Most people struggle to build wealth because they lack a structured approach to their finances. Without clear direction, even good intentions fall short.

We at Davies Wealth Management believe a well-crafted 5-year financial plan transforms your relationship with money. This roadmap helps you move from financial uncertainty to confident wealth building through systematic planning and strategic decision-making.

What Does Your Financial Picture Really Look Like

Your financial foundation determines everything that follows in your 5-year plan. Most people skip this step and jump straight into goal-setting, which explains why many Americans struggle financially according to the Federal Reserve. This mistake sabotages even the most ambitious plans.

Calculate Your True Financial Position

Start with your net worth calculation by listing every asset you own and every debt you owe. Include your home value, retirement accounts, checking and savings balances, investment accounts, and any other valuable assets. Subtract all debts including your mortgage, credit cards, student loans, and car payments.

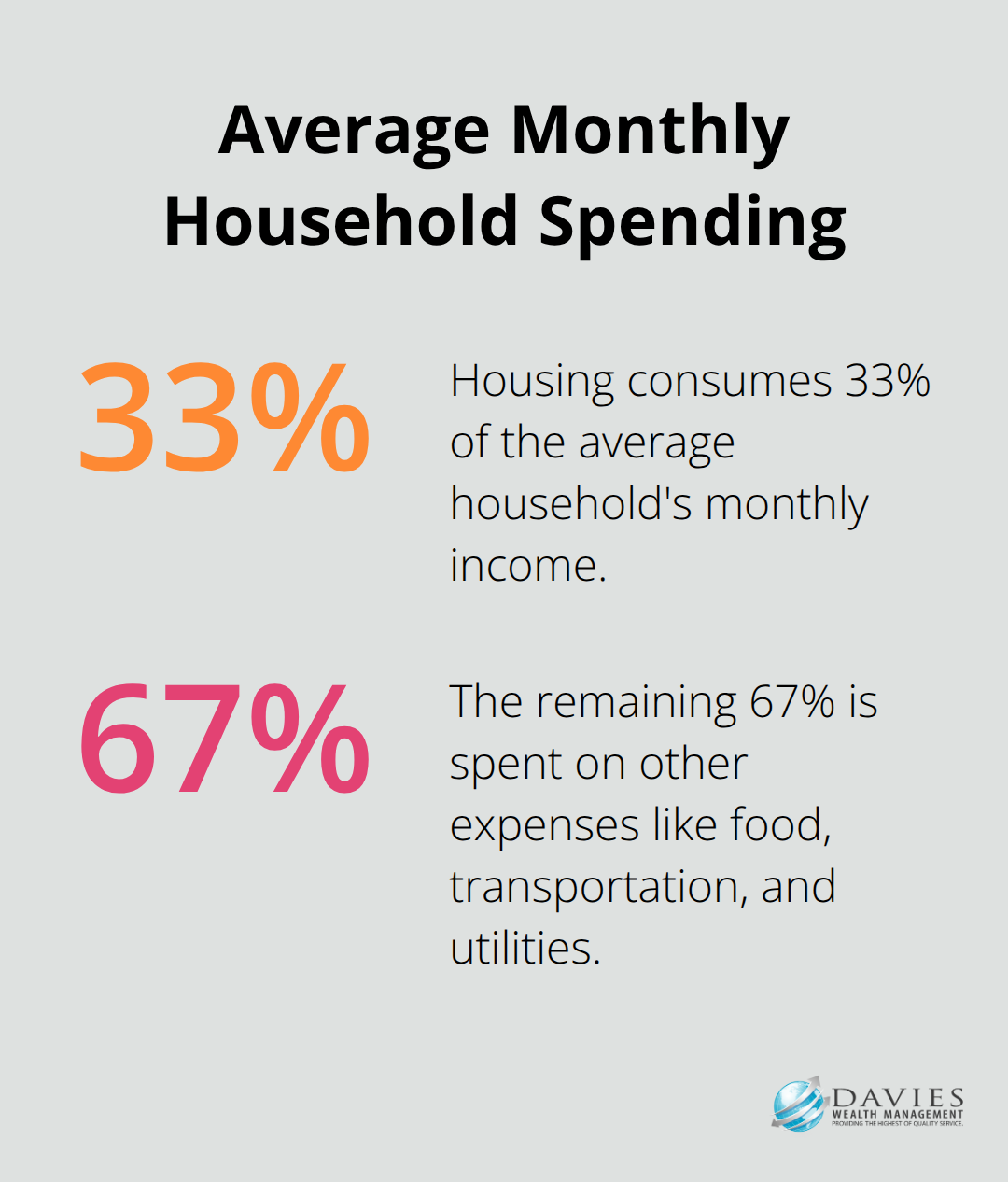

The Federal Reserve tracks household net worth through their Survey of Consumer Finances, but this number means nothing without understanding your cash flow. Track your income and expenses for three months. Fixed expenses like rent and insurance are easy to identify, but variable costs like groceries and entertainment often surprise people. The Bureau of Labor Statistics reports that the average household spends $5,111 monthly, with housing consuming 33% of income.

