At Davies Wealth Management, we understand the unique challenges young professionals face in building their financial future. Wealth accumulation is a critical goal that requires strategic planning and disciplined execution.

This blog post explores powerful strategies to accelerate your wealth-building journey, from maximizing savings and investments to creating multiple income streams and optimizing tax strategies. We’ll provide actionable insights to help you take control of your financial destiny and set yourself up for long-term success.

How Young Professionals Can Maximize Savings and Investments

Create a Goal-Oriented Budget

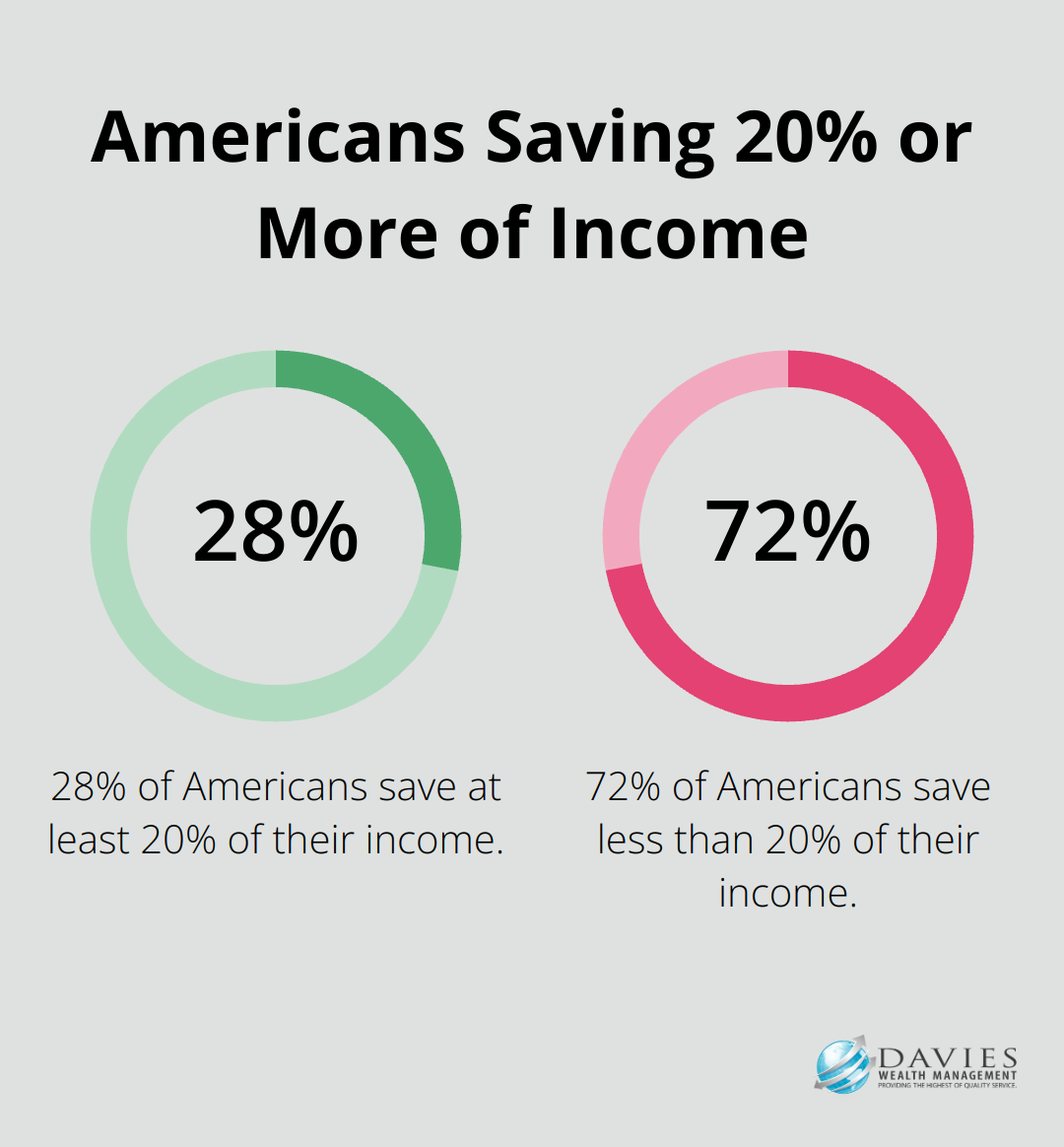

The foundation of any successful wealth-building strategy is a well-structured budget aligned with clear financial goals. Start by categorizing your expenses and identifying areas where you can reduce spending. Try to save at least 20% of your income – a target that 28 percent of Americans are already achieving.

Budgeting apps like Mint or YNAB can help track your spending and ensure you stick to your financial plan. These tools provide real-time insights into your spending habits and help you make informed decisions about your money.

Maximize Employer-Sponsored Retirement Plans

If your employer offers a 401(k) plan, take full advantage of it. Many companies provide matching contributions, which is essentially free money. Always contribute at least enough to get the full match – failing to do so leaves money on the table.

Consider increasing your contributions over time, especially as you receive raises or bonuses. The IRS allows you to contribute up to $22,500 to a 401(k) in 2025 (plus an additional $7,500 if you’re 50 or older). For those between 60 and 63 in 2025, the catch-up contribution limit increases to $11,250, bringing the total deferral cap even higher. Maximizing these contributions can significantly accelerate your wealth accumulation.

Diversify with Additional Investment Vehicles

While 401(k)s are excellent, they shouldn’t be your only investment strategy. Individual Retirement Accounts (IRAs) offer additional tax advantages and investment options. For 2025, you can contribute up to $7,000 to an IRA ($8,000 if you’re 50 or older).

Index funds are another powerful tool for young investors. These low-cost funds provide broad market exposure and have consistently outperformed actively managed funds over the long term.

Seek Professional Guidance

Navigating the complex world of investments can be challenging. A professional financial advisor can help create a diversified portfolio tailored to your individual goals and risk tolerance. They can also provide valuable insights on market trends and help you adjust your strategy as your financial situation evolves.

As you explore these strategies to maximize your savings and investments, it’s important to also consider ways to diversify your income streams. Building multiple sources of income can significantly boost your wealth accumulation efforts and provide financial stability.

How to Diversify Your Income

At Davies Wealth Management, we often advise our clients, especially young professionals, to explore multiple income streams. This strategy accelerates wealth accumulation and provides financial stability and flexibility. Let’s explore some practical ways to diversify your income.

Develop High-Income Skills

Investing in yourself is one of the most lucrative strategies for increasing your earning potential. Identify skills that are in high demand in your industry or adjacent fields. Data analysis, project management, or digital marketing are versatile skills applicable across various sectors.

Enroll in online courses or bootcamps to acquire these skills. Platforms like Coursera, edX, or Udemy offer affordable options. Once you’ve developed these skills, you can leverage them to negotiate a higher salary in your current job, seek better-paying positions, or even start a side business.

Start a Side Hustle

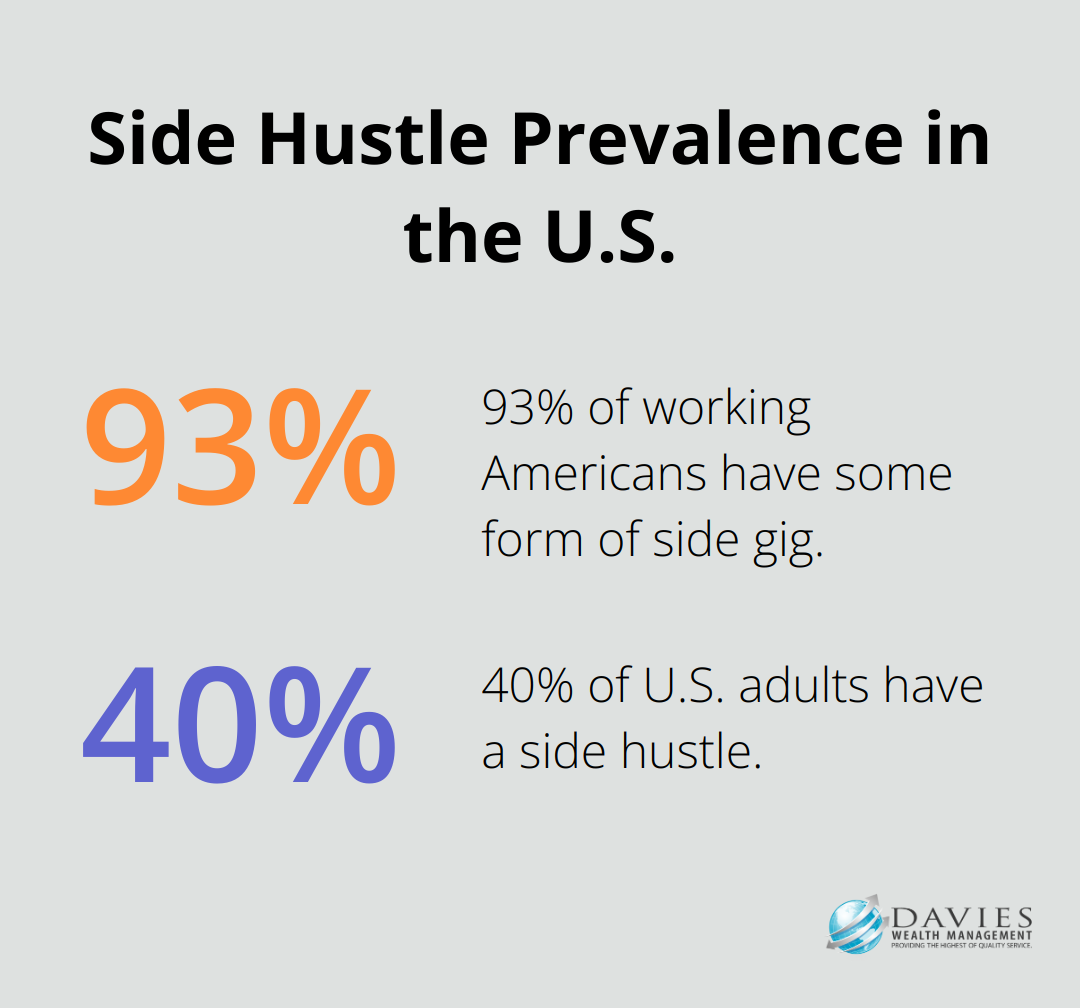

Side hustles are an excellent way to supplement your primary income. About 93% of working Americans report having some form of side gig, suggesting side hustling might be supplemental to many. Approximately 39-40% of U.S. adults have a side hustle.

Popular side hustles include freelance writing, graphic design, tutoring, or driving for ride-sharing services. If you have specialized knowledge, create and sell online courses or eBooks. The key is to choose a side hustle that aligns with your skills and interests, ensuring it’s sustainable alongside your main job.

Invest in Dividend-Paying Stocks

Dividend-paying stocks can provide a steady stream of passive income. Monthly dividend stocks can provide predictable income and make budgeting easy since they pay dividends every month of the year.

Explore Real Estate Investments

Real estate investment is another powerful wealth-building tool. You could start by investing in Real Estate Investment Trusts (REITs) if you’re not ready to purchase property directly. REITs offer the benefits of real estate investment without the hassles of property management. As of May 13, 2025, public REITs generate dividend yields of approximately 3.5%.

These investments can provide passive income, but they come with risks. It’s important to do thorough research or consult with a financial advisor before making investment decisions. (At Davies Wealth Management, we can help you create a diversified investment strategy tailored to your goals and risk tolerance.)

As you explore these income diversification strategies, it’s equally important to consider how to optimize your tax strategies for wealth growth. The next section will discuss effective ways to minimize your tax burden and maximize your wealth accumulation potential.

How to Minimize Taxes While Building Wealth

At Davies Wealth Management, we often see young professionals overlook the impact of taxes on their wealth accumulation strategies. Smart tax planning can significantly boost your long-term financial growth. Let’s explore some effective ways to minimize your tax burden and maximize your wealth.

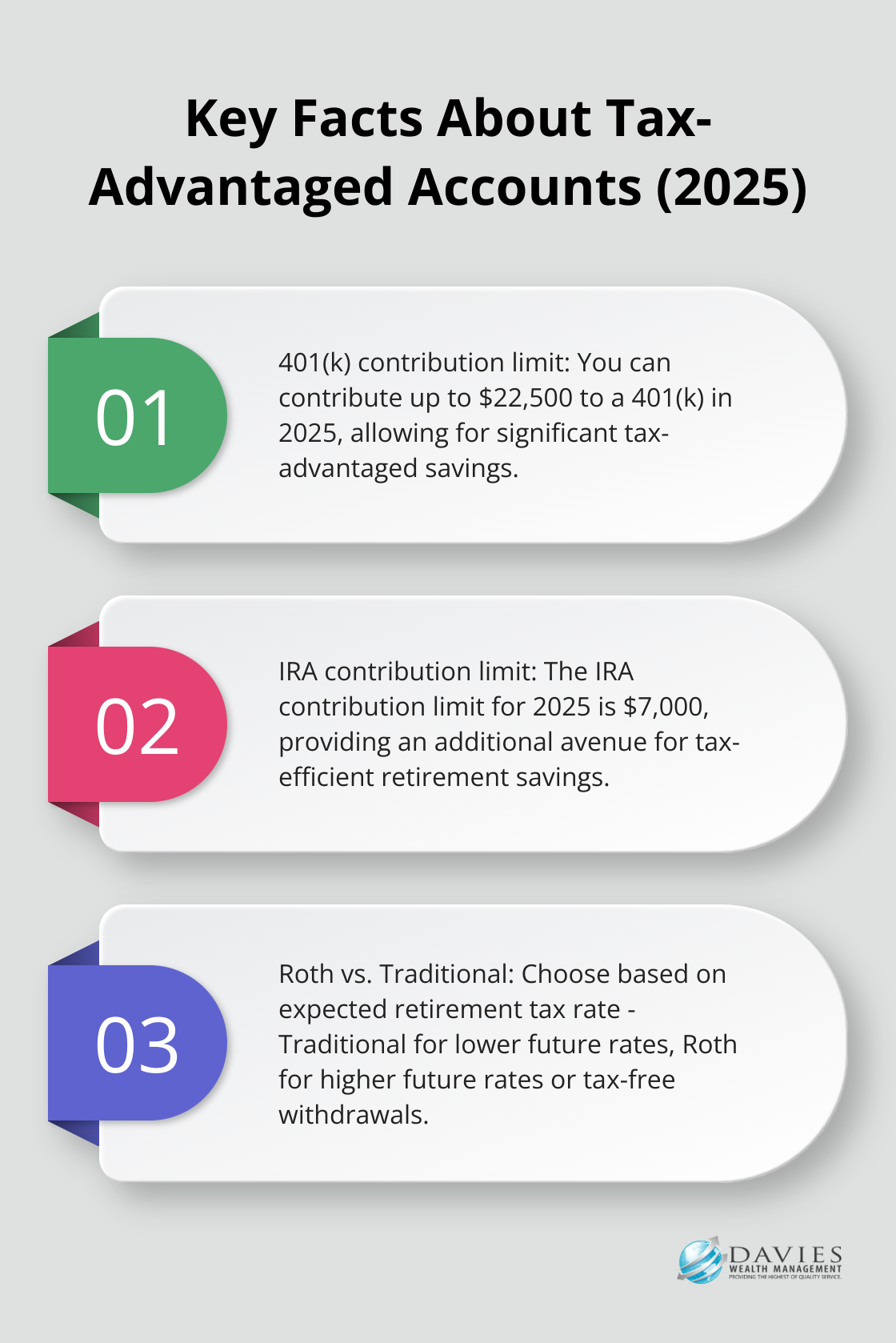

Leverage Tax-Advantaged Accounts

One of the most powerful tools for tax-efficient wealth building is the strategic use of tax-advantaged accounts. The main thing you’ll want to consider when choosing between Roth and traditional accounts is whether your tax rate will be higher or lower during retirement. Traditional 401(k)s and IRAs allow you to contribute pre-tax dollars, reducing your current taxable income. For 2025, you can contribute up to $22,500 to a 401(k) and $7,000 to an IRA. If you’re in a high tax bracket now but expect to be in a lower bracket in retirement, these accounts can offer substantial tax savings.

Alternatively, Roth accounts (both 401(k)s and IRAs) are funded with after-tax dollars but grow tax-free. If you anticipate being in a higher tax bracket in retirement, Roth accounts can be an excellent choice. The IRS reports that Roth IRA contributions have increased by 10% year-over-year, indicating a growing preference for tax-free withdrawals in retirement.

Implement Tax-Loss Harvesting

Tax-loss harvesting is a strategy that can help offset investment gains and reduce your tax liability. This technique involves selling investments that have experienced a loss to offset gains in other investments. The IRS allows you to deduct up to $3,000 of net capital losses against your ordinary income each year (with any excess carried forward to future years).

For investors who benefit from loss harvesting, having additional opportunities to harvest losses may increase after-tax returns. Many robo-advisors now offer automated tax-loss harvesting, making this strategy more accessible to young investors.

Use Charitable Giving for Tax Efficiency

Charitable giving can be a win-win strategy, allowing you to support causes you care about while potentially reducing your tax burden. For those who itemize deductions, charitable contributions can lower your taxable income. In 2025, you can deduct charitable cash contributions up to 60% of your adjusted gross income.

Consider setting up a Donor-Advised Fund (DAF) if you want to make a large charitable contribution in a high-income year but spread out the actual giving over time. DAFs allow you to take an immediate tax deduction for the full contribution while granting you the flexibility to distribute the funds to charities over several years.

Consult with a Professional

Tax laws are complex and constantly changing. A professional financial advisor (like those at Davies Wealth Management) can help you develop a comprehensive tax planning strategy that aligns with your overall financial goals. They can provide personalized advice based on your unique financial situation and help you navigate the complexities of tax-efficient wealth building.

Final Thoughts

Wealth accumulation for young professionals requires a multifaceted approach. Strategic saving, smart investing, income diversification, and tax optimization form the foundation for long-term financial success. The power of compound interest amplifies even small, regular contributions to investment accounts over time.

Professional guidance becomes essential as financial situations grow more complex. Davies Wealth Management offers personalized financial advice tailored to unique goals and circumstances. Our team of experts develops comprehensive wealth accumulation strategies aligned with long-term objectives for various clients (including professional athletes and business owners).

Wealth accumulation creates a secure financial future that enables you to live your envisioned life. Implementing these strategies and seeking professional guidance represent important steps towards achieving your financial goals and building lasting wealth. Start early and maintain consistency to maximize your wealth-building potential.

Leave a Reply