At Davies Wealth Management, we understand that starting your investment journey can be daunting, especially for young people. That’s why we’ve created this guide to provide investment advice for young people looking to build their financial future.

In this post, we’ll cover the basics of investing, strategies tailored for young investors, and practical steps to get started. Whether you’re a recent graduate or just beginning your career, these tips will help you make informed decisions about your money and set you on the path to long-term financial success.

What is Investing and Why Should You Start Now?

The Power of Compound Interest

Investing puts your money to work for you, with the goal of growing your wealth over time. At Davies Wealth Management, we believe that early investment is one of the most powerful financial decisions you can make. Compound interest acts as the driving force behind this power.

Compound interest allows you to earn returns not just on your initial investment, but also on the returns you’ve already earned. This creates a snowball effect that can dramatically increase your wealth over time.

Investment Options for Beginners

As a young investor, you have several options to choose from:

- Stocks: Buying shares of individual companies can offer high potential returns (but also comes with higher risk).

- Bonds: These are generally lower-risk investments that provide steady income.

- Mutual Funds and ETFs: These allow you to invest in a diversified portfolio of stocks or bonds, spreading your risk across many different investments.

- Real Estate Investment Trusts (REITs): These allow you to invest in real estate without actually buying property. REITs offer easier buying and selling compared to physical properties and eliminate the need for direct property management.

For most young investors, a mix of low-cost index funds or ETFs often serves as a good starting point. These provide broad market exposure and diversification at a low cost.

Balancing Risk and Reward

Every investment carries some level of risk, but generally, higher risk investments have the potential for higher returns. As a young investor, time is on your side, which means you can typically afford to take on more risk in pursuit of higher returns.

However, it’s important to understand your own risk tolerance. This is where professional advice can prove invaluable. At Davies Wealth Management, we work with our clients to understand their financial goals and risk tolerance, helping them create an investment strategy that aligns with their individual needs.

Investing is not about getting rich quick. It’s about consistently setting money aside and letting it grow over time. Starting now and staying committed to your investment strategy sets you up for long-term financial success.

Now that we’ve covered the basics of investing and its importance, let’s explore how you can start your investment journey.

How to Start Your Investment Journey

Define Your Financial Goals

Before you invest your first dollar, you must understand what you’re investing for. Are you saving for a house down payment? Planning for retirement? Or do you want to build wealth for future business ventures? Your goals will shape your investment strategy.

Short-term goals (like a house down payment in 3-5 years) might require more conservative investments. Long-term goals (such as retirement in 30+ years) allow for more risk-taking, potentially yielding higher returns.