Identify Your Financial Gaps and Opportunities

Your current investment mix reveals whether you’re positioned for growth or playing it too safe. Check if you maximize employer 401k matches, as many eligible employees miss out on this benefit according to retirement plan research. Review your emergency fund against your monthly expenses (only 39% of Americans can cover a $1,000 emergency with savings), yet financial experts recommend three to six months of expenses.

Look at your debt-to-income ratio, which should stay below 36% for total debt and 28% for housing costs. High-interest credit card debt averaging 21.47% interest rates destroys wealth faster than most investments can build it. Your insurance coverage also needs scrutiny, as one in four workers will experience a disability before retirement, yet many lack adequate disability insurance.

Map Your Financial Behavior Patterns

Your spending habits reveal more than numbers on a statement. Track where your money disappears each month and identify patterns that either support or undermine your wealth-building efforts. Small recurring expenses (subscription services, daily coffee purchases) add up to significant amounts over time.

Once you complete this financial assessment, you’ll have the clarity needed to set realistic and achievable goals for the next five years.

What Financial Goals Will Transform Your Next Five Years

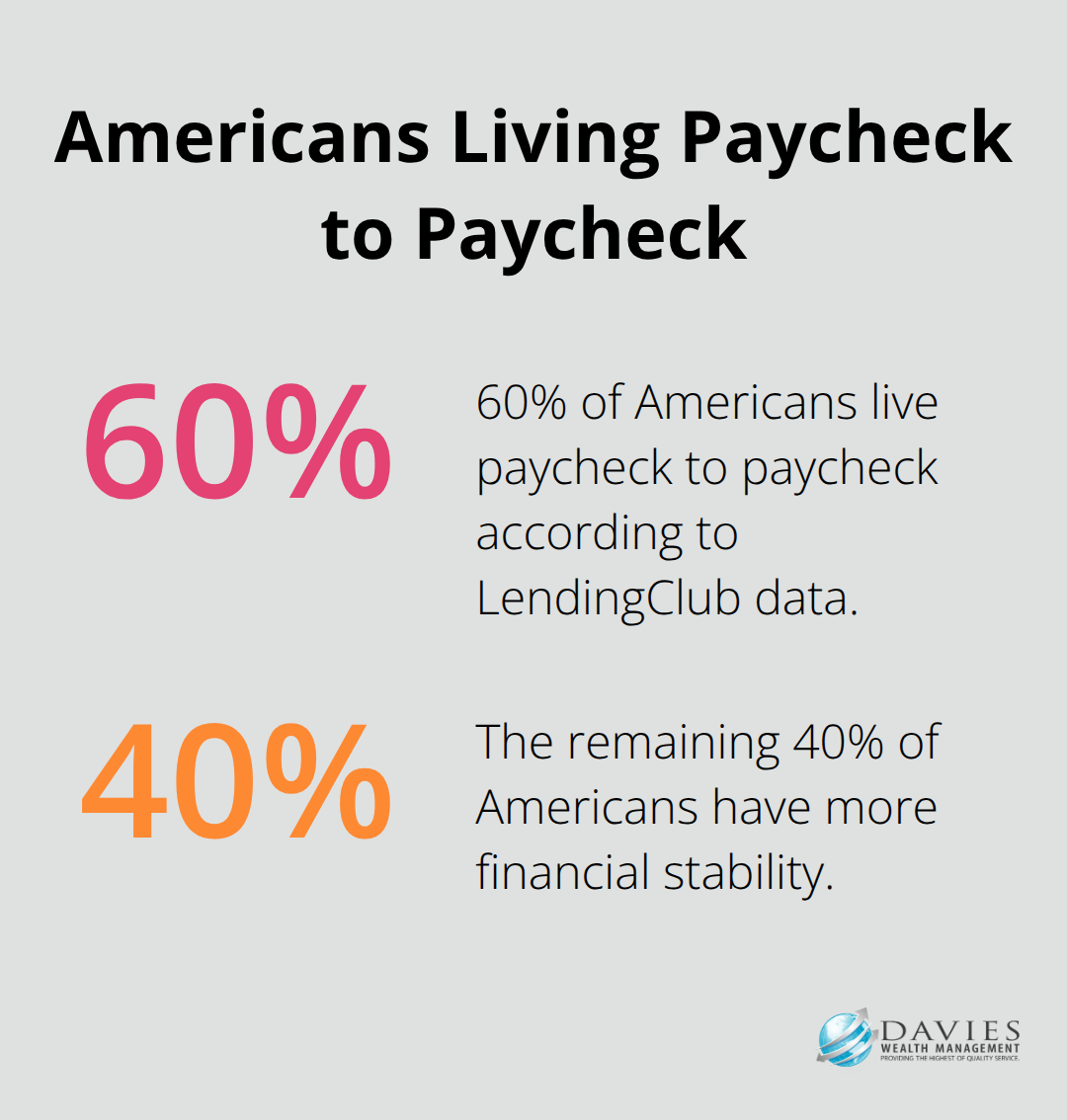

Your financial assessment reveals the starting point, but specific goals drive actual progress. The Federal Reserve Survey provides comprehensive data on families’ balance sheets, pensions, income, and demographic characteristics. Most people set vague goals like “save more money” or “pay off debt,” which explains why 60% of Americans live paycheck to paycheck according to LendingClub data. Effective goal-setting requires mathematical precision and realistic timelines that match your cash flow capacity.

Transform Vague Wishes Into Mathematical Targets

Your 5-year plan needs specific dollar amounts and deadlines, not wishful thinking. If you want to buy a $400,000 home with 20% down, you need $80,000 plus closing costs and moving expenses (totaling roughly $90,000). This amount over 60 months requires $1,500 monthly contributions to reach your target. Similarly, eliminating $25,000 in credit card debt at 21% interest demands $600 monthly payments to become debt-free within five years. The Bureau of Labor Statistics provides weekly earnings data, meaning these goals must fit within your actual earnings capacity rather than optimistic projections.

Sequence Goals Based on Financial Impact and Urgency

High-interest debt elimination takes priority over everything except basic emergency savings because credit card interest rates destroy wealth faster than most investments generate returns. Build a $2,000 starter emergency fund first, then attack debt aggressively with either the avalanche method for maximum mathematical efficiency or the snowball approach for psychological momentum. Once you eliminate consumer debt, redirect those payments toward your emergency fund until it covers six months of expenses.

