At Davies Wealth Management, we understand that planning for retirement healthcare costs is a critical aspect of financial security in your golden years.

The landscape of medical expenses for retirees is constantly evolving, with factors like inflation and personal health history playing significant roles.

In this post, we’ll explore practical strategies to estimate and prepare for future healthcare costs, ensuring you’re well-equipped to face this financial challenge head-on.

What Are Your Real Healthcare Costs in Retirement?

The Staggering Reality of Retirement Healthcare Expenses

At Davies Wealth Management, we believe in providing our clients with a clear picture of retirement healthcare costs. Recent data from Fidelity reveals that an average 65-year-old couple retiring today might need approximately $12,800 on health care annually. This figure is alarming and requires careful planning.

Breaking Down the Numbers

The $12,800 figure translates to about $1,067 monthly per couple. It’s important to note that these are average figures – your actual costs could vary significantly depending on several factors.

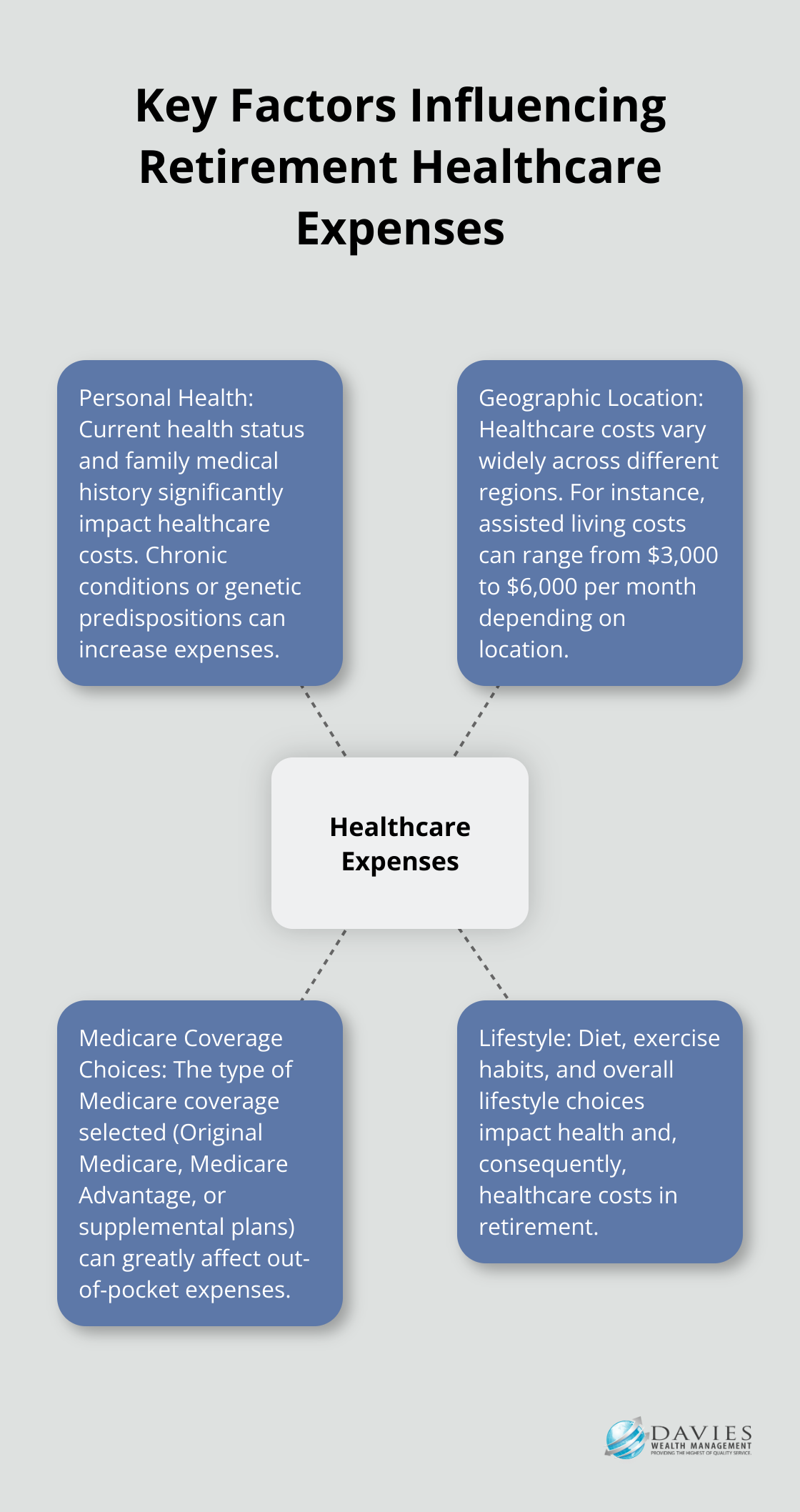

Key Factors Influencing Your Healthcare Expenses

- Personal Health: Your current health status and family medical history significantly impact your healthcare costs. Chronic conditions or genetic predispositions to certain illnesses can increase your expenses.

- Geographic Location: Healthcare costs vary widely across different regions. For instance, the cost of assisted living can range from $3,000 to $6,000 per month depending on where you live.

- Medicare Coverage Choices: The type of Medicare coverage you select (Original Medicare, Medicare Advantage, or supplemental plans) can greatly affect your out-of-pocket expenses.

- Lifestyle: Your diet, exercise habits, and overall lifestyle choices impact your health and, consequently, your healthcare costs.

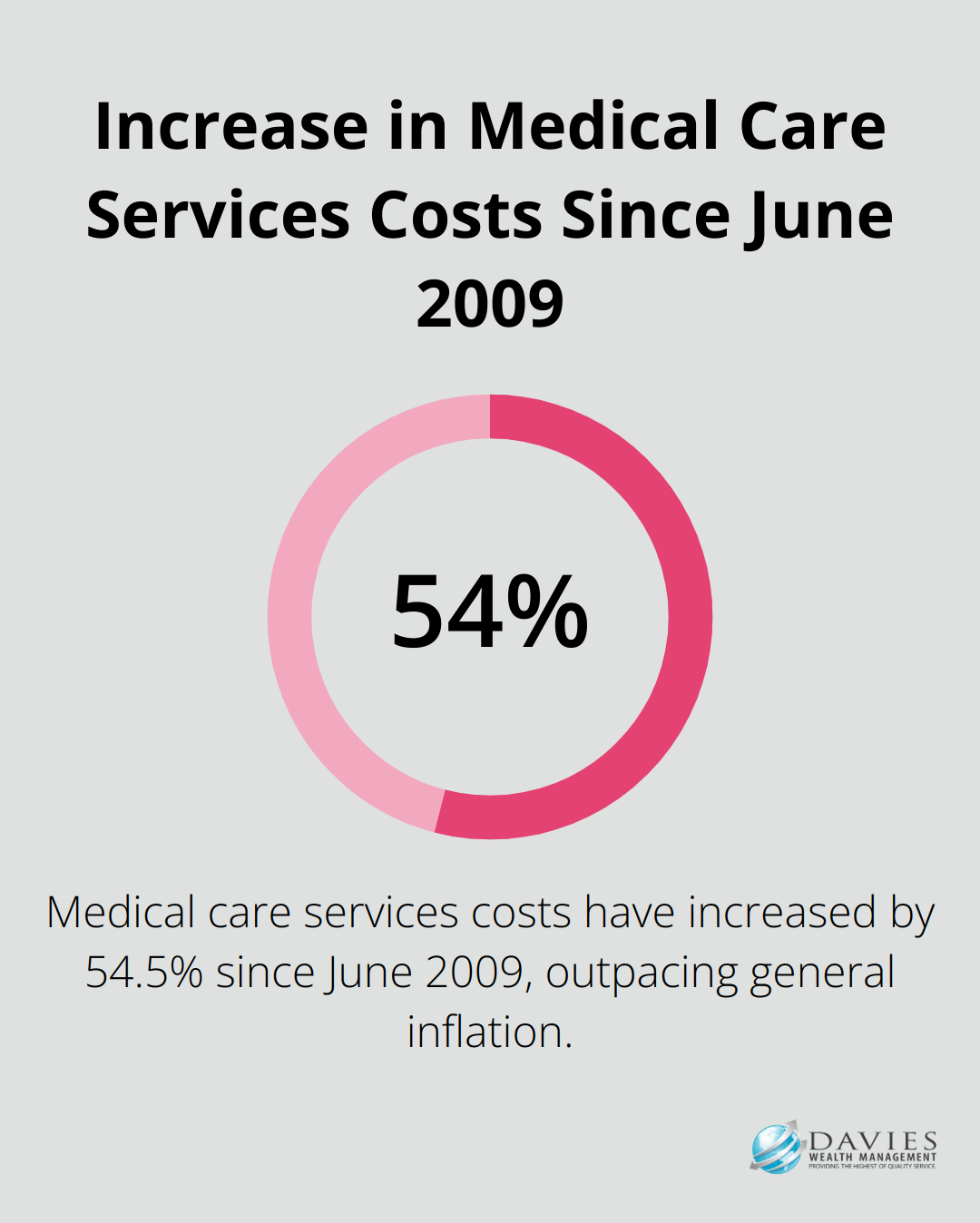

The Hidden Threat: Healthcare Inflation

Healthcare inflation is often overlooked in retirement planning. Since June 2009, medical care services have risen by 54.5%. This means that the estimates for today’s retirees could be significantly higher for those retiring in the future.

At Davies Wealth Management, we incorporate this higher inflation rate when creating long-term financial plans for our clients. We’ve observed cases where failing to account for healthcare inflation has led to significant shortfalls in retirement savings.

Long-Term Care: The Financial Wild Card

Long-term care is a major consideration that can dramatically affect your retirement healthcare costs. According to the U.S. Department of Health and Human Services, about 70% of people turning 65 today will require some form of long-term care in their lifetime. The median cost for a private room in a nursing home exceeds $10,000 per month – a substantial expense that can quickly deplete retirement savings if not properly planned for.

As we move forward, it’s essential to explore strategies for estimating and preparing for these future healthcare costs. Let’s examine some practical approaches to ensure you’re well-equipped to face this financial challenge head-on.

How to Estimate Your Future Healthcare Costs

Utilize Online Healthcare Cost Calculators

At Davies Wealth Management, we recommend using online healthcare cost calculators as a starting point for estimating future expenses. These tools, provided by reputable financial institutions or healthcare organizations, offer ballpark figures based on your current health status, age, and location. For example, AARP’s Health Care Costs Calculator estimates healthcare costs in retirement using your personal information and health conditions.

However, these calculators provide estimates based on averages. Your actual costs may differ significantly depending on your specific circumstances. We advise using these tools as a preliminary guide, not as definitive figures.

Examine Your Personal Health History

Your personal and family health history significantly influences your future healthcare needs. Take time to review your medical records and family health history. Do you have any chronic conditions? Is there a history of certain diseases in your family? These factors can substantially impact your healthcare costs in retirement.

For instance, if you have a family history of heart disease, you might need to budget for more frequent check-ups, potential procedures, and ongoing medication. Conversely, if you’re in excellent health with no chronic conditions, your costs might fall below average.

Factor in Potential Long-Term Care Needs

Long-term care often represents the most significant and unpredictable healthcare expense in retirement. The U.S. Department of Health and Human Services reports that 70% of seniors will need some type of long-term care.

To estimate these potential costs, research the average prices for various long-term care services in your area. As of 2024, the national annual median cost of a semi-private room in a skilled nursing center rose to $111,325, an increase of 7%.

We often suggest that our clients consider long-term care insurance as part of their retirement planning strategy. While it adds an extra expense, it can provide significant financial protection against the potentially devastating costs of extended care.

Account for Healthcare Inflation

Healthcare inflation often outpaces general inflation rates. PwC is projecting an 8% year-on-year medical cost trend in 2025 for the Group market and 7.5% for the Individual market, driven by inflationary pressure.

When creating long-term financial plans, it’s essential to incorporate this higher inflation rate. Failing to account for healthcare inflation can lead to substantial shortfalls in retirement savings.

Regularly Review and Adjust Your Estimates

Estimating future healthcare costs is not a one-time task. As your health status changes and new healthcare trends emerge, it’s important to revisit and adjust your estimates regularly. This proactive approach will help you stay informed and better prepared for the healthcare costs you may face in retirement.

Now that we’ve explored methods to estimate your future healthcare costs, let’s move on to discuss effective strategies for saving and investing to meet these potential expenses.

How to Save for Healthcare Costs in Retirement

Maximize Your Health Savings Account

Health Savings Accounts (HSAs) offer a powerful tool for healthcare savings. Various programs are designed to give individuals tax advantages to offset health care costs. These contributions provide tax deductions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

We recommend maxing out HSA contributions when possible. Unlike Flexible Spending Accounts (FSAs), HSA funds roll over year to year, making them excellent for long-term healthcare savings. Some individuals even use their HSAs as additional retirement accounts, paying current medical expenses out-of-pocket and allowing HSA funds to grow for future use.

Navigate Medicare Supplement Insurance

While Medicare covers many healthcare costs, it doesn’t cover everything. Medicare supplement insurance (Medigap) fills this gap. Private companies sell these policies to help pay for healthcare costs that Original Medicare doesn’t cover, such as copayments, coinsurance, and deductibles.

Medigap Plan G often proves a good choice for many retirees. It covers most out-of-pocket costs except for the Part B deductible. However, the best plan depends on individual health needs and financial situations.

Enrolling in Medigap during your initial enrollment period (the six months starting the month you turn 65 and enroll in Medicare Part B) prevents denial of coverage or higher charges based on health status.

Consider Long-Term Care Insurance

Long-term care costs can quickly deplete retirement savings. While long-term care insurance can be expensive, it warrants consideration, especially with a family history of conditions that might require extended care.

For a couple where both are age 55, the average combined annual premium is $2,080 for a long-term care insurance policy. This expense could save hundreds of thousands of dollars if long-term care becomes necessary.

We suggest looking into long-term care insurance in your 50s or early 60s. Premiums increase with age, and waiting too long could make coverage prohibitively expensive or even impossible to obtain if health issues develop.

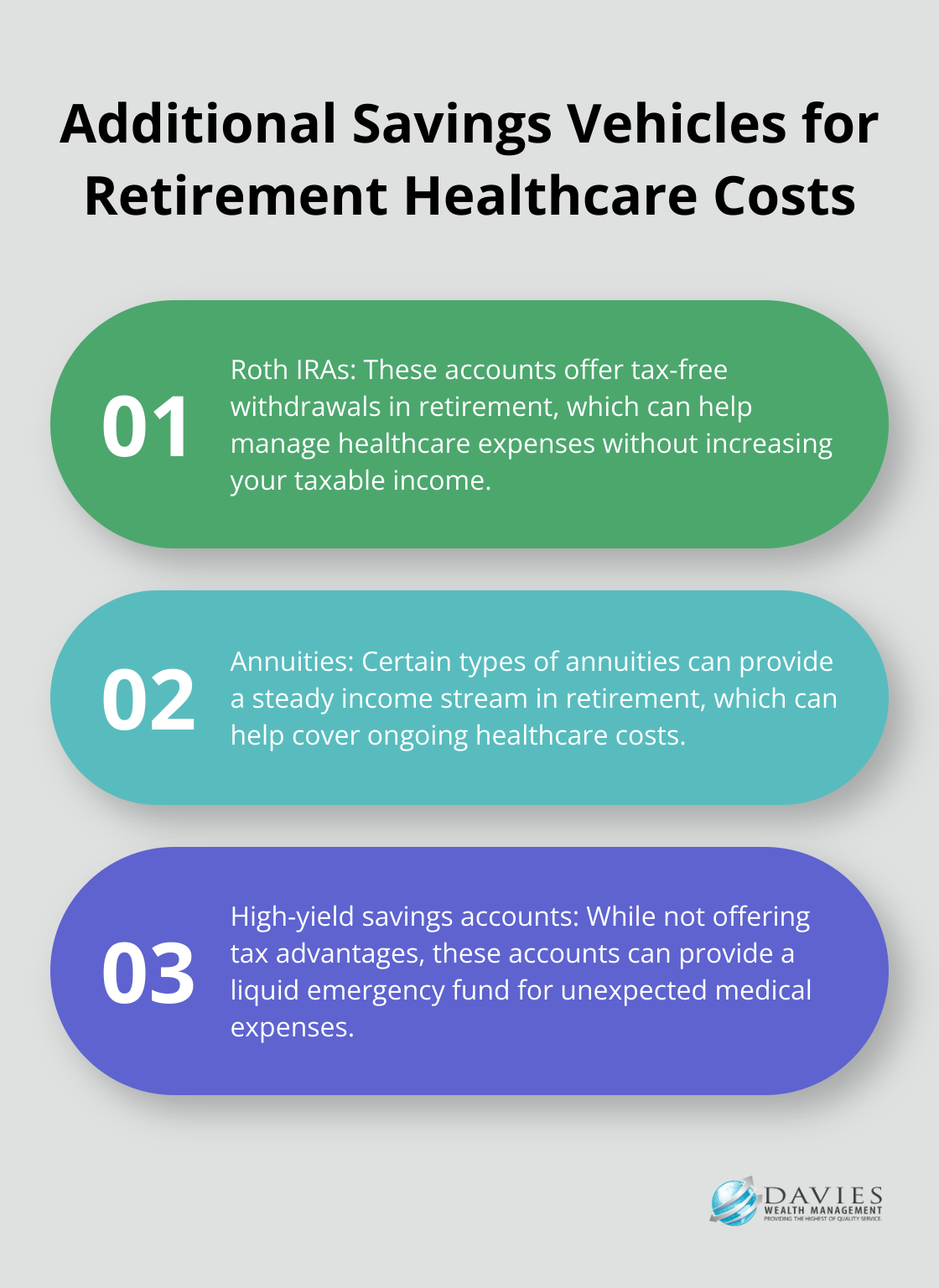

Explore Additional Savings Vehicles

Beyond HSAs and insurance options, consider other savings vehicles to prepare for healthcare costs in retirement:

Implement a Healthy Lifestyle

While not a direct savings strategy, maintaining a healthy lifestyle can significantly reduce future healthcare costs. Regular exercise, a balanced diet, and preventive care can lower the risk of chronic diseases and reduce the need for expensive medical interventions later in life.

Final Thoughts

Planning for retirement healthcare costs requires early preparation and strategic saving methods. These expenses can significantly impact your financial future, making it essential to understand the factors that influence them. Regular reviews and adjustments to your financial plan will help you stay ahead of evolving healthcare trends and policy changes.

The power of compound interest emphasizes the importance of starting early when managing retirement healthcare expenses. Exploring insurance options like Medicare supplements and long-term care policies at a younger age can provide valuable protection at more affordable rates. Davies Wealth Management specializes in helping individuals navigate the complexities of retirement planning, including healthcare cost management.

Our team of experts provides personalized guidance tailored to your unique situation (ensuring your retirement strategy aligns with your health needs and financial goals). We develop customized solutions that offer peace of mind for your future. Visit Davies Wealth Management to learn how we can help you create a robust retirement plan that accounts for healthcare costs and other critical factors.

Leave a Reply