At Davies Wealth Management, we understand the unique challenges high net-worth individuals face when it comes to managing their wealth and minimizing tax liabilities.

Tax strategies for high net-worth individuals are essential for preserving and growing wealth in today’s complex financial landscape. This blog post will explore effective tax planning techniques tailored specifically for high net-worth individuals.

We’ll cover both fundamental and advanced strategies to help you optimize your tax position and protect your hard-earned assets.

Who Are High Net-Worth Individuals and Why Do They Need Tax Strategies?

Defining High Net-Worth Individuals

High-net-worth individuals (HNWIs) are persons who maintain liquid assets at or above a certain threshold. This group often includes successful business owners, executives, and professional athletes. These individuals face unique financial challenges that require specialized tax strategies to protect and grow their wealth.

The Critical Role of Tax Planning in Wealth Preservation

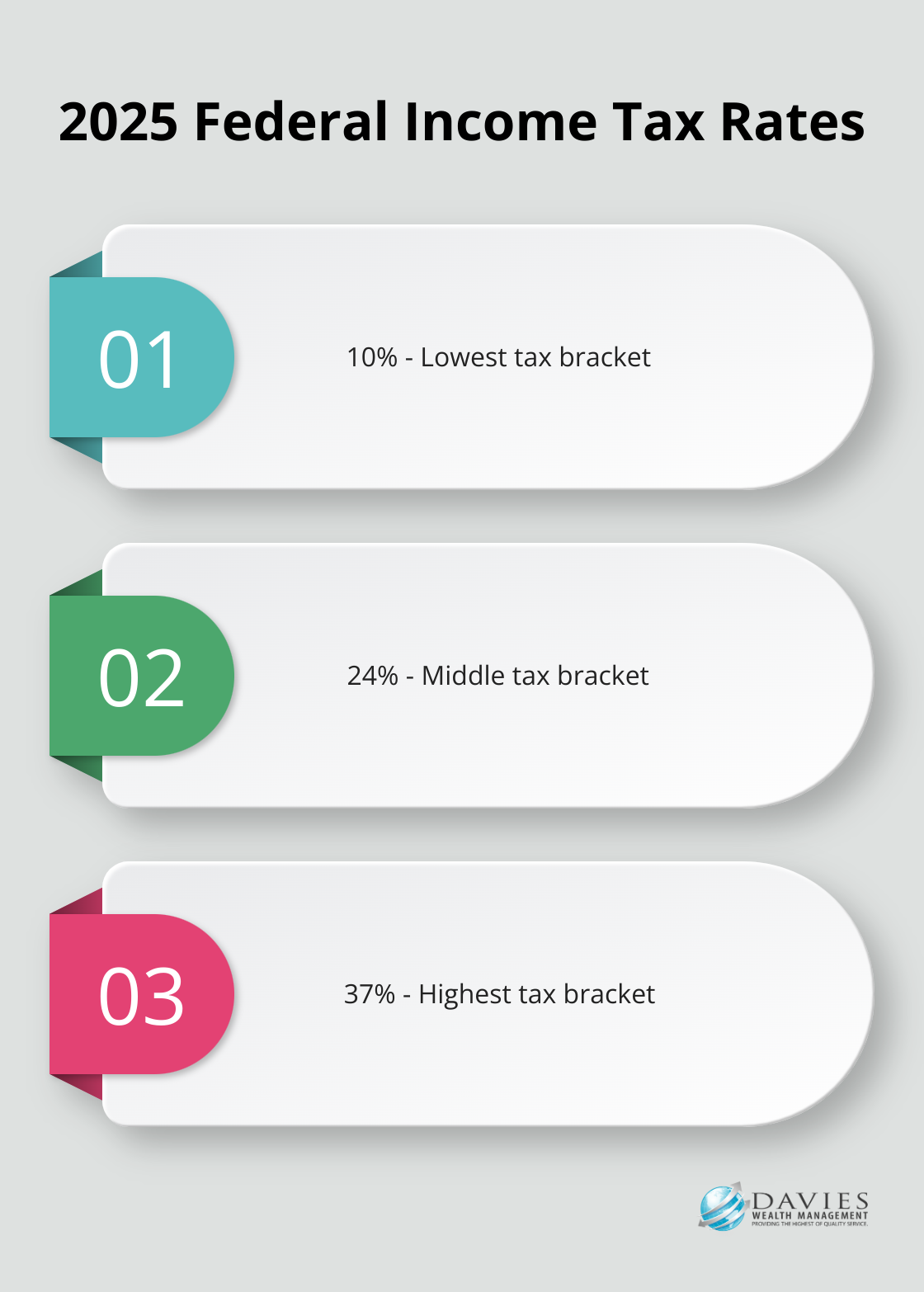

Tax planning serves as a cornerstone of long-term wealth preservation. Without effective strategies, HNWIs can lose a substantial portion of their wealth to taxes. For instance, the federal income tax has seven tax rates in 2025: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. This rate doesn’t account for state taxes, which can push the total tax burden even higher in certain locations.

Strategic tax planning allows HNWIs to retain more of their earnings, creating opportunities for greater investment and wealth accumulation over time. It’s not merely about reducing tax bills; it’s about strategic wealth management to achieve specific financial objectives.

Tax Challenges Unique to High Net-Worth Individuals

HNWIs often encounter complex tax situations due to their diverse income sources and investment portfolios. Let’s explore some common challenges:

Alternative Minimum Tax (AMT)

The AMT aims to ensure high-income earners pay a minimum amount of tax. This can significantly increase tax liability for some HNWIs, particularly those with large deductions or certain types of income.

Net Investment Income Tax (NIIT)

The NIIT imposes an additional 3.8% tax on investment income for individuals, estates, and trusts that have net investment income above applicable threshold amounts.

Estate Taxes

Estate taxes present a significant concern for many HNWIs. While the federal estate tax exemption stands at $12.92 million per individual in 2023, some states impose their own estate taxes with much lower exemption thresholds.

Navigating Complex Tax Landscapes

Professional athletes, in particular, face unique tax challenges due to their short career spans and potentially high, fluctuating incomes. They must navigate complex tax situations, including multi-state taxation and potential international tax implications.

To address these challenges effectively, HNWIs (including professional athletes) should consider working with experienced financial advisors who specialize in high net-worth tax strategies. These professionals can develop comprehensive tax plans that align with overall financial goals, helping to maximize wealth retention and achieve long-term financial objectives.

As we move forward, we’ll explore specific tax strategies that HNWIs can implement to optimize their tax positions and protect their assets. These strategies range from maximizing retirement account contributions to exploring advanced tax planning techniques.

Powerful Tax Strategies for High Net-Worth Individuals

At Davies Wealth Management, we have developed a set of powerful tax strategies tailored for high net-worth individuals. These strategies maximize wealth retention and minimize tax liabilities. Let’s explore some of the most effective approaches we recommend to our clients.

