Financial planning for high-net-worth individuals presents unique challenges and opportunities. At Davies Wealth Management, we understand the complexities that come with substantial wealth and the need for tailored strategies.

This blog post explores the key aspects of effective financial planning for high-net-worth clients, from managing complex asset structures to optimizing tax strategies and ensuring comprehensive estate planning.

What Challenges Do High-Net-Worth Individuals Face?

High-net-worth individuals (HNWIs) face a complex financial landscape filled with unique challenges. This chapter explores the key obstacles HNWIs must overcome to effectively manage and grow their wealth.

Complex Asset Structures

HNWIs typically own diverse portfolios that include traditional investments, real estate, private equity, and business interests. Managing these varied assets requires a sophisticated approach. Private equity accounts for 27% of high-net-worth families’ asset allocation to alternative investments. This diversification, while beneficial, adds layers of complexity to financial planning (requiring specialized knowledge and strategies).

Tax Implications and Optimization

Tax optimization stands as a critical concern for HNWIs. The top 1% of taxpayers (AGI of $682,577 and above) paid the highest average income tax rate of 25.93 percent. This statistic underscores the need for strategic tax planning. Effective techniques include tax-loss harvesting, charitable giving strategies, and the use of tax-advantaged accounts. For example, investments in Qualified Opportunity Zones can defer capital gains taxes while supporting community development (a win-win situation for HNWIs and local communities).

Estate Planning and Wealth Transfer

Estate planning for HNWIs extends far beyond basic wills. It involves intricate strategies to transfer wealth efficiently and minimize estate taxes. The current historically high federal estate and gift tax exemptions are set to “sunset” at the end of 2025, which will lead to a substantial increase in estate taxes. This impending change makes proactive estate planning essential. Strategies such as establishing irrevocable trusts or family limited partnerships can effectively preserve wealth across generations (ensuring a lasting financial legacy).

Risk Management for Substantial Assets

With great wealth comes greater risk exposure. HNWIs face unique risks, from market volatility to potential lawsuits. A comprehensive risk management strategy must address these concerns. This strategy might include umbrella insurance policies, which typically offer coverage of $1 million to $10 million. Professional athletes, who form a significant part of many wealth management clienteles, require specialized risk management strategies that account for their unique career trajectories and income patterns.

As we move forward, it’s clear that addressing these challenges requires a multifaceted approach. The next chapter will explore key strategies that HNWIs can employ to navigate these complexities and optimize their financial planning efforts.

