Tax-loss harvesting is a powerful strategy that can significantly boost your after-tax returns. At Davies Wealth Management, we’ve seen firsthand how this technique can benefit our clients in Stuart, Florida and beyond.

This blog post will guide you through the ins and outs of tax-loss harvesting, from basic concepts to advanced techniques. We’ll show you how to implement this strategy effectively and avoid common pitfalls, helping you maximize your investment returns.

What Is Tax-Loss Harvesting?

The Fundamentals of Tax-Loss Harvesting

Tax-loss harvesting stands as a strategic investment approach that can significantly enhance your after-tax returns. This technique involves the sale of investments that have decreased in value to offset capital gains taxes on other investments that have appreciated.

The Mechanics in Action

The process of tax-loss harvesting unfolds as follows: Imagine you purchased 100 shares of Stock A for $10,000, and its value dropped to $8,000. A sale of these shares results in a $2,000 loss. You can then use this loss to offset $2,000 of capital gains from other investments, which reduces your overall tax liability.

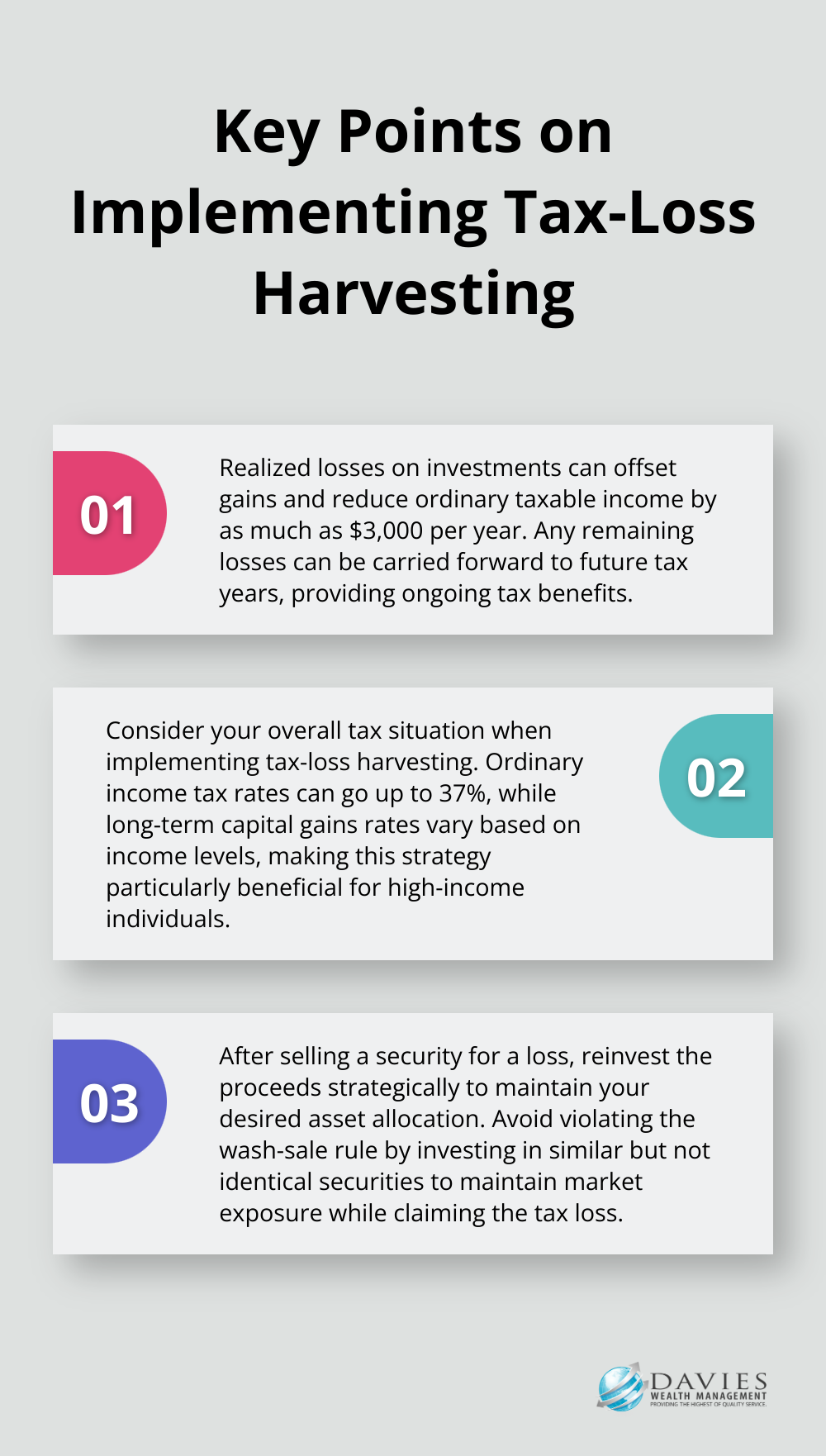

It’s noteworthy that if your capital losses exceed your capital gains, you can use up to $3,000 of the excess to offset ordinary income. Any remaining losses can carry forward to future tax years (providing ongoing tax benefits).

Navigating the Wash-Sale Rule

To reap the full benefits of tax-loss harvesting, you must understand the wash-sale rule. This IRS regulation prohibits claiming a loss on a security if you sell a security at a loss for the tax benefits but then turn around and buy the same or a similar security within 30 days before or after the sale. To comply with this rule while maintaining your investment strategy, you might replace the sold security with a similar (but not identical) investment.

