Ultra-high-net-worth families face unique challenges in managing their wealth. These complexities demand specialized solutions that go beyond traditional financial services.

At Davies Wealth Management, we recognize the pivotal role family offices play in addressing these intricate needs. Family offices offer a tailored approach to wealth management, ensuring the preservation and growth of assets across generations while providing a wide array of essential services.

What Do Family Offices Do?

Family offices serve as the financial command centers for ultra-high-net-worth families. They don’t just manage wealth; they architect multigenerational financial success. Let’s explore the key functions of family offices and how they transform complex financial landscapes into streamlined, efficient systems.

Tailored Investment Strategies

Family offices create custom investment portfolios that align with a family’s specific goals and risk tolerance. The 2022 UBS Global Family Office Report revealed that private equity stands out as the only asset class where the number of family offices making allocations has risen steadily year after year. This shift towards alternative investments (such as real estate and venture capital) demonstrates how family offices adapt to market trends to preserve and grow wealth.

Intergenerational Wealth Transfer

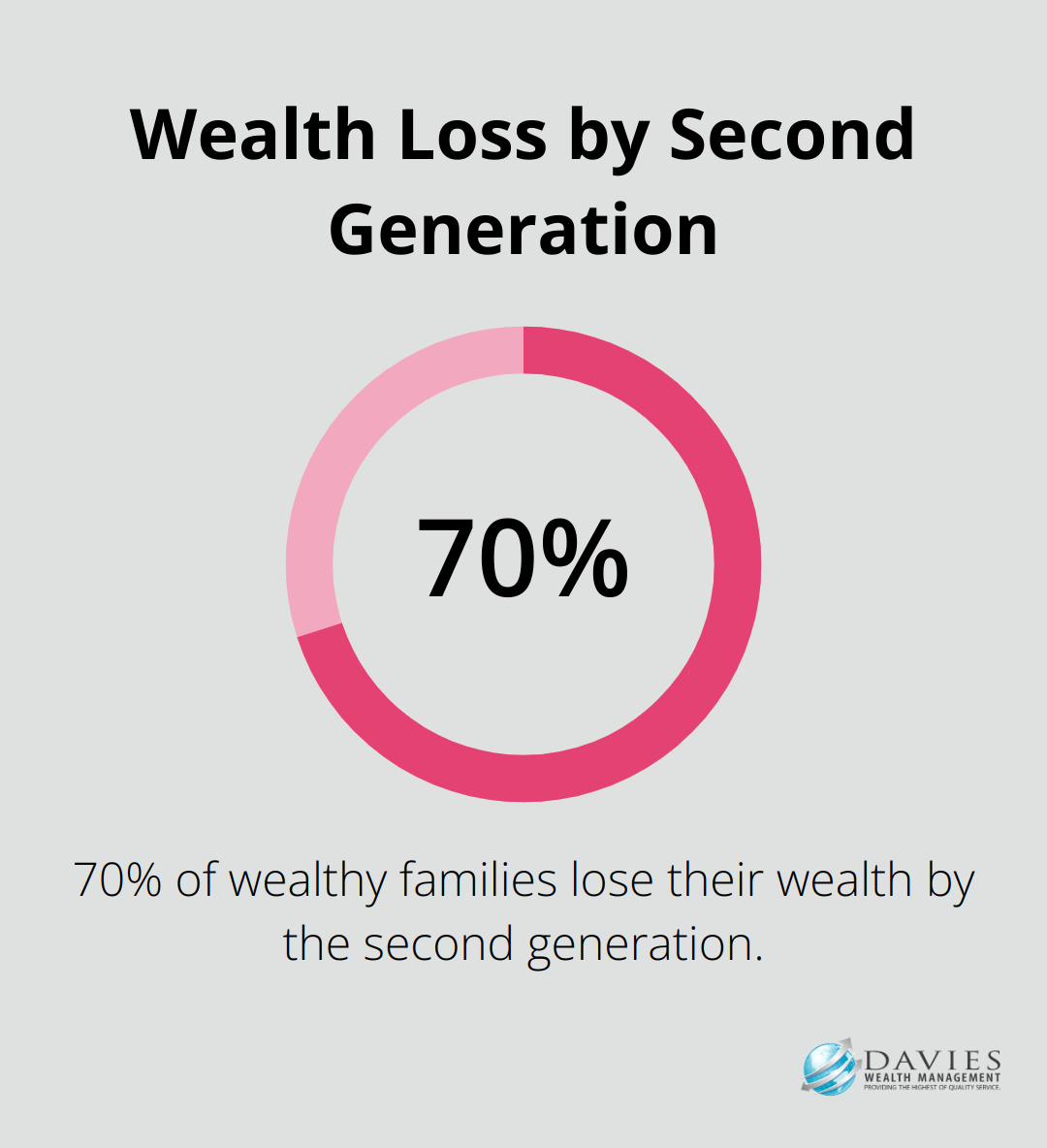

One of the most important roles of a family office is to ensure smooth wealth transitions between generations. A 20-year study by the Williams Group of 3,200 families found that 70% of wealthy families lose their wealth by the second generation. Family offices combat this statistic through meticulous succession planning and financial education for younger family members (often starting as early as adolescence).

