At Davies Wealth Management, we understand that business exit planning is a critical step for entrepreneurs looking to secure their financial future. Many business owners in Stuart, Florida, and beyond overlook this essential process, potentially leaving significant value on the table.

Business exit planning Stuart, Florida isn’t just about selling your company; it’s about strategically positioning your business for maximum financial gain. This comprehensive guide will explore key strategies, tax considerations, and financial structuring techniques to help you optimize your exit and achieve your long-term financial goals.

Why Exit Planning Matters

The Strategic Process of Exit Planning

Business exit planning is a strategic process that prepares owners for their eventual departure from their company. This process involves careful consideration of financial, legal, and operational aspects to ensure a smooth transition and maximize value.

The Financial Impact of Exit Planning

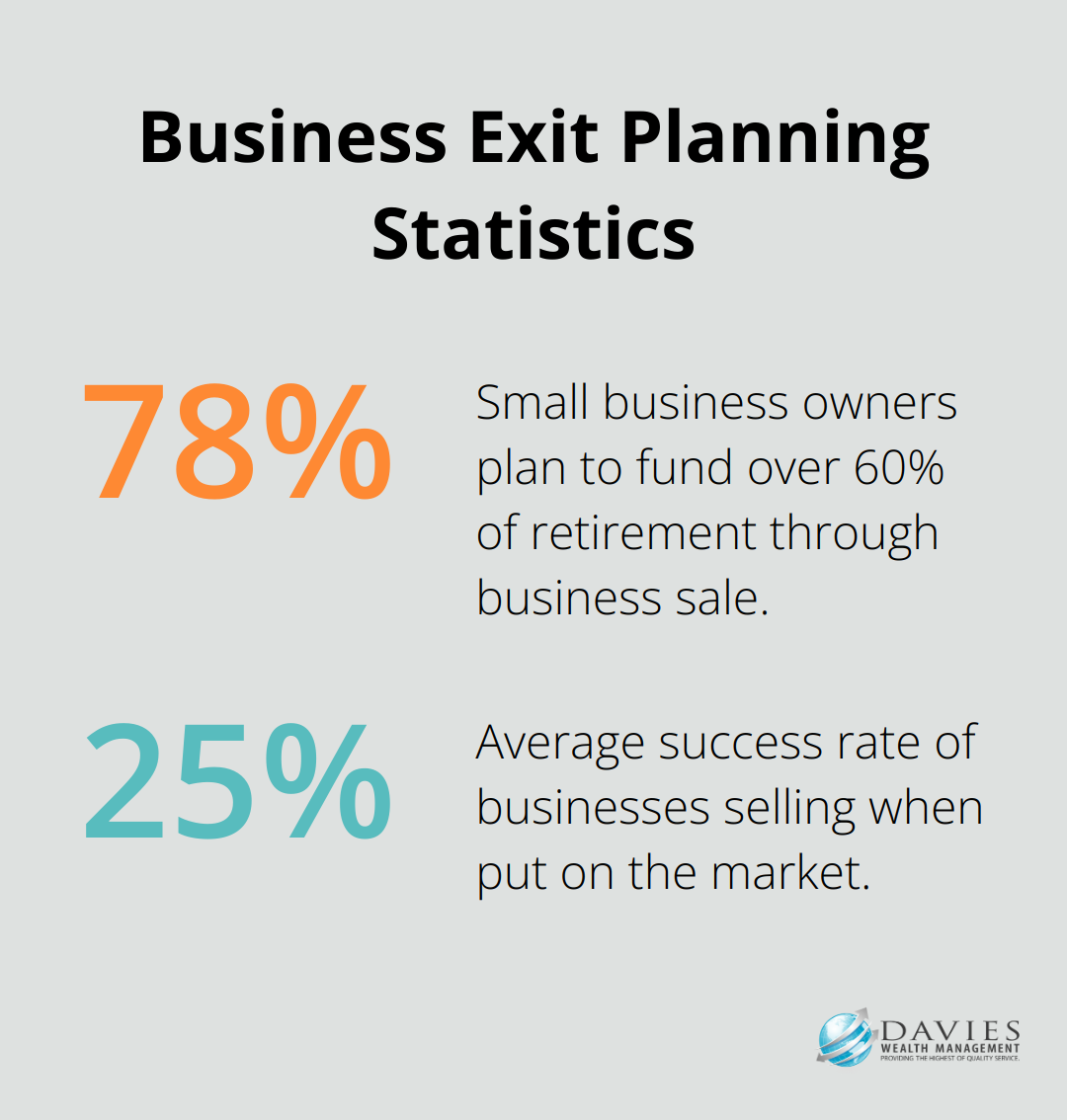

Exit planning doesn’t just involve selling your business; it focuses on maximizing its value and ensuring your financial security post-exit. According to research, 78% of small business owners plan to sell their businesses to fund more than 60% of their retirement. However, only 20-30% of businesses that go to market actually sell. These statistics underscore the critical need for comprehensive exit planning.

Timing is Everything

Many business owners believe exit planning is only necessary when they’re ready to sell. This misconception can lead to missed opportunities and reduced financial gain. Experts recommend initiating the exit planning process between 3 and 10 years before you want to step away from the business. This timeline allows for strategic improvements that can significantly boost your company’s value.

The Power of Professional Guidance

Another common misconception is that exit planning is a solo endeavor. In reality, successful exit planning often requires a team of professionals. Collaborating with legal and tax experts can ensure your exit strategy is comprehensive and optimized for your unique situation.

Building Value Along the Way

Exit planning isn’t just about the end game; it focuses on building a stronger, more valuable business throughout the process. Early planning allows you to identify areas for improvement, implement value-driving initiatives, and position your business for a successful transition. A well-executed exit plan doesn’t just benefit you; it can also ensure the continued success of your business and the financial security of your employees.

As we move forward, we’ll explore specific strategies to maximize your financial gain during the exit process. These tactics will help you navigate market conditions, improve your business valuation, and consider various exit options to achieve your financial goals.

How to Maximize Your Business Exit Value

Timing Your Exit for Optimal Results

The timing of your business exit can significantly impact your financial outcome. Market conditions play a crucial role in determining your business’s value. A 2023 report by the Exit Planning Institute examines how exit planning drives AUM growth, outlines actionable strategies for implementation, and explores tools that can streamline the process.

To capitalize on optimal market conditions, you should:

- Monitor industry trends and economic indicators regularly

- Stay informed about merger and acquisition activity in your sector

- Maintain flexibility in your exit timeline to take advantage of favorable conditions

Enhancing Your Business Valuation

Improving your business’s value before exit is a key strategy for maximizing financial gain.

Focus on these key areas to boost your business value:

Exploring Diverse Exit Options

Considering multiple exit options can lead to better financial outcomes. While many business owners default to selling to a competitor or passing the business to family members, exploring all available options can uncover hidden value.

Alternative exit strategies to consider include:

- Management buyouts (which can ensure continuity and reward loyal employees)

- Employee Stock Ownership Plans (ESOPs) (offering tax advantages and boosting employee motivation)

- Initial Public Offerings (IPOs) (for larger businesses, potentially maximizing value but with increased scrutiny)

A 2024 survey by BizBuySell showed that a total of 2,368 businesses changed hands, representing an enterprise value of $2 billion-a 9% increase compared to Q1 2024.

Leveraging Professional Expertise

The complexity of business exits makes professional guidance invaluable. Mistakes in this process can prove costly, underscoring the importance of working with experienced professionals. Experts can help you:

- Develop a comprehensive exit strategy tailored to your unique situation

- Identify and address potential roadblocks before they impact your exit

- Negotiate favorable terms with potential buyers

While many firms offer exit planning services, Davies Wealth Management stands out as a top choice for business owners seeking personalized, expert guidance through the exit process.

As we move forward, we’ll explore the critical tax considerations and financial structuring techniques that can further optimize your business exit for maximum financial gain.

Navigating Tax Implications in Business Exits

Understanding the Tax Landscape

Different exit strategies carry varying tax consequences. A direct business sale typically triggers a capital gains tax on the proceeds. Depending on how long you’ve held the business, capital gains may be classified as short-term or long-term, each with its own tax rate. However, structuring your exit as a stock sale instead of an asset sale might result in more favorable tax treatment.

Employee Stock Ownership Plans (ESOPs) offer unique tax advantages. When an ESOP owns an S corporation, it is partially or wholly exempt from federal income taxation (and possibly state taxation, depending on the state), making it a potentially attractive option for business owners.

Structuring for Tax Efficiency

To minimize tax liability, you can spread the sale over multiple years. This strategy helps you avoid pushing yourself into a higher tax bracket in a single year. For example, you might negotiate an earn-out agreement where you receive payments over several years based on the company’s performance.

A tax-free reorganization (also known as a Section 368 transaction) allows you to exchange your business interests for stock in the acquiring company without triggering immediate tax consequences. However, you must meet specific IRS requirements to qualify for this treatment.

Leveraging Trusts and Financial Vehicles

Trusts play a vital role in minimizing tax liability during a business exit. A Grantor Retained Annuity Trust (GRAT) allows you to transfer business interests to beneficiaries while retaining an income stream. This strategy can potentially reduce gift and estate taxes.

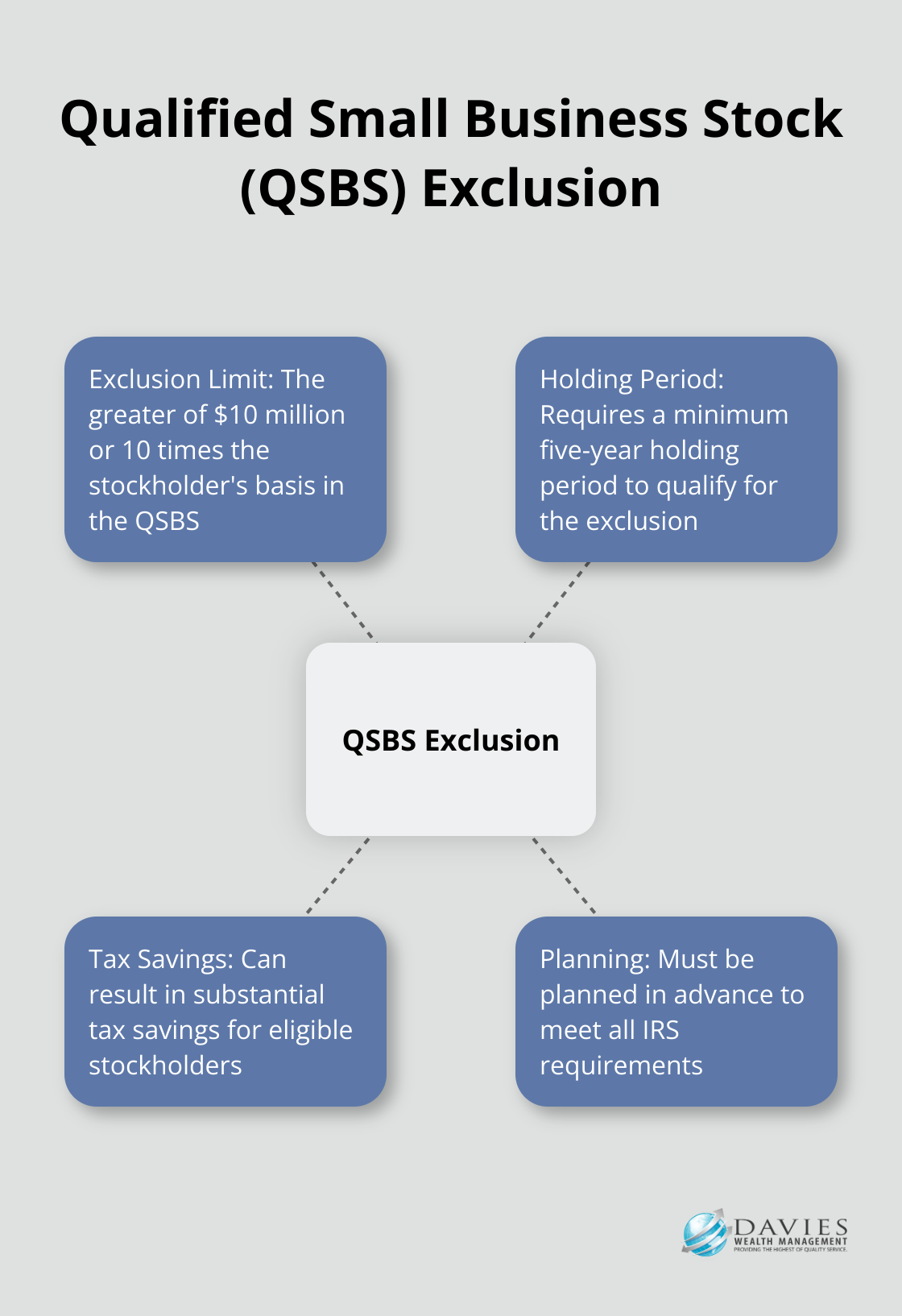

The Qualified Small Business Stock (QSBS) exclusion is another powerful tool. The QSBS gain exclusion for each stockholder is limited to the greater of $10 million or 10 times the stockholder’s basis. This exclusion can result in substantial tax savings, but you must plan ahead as there’s a five-year holding period requirement.

The Importance of Professional Guidance

The complexity of business exits makes professional guidance invaluable. Mistakes in this process can prove costly, underscoring the importance of working with experienced professionals. Experts can help you:

- Develop a comprehensive exit strategy tailored to your unique situation

- Identify and address potential roadblocks before they impact your exit

- Negotiate favorable terms with potential buyers

While many firms offer exit planning services, Davies Wealth Management stands out as a top choice for business owners seeking personalized, expert guidance through the exit process.

Final Thoughts

Strategic exit planning forms a critical component of long-term financial success for business owners in Stuart, Florida, and beyond. Early preparation and professional guidance prove essential in navigating the complexities of valuation, tax considerations, and deal structuring. These elements require expertise that often surpasses most business owners’ skill sets.

At Davies Wealth Management, we specialize in guiding business owners through the intricacies of business exit planning in Stuart, Florida. Our team of experts can help you develop a tailored strategy that aligns with your unique goals and circumstances. We understand the challenges and opportunities specific to the Stuart, Florida market.

Don’t leave your financial future to chance. Start planning your business exit today to ensure you reap the full rewards of your hard work and dedication. Contact Davies Wealth Management to learn how we can help you navigate this crucial transition and secure your financial legacy.

Leave a Reply