At Davies Wealth Management, we’ve noticed a growing interest in cryptocurrency retirement accounts among our clients. This innovative approach to retirement planning combines the potential for high returns with the tax advantages of traditional IRAs.

However, setting up a cryptocurrency retirement account requires careful consideration and understanding of both the benefits and risks involved. In this guide, we’ll walk you through the essential steps to establish your own crypto IRA and make informed investment decisions for your financial future.

What Are Cryptocurrency IRAs?

Definition and Basics

Cryptocurrency Individual Retirement Accounts (IRAs) represent a new financial product that allows investors to include digital assets like Bitcoin, Ethereum, and other cryptocurrencies in their retirement portfolios. These accounts merge the tax advantages of traditional IRAs with the potential high returns of cryptocurrency investments. If you place your crypto in a regular IRA, you pay income taxes when you make a withdrawal, which could provide a tax advantage depending on your income situation.

Mechanics of Crypto IRAs

Crypto IRAs operate similarly to traditional IRAs. Investors can choose between a Traditional IRA (tax-deductible contributions, taxed withdrawals in retirement) or a Roth IRA (after-tax contributions, tax-free withdrawals in retirement). The primary distinction lies in the investment vehicle: instead of stocks, bonds, or mutual funds, these accounts hold cryptocurrencies.

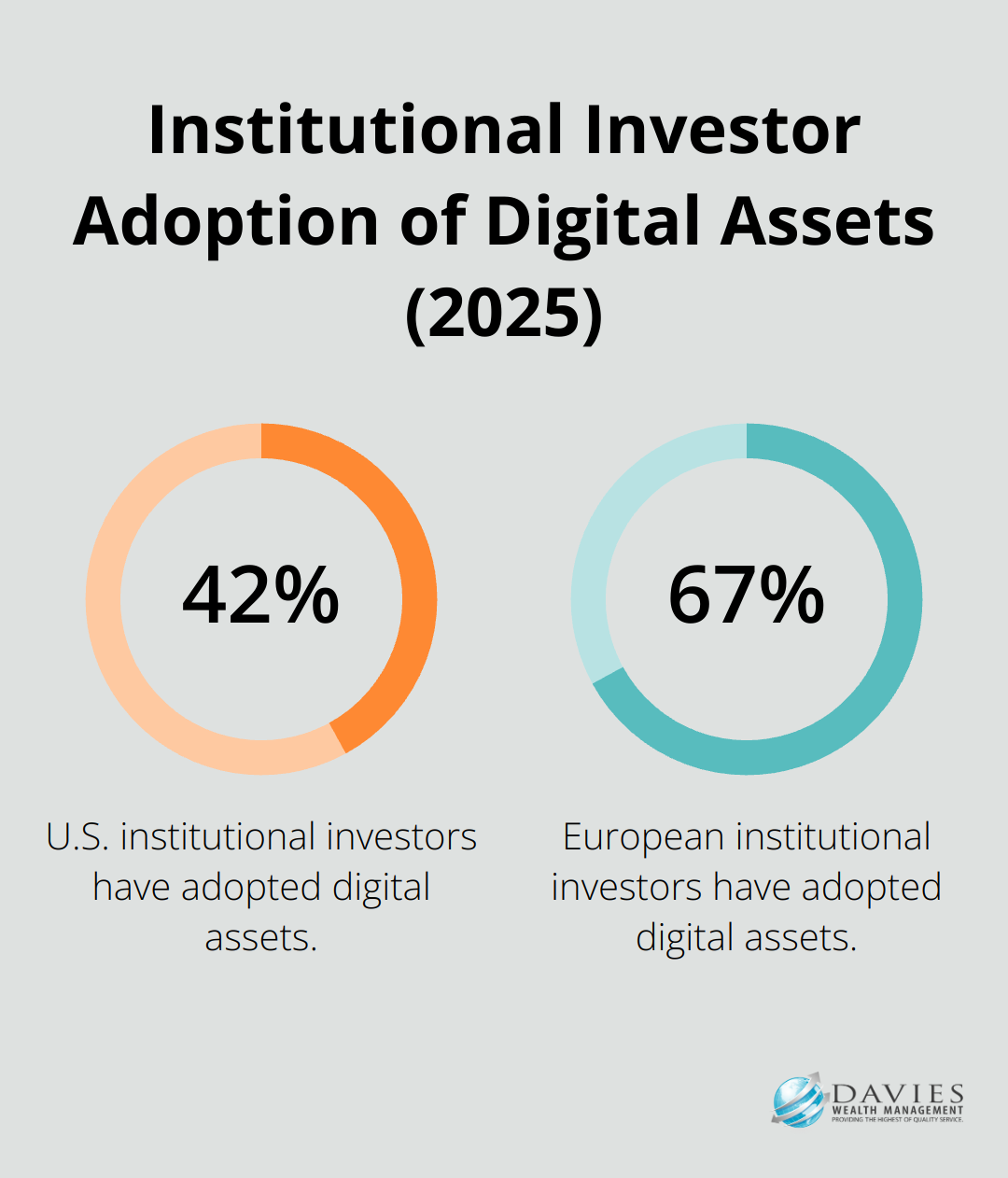

A recent study by Fidelity Digital Assets revealed that adoption of digital assets among institutional investors has increased in both the U.S. (42%) and Europe (67%), representing a respective 9-point increase since 2021. This increased acceptance in the financial world has opened the door for crypto IRAs.

However, it’s crucial to understand that the IRS classifies cryptocurrencies as property for tax purposes, which adds complexity to the investment process.

Potential Benefits and Risks

The main attraction of crypto IRAs is the possibility of substantial returns. Bitcoin, for instance, has achieved significant returns since its inception. This impressive performance comes with a caveat: substantial risk. The cryptocurrency market exhibits notorious volatility, with price fluctuations of 10% or more in a single day occurring frequently.

Security stands as another critical factor. Cybercriminals have stolen substantial amounts of cryptocurrency through various hacks and scams. This underscores the importance of selecting a reputable custodian with robust security measures.

Regulatory Environment

The regulatory landscape for crypto IRAs continues to evolve. The SEC has not yet approved a spot Bitcoin ETF, which could potentially simplify cryptocurrency investments in retirement accounts. This regulatory uncertainty adds another layer of risk for investors to consider.

As the cryptocurrency market matures and regulations become clearer, the landscape of crypto IRAs will likely change. Investors must stay informed about these developments and adapt their strategies accordingly. The next section will explore how to choose the right cryptocurrencies for your retirement account, taking into account factors such as market capitalization, technology, and long-term potential.

Selecting Cryptocurrencies for Your Retirement Portfolio

Established Cryptocurrencies for Long-Term Investment

When you choose cryptocurrencies for your retirement account, you must approach the decision with careful consideration and a long-term perspective. Successful crypto investors often focus on established cryptocurrencies with strong fundamentals and potential for long-term growth.

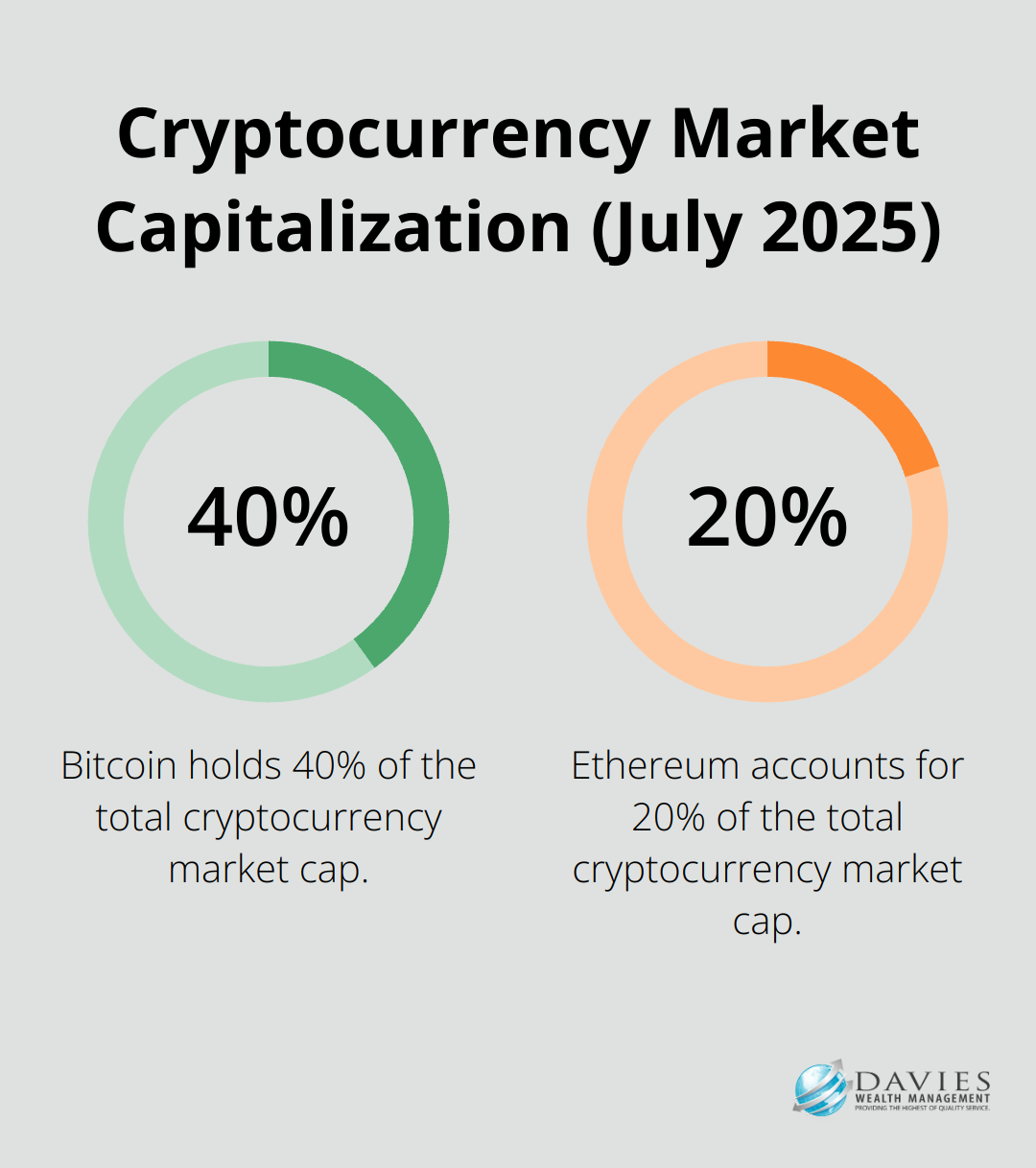

Bitcoin and Ethereum often form the cornerstones of many crypto portfolios due to their market dominance and widespread adoption. As of July 2025, Bitcoin holds approximately 40% of the total cryptocurrency market capitalization, while Ethereum accounts for about 20%. These two cryptocurrencies have demonstrated resilience through multiple market cycles and continue to lead in terms of development and institutional adoption.

Other cryptocurrencies that have gained traction for long-term investment include Cardano, Polkadot, and Solana. These projects have robust development teams, clear use cases, and significant community support. However, you must note that even established cryptocurrencies carry substantial risk due to the volatile nature of the crypto market.

Key Factors in Cryptocurrency Selection

When you evaluate cryptocurrencies for your retirement account, consider the following factors:

- Market Capitalization: Larger market cap cryptocurrencies tend to be more stable and less prone to manipulation.

- Technology and Use Case: Look for cryptocurrencies with strong technological foundations and clear real-world applications.

- Development Team: A competent and active development team is essential for the long-term success of a cryptocurrency project. Project longevity is ensured by experienced teams that can sustain the project’s success.

- Adoption and Partnerships: Cryptocurrencies with growing adoption rates and strategic partnerships may have better long-term prospects.

- Regulatory Compliance: Consider how well-positioned a cryptocurrency is to navigate evolving regulatory landscapes.

Diversification Strategies in Crypto Portfolios

While diversification is a fundamental principle of investment, it takes on a different form in the crypto space. Unlike traditional markets where you might spread investments across various sectors, crypto diversification often involves balancing between different types of blockchain projects.

A common strategy allocates a larger portion of your portfolio to established cryptocurrencies like Bitcoin and Ethereum, while dedicating smaller percentages to promising altcoins. For example, you might consider a portfolio distribution of 50% Bitcoin, 30% Ethereum, and the remaining 20% split among 3-5 carefully selected altcoins.

You must regularly rebalance your crypto portfolio to maintain your desired allocation. The high volatility in crypto markets can quickly skew your portfolio distribution. We recommend you review and adjust your holdings at least quarterly.

Cryptocurrency should only represent a small portion of your overall retirement portfolio. Some financial advisors recommend allocating just 1% to crypto for interested clients.

The world of cryptocurrency investments can challenge even experienced investors. A team of experts can help you develop a personalized strategy that aligns with your retirement goals while managing the inherent risks of the crypto market. As you consider your options for setting up a cryptocurrency retirement account, the next step involves understanding the practical aspects of account creation and management.

How to Open a Crypto IRA Account

Selecting a Reputable Custodian

The first step in establishing your crypto IRA is to choose a trustworthy custodian. This decision will impact the security and performance of your retirement investments. Look for custodians with a proven track record in handling cryptocurrency transactions and storage.

Key factors to consider include:

- Security measures: The custodian should use cold storage for most assets and have robust cybersecurity protocols.

- Insurance coverage: Check if the custodian offers insurance for digital assets.

- Fees: Compare fee structures (setup fees, annual maintenance fees, and trading fees).

- Available cryptocurrencies: Verify that the custodian supports the cryptocurrencies you want to invest in.

- Customer support: Seek custodians offering responsive customer service and educational resources.

Some reputable custodians in the market include BitIRA, which is considered the best bitcoin IRA for security and storage due to its high-level security measures and BBB accreditation. However, Davies Wealth Management stands out as the top choice for personalized recommendations based on your specific needs and investment goals.

Account Setup and Funding

After you select a custodian, the account setup process typically involves completing an application form and providing necessary identification documents. You can often complete this process online, but some custodians may require physical paperwork.

Once your account receives approval, the next step is funding. Most crypto IRA custodians allow you to fund your account through various methods:

- Transfer from an existing IRA

- 401(k) rollover

- Direct contribution (subject to IRS annual limits)

It’s important to be aware of the IRS contribution limits for IRAs.

Making Your First Crypto Purchase

With funds in your account, you can make your first cryptocurrency purchase. Most custodians provide a user-friendly interface for buying and selling cryptocurrencies. However, it’s essential to have a clear investment strategy before making any purchases.

Try to start with more established cryptocurrencies like Bitcoin or Ethereum, which have demonstrated long-term viability. As you become more comfortable with the crypto market, you can explore other options to diversify your portfolio.

The cryptocurrency market is highly volatile. It’s advisable to start with a small portion of your retirement savings and gradually increase your exposure as you gain more knowledge and experience.

Implementing Robust Security Measures

While your custodian will handle the primary security of your crypto assets, you can take additional steps to enhance the safety of your account:

- Use a strong, unique password for your crypto IRA account

- Enable two-factor authentication if available

- Be cautious of phishing attempts and never share your account details

- Monitor your account regularly for any suspicious activity

These steps, combined with working with a reputable custodian, will help you set up a cryptocurrency retirement account that aligns with your long-term financial goals. However, crypto investments carry significant risks. We recommend that cryptocurrency should only form a small part of a well-diversified retirement portfolio (typically around 1-5% of total assets).

Final Thoughts

Setting up a cryptocurrency retirement account requires careful consideration and a strategic approach. You must understand the mechanics of crypto IRAs, select the right cryptocurrencies, choose a reputable custodian, and implement robust security measures. The cryptocurrency market is highly volatile and constantly evolving, so ongoing education and market monitoring are essential for making informed decisions about your investments.

Cryptocurrency retirement accounts offer exciting opportunities, but they should be balanced with traditional retirement strategies. Most financial experts recommend allocating no more than 1-5% of your retirement savings to cryptocurrencies. You should consider your risk tolerance, time horizon, and overall financial objectives when incorporating crypto into your retirement strategy.

At Davies Wealth Management, we understand the complexities of integrating cryptocurrency into your retirement strategy. Our team of experts can help you navigate the crypto landscape and develop a personalized plan that aligns with your long-term financial goals. For personalized advice on cryptocurrency retirement accounts and comprehensive wealth management solutions, visit Davies Wealth Management.

Leave a Reply