Create a Realistic Budget

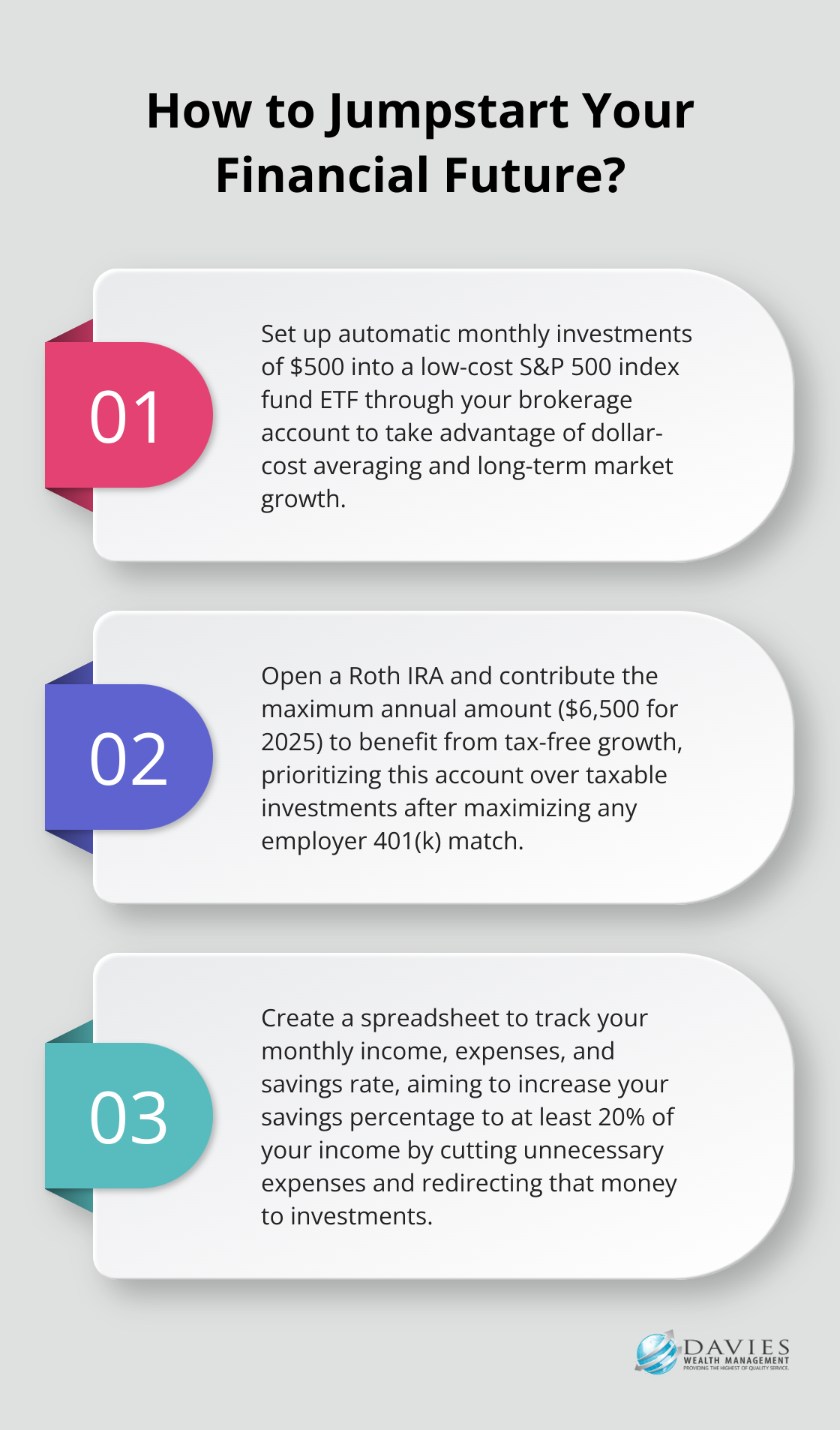

You can’t invest money you don’t have. Creating a budget is a critical step in your investment journey. Track your income and expenses for a month to get a clear picture of your financial situation. Identify areas where you can reduce spending and redirect that money towards investments.

Consider the 50/30/20 rule: allocate 50% of your income to necessities, 30% to wants, and 20% to savings and investments. To accelerate your wealth growth, you might want to increase the savings and investment percentage even further.

Build Your Emergency Fund

A financial safety net is essential before you start investing. Try to save 3-6 months of living expenses in an easily accessible savings account. This fund will protect you from having to sell investments at inopportune times to cover unexpected expenses.

High-yield savings accounts are excellent options for emergency funds. As of March 2025, some online banks offer annual percentage yields (APYs) of up to 4.50% on savings accounts (significantly higher than traditional brick-and-mortar banks).

Choose the Right Investment Account

After you’ve set your goals, created a budget, and built an emergency fund, it’s time to select where you’ll invest. Here are some popular options:

- 401(k): If your employer offers a 401(k) with matching contributions, this should be your first choice. It’s essentially free money.

- Roth IRA: This account allows you to contribute after-tax dollars, but your investments grow tax-free.

- Taxable Brokerage Account: If you’ve maxed out your tax-advantaged accounts or want more flexibility, a regular brokerage account is a good choice. There are no contribution limits, and you can withdraw money at any time.

The biggest difference between a retirement account and a brokerage account is how the IRS taxes – or doesn’t tax – contributions, investment gains and withdrawals.

Starting your investment journey doesn’t require a large sum of money. It’s about consistency, patience, and making informed decisions. With the right strategy and guidance, even small, regular investments can grow into substantial wealth over time. In the next section, we’ll explore specific investment strategies tailored for young people to help you make the most of your early start in investing.

Smart Investment Strategies for Young People

The Power of Dollar-Cost Averaging

Dollar-cost averaging is a simple yet effective strategy. It involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach helps reduce the impact of market volatility and the risk of investing a large sum at the wrong time.

For example, instead of investing $6,000 in a lump sum, you could invest $500 monthly over a year. This strategy works particularly well with mutual funds and ETFs. It allows you to accumulate more shares when prices are low and fewer when prices are high.

Dollar-cost averaging may result in lower returns over the long term compared to lump-sum investing, especially in a rising market.

Index Fund Investing for Long-Term Growth

Index funds are a cornerstone of many successful investment strategies, especially for young investors. These funds track a specific market index (such as the S&P 500), providing broad market exposure at a low cost.

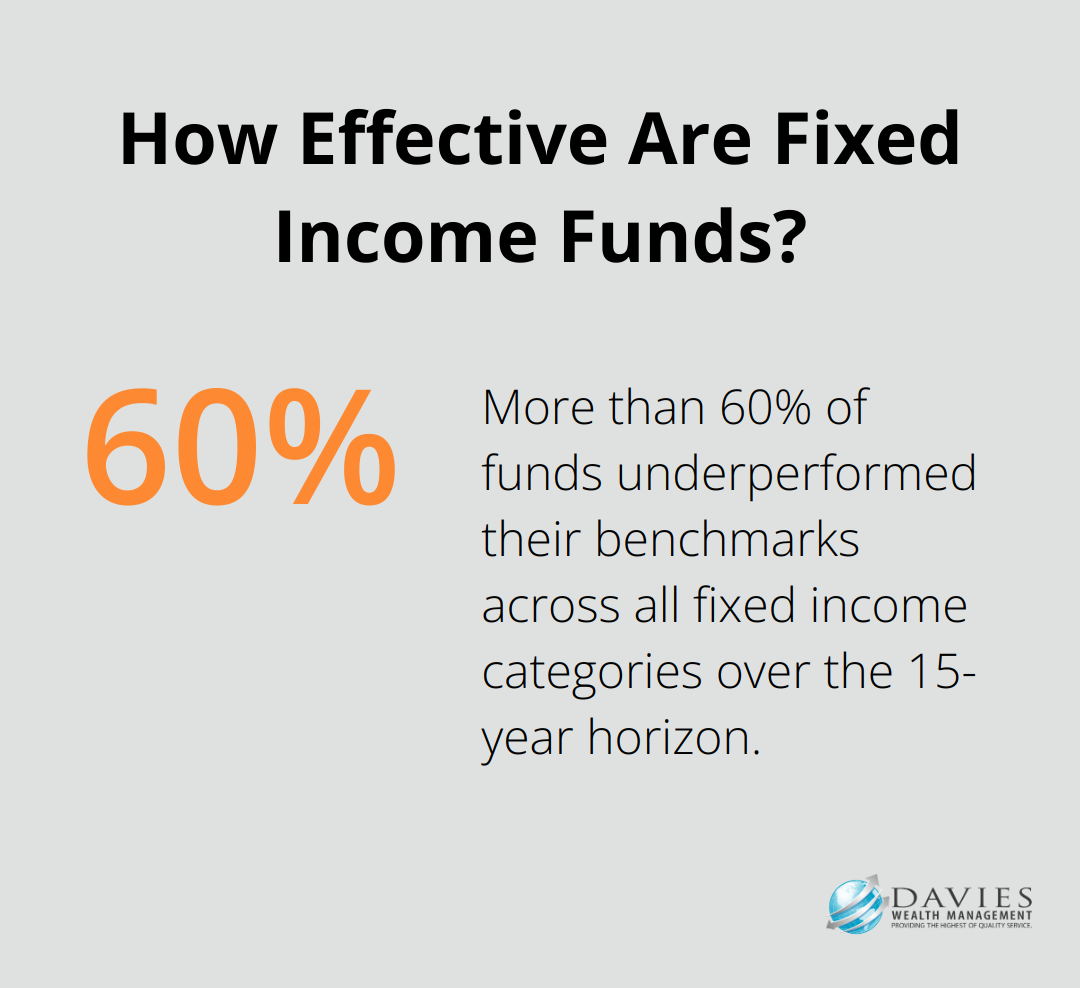

Over the long term, index funds have consistently outperformed actively managed funds. More than 60% of funds underperformed their benchmarks across all fixed income categories over the 15-year horizon.

A portfolio built around low-cost index funds can provide diversification and strong long-term returns without the need for constant monitoring or frequent trading.

Leveraging Low-Cost ETFs

Exchange-Traded Funds (ETFs) offer another excellent option for young investors. Like index funds, many ETFs track market indexes, but they trade like individual stocks, offering more flexibility.

ETFs typically have lower expense ratios than mutual funds, making them cost-effective for long-term investing. As of 2025, some of the largest ETF providers offer funds with expense ratios as low as 0.03% (meaning you’ll pay just $3 annually for every $10,000 invested).

Young investors can use ETFs to build a diversified portfolio across various asset classes, including stocks, bonds, and even alternative investments like real estate or commodities.

The Role of Professional Guidance

While these strategies can be effective, professional guidance can help you navigate the complexities of investing. A financial advisor can help you select the right mix of investments to align with your financial goals and risk tolerance, ensuring your portfolio is well-positioned for long-term growth.

When seeking professional advice, consider firms that specialize in working with young investors and understand their unique needs. Davies Wealth Management, for example, offers tailored solutions for individuals at various stages of their financial journey, including young professionals just starting their investment path.

Final Thoughts

Investing as a young person will build long-term wealth and financial security. You will harness the power of compound interest, which allows your money to grow exponentially over time. Regular contributions to your investment accounts, even small ones, can lead to significant returns in the future.

We explored various strategies for young investors, including dollar-cost averaging, index fund investing, and low-cost ETFs. These approaches offer growth potential and risk management, making them ideal for beginners. It’s important to align your investment strategy with your personal financial goals and risk tolerance.

Self-education is valuable, but professional investment advice for young people can provide clarity in your financial journey. At Davies Wealth Management, we offer personalized financial guidance to individuals at various life stages, including young professionals. Our team can help you navigate the financial world and tailor your investment strategy to your unique circumstances (and aspirations).

Leave a Reply