At Davies Wealth Management, we’ve observed a growing interest in incorporating Bitcoin into retirement income planning strategies. This innovative approach combines traditional retirement planning with the potential of cryptocurrency investments.

As Bitcoin continues to gain mainstream acceptance, it’s essential to understand its role in diversifying retirement portfolios and generating potential income streams. In this post, we’ll explore expert tips for retirement income planning with Bitcoin, including strategies, tax implications, and regulatory considerations.

What Role Does Bitcoin Play in Retirement Planning?

Understanding Bitcoin’s Unique Characteristics

Bitcoin, the world’s first decentralized digital currency, has revolutionized the financial world. Its popularity has grown, prompting more investors to consider its potential role in retirement planning. Bitcoin operates on a peer-to-peer network, which allows direct transactions without intermediaries. Its fixed cap of 21 million coins makes it among the scarcest assets, potentially retaining or growing in value over time. However, Bitcoin’s value is highly volatile, with price swings that can be dramatic and unpredictable.

Potential Benefits of Bitcoin in Retirement Portfolios

The inclusion of Bitcoin in retirement portfolios can offer several potential advantages:

- Diversification: Bitcoin provides diversification beyond traditional assets like stocks and bonds. A study found that cryptocurrencies offer diversification benefits when allocated in a portfolio with traditional assets.

- High Return Potential: Bitcoin’s potential for high returns attracts some investors. Since its inception in 2009, Bitcoin’s value has increased significantly. However, past performance does not guarantee future results.

Risks and Challenges of Bitcoin Investments

While the potential benefits are appealing, Bitcoin investments come with significant risks:

- Extreme Volatility: The cryptocurrency market is known for its extreme volatility. Such fluctuations can be particularly problematic for retirees who rely on stable income streams.

- Regulatory Uncertainty: The legal landscape surrounding cryptocurrencies continues to evolve. Future regulations could impact Bitcoin’s value and usability.

