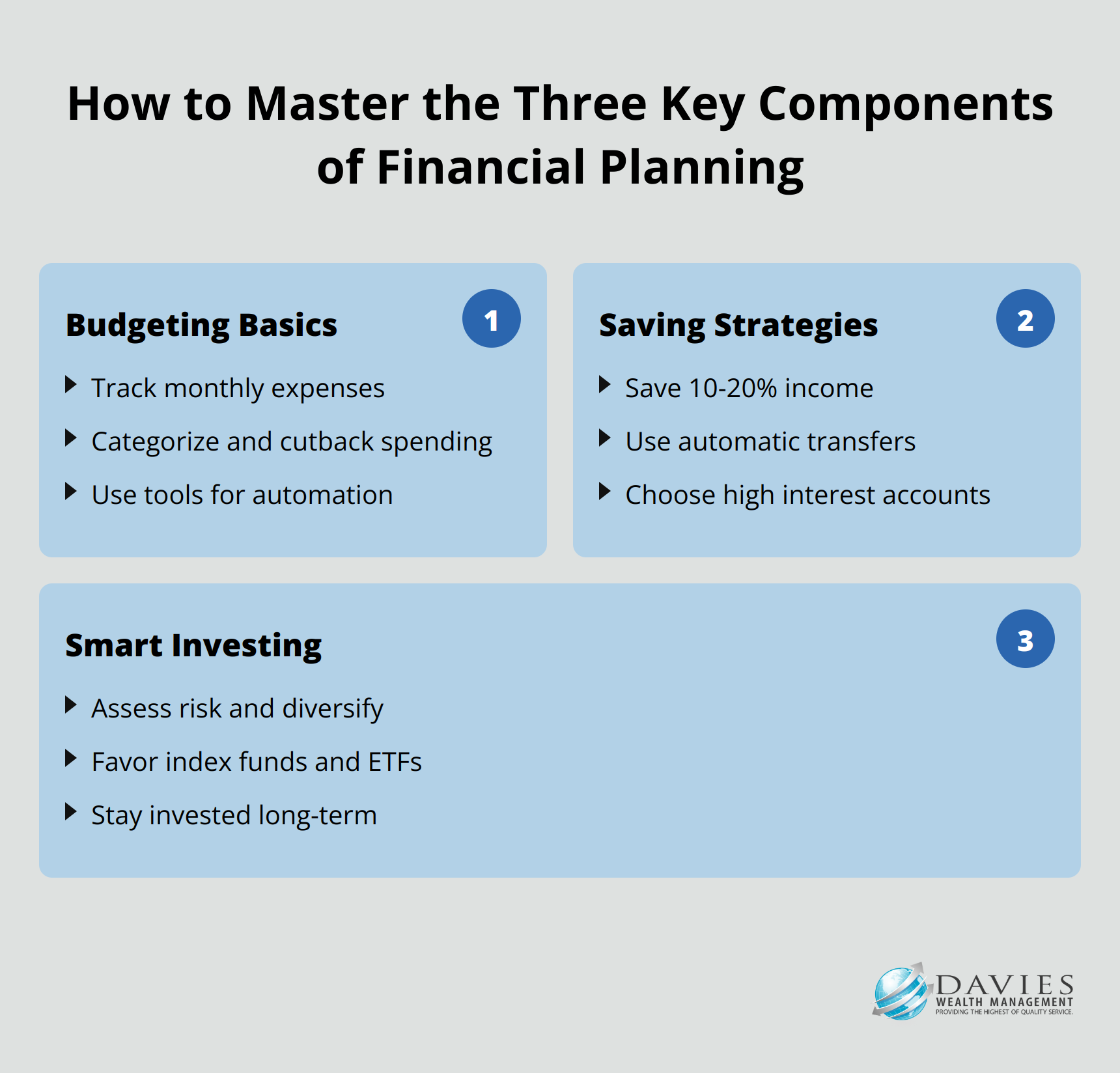

Financial planning can seem overwhelming, but it’s essential for achieving your long-term goals. At Davies Wealth Management, we believe that mastering the three key components of financial planning is crucial for building a secure financial future.

These components – budgeting, saving, and investing – form the foundation of a solid financial strategy. In this post, we’ll explore each element in detail and provide practical tips to help you take control of your finances.

1. Budgeting Basics Every Financial Plan Needs

Budgeting forms the cornerstone of any solid financial plan. Having a goal in mind for your budget is important when you decide how much money to set aside and how much to spend. A well-crafted budget provides a clear picture of your income and expenses, which allows you to make informed decisions about your money. To create an effective budget, you should track all your expenses for a month – this often reveals surprising spending patterns. After tracking, categorize your spending into necessities and discretionary items, then identify areas for potential cutbacks.

Numerous tools can help with budgeting, from simple spreadsheets to sophisticated apps like Empower. These tools automate much of the process, which makes it easier to stick to your financial goals. However, you should avoid common budgeting pitfalls, such as underestimating irregular expenses or setting unrealistic targets. A budget isn’t about restriction; it aligns your spending with your priorities and long-term financial objectives. This fundamental skill will set you on the path to achieving your financial dreams, whether you’re a professional athlete managing variable income or a business owner planning for the future.

To create an effective budget, try these steps:

- Track all expenses for a month

- Categorize spending into necessities and discretionary items

- Identify areas for potential cutbacks

- Use budgeting tools to automate the process

- Regularly review and adjust your budget

2. Saving Strategies That Supercharge Your Financial Safety Net

Saving money forms a critical step in building financial security. We recommend setting specific, measurable savings goals tailored to your unique situation. Most people should try to save 10-20% of their income as a starting point. To simplify saving, set up automatic transfers from your checking account to a high-yield savings account on payday. A study by America Saves shows that individuals who use automatic savings are twice as likely to meet their savings goals.

When selecting a savings account, prioritize options with high interest rates and low fees. Online banks often outperform traditional brick-and-mortar institutions in this regard. As of January 2025, some online savings accounts offer annual percentage yields (APYs) that are many times higher than the national average rate of 0.42%. The power of compound interest can significantly grow even small, consistent savings over time. For example, saving $200 monthly at a 4% APY would grow to over $29,000 in 10 years (without accounting for potential tax implications). This growth demonstrates why a robust savings strategy proves essential for long-term financial success, regardless of your profession or income structure.

3. Smart Investing Strategies for Long-Term Wealth Growth

Investing forms the cornerstone of wealth accumulation, but it requires a strategic approach. We recommend that you start by assessing your risk tolerance and investment objectives. This assessment will help you determine the right mix of assets for your portfolio. Diversification is essential to manage risk; you should spread investments across various asset classes like stocks, bonds, and real estate. Diversification is a risk management strategy that creates a mix of various investments within a portfolio.

For most investors, a combination of low-cost index funds and ETFs provides a solid foundation. Research shows that over the long run, passive indexing strategies tend to outperform their active counterparts. These vehicles offer broad market exposure and tend to outperform actively managed funds over the long term. The S&P 500 index has historically returned about 10% annually. Data illustrates the importance of staying invested through market fluctuations: a perfectly timed purchase of the S&P 500 in 2000 would have been at a value of 1,254 points. By December 31, 2019 the S&P 500 stood at 3,230. Professional athletes with unique financial situations should consider tailored investment strategies that account for variable income and shorter career spans (Davies Wealth Management specializes in this area). As we move forward, let’s explore how to integrate these investing principles with budgeting and saving to create a comprehensive financial plan.

Final Thoughts

The three key components of financial planning include budgeting, saving, and investing. These elements create a powerful synergy that propels you towards your financial goals. Your budget serves as a roadmap, guiding your saving and investing decisions. We recommend you allocate a portion of your income to savings and investments based on your budget.

Financial planning requires ongoing attention and periodic adjustments. You should review your financial plan at least annually to reflect changes in your life circumstances, income, or goals. Market conditions and economic factors evolve, so it’s important to reassess your investment strategy regularly.

Professional guidance can provide valuable insights and expertise for managing your finances. At Davies Wealth Management, we specialize in creating comprehensive financial strategies tailored to individual needs. Our team can help you navigate complex financial decisions, optimize your investment portfolio, and align your financial plan with your long-term objectives.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply