Economic uncertainty has reached levels not seen since 2008, with inflation hitting 9.1% in June 2022 and market volatility spiking 40% above historical averages.

Smart investors are shifting their focus from growth to preservation. At Davies Wealth Management, we see clients implementing sophisticated risk management strategies to protect their wealth against market downturns and economic shocks.

The key lies in building multiple layers of financial defense.

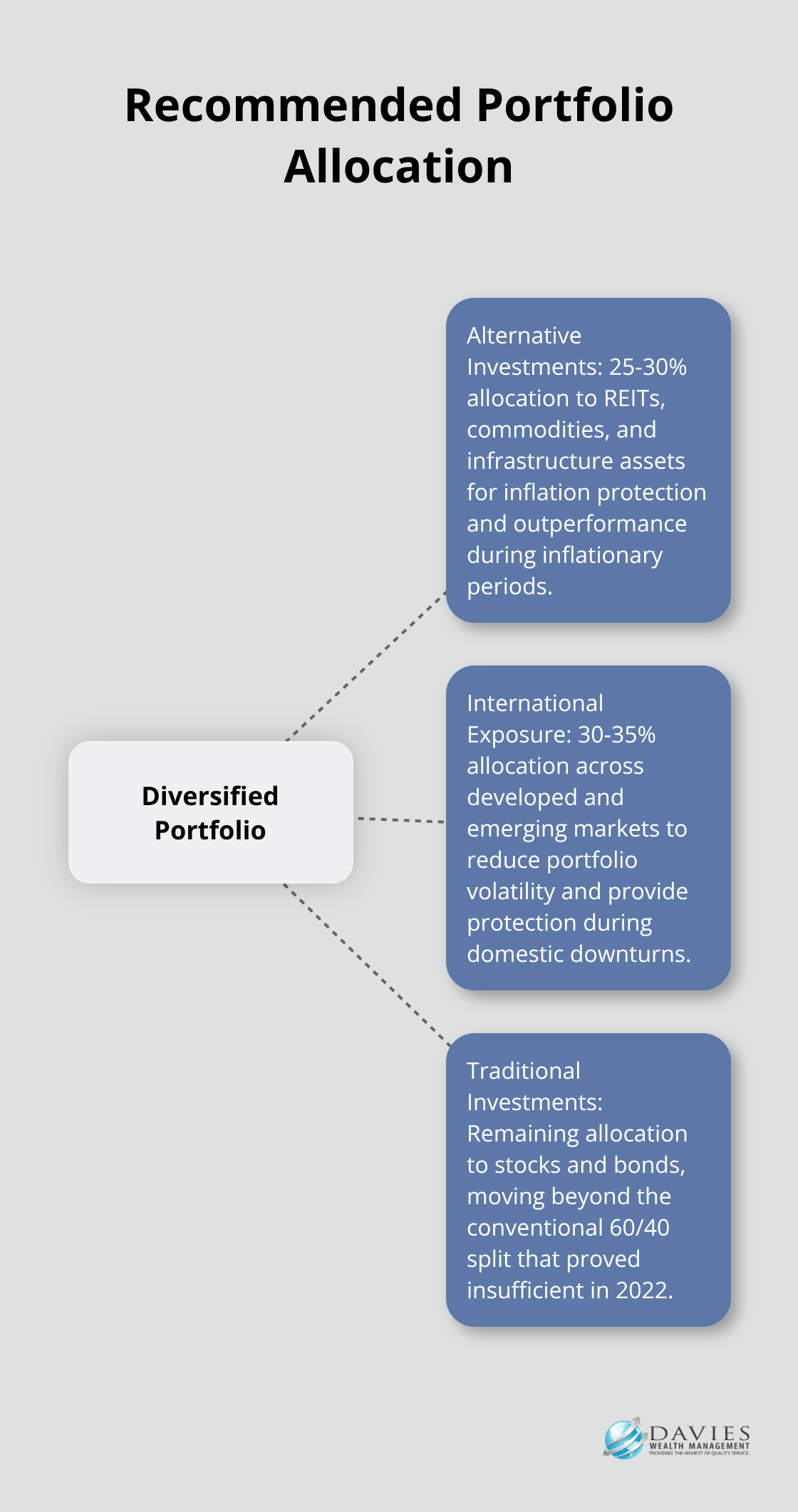

Smart Diversification Beyond Stocks and Bonds

Traditional 60/40 portfolios lost 16% in 2022, which proves that conventional diversification fails during economic stress. We recommend that investors allocate 25-30% of portfolios to alternative investments that include real estate investment trusts, commodities, and infrastructure assets. REITs provide inflation protection that bonds cannot match. Commodities like gold and agricultural futures historically outperform during inflationary periods.

Geographic Risk Distribution

International diversification reduces portfolio volatility according to research. We advocate for 30-35% international exposure across developed and emerging markets. Australian and European markets often move independently from US cycles, which provides natural protection during domestic downturns. Currency diversification through foreign assets protects against dollar devaluation risk that could erode domestic purchasing power.

Alternative Investment Integration

Private equity and hedge funds offer returns uncorrelated to public markets. Direct real estate ownership provides tangible asset protection and rental income streams that adjust with inflation. We recommend 10-15% allocation to alternatives for high net worth clients (focus on liquid alternatives that maintain accessibility while they reduce correlation to traditional markets).

Tactical Asset Allocation

Market conditions demand active portfolio management rather than static allocation models. Professional investors adjust their positions based on economic indicators and market cycles. The CBOE Volatility Index (VIX) serves as a key signal for portfolio rebalancing decisions. When volatility spikes above 30, defensive positioning becomes necessary to protect capital from sudden market drops through resilient portfolio construction.

How Do You Navigate Market Volatility

Market volatility has increased significantly since 2020, with current VIX levels around 16.35 indicating relatively stable market conditions compared to historical volatility peaks. Professional investors use systematic approaches to manage this turbulence rather than emotional reactions. We implement stop-loss orders at 8-10% below purchase prices for individual positions, while portfolio-level stops trigger at 15% drawdowns. The S&P 500 experiences corrections of 10% or more approximately every 18 months, which makes defensive positions essential rather than optional.

Economic Warning Signals

Economic indicators provide 6-12 months advance warning of major shifts. The yield curve inversion has been a relatively reliable recession indicator in the past, with the 10-year minus 2-year spread that turned negative in July 2022. Manufacturing PMI readings below 50 signal contraction, while unemployment claims above 400,000 indicate labor market stress. We monitor these metrics weekly and adjust portfolio risk exposure when two or more indicators flash warning signals simultaneously.