Strategies for High-Net-Worth Financial Success

Diversifying with Alternative Investments

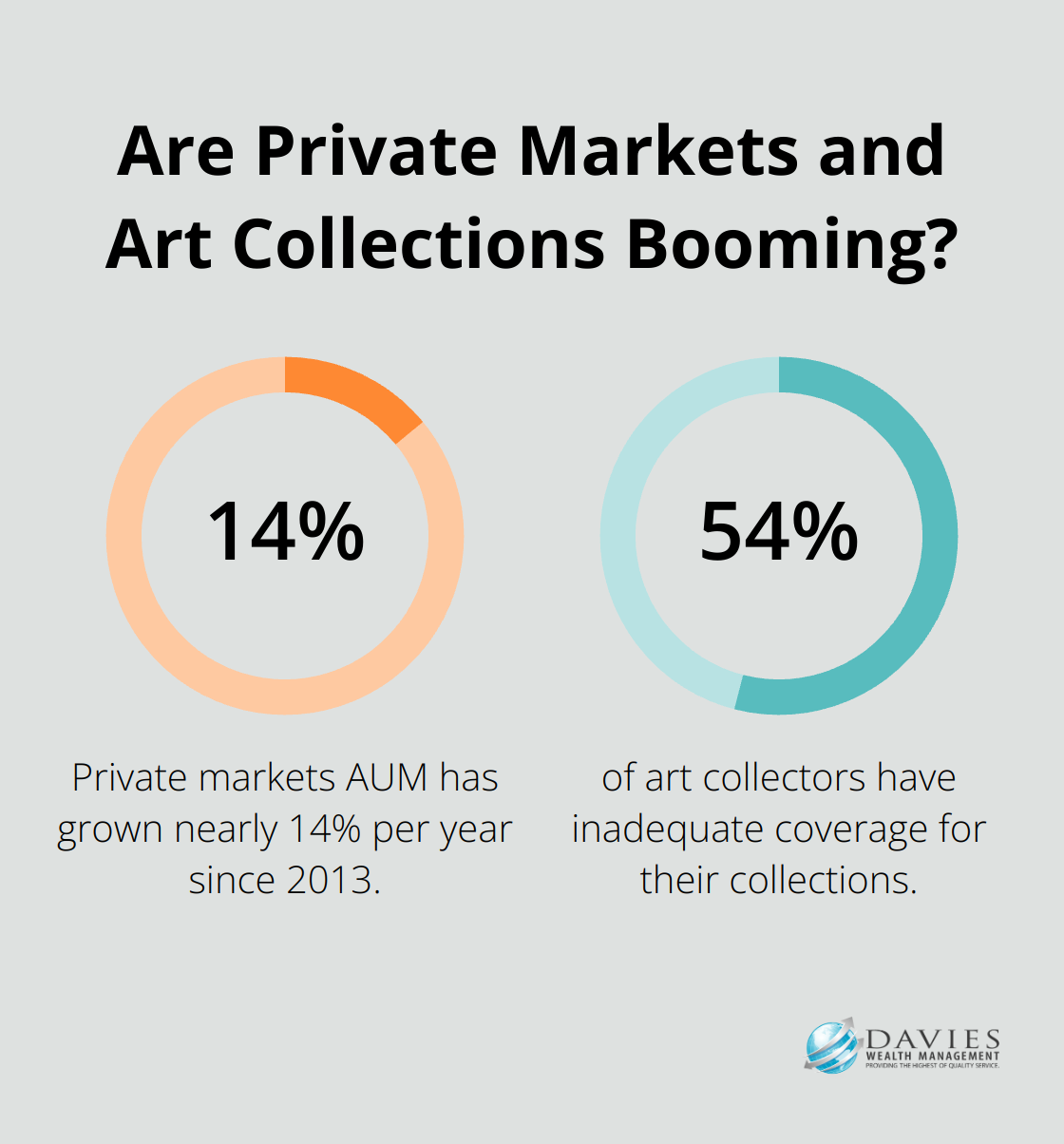

High-net-worth individuals benefit from expanding beyond traditional stocks and bonds. Private markets AUM has grown nearly 14% per year since 2013 as institutional investors steadily increase allocations to private asset classes. Real estate investment trusts (REITs) offer another avenue for diversification, providing both income and potential appreciation. For clients interested in sustainable investments, green bonds present an attractive option.

Maximizing Tax Efficiency

Advanced tax strategies preserve wealth for high-net-worth individuals. Charitable remainder trusts (CRTs) support philanthropic goals while providing immediate tax deductions, the size of which is influenced by the IRS Section. For clients with significant unrealized gains, a systematic tax-loss harvesting strategy can save up to 1.5% annually in taxes (based on research by Vanguard).

Comprehensive Estate Planning

Estate planning for high-net-worth individuals extends beyond basic wills and trusts. Advanced techniques such as grantor retained annuity trusts (GRATs) and intentionally defective grantor trusts (IDGTs) can significantly reduce estate tax liabilities while efficiently transferring wealth to future generations. Selling assets to an IDGT can potentially reduce your taxable estate and provide long-term benefits for your family.

Sophisticated Risk Management

High-net-worth individuals face unique risks that require tailored insurance solutions. Umbrella policies with coverage limits of $5 million to $10 million protect against potential lawsuits. For clients with significant art collections, specialized fine art insurance proves essential. AXA XL reports that 54% of art collectors have inadequate coverage for their collections, highlighting the importance of proper valuation and insurance.

Personalized Approach to Wealth Management

Each high-net-worth client has unique needs and goals. Financial experts work closely with clients to implement these strategies in alignment with individual financial objectives. Professional athletes looking to secure their financial future beyond playing years or business owners planning for succession require tailored expertise to navigate complex financial decisions.

The implementation of these strategies requires ongoing monitoring and adjustment. As we move forward, we’ll explore the importance of partnering with financial professionals to ensure the long-term success of your wealth management plan.

Why Partner with Financial Professionals?

The Power of a Specialized Team

High-net-worth individuals face unique challenges that extend beyond basic financial planning. A specialized wealth management team brings together experts in various fields, each contributing their specific knowledge to create a comprehensive financial strategy. For instance, a tax specialist can identify opportunities to minimize tax liabilities, while an estate planning attorney can structure trusts and other vehicles for efficient wealth preservation.

Roles of Key Financial Experts

Different financial experts play crucial roles in managing high-net-worth portfolios. Investment managers focus on asset allocation and portfolio construction, often accessing exclusive investment opportunities not available to retail investors.

Tax strategists prove invaluable in navigating the complex tax landscape. They implement strategies like tax-loss harvesting. Estate planning attorneys create robust succession plans and minimize estate taxes. With the federal estate tax exemption set to decrease in 2026, proactive planning with these experts becomes more critical than ever.

Tailored Services for High-Net-Worth Clients

Each high-net-worth client has unique needs and goals. Financial professionals create customized strategies that align with individual financial objectives. For professional athletes, who form a significant part of many wealth management clienteles, specialized plans account for their unique career trajectories and income patterns.

Advanced financial planning tools and analytics provide data-driven insights and recommendations. This technology-enhanced approach offers more precise and effective financial strategies, ensuring that clients’ wealth receives management with the utmost care and expertise.

Building Long-Term Financial Partnerships

The most effective financial planning relationships rely on trust and long-term collaboration. This longevity allows advisors to deeply understand their clients’ evolving needs and adjust strategies accordingly.

Regular communication and ongoing education form key components of these long-term relationships. Financial professionals prioritize keeping their clients informed about market trends, regulatory changes, and new financial opportunities. This proactive approach ensures that clients always remain well-positioned to make informed decisions about their wealth.

Final Thoughts

Financial planning for high-net-worth individuals demands a sophisticated, multifaceted approach. We explored unique challenges faced by wealthy clients, from complex asset structures to tax optimization and estate planning. The strategies we discussed form the foundation of effective wealth management for high-net-worth individuals (including diversification through alternative investments, advanced tax planning techniques, and comprehensive risk management).

A personalized approach is essential in high-net-worth financial planning. Each client’s financial situation, goals, and risk tolerance require tailored strategies that align with their specific needs. This personalization extends beyond investment choices to encompass tax planning, estate management, and risk mitigation.

At Davies Wealth Management, we provide comprehensive financial planning services for high-net-worth individuals. Our team understands the intricacies of managing substantial wealth and offers personalized solutions to help clients achieve their financial goals. Visit Davies Wealth Management to learn how we can help you master your financial planning journey and secure your long-term financial success.

Leave a Reply