Retirement contributions should begin immediately if your employer offers matching, as this represents guaranteed 50% to 100% returns that compound over decades. The Employee Benefit Research Institute found that workers who delay retirement savings by just five years need to save 50% more monthly to reach the same retirement income target.

Build Accountability Through Measurement Systems

Track progress monthly with specific metrics rather than general impressions about your financial health. Your debt payoff schedule should show exact balances and payment dates, while savings goals need monthly contribution targets and account balance milestones. Investment goals require portfolio allocation percentages and rebalancing schedules (not just total dollar targets). Most successful savers automate contributions immediately after payday, which removes willpower from the equation entirely.

These specific, measurable goals create the foundation for your investment and savings strategy that will fund your financial future.

How to Structure Your Investment Portfolio for Maximum Growth

Your investment strategy must align with your specific timeline and risk tolerance, not generic advice from financial media. The S&P 500 has delivered strong historical returns with significant volatility that can destroy short-term goals. Money you need within two years belongs in high-yield savings accounts that currently offer 4.5% to 5.25% rates. Funds needed in three to five years work best in conservative bond funds or certificates of deposit, while money for goals beyond five years can handle stock market volatility through diversified index funds.

Build Your Emergency Fund Through Automatic Transfers

Your emergency fund requires immediate access, not investment growth. High-yield savings accounts at online banks like Marcus by Goldman Sachs or Ally Bank offer competitive rates without minimum balance requirements. Set up automatic weekly transfers of $125 to build a $6,500 emergency fund within one year, then increase contributions to reach six months of expenses. The Federal Deposit Insurance Corporation protects deposits up to $250,000 per account, which makes these accounts completely safe for emergency funds. Never put emergency money in stocks or bonds, as market downturns often coincide with personal financial crises when you need the funds most.

Maximize Retirement Account Tax Benefits

Contribute enough to your 401k to capture the full employer match before you invest in taxable accounts, as this represents guaranteed returns between 50% and 100%. The 2024 contribution limit allows $23,000 annually for workers under 50 (with an additional $7,500 catch-up contribution for older workers). Roth IRA contributions make sense for younger workers in lower tax brackets, while traditional IRA contributions benefit higher earners who need immediate tax reduction. Vanguard research shows that consistent monthly contributions outperform lump-sum investments for most investors due to dollar-cost effects that reduce market timing risk.