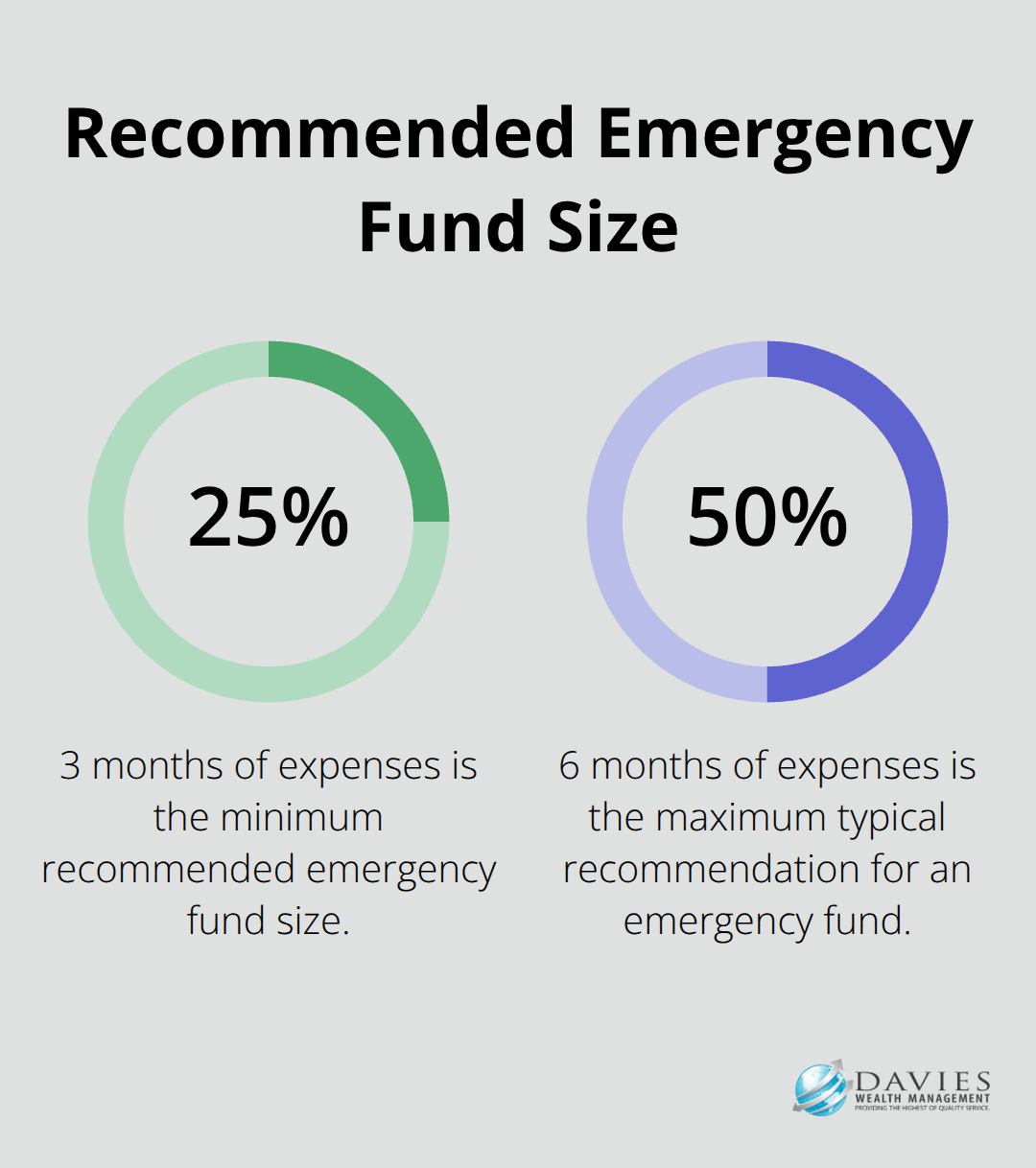

Emergency Liquidity Strategy

The recommended size for an emergency fund is typically three to six months’ worth of living expenses, though the ideal amount can vary based on individual circumstances. High-yield savings accounts now offer 4.5-5.2% returns, which makes cash positions profitable rather than costly. Money market funds provide additional yield while they maintain daily liquidity for immediate access. We recommend that investors keep 20% of total portfolio value in liquid assets during periods when the VIX exceeds 25, which allows them to capitalize on market dislocations without forced sales of long-term positions at depressed prices.

Hedging Techniques

Protective put options on major indices like the S&P 500 limit downside risk during market stress. These instruments cost 1-3% of portfolio value but provide insurance against significant losses (similar to homeowner’s insurance). Inverse ETFs offer another hedge that profits when markets decline, though they require careful timing and position sizing. Professional money managers also use currency hedging to protect international positions from dollar strength that can erode foreign returns.

The foundation of volatility management extends beyond reactive measures to proactive tax strategies that preserve wealth regardless of market conditions.

Tax-Efficient Wealth Preservation Strategies

High net worth individuals lose 30-40% of their wealth to taxes without proper planning. The top federal income tax rate of 37% combines with state taxes to reach 50% in states like California and New York. Smart tax planning reduces this burden through strategic asset location, where tax-inefficient investments go into tax-deferred accounts while tax-efficient holdings stay in taxable accounts.

Municipal bonds provide tax-free income for investors in high tax brackets, with yields of 3.5-4.2% that often exceed taxable bond returns on an after-tax basis. Qualified Small Business Stock offers complete capital gains exclusion up to $10 million per company under Section 1202, which makes it a powerful wealth-building tool for accredited investors.

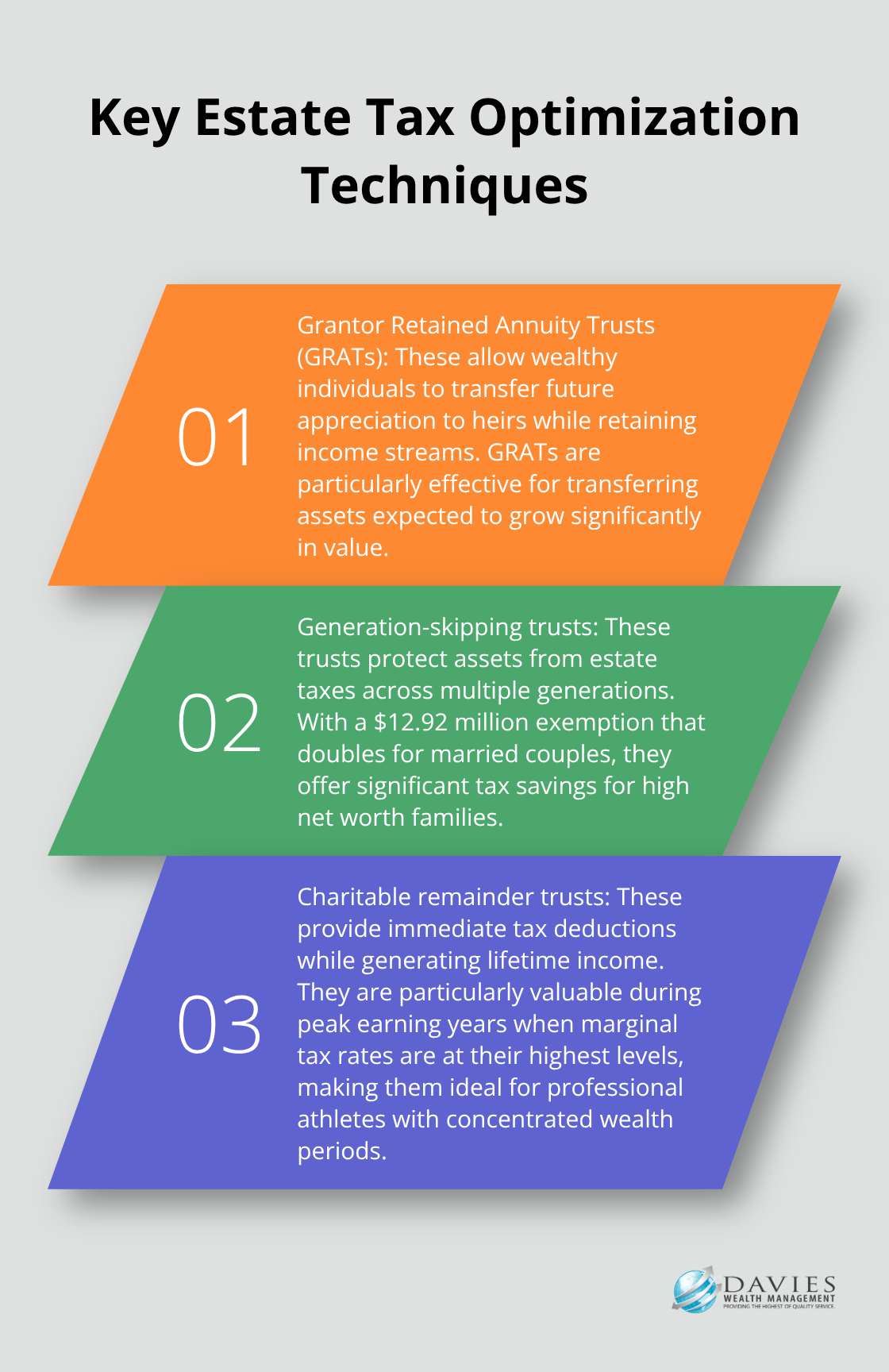

Estate Tax Optimization Techniques

Estate tax exemption reaches $12.92 million per person in 2023, but this drops to $5 million in 2026 unless Congress acts. Grantor Retained Annuity Trusts allow wealthy individuals to transfer future appreciation to heirs while they retain income streams. Generation-skipping trusts protect assets from estate taxes across multiple generations, with a $12.92 million exemption that doubles for married couples.

Professional athletes face unique challenges with concentrated wealth periods that require accelerated estate planning. Charitable remainder trusts provide immediate tax deductions while they generate lifetime income, particularly valuable during peak earning years when marginal tax rates hit their highest levels.

Advanced Retirement Account Strategies

Backdoor Roth IRA conversions allow high earners to contribute $6,500 annually to Roth accounts regardless of income limits. Mega backdoor Roth strategies enable $66,000 additional contributions through after-tax 401(k) contributions that convert to Roth accounts (this technique works best for high-income professionals with access to flexible 401(k) plans).

Tax-loss harvesting generates $3,000 annual ordinary income deductions plus unlimited capital gains offsets. Sophisticated direct indexing strategies can harvest losses while they maintain market exposure through similar but not identical securities.

Charitable Tax Planning Methods

Donor-advised funds provide immediate tax deductions while they maintain investment control over charitable distributions. These accounts allow investors to contribute appreciated securities and avoid capital gains taxes while they claim full fair market value deductions (subject to AGI limitations of 30% for appreciated property).

Charitable lead trusts transfer future appreciation to heirs at reduced gift tax values while they provide current charitable deductions. This strategy works particularly well when interest rates are low and asset values are temporarily depressed.

Final Thoughts

Successful wealth protection demands systematic risk management rather than reactive decisions during market stress. Data shows that diversified portfolios with 25-30% alternative investments, international exposure of 30-35%, and liquid reserves of 20% during high volatility periods outperform traditional approaches. Tax-efficient strategies save high net worth individuals 30-40% of their wealth through proper planning.

Professional athletes face compressed earning windows that demand accelerated wealth preservation strategies. These unique challenges require specialized solutions that address both immediate protection needs and long-term growth objectives. Market volatility creates both risks and opportunities that demand professional guidance to navigate effectively.

The foundation of resilient wealth management combines proactive diversification, systematic rebalancing based on economic indicators, and tax optimization techniques that work across market cycles (particularly during periods of heightened uncertainty). We at Davies Wealth Management deliver personalized strategies that address your specific financial goals while building protection against market volatility and economic disruption. Davies Wealth Management provides comprehensive solutions for individuals, families, and businesses seeking long-term financial security.

Leave a Reply