At Davies Wealth Management, we know that understanding risk tolerance is a cornerstone of successful investing. It’s the key to making informed decisions that align with your financial goals and comfort level.

Risk tolerance shapes your investment strategy, influencing everything from asset allocation to your response during market fluctuations. In this post, we’ll explore why grasping your risk tolerance is essential and how it can significantly impact your investment journey.

What Is Risk Tolerance?

Definition and Importance

Risk tolerance is the degree of risk that an investor is willing to endure given the volatility in the value of an investment. It represents the level of risk you’re willing to accept in pursuit of potential returns. Understanding risk tolerance forms the foundation of successful investing and shapes your entire investment strategy.

Factors Shaping Your Risk Tolerance

Several factors influence an individual’s risk tolerance:

- Age: Younger investors often have a higher risk tolerance due to a longer investment horizon.

- Financial Goals: Short-term goals (e.g., saving for a house down payment) typically require a more conservative approach compared to long-term retirement planning.

- Income Stability: Those with steady, reliable income streams may feel more comfortable taking on higher investment risks.

- Overall Financial Situation: Your assets, debts, and financial responsibilities play a significant role in shaping your risk tolerance.

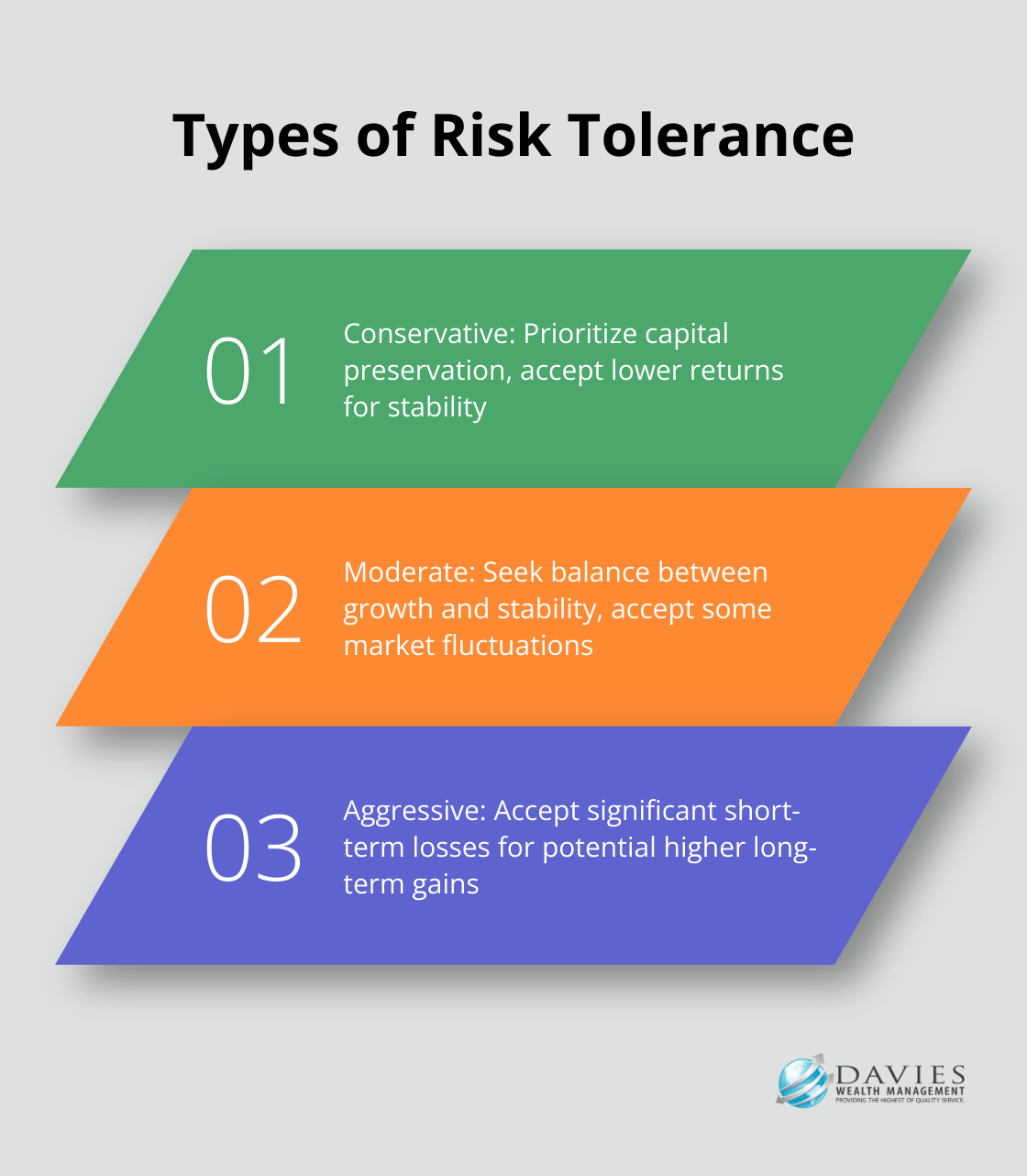

Types of Risk Tolerance

Risk tolerance generally falls into three categories:

- Conservative: These investors prioritize capital preservation and accept lower returns for greater stability. They often prefer investments like high-quality bonds and certificates of deposit.

- Moderate: These investors seek a balance between growth and stability. They accept some market fluctuations for the potential of higher returns. A typical moderate portfolio might include a mix of stocks and bonds (often in a 60/40 ratio).