Supercharge Your Retirement Accounts

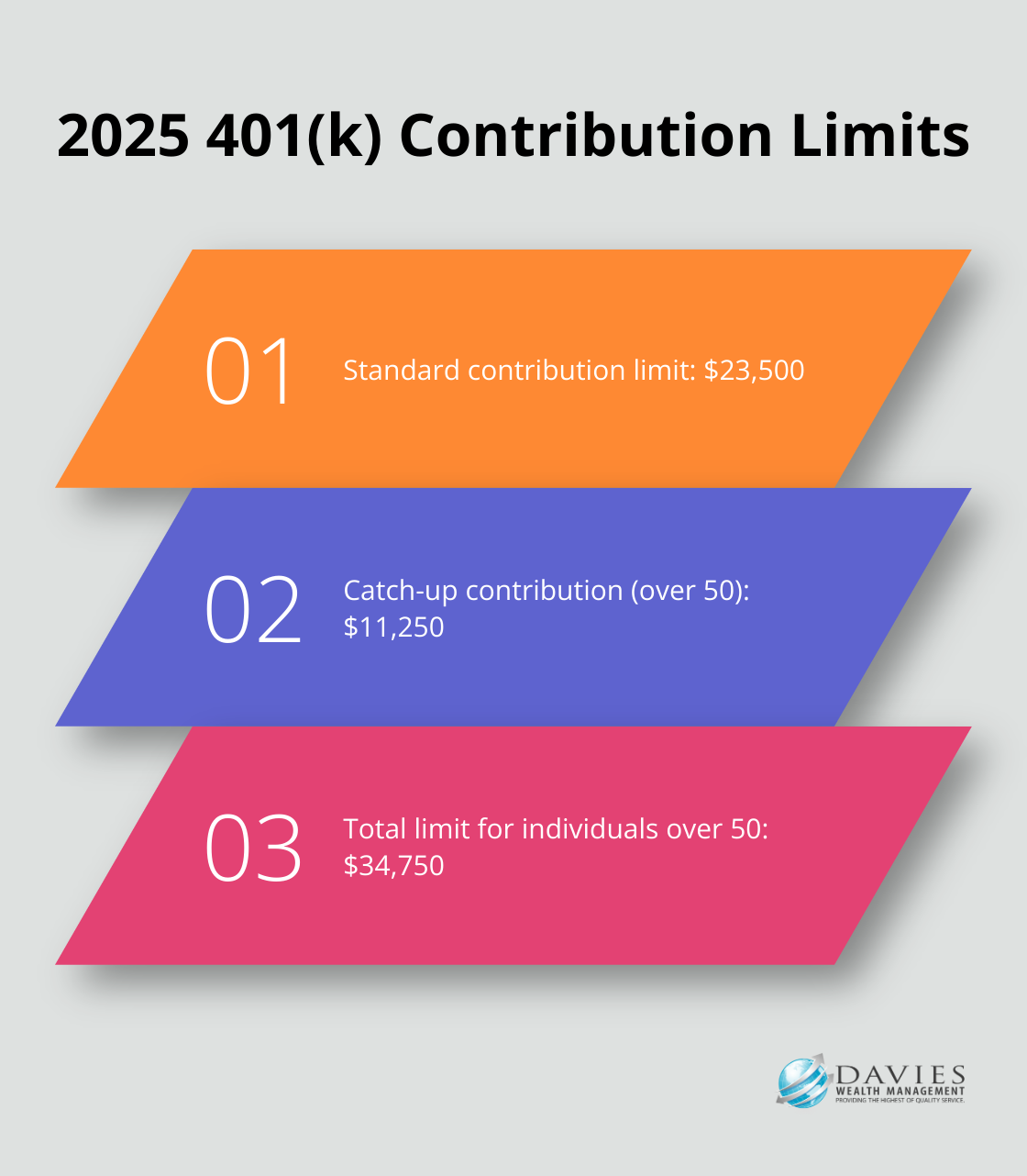

One of the most straightforward yet powerful strategies involves maximizing contributions to retirement accounts. In 2025, the contribution limit for 401(k) plans will increase to $23,500, with an additional catch-up contribution limit of $11,250 for those over 50. This means individuals over 50 can contribute up to $34,750 annually to their 401(k) plans.

For those with self-employment income, a Solo 401(k) or SEP IRA might prove beneficial. These plans often allow for higher contribution limits (potentially up to $69,000 in 2025, depending on your income).

Implement Strategic Tax-Loss Harvesting

Tax-loss harvesting is a sophisticated strategy that involves selling underperforming investments to offset capital gains. This technique can significantly reduce your tax liability. Key considerations include the wash-sale rule, offsetting capital gains with losses, and any rules specific to your state.

A knowledgeable advisor can help you navigate these complexities and maximize the benefits of tax-loss harvesting.

Leverage Charitable Giving for Tax Benefits

Charitable giving not only supports causes you care about but can also provide substantial tax benefits. For high net-worth individuals, establishing a donor-advised fund (DAF) can prove advantageous. A DAF allows you to take an immediate tax deduction when you make a charitable contribution, reducing your tax liability.

Another powerful strategy involves donating appreciated securities directly to charities. This approach allows you to avoid capital gains taxes on the appreciation while still claiming a deduction for the full market value of the securities.