Coordinating Complex Financial Affairs

Family offices act as the central hub for all financial matters. They manage everything from tax planning to philanthropic endeavors. A study by Campden Wealth explores family offices’ investment strategy, portfolio allocations and performance across all asset classes, illustrating their ability to align financial strategies with family values.

Risk Management and Asset Protection

Family offices implement sophisticated risk management strategies to protect family wealth. This includes diversification across asset classes, geographic regions, and investment vehicles. They also employ advanced hedging techniques and insurance strategies to mitigate potential losses.

Concierge Services and Lifestyle Management

Many family offices go beyond financial management to offer lifestyle services. These can include managing real estate portfolios, overseeing household staff, coordinating travel arrangements, and even handling personal shopping. This comprehensive approach allows family members to focus on their passions and pursuits without getting bogged down in day-to-day financial minutiae.

Family offices aren’t just a luxury; they’re a necessity for ultra-high-net-worth families seeking to navigate the complexities of wealth management. While traditional financial advisors might offer some of these services, the comprehensive, tailored approach of a family office is unmatched in its ability to safeguard and grow family wealth across generations. As we move forward, let’s examine the specific benefits that family offices provide to ultra-high-net-worth families.

What Services Do Family Offices Provide?

Family offices offer a comprehensive suite of services tailored to the unique needs of ultra-high-net-worth families. These services extend far beyond traditional wealth management, addressing every aspect of a family’s financial life. Let’s explore the key services that make family offices indispensable for wealthy families.

Sophisticated Investment Management

Family offices create bespoke investment strategies. They use their expertise to access exclusive investment opportunities, including private equity deals and alternative investments. A study found that the average family wealth for those surveyed worldwide is US$1.8 billion, with an estimated total wealth of US$699 billion.

Tax Optimization and Compliance

Tax planning stands as a critical service provided by family offices. They employ strategies to minimize tax liabilities while ensuring full compliance with complex tax laws. A report shares insights into the current thinking and experiences of business families on their most important tax considerations.

Succession Planning and Wealth Transfer

Family offices facilitate smooth intergenerational wealth transfers. They develop comprehensive succession plans that address both financial and non-financial aspects of wealth transfer.

Strategic Philanthropy

Many ultra-high-net-worth families commit deeply to philanthropic endeavors. Family offices structure and manage charitable giving to maximize impact. They assist in establishing private foundations, creating donor-advised funds, and developing strategic giving plans.

Comprehensive Risk Management

Family offices take a holistic approach to risk management, protecting family wealth from various threats. This includes implementing cybersecurity measures, securing appropriate insurance coverage, and developing crisis management plans.

The breadth and depth of services provided by family offices underscore their value to ultra-high-net-worth families. However, these services come at a cost. In the next section, we’ll examine the benefits that justify the investment in a family office structure.

Why Family Offices Transform Wealth Management for the Ultra-Wealthy

Family offices have become indispensable for ultra-high-net-worth families, offering a level of service and customization that traditional wealth management firms cannot match. These specialized entities transform wealth management for the most affluent clients in ways that go beyond conventional financial services.

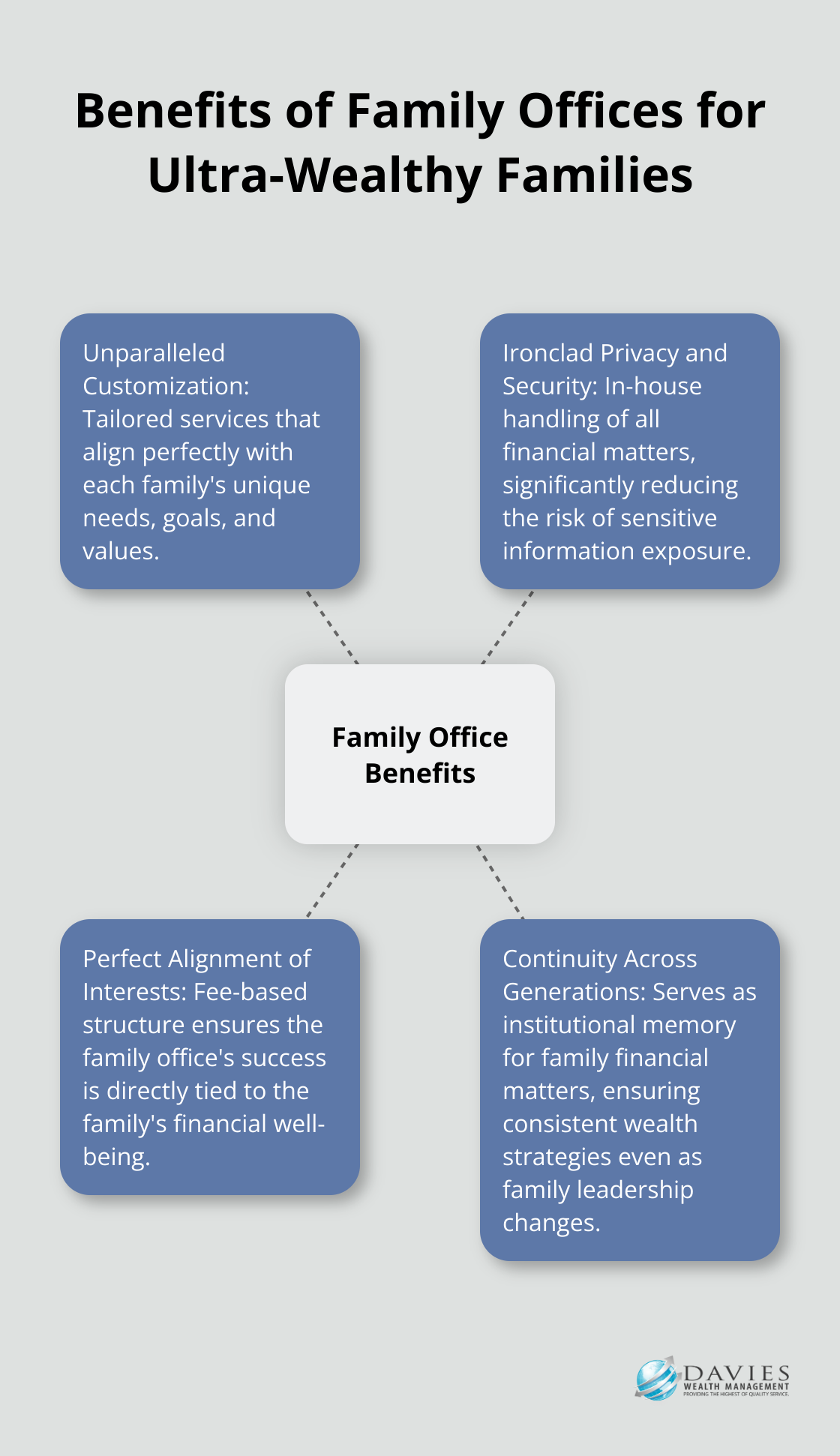

Unparalleled Customization

Family offices provide a degree of personalization that’s unmatched in the financial industry. Unlike standardized wealth management services, family offices tailor every aspect of their offerings to the unique needs, goals, and values of each family they serve. This bespoke approach ensures that every financial decision aligns perfectly with the family’s long-term objectives.

A family office might create a custom investment strategy that balances the family’s desire for growth with their commitment to sustainable investing. They might also develop a unique philanthropic plan that reflects the family’s specific charitable interests (such as funding medical research or supporting local education initiatives).

Ironclad Privacy and Security

In an age where data breaches and privacy concerns proliferate, family offices offer a fortress of confidentiality. They handle all financial matters in-house, which significantly reduces the risk of sensitive information exposure. This level of privacy is particularly important for high-profile families or those with complex business interests.

Perfect Alignment of Interests

Unlike traditional financial advisors who may have conflicting interests due to commission-based compensation models, family offices operate with complete alignment to the family’s goals. They typically work on a fee-based structure, which ensures that their success directly ties to the family’s financial well-being.

This alignment extends beyond just financial matters. Family offices often integrate deeply with the family, understanding their values, dynamics, and long-term vision. This intimate knowledge allows them to make decisions that truly serve the family’s best interests, both financially and personally.

Continuity Across Generations

One of the most significant advantages of family offices is their ability to provide continuity in wealth management across generations. They serve as the institutional memory for family financial matters, which ensures that wealth strategies remain consistent even as family leadership changes.

Family offices combat wealth loss by implementing robust succession plans and providing financial education to younger family members, which helps to preserve wealth for generations to come.

Final Thoughts

Family offices have become essential for ultra-high-net-worth families, offering unmatched customization, privacy, and comprehensive wealth management. These specialized entities will likely incorporate advanced technologies like artificial intelligence and blockchain to enhance their services in the future. We expect a growing focus on sustainable investing, cybersecurity, and digital asset management, with virtual family offices potentially making these services more accessible.

Ultra-high-net-worth families should consider factors such as financial complexity, desired control, and long-term wealth goals when contemplating a family office structure. The benefits are significant, but establishing a family office requires careful planning and substantial resources. At Davies Wealth Management, we understand the unique challenges faced by ultra-high-net-worth individuals and families.

Our wealth management services offer many benefits associated with family offices, including personalized investment strategies and comprehensive financial planning. We excel at serving professional athletes, addressing their unique financial needs and helping secure their long-term financial future. The key is to ensure your financial strategy aligns with your unique needs, values, and long-term objectives.

Leave a Reply