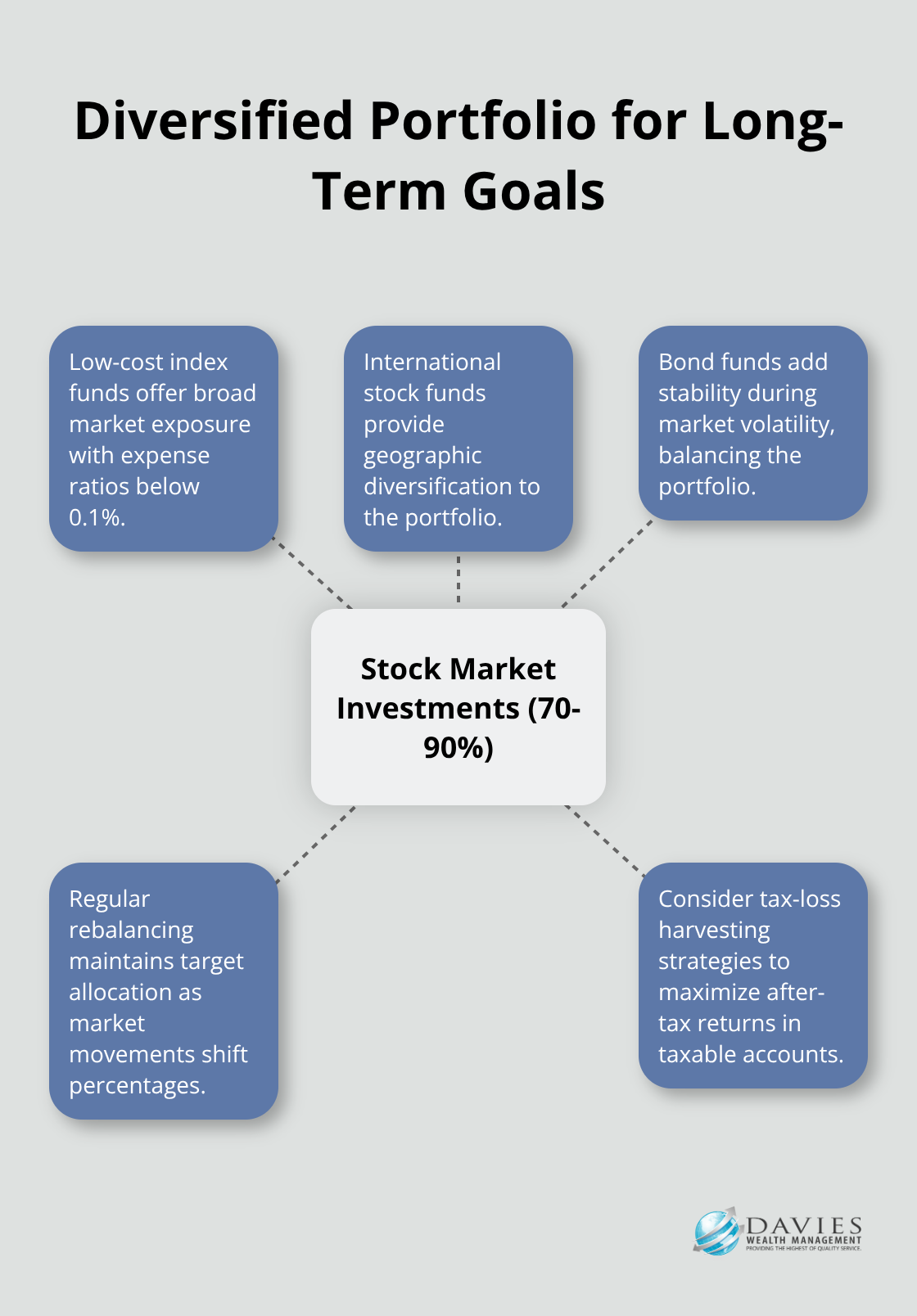

Create a Diversified Portfolio That Matches Your Timeline

Stock market investments should represent 70% to 90% of portfolios for goals more than 10 years away, but this percentage should decrease as you approach your target date. Low-cost index funds from Vanguard, Fidelity, or Schwab offer broad market exposure with expense ratios below 0.1%. International stock funds provide geographic diversification, while bond funds add stability during market volatility. Rebalance your portfolio annually to maintain your target allocation, as market movements will shift your percentages over time. Consider tax-loss harvesting strategies to maximize your after-tax returns in taxable investment accounts.

Final Thoughts

Your 5-year financial plan succeeds through consistent execution, not perfect market conditions. The three pillars we covered work together to create sustainable wealth growth that outperforms sporadic efforts. Most Americans who follow structured financial plans accumulate significantly more wealth than those who save randomly.

Regular plan reviews prevent small problems from becoming major setbacks. Schedule quarterly check-ins to track progress against your specific targets and adjust for income changes or life events. The Bureau of Labor Statistics shows that household expenses fluctuate throughout economic cycles (making flexibility essential for long-term success).

Professional guidance accelerates progress and identifies blind spots in your strategy. We at Davies Wealth Management help clients navigate complex financial decisions while building long-term wealth through every stage of life. Start your plan today rather than waiting for higher income levels or perfect market conditions.

Leave a Reply