Explore Tax-Efficient Investment Vehicles

Investing in tax-efficient vehicles can significantly reduce your tax burden. Municipal bonds, for instance, generate interest that’s exempt from federal income tax (and often state tax if you reside in the issuing state).

Exchange-traded funds (ETFs) are another tax-efficient option. Unlike mutual funds, ETFs typically generate fewer capital gains distributions, reducing your tax liability.

For real estate investments, 1031 exchanges offer potential benefits. This strategy allows you to defer capital gains taxes by reinvesting proceeds from the sale of an investment property into a like-kind property.

As we move forward, we’ll explore advanced tax planning techniques that can further optimize your financial strategy and help you achieve your long-term wealth goals.

Advanced Tax Strategies for Wealth Preservation

Family Limited Partnerships: A Powerful Wealth Transfer Tool

Family Limited Partnerships (FLPs) offer high net-worth individuals a sophisticated method to reduce estate taxes while maintaining asset control. Parents typically act as general partners, controlling the partnership’s assets and operations, while children or other family members serve as limited partners.

FLPs excel at transferring wealth to the next generation at a discounted value. The gifting of limited partnership interests to family members can potentially reduce the taxable estate’s value. Discount valuations in Family Limited Partnerships offer significant tax advantages by reducing the taxable value of transferred interests.

Proper FLP structuring is essential to avoid IRS scrutiny. The partnership must have a legitimate business purpose beyond tax savings, and general partners must actively manage the partnership’s assets.

Strategic Use of Trusts in Estate Planning

Trusts serve as versatile tools in advanced tax planning. Irrevocable Life Insurance Trusts (ILITs) can remove life insurance proceeds from a taxable estate, which proves particularly effective for individuals with large life insurance policies.

Grantor Retained Annuity Trusts (GRATs) allow the transfer of appreciating assets to beneficiaries while retaining an income stream for a specified term. A GRAT is a trust that allows an individual to pass assets to others free of gift tax.

Opportunity Zone Investments: Tax Benefits and Economic Development

Opportunity Zone investments combine tax benefits with potential economic development support. Investing capital gains into Qualified Opportunity Funds (QOFs) allows investors to defer and potentially reduce tax liability while supporting economically distressed communities.

Opportunity Zone investments offer substantial tax benefits. An investor can defer tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a Qualified Opportunity Fund (QOF).

Tax-Efficient Business Structures

Selecting the right business structure can significantly impact tax liabilities for high net-worth individuals. S Corporations, for example, allow business income to pass through to the owner’s personal tax return, potentially reducing self-employment taxes.

Limited Liability Companies (LLCs) offer flexibility in taxation. They can be taxed as sole proprietorships, partnerships, or corporations, depending on the owner’s preference and tax situation.

International Tax Planning Options

For high net-worth individuals with global interests, international tax planning presents opportunities for tax optimization. Strategies may include:

- Utilizing foreign tax credits to avoid double taxation

- Establishing offshore trusts in tax-favorable jurisdictions

- Implementing corporate structures to manage international business income

These advanced strategies require careful consideration and expert guidance to ensure compliance with complex international tax laws and regulations.

Final Thoughts

Tax strategies for high net-worth individuals require expert knowledge and continuous attention. Davies Wealth Management specializes in providing personalized wealth management solutions, including tax-efficient strategies for high net-worth individuals and professional athletes. Our team’s expertise can help you navigate complex tax situations and make informed decisions to protect and grow your wealth.

Tax planning is an ongoing process that demands regular review and adjustment to remain effective. As tax laws change and your financial situation evolves, your tax planning approach should adapt accordingly. Working with experienced financial advisors is essential to develop and implement a comprehensive tax strategy tailored to your unique financial situation and goals.

Davies Wealth Management is here to help you navigate the complexities of tax planning and achieve your long-term financial goals. We can assist you in maximizing the benefits of various tax strategies and securing your financial future. Whether you’re a business owner, executive, or professional athlete, our team is ready to support your wealth management needs.

Leave a Reply