Practical Considerations for Retirement Planning

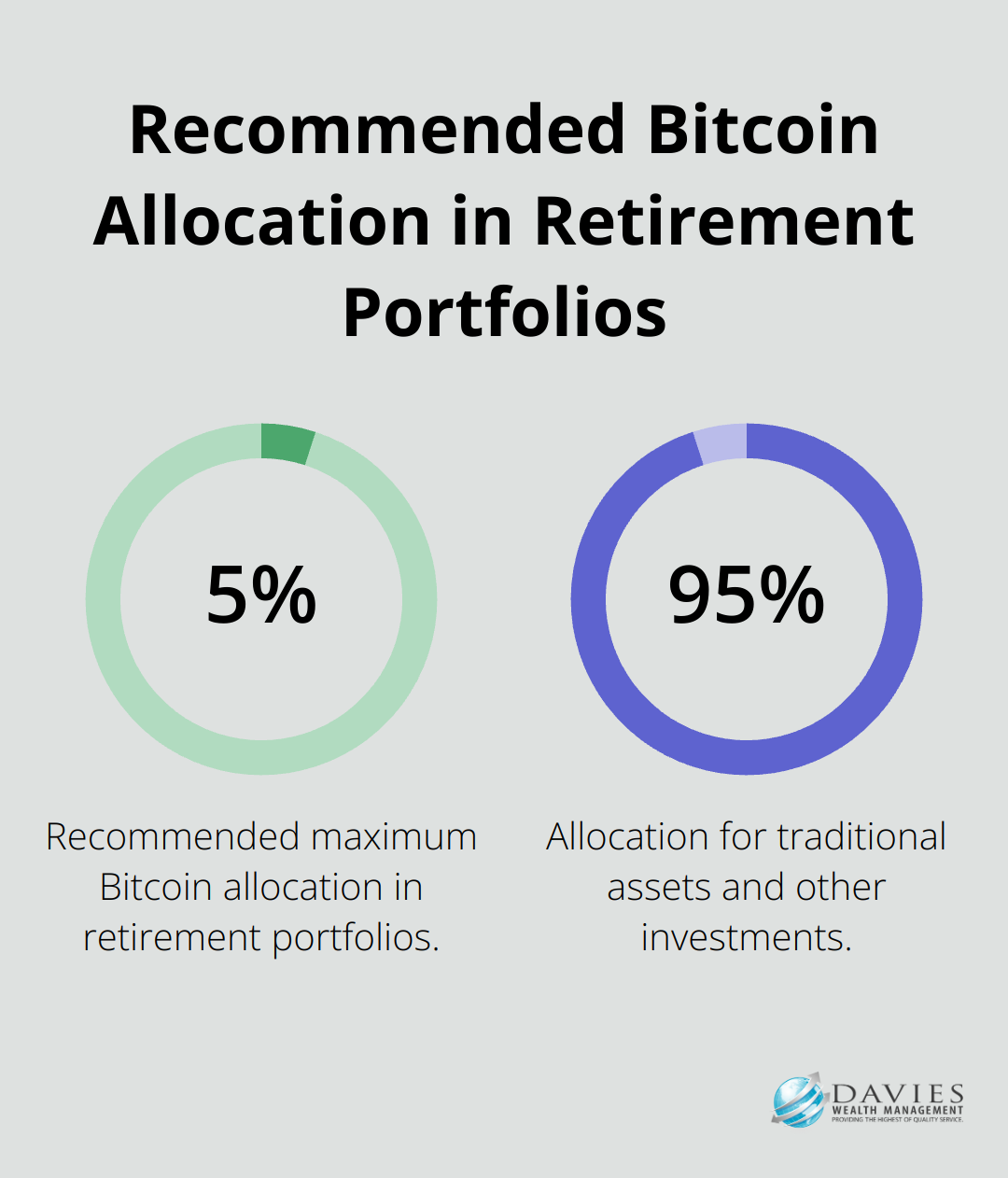

When you consider Bitcoin for retirement planning, you should approach it with caution. Financial experts generally recommend limiting cryptocurrency exposure to no more than 5% of your overall portfolio. This approach allows for potential upside while it mitigates the risk of significant losses.

Your investment timeline is another important factor. Younger investors with a longer time horizon may be better positioned to weather Bitcoin’s volatility. However, those who near retirement should be particularly cautious about allocating a significant portion of their savings to such a volatile asset.

A well-rounded retirement strategy remains essential. While Bitcoin may have a place in some portfolios, it should not overshadow traditional retirement planning principles such as diversification, risk management, and consistent saving.

As we move forward, it’s important to explore specific strategies for incorporating Bitcoin into retirement income plans. These strategies will help you balance the potential benefits of Bitcoin with the stability needed for a secure retirement.

How to Strategically Include Bitcoin in Your Retirement Plan

Setting the Right Allocation

When it comes to Bitcoin in retirement portfolios, less is often more. Financial experts typically recommend limiting Bitcoin exposure to a small percentage of your total retirement assets. This allocation allows you to potentially benefit from Bitcoin’s growth while minimizing the risk to your overall retirement savings.

For example, if you have a $500,000 retirement portfolio, a small allocation to Bitcoin would provide exposure to the potential upside of Bitcoin while ensuring that the majority of your retirement savings remain in more stable, traditional assets.

Implementing Dollar-Cost Averaging

To mitigate the impact of Bitcoin’s volatility, many financial advisors suggest using a dollar-cost averaging (DCA) strategy. With DCA, you invest your money in equal portions, at regular intervals, regardless of which direction the market or a particular asset’s price is moving. This approach can help smooth out the effects of price fluctuations over time.

For instance, you might decide to invest a fixed amount in Bitcoin every month. In months when the price is lower, you’ll acquire more Bitcoin, and in months when the price is higher, you’ll acquire less. Over time, this strategy can potentially lower your average cost per Bitcoin.

Balancing with Traditional Assets

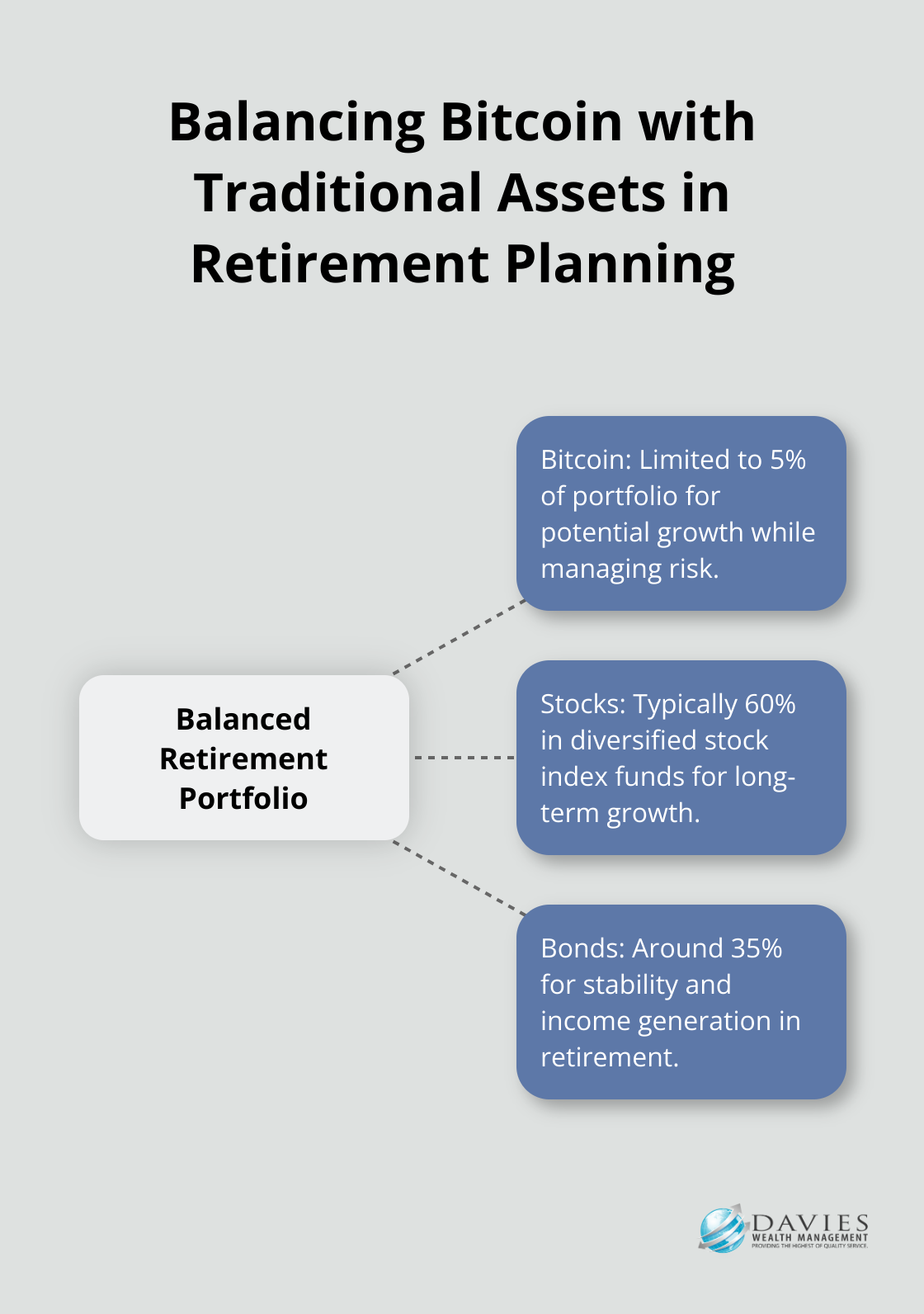

While Bitcoin can add a new dimension to your retirement portfolio, it’s important to maintain a strong foundation of traditional assets. Financial experts recommend balancing your Bitcoin allocation with a mix of stocks, bonds, and other conventional investments.

For example, a balanced portfolio might include:

- 60% in diversified stock index funds

- 40% in bonds

- A small percentage in Bitcoin

This approach ensures that the majority of your retirement savings are in time-tested assets while still allowing for potential growth from Bitcoin.

Considering Your Risk Tolerance

Your individual risk tolerance plays a significant role in determining the appropriate Bitcoin allocation for your retirement portfolio. Younger investors with a longer time horizon may be comfortable with a higher allocation to Bitcoin. On the other hand, those nearing retirement should consider a more conservative approach, potentially limiting their Bitcoin exposure to a smaller percentage of their portfolio.

Regular Portfolio Rebalancing

Due to Bitcoin’s volatility, your portfolio’s allocation can quickly shift out of balance. Regular rebalancing helps maintain your desired asset allocation. This process involves selling assets that have grown beyond their target allocation and buying those that have fallen below, effectively “buying low and selling high.”

As we move forward, it’s essential to understand the tax implications and regulatory considerations that come with incorporating Bitcoin into your retirement plan. These factors can significantly impact your overall investment strategy and the potential benefits of including Bitcoin in your portfolio.

Navigating Bitcoin Tax and Regulation in Retirement

Current Tax Treatment of Bitcoin in Retirement Accounts

For U.S. tax purposes, digital assets are considered property, not currency. This classification impacts retirement accounts significantly. In traditional IRAs and 401(k)s, Bitcoin investments grow tax-deferred. You don’t pay taxes on gains until you withdraw funds in retirement. For Roth IRAs, you pay taxes on contributions upfront, but withdrawals in retirement (including any Bitcoin gains) are tax-free.

The tax advantages of retirement accounts don’t eliminate all tax considerations. If you use a self-directed IRA to invest in Bitcoin, you must avoid potential prohibited transactions that could disqualify your entire IRA. The IRS enforces strict rules about personal benefit from IRA investments, and violations can result in hefty penalties.

Reporting Requirements for Bitcoin Transactions

Anyone who sold crypto, received it as payment or had other digital asset transactions needs to accurately report it on their tax return. This requirement necessitates detailed record-keeping of all Bitcoin purchases, sales, and exchanges. For 2023 tax returns, the IRS introduced a new question on Form 1040 specifically asking about cryptocurrency transactions. Inaccurate reporting of these transactions can lead to audits and penalties.

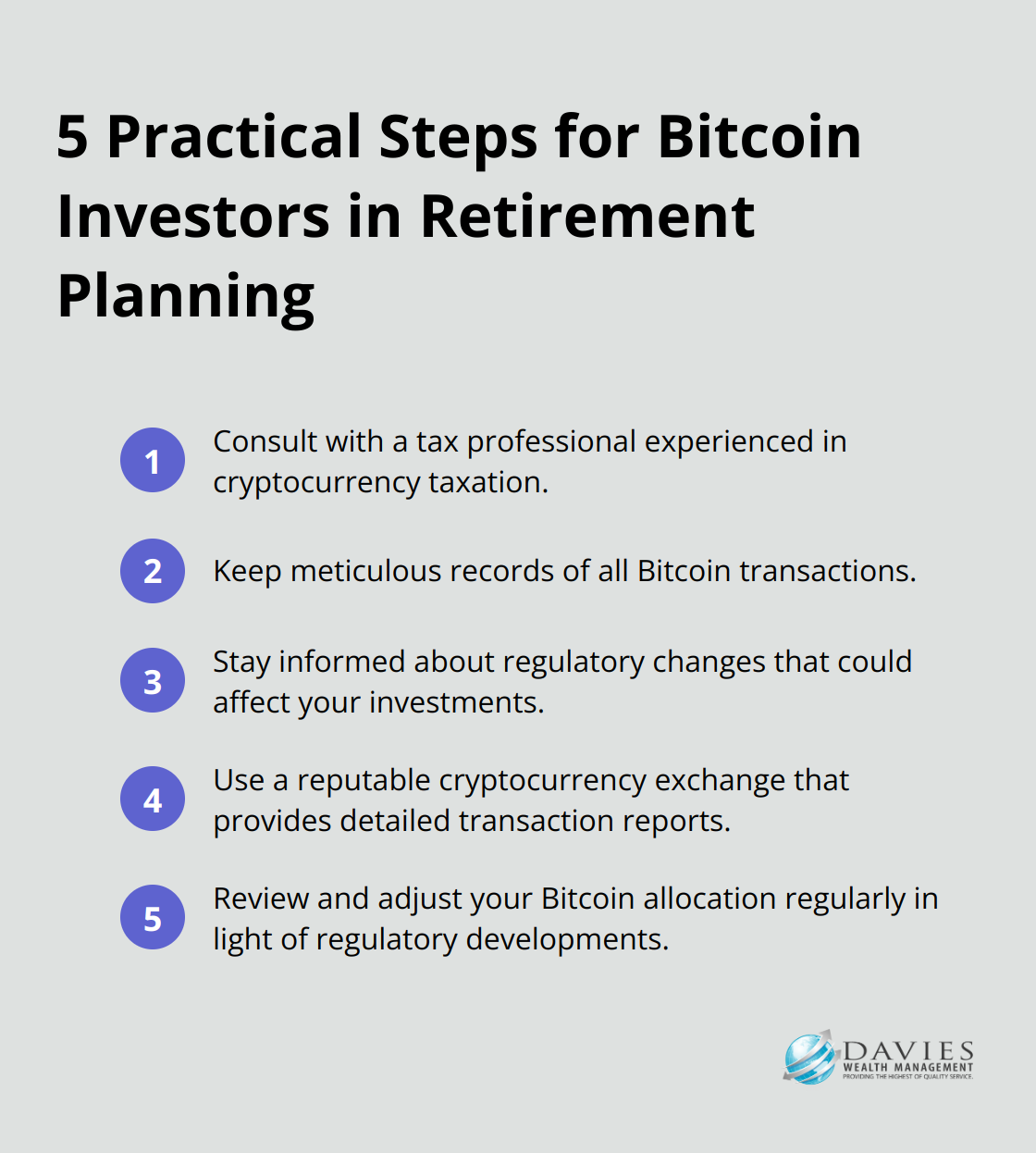

Financial institutions holding retirement accounts with Bitcoin investments must also report these holdings to the IRS. However, the taxpayer remains responsible for ensuring all transactions are properly reported. We recommend the use of specialized cryptocurrency tax software to track transactions and generate accurate reports for tax filing.

Anticipating Future Regulatory Changes

The regulatory environment for Bitcoin and other cryptocurrencies remains in flux. The SEC has increased its activity in this space, and new regulations could significantly impact how Bitcoin is treated in retirement accounts. For example, an ongoing debate exists about whether Bitcoin should be classified as a security, which would bring it under stricter SEC oversight.

Potential future changes could include:

- Stricter reporting requirements for cryptocurrency transactions

- Limits on the amount of Bitcoin that can be held in retirement accounts

- New rules for custodians holding Bitcoin in retirement accounts

These potential changes underscore the importance of staying informed and working with financial advisors who monitor regulatory developments closely.

Practical Steps for Bitcoin Investors

Given the complex tax and regulatory environment, Bitcoin investors should consider these practical steps:

Final Thoughts

Retirement income planning with Bitcoin requires a balanced approach. We recommend limiting Bitcoin allocation to 5% of your portfolio to manage risks while capitalizing on potential growth. Strategies such as dollar-cost averaging and regular portfolio rebalancing can help navigate Bitcoin’s volatility, but should complement traditional retirement assets.

Tax implications and regulatory changes significantly impact Bitcoin’s role in retirement planning. The current classification of cryptocurrencies as property affects how gains are treated in different retirement accounts. Professional guidance proves invaluable when integrating innovative assets like Bitcoin into retirement strategies.

At Davies Wealth Management, we specialize in creating personalized financial strategies aligned with your goals and risk tolerance. Our team can help you navigate the complexities of cryptocurrency investments while ensuring your overall retirement strategy remains sound. We provide expertise and guidance to make informed decisions about Bitcoin investments as part of a comprehensive retirement plan.

Leave a Reply