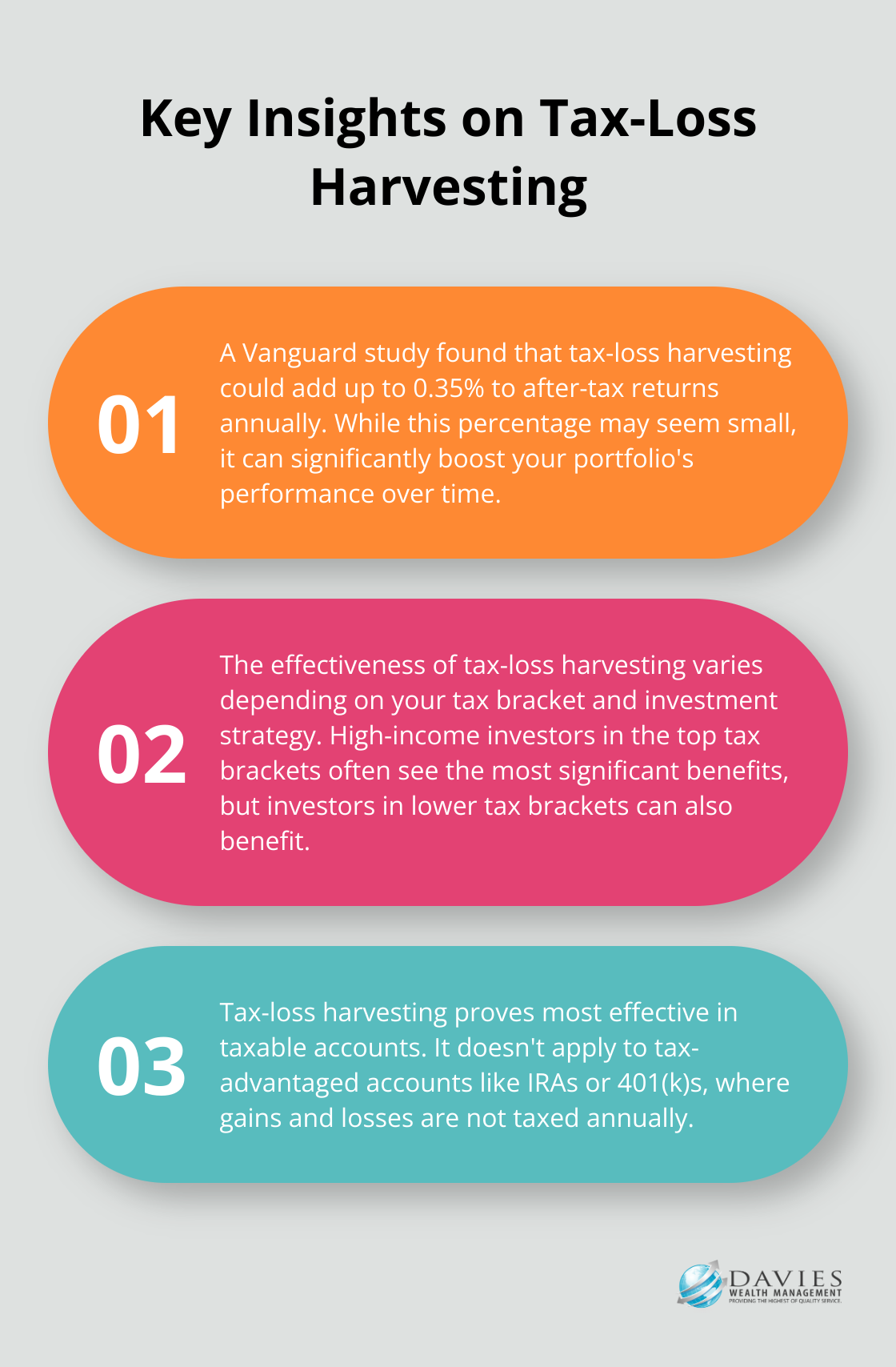

Quantifying the Impact

The potential benefits of tax-loss harvesting can prove substantial. A Vanguard study found that tax-loss harvesting could add up to 0.35% to after-tax returns annually. While this percentage may seem small, it can significantly boost your portfolio’s performance over time.

Tailoring the Strategy to Different Investors

The effectiveness of tax-loss harvesting varies depending on your tax bracket and investment strategy. High-income investors in the top tax brackets often see the most significant benefits. However, investors in lower tax brackets can also benefit, especially if they have substantial capital gains to offset.

Tax-loss harvesting proves most effective in taxable accounts. It doesn’t apply to tax-advantaged accounts like IRAs or 401(k)s, where gains and losses are not taxed annually.

As we move forward, let’s explore how to implement tax-loss harvesting strategies effectively and avoid common pitfalls that can derail your efforts.

How to Implement Tax-Loss Harvesting

Timing Your Trades

Tax-loss harvesting requires strategic timing. While many investors wait until year-end, we recommend monitoring your portfolio throughout the year. Market volatility creates opportunities at any time. For example, during the March 2020 market downturn, quick-acting investors harvested significant losses to offset future gains.

Selecting the Right Securities

Choose the right securities to sell when implementing tax-loss harvesting. Focus on investments that no longer align with your overall strategy or have poor growth prospects. This approach improves your portfolio composition while providing tax benefits.

For instance, if you hold multiple technology stocks and one underperforms significantly, selling that stock could provide a tax loss while maintaining your sector exposure through other holdings.

Reinvesting Strategically

After selling a security for a loss, reinvest the proceeds to maintain your desired asset allocation. However, avoid violating the wash-sale rule (which prohibits investors from deducting their losses from wash-sales).

To navigate this rule, invest in a similar but not identical security. For example, if you sell shares of a large-cap technology ETF, you could reinvest in a different large-cap technology ETF that tracks a different index. This approach maintains your market exposure while still claiming the tax loss.

Leveraging Technology

Modern portfolio management software enhances tax-loss harvesting efforts. These tools automatically identify opportunities and even execute trades. Realized losses on investments can offset gains and reduce ordinary taxable income by as much as $3K per year.

However, technology should not replace professional judgment. Combining advanced technology with expert advice ensures that tax-loss harvesting aligns with your unique financial situation and goals.

Coordinating with Your Overall Tax Strategy

Tax-loss harvesting should form part of a comprehensive tax management strategy. Consider your overall tax situation, including current and projected future tax brackets, when deciding whether to harvest losses. For high-income individuals, the potential tax savings from harvesting losses can be substantial (ordinary income tax rates can go up to 37%, while long-term capital gains rates vary based on income levels).

Tax-loss harvesting is just one tool in your financial toolkit. Use it in conjunction with other tax-efficient strategies, such as asset location and charitable giving, to maximize your after-tax returns.

As we move forward, we’ll explore advanced tax-loss harvesting techniques that can further enhance your investment strategy and potentially boost your after-tax returns.

Elevating Your Tax-Loss Harvesting Game

Year-Round Approach for Maximum Benefits

Tax-loss harvesting should not be limited to year-end activities. A proactive, continuous approach maximizes its benefits. This strategy allows investors to capitalize on market volatility whenever it occurs, rather than limiting opportunities to a single period.

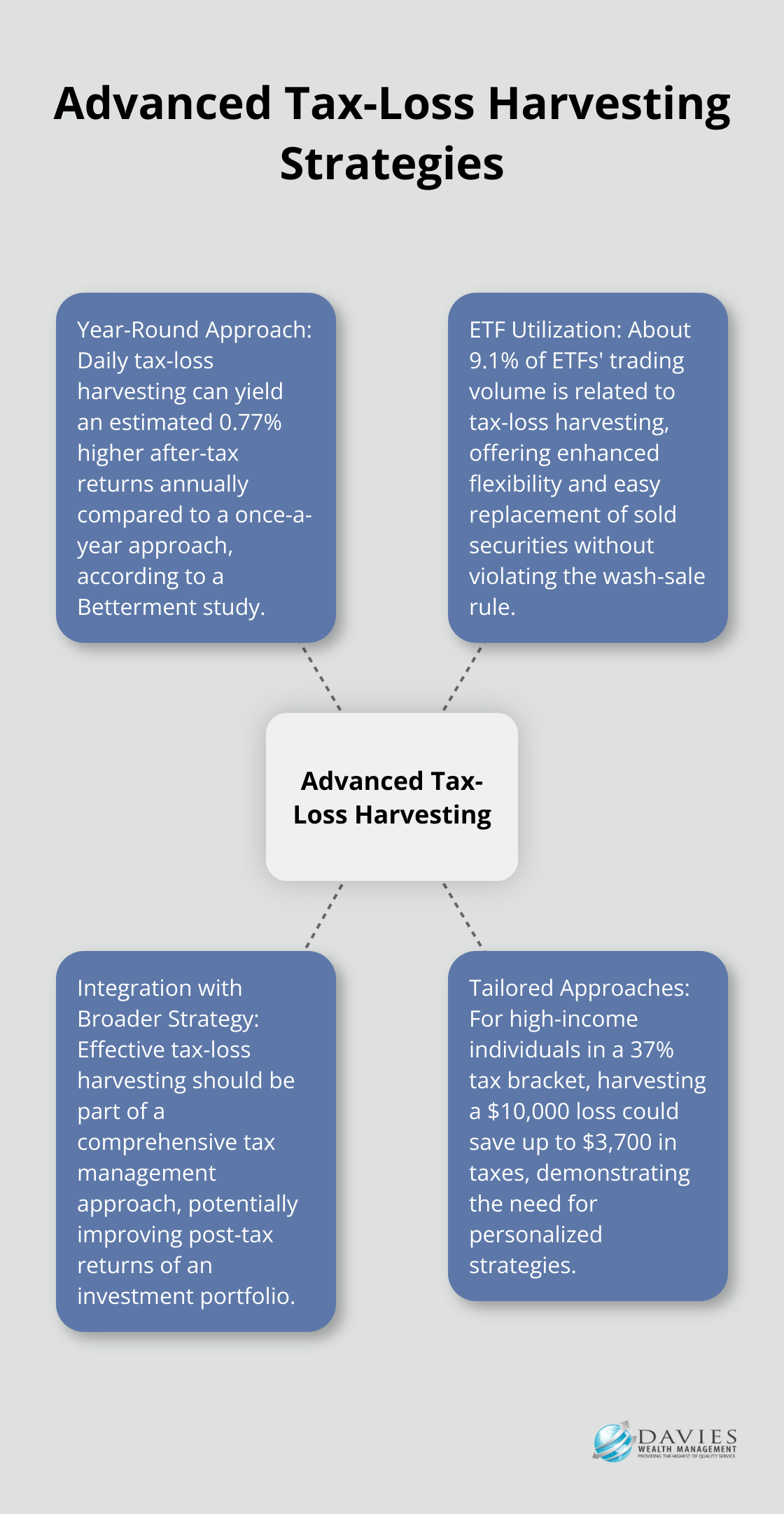

A study by Betterment found that daily tax-loss harvesting can yield an estimated 0.77% higher after-tax returns annually compared to a once-a-year approach. This significant difference underscores the importance of ongoing portfolio surveillance. Consistent monitoring of investments enables identification and action on loss-harvesting opportunities as they arise, potentially boosting after-tax returns substantially over time.

Utilizing ETFs for Enhanced Flexibility

Exchange-Traded Funds (ETFs) offer unique advantages for tax-loss harvesting. Their structure allows for easy replacement of sold securities without violating the wash-sale rule. For instance, an investor who sells an S&P 500 index fund at a loss can immediately purchase a different S&P 500 ETF to maintain market exposure while still claiming the tax loss.

A study found that about 9.1% trading volume of ETFs’ assets under management (AUM) is related to tax-loss harvesting, or about 20.7% of their total trading volume. This indicates the significant role ETFs play in tax-loss harvesting strategies.

Integration with Broader Financial Strategy

Effective tax-loss harvesting should form part of a comprehensive tax management approach. This integration can lead to significant long-term benefits. Empirical research has shown that tax-loss harvesting strategies in separately managed accounts can improve the post-tax returns of an investment portfolio.

Investors should consider their current and future tax brackets when deciding to harvest losses. For high-income individuals facing a 37% marginal tax rate, the tax savings from harvesting a $10,000 loss could be as much as $3,700. However, if an investor expects to be in a lower tax bracket in the future, it might be more beneficial to defer some loss harvesting to those years.

Tailored Strategies for Unique Situations

Tax-loss harvesting strategies should be tailored to each individual’s unique financial situation. For professional athletes (who often face fluctuating income and short career spans), dynamic tax-loss harvesting strategies that adapt to changing tax situations year by year prove beneficial.

Tax-loss harvesting is a powerful tool, but it’s just one piece of the puzzle. It should complement other tax-efficient strategies like asset location, charitable giving, and strategic Roth conversions. The combination of these strategies creates a robust, tax-efficient investment approach that maximizes after-tax wealth over the long term.

Final Thoughts

Tax-loss harvesting stands as a powerful strategy for investors who want to optimize their after-tax returns. This technique allows investors to offset capital gains and potentially reduce their tax burden by strategically selling underperforming assets. Tax-loss harvesting provides an opportunity to rebalance portfolios, improve diversification, and align investments with current financial goals.

The effectiveness of tax-loss harvesting varies based on individual circumstances, including tax brackets, investment strategies, and overall financial objectives. Professional guidance proves invaluable when implementing a tax-loss harvesting strategy. Our team at Davies Wealth Management specializes in crafting personalized financial strategies, including tax-loss harvesting in Stuart, Florida.

We tailor our approach to maximize the benefits of tax-loss harvesting for your specific circumstances. Tax-loss harvesting forms just one component of a comprehensive wealth management strategy. Davies Wealth Management offers the expertise and personalized service to help you integrate tax-loss harvesting into a holistic approach to wealth management (ensuring you’re well-positioned to build, protect, and grow your wealth over time).

Leave a Reply