- Aggressive: These investors have the highest risk tolerance. They accept significant short-term losses for the possibility of higher long-term gains. Their portfolios often heavily weight towards stocks, including growth and small-cap stocks.

The Impact of Market Conditions

It’s important to note that risk tolerance isn’t static. Market conditions can significantly influence how investors perceive and handle risk. Those with good risk composure can stay on course during market volatility, and it is important to understand which investors struggle to maintain their risk tolerance during turbulent times.

Many investors overestimate their risk tolerance during calm market periods. It’s only when markets become volatile that their true risk tolerance becomes apparent. This underscores the importance of regular risk tolerance assessments, especially during different market conditions.

The Role of Professional Guidance

Given the complexity of assessing and applying risk tolerance, many investors benefit from professional guidance. Financial advisors (like those at Davies Wealth Management) can provide valuable insights and tools to help investors accurately gauge their risk tolerance and align their investment strategies accordingly. These professionals can also help investors navigate market volatility and adjust their strategies as their risk tolerance evolves over time.

Why Risk Tolerance Matters

Tailoring Your Investment Strategy

Your risk tolerance should serve as the compass that guides your investment decisions. If you’re a conservative investor nearing retirement, a portfolio heavily weighted in high-risk stocks could jeopardize your financial security. Conversely, if you’re a young professional with a high risk tolerance, an overly cautious approach could result in missed growth opportunities.

A Vanguard study found that investors who aligned their portfolios with their risk tolerance were 7% more likely to adhere to their investment plans during market downturns. This consistency proves essential for long-term success.

Navigating Market Volatility

Market fluctuations are inevitable, but your reaction to them shouldn’t be. Understanding your risk tolerance helps you maintain composure during turbulent times. For example, during the 2020 market crash, investors who had a clear understanding of their risk tolerance were less likely to panic-sell at the bottom, thus avoiding significant losses.

Professional risk assessment tools can help investors understand their true risk tolerance. This knowledge proves invaluable during market volatility, allowing investors to make rational decisions rather than emotional ones.

Building a Resilient Portfolio

Your risk tolerance should inform the construction of your investment portfolio. A well-balanced portfolio that aligns with your risk tolerance can help you weather market storms and capitalize on opportunities.

For instance, a moderate-risk investor might opt for a 60/40 split between stocks and bonds. This balance provides growth potential while offering some protection against market downturns.

The Importance of Regular Reassessment

Understanding your risk tolerance isn’t a one-time event. Life changes, financial goals shift, and market conditions evolve. Regular reassessment of your risk tolerance ensures your investment strategy remains aligned with your current situation and future objectives.

A deep understanding of risk tolerance forms the foundation of a successful investment strategy. Whether you’re a professional athlete managing a short career window or a business owner planning for long-term growth, understanding and applying your risk tolerance can significantly impact your financial journey. The next section will explore practical methods to assess your risk tolerance accurately.

How to Assess Your Risk Tolerance

Take a Risk Tolerance Questionnaire

Risk tolerance questionnaires serve as a starting point for assessment. These typically present scenarios about potential investment losses and gains, asking for your reactions. For example, a question might ask, “If your investment dropped 20% in a month, would you sell, hold, or buy more?”

However, questionnaires have limitations. An effective risk tolerance questionnaire may not only make it easier to properly match investment solutions to a client’s needs but also highlights the need to combine questionnaires with other assessment methods for a more accurate picture.

Analyze Your Past Financial Behavior

Your previous financial decisions offer valuable insights into your risk tolerance. Did you sell during market downturns? Or did you maintain your position, perhaps even buying more when prices dropped? These actions strongly indicate your actual risk tolerance.

The 2008 financial crisis led to a range of major reforms in banking and financial regulation. Your actions during such periods reveal your true risk tolerance.

Evaluate Your Current Financial Circumstances

Your present financial situation significantly influences your risk tolerance. Key factors to consider include:

Utilize Professional Risk Assessment Tools

Professional risk assessment tools offer more sophisticated analysis than simple questionnaires. These tools use complex algorithms to examine various aspects of your financial life, providing a more accurate picture of your risk tolerance.

The FinaMetrica risk profiling tool determines the value of a profile by its accuracy. When profiling, characteristics associated with risk tolerance can be enlisted to differentiate between investors.

Seek Expert Guidance

While self-assessment proves helpful, working with a financial advisor provides a more comprehensive and objective evaluation of your risk tolerance. Financial advisors use a combination of quantitative tools and qualitative discussions to fully understand their clients’ risk tolerance.

Advisors help navigate complex scenarios and illustrate how different risk levels might impact your financial goals. This personalized approach ensures that your investment strategy aligns not just with your risk tolerance, but with your overall financial objectives.

Regular reassessment of your risk tolerance (ideally with professional help) ensures your investment strategy remains aligned with your risk tolerance and financial goals as your life circumstances evolve.

Final Thoughts

Understanding your risk tolerance forms the foundation of successful investing. It allows you to build a resilient portfolio that aligns with your financial goals and emotional comfort. We at Davies Wealth Management help investors understand and apply their risk tolerance effectively through advanced assessment tools and personalized consultations.

Our team develops tailored investment strategies that align with your unique risk profile. We offer specialized expertise for professional athletes, addressing the complexities of short career spans, fluctuating income, and potential earnings from endorsements. Our advisors create financial plans that address these specific needs while considering individual risk tolerance.

Davies Wealth Management guides you through every stage of your financial journey. We provide you with the confidence to pursue your financial goals by helping you understand and apply your risk tolerance. Our team offers clear, actionable solutions tailored to your risk tolerance and financial objectives.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply