Capital gains tax can significantly impact your investment returns. At Davies Wealth Management, we understand the importance of implementing effective capital gains tax reduction strategies.

In this post, we’ll explore practical methods to minimize your tax burden and maximize your wealth. From basic techniques to advanced planning, you’ll learn how to keep more of your hard-earned money in your pocket.

Understanding Capital Gains Tax

What Is Capital Gains Tax?

Capital gains tax is a levy on the profit you make when selling an asset that has increased in value. This tax applies to various assets, including stocks, bonds, real estate, and even collectibles. Many investors underestimate the impact of capital gains tax on their investment returns.

Short-Term vs. Long-Term Capital Gains

The duration you hold an asset significantly affects your tax liability. Short-term capital gains apply to assets held for one year or less and are taxed at your ordinary income tax rate. Long-term capital gains (for assets held longer than a year) benefit from lower tax rates.

Current Tax Rates and Thresholds

For 2025, long-term capital gains tax rates are expected to remain favorable for most investors. These rates have not changed in recent years.

High-income earners may face an additional 3.8% Net Investment Income Tax (NIIT) on their capital gains. This applies to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts.

Strategic Considerations

Understanding these thresholds is vital for tax planning. If your income is near a threshold, strategically timing the sale of assets could save you thousands in taxes. Professional athletes with fluctuating incomes, for example, must navigate these complexities to optimize their tax situations.

The difference between short-term and long-term capital gains rates can be substantial. For high-income earners, the gap between their ordinary income tax rate and the long-term capital gains rate represents significant tax savings potential.

Impact on Investment Strategy

Your investment strategy should account for these tax implications. Holding assets for longer periods (over one year) can result in substantial tax savings. Additionally, considering the tax efficiency of different investment vehicles (such as index funds vs. actively managed funds) can further reduce your tax burden.

As we move forward, we’ll explore specific strategies to minimize your capital gains tax liability and maximize your after-tax returns.

Proven Strategies to Slash Your Capital Gains Tax

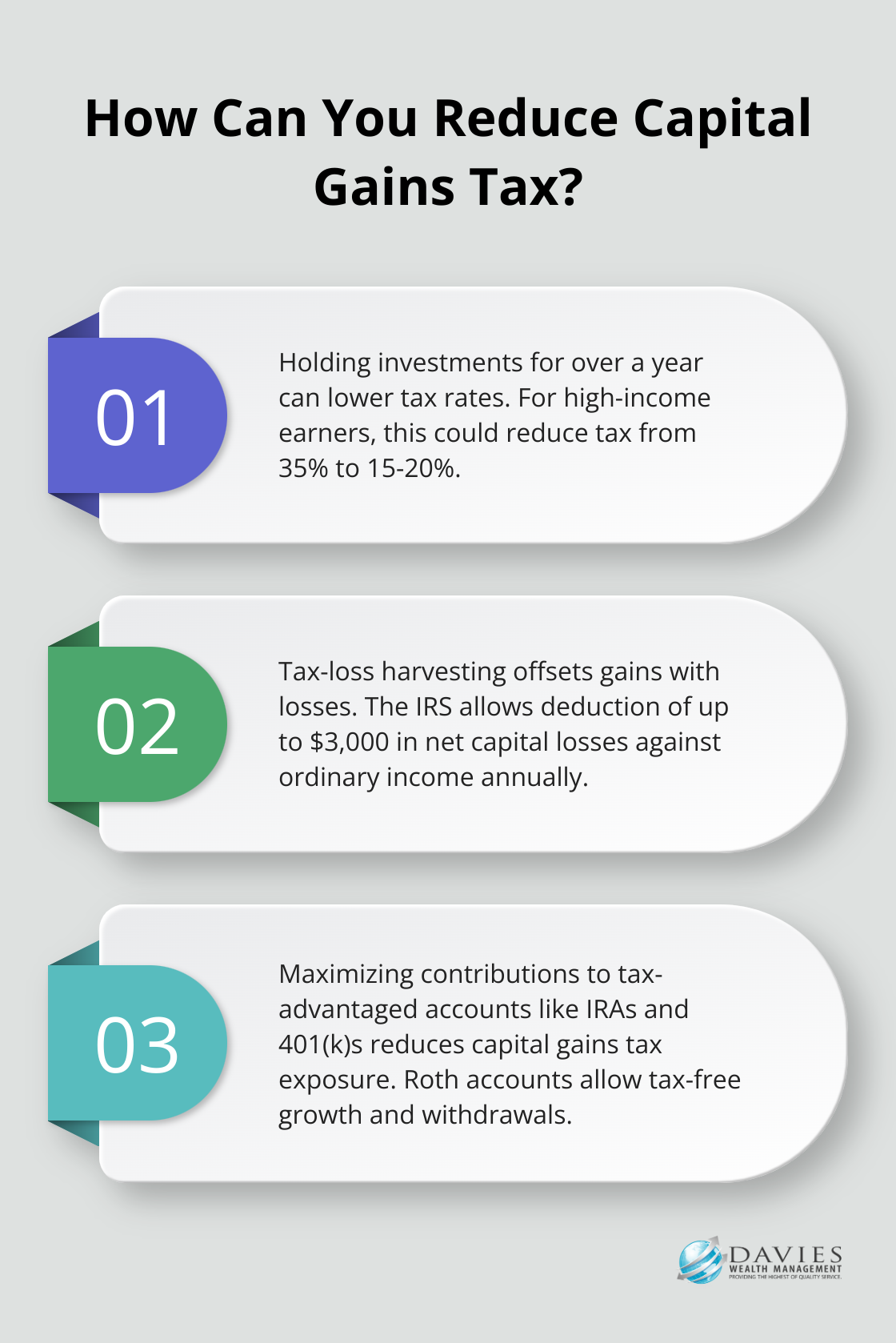

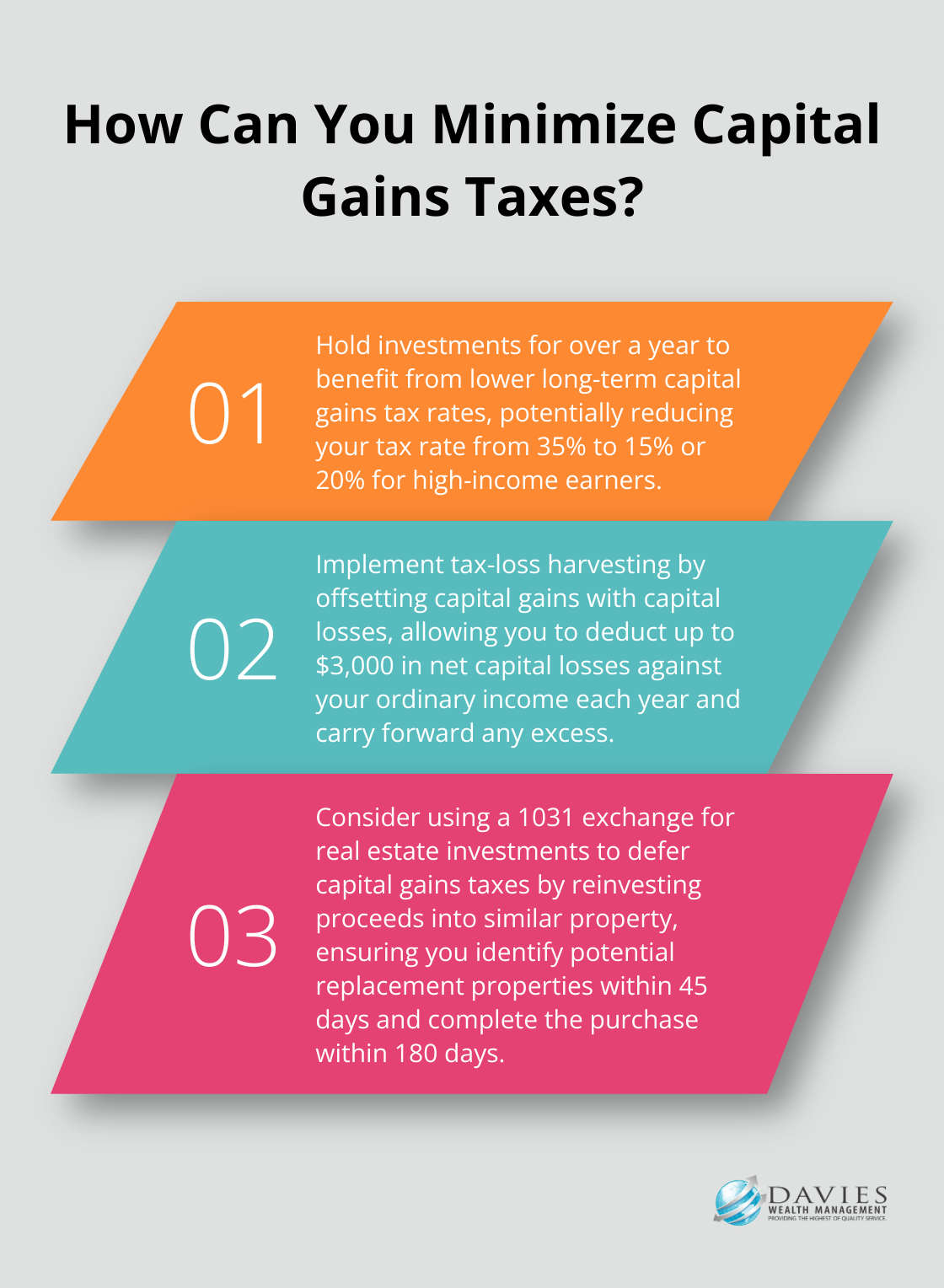

Extend Your Investment Horizon

Holding investments for over a year can dramatically reduce your tax liability. If you’re in the 35% tax bracket, selling a stock after 11 months could cost you 35% in taxes, while waiting just one more month could drop that to 15% or 20%. This strategy proves particularly effective for high-income earners (such as professional athletes) who face significant tax burdens on their short-term gains.

Master Tax-Loss Harvesting

Tax-loss harvesting serves as a powerful tool in your tax-reduction arsenal. By offsetting capital gains with capital losses, you can lower your tax bill and better position your portfolio going forward. The IRS allows you to deduct up to $3,000 in net capital losses against your ordinary income each year, with any excess carried forward to future years.

Leverage Tax-Advantaged Accounts

Maximizing contributions to tax-advantaged accounts like IRAs and 401(k)s can significantly reduce your capital gains tax exposure. Roth accounts, for example, are funded with “after-tax” dollars, but assets may grow tax-free and can be withdrawn tax-free. These accounts allow your investments to grow tax-deferred or tax-free, depending on the account type.

Time Your Income Strategically

If you expect a lower income year, perhaps due to retirement or a career transition, this could present an opportune time to realize capital gains. For instance, if your income drops you into the 0% long-term capital gains tax bracket, you could potentially sell appreciated assets without incurring any capital gains tax. This strategy requires careful planning and projection of your annual income.

Consider Charitable Giving

Donating appreciated assets to charity can create a win-win situation. While donating appreciated securities typically eliminates long-term capital gains exposure, you are limited to 30% of your adjusted gross income (AGI) for such donations. This strategy can potentially provide a tax deduction while avoiding capital gains tax on the appreciation.

These strategies offer powerful ways to minimize your capital gains tax burden. However, implementing them effectively often requires expert guidance. In the next section, we’ll explore more advanced tax planning techniques that can further optimize your financial strategy.

Advanced Tax Strategies for Savvy Investors

At Davies Wealth Management, we often encounter clients who seek more sophisticated methods to minimize their capital gains tax burden. These advanced strategies can offer significant tax advantages, but they require careful planning and execution. Let’s explore some powerful techniques that can elevate your tax planning.

Real Estate Investors: The Power of 1031 Exchanges

For real estate investors, 1031 exchanges provide a potent tool for deferring capital gains taxes. This strategy allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange. The IRS defines like-kind broadly for real estate, which offers flexibility in your investment choices.

A successful 1031 exchange requires strict adherence to IRS rules. You must identify potential replacement properties within 45 days of selling your relinquished property and complete the purchase within 180 days. Working with a qualified intermediary will ensure compliance and help you avoid costly mistakes.

Opportunity Zone Investments: Tax Benefits and Community Impact

Opportunity Zone investments offer a unique combination of tax benefits and potential for community development. You can defer tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a Qualified Opportunity Fund (QOF).

The tax advantages are substantial. You can defer capital gains tax on the invested amount until 2026, receive a 10% reduction in the deferred gain if held for five years, and potentially eliminate capital gains tax on the appreciation of your Opportunity Zone investment if held for at least 10 years.

Charitable Remainder Trusts: Philanthropy with Tax Advantages

For philanthropically inclined investors, Charitable Remainder Trusts (CRTs) offer a way to support causes you care about while potentially reducing your tax burden. With a CRT, you transfer appreciated assets into an irrevocable trust, which then provides you or your beneficiaries with an income stream for a specified period.

The tax benefits are twofold. First, you receive an immediate charitable deduction for the present value of the remainder interest that will eventually go to charity. Second, when you transfer appreciated assets into the CRT, you avoid paying immediate capital gains tax on the appreciation.

Leveraging Net Unrealized Appreciation for Company Stock

If you hold company stock in your employer-sponsored retirement plan, the Net Unrealized Appreciation (NUA) strategy could offer significant tax savings. This tax strategy, when applied to company stock, can help you effectively pay lower capital gains rates on a portion of your distribution.

You’ll pay ordinary income tax on the cost basis of the stock at distribution, but any appreciation (the NUA) will be taxed at the lower long-term capital gains rate when you sell the shares. This strategy can be particularly beneficial if your company stock has appreciated significantly.

These advanced strategies demonstrate the potential for substantial tax savings through careful planning. However, they also underscore the complexity of tax law and the importance of professional guidance. We specialize in tailoring these strategies to individual client situations (including professional athletes with unique financial challenges), ensuring you maximize your tax advantages while staying compliant with IRS regulations.

Final Thoughts

Capital gains tax reduction strategies can significantly impact your overall financial health. From basic approaches to advanced techniques, numerous methods exist to minimize your tax burden and maximize your wealth. The key to successful tax planning lies in understanding your unique financial situation and tailoring strategies accordingly.

Professional guidance proves invaluable when implementing these strategies, given the intricacies of tax law and potential consequences of missteps. At Davies Wealth Management, we create personalized tax planning strategies that align with your specific financial goals and circumstances. Our team of experts can help you navigate the complexities of capital gains tax, ensuring you make informed decisions that optimize your tax situation.

Effective tax planning requires an ongoing process, not a one-time event. As tax laws change and your financial situation evolves, your strategies should adapt accordingly. Working with experienced professionals allows you to develop a comprehensive approach to managing your capital gains tax liability, ultimately preserving more of your hard-earned wealth for the future.

Leave a Reply