At Davies Wealth Management, we’ve seen a growing interest in responsible investment strategies among our clients. This approach aligns financial goals with positive environmental and social impacts, creating a win-win situation for investors and society.

Implementing these strategies requires a thoughtful and structured approach. In this post, we’ll guide you through the process of developing and executing responsible investment practices that can enhance your portfolio’s performance while contributing to a more sustainable future.

What Is Responsible Investment?

The Essence of Responsible Investing

Responsible investment is a strategy that considers environmental, social, and governance (ESG) factors alongside financial metrics when making investment decisions. This approach recognizes the importance of sustainability and ethical practices in long-term value creation.

The foundation of responsible investing rests on the belief that companies addressing ESG issues position themselves better for long-term success. This strategy expands beyond traditional financial analysis, incorporating factors such as a company’s carbon footprint, labor practices, and board diversity into investment decisions.

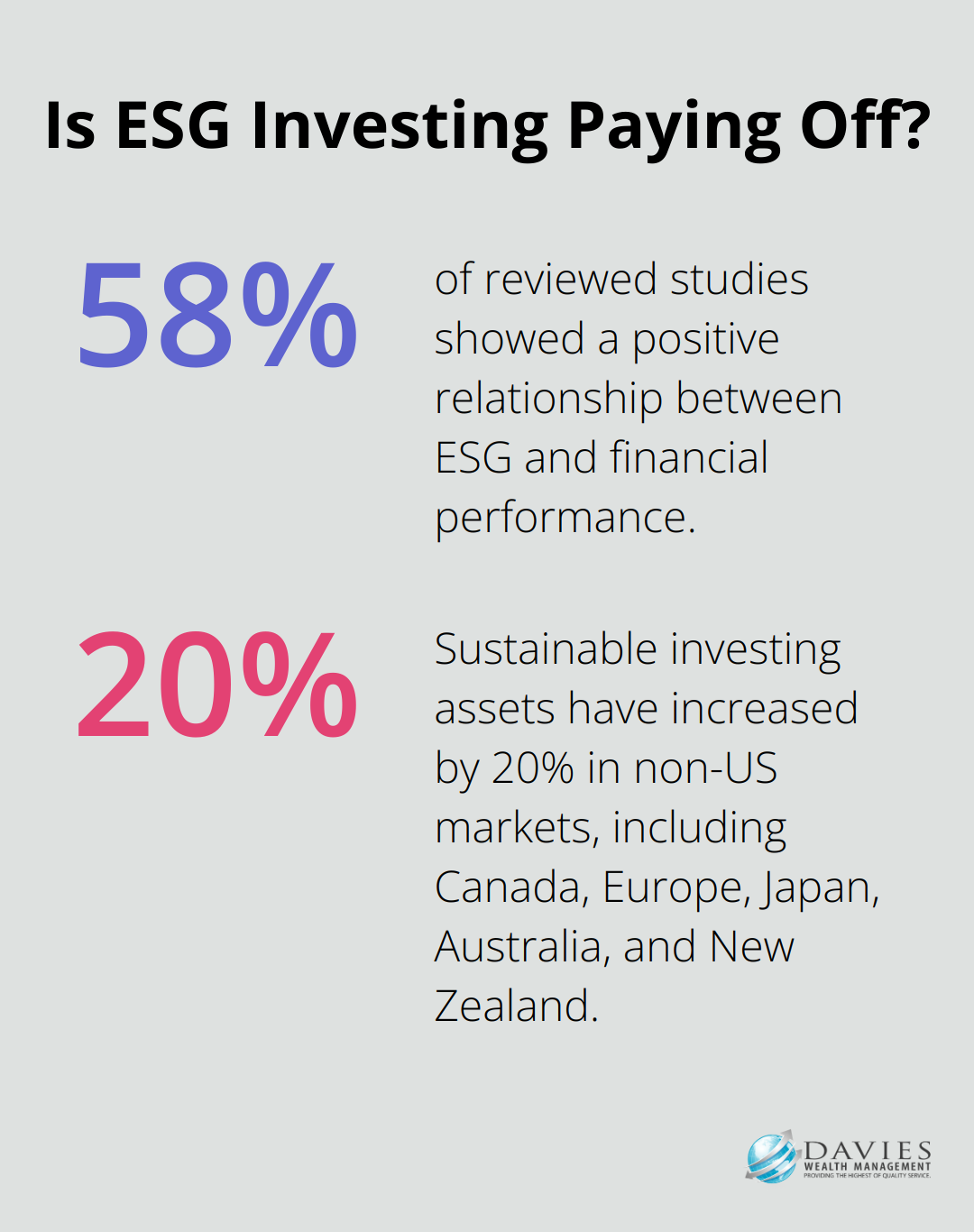

A 2020 study by NYU Stern Center for Sustainable Business revealed that 58% of reviewed studies showed a positive relationship between ESG and financial performance. This data supports the notion that responsible investing can lead to better risk-adjusted returns over time.

Key Strategies in Responsible Investing

Investors can implement responsible investment strategies through several methods:

- ESG Integration: This method systematically includes ESG factors in financial analysis. For example, when evaluating an energy company, an investor might consider its investments in renewable technologies alongside traditional financial metrics.

- Exclusionary Screening: This strategy avoids investments in companies or sectors that don’t align with an investor’s values. Common exclusions include tobacco, weapons, and fossil fuels.

- Impact Investing: This approach seeks to generate measurable social or environmental benefits alongside financial returns. For instance, investing in companies that develop clean water technologies for developing countries exemplifies this strategy.

The Ripple Effect of Responsible Investing

Responsible investing creates a positive feedback loop. As more capital flows into companies with strong ESG practices, it incentivizes other businesses to improve their own practices. This can lead to broader positive changes in corporate behavior and societal outcomes.

A report by the Global Sustainable Investment Alliance showed that sustainable investing assets have increased by 20% in non-US markets, including Canada, Europe, Japan, Australia, and New Zealand. This growth demonstrates the increasing influence responsible investors can have on corporate practices and global issues.

The Growing Influence of Responsible Investing

The shift towards responsible investing continues to gain momentum. Investors increasingly recognize the potential for enhanced portfolio performance while contributing to positive societal and environmental outcomes. As this field evolves, staying informed about emerging trends and best practices in responsible investing will prove essential for maximizing both financial returns and positive impact.

This growing trend sets the stage for the next critical step: developing a robust responsible investment framework. Let’s explore how to create a structured approach that aligns with your values and financial goals.

Building Your Responsible Investment Framework

At Davies Wealth Management, we have developed a systematic approach to create a robust responsible investment framework. This process involves several key steps that can help you align your investments with your values while potentially enhancing long-term returns.

Evaluating Your Current Portfolio

The first step in building a responsible investment framework is to thoroughly assess your existing investments. This involves an analysis of each holding through an ESG lens. You might examine the carbon footprint of companies in your portfolio, their labor practices, or their board diversity.

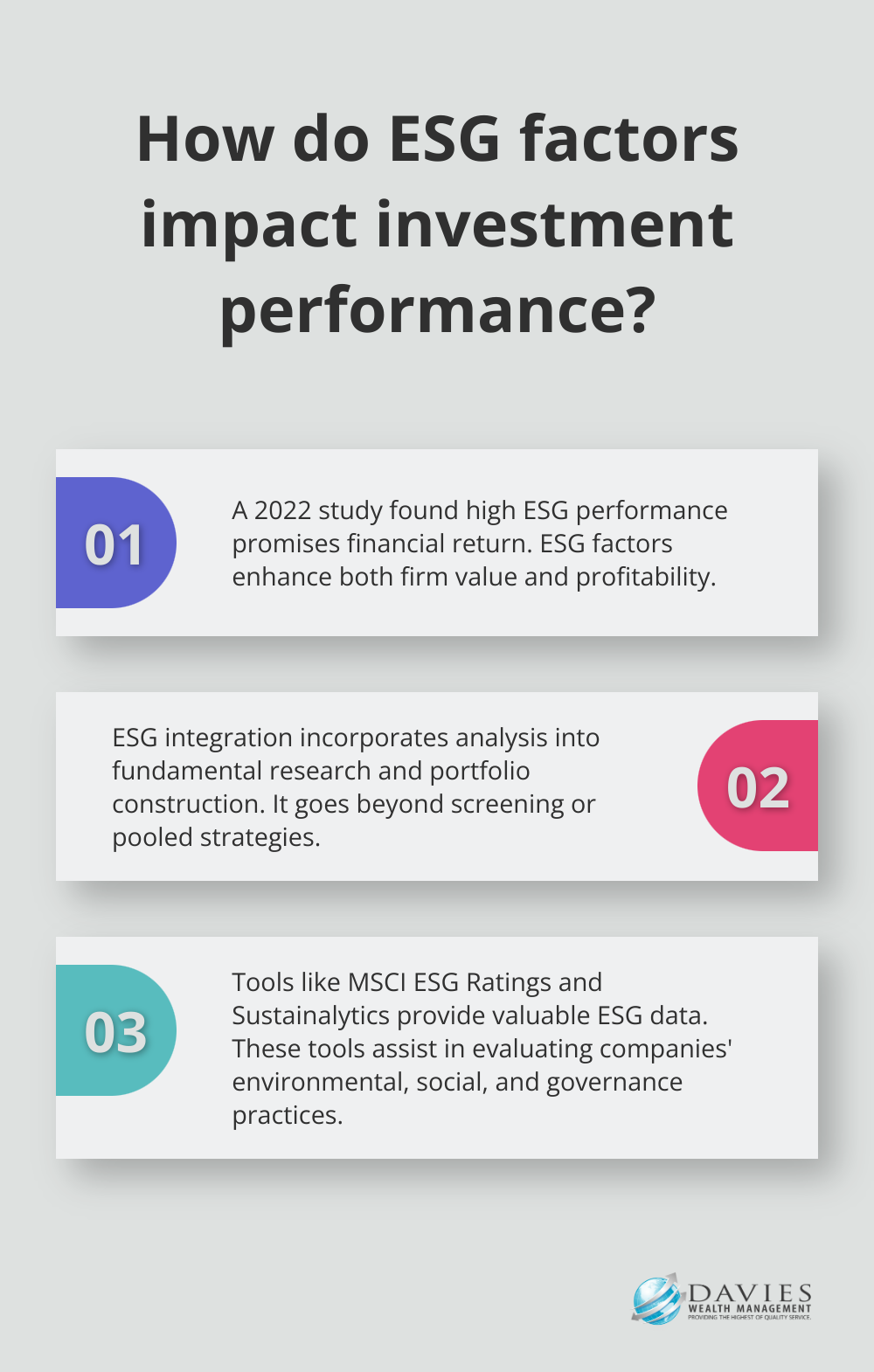

A 2022 study found that investing in high ESG performance promises financial return for firms in terms of both value and profitability. This underscores the importance of ESG considerations in portfolio construction.

Defining Your ESG Priorities

Next, it’s important to clearly define your ESG priorities. These will vary based on your personal values and financial goals. For instance, you might prioritize climate change mitigation, social justice, or corporate governance.

Understanding your priorities will guide your investment decisions and help you measure progress.

Incorporating ESG Factors into Analysis

Once you identify your priorities, the next step is to integrate ESG factors into your investment analysis. This involves looking beyond traditional financial metrics to consider a company’s environmental impact, social responsibility, and governance practices.

ESG integration incorporates ESG analysis into fundamental research and portfolio construction beyond screening or pooled strategies. For example, when you evaluate a tech company, you might consider its data privacy policies, energy efficiency measures, and diversity in leadership positions (alongside its financial performance). Tools like MSCI ESG Ratings or Sustainalytics can provide valuable data for this analysis.

Crafting Your Responsible Investment Policy

The final step is to formalize your approach by creating a responsible investment policy. This document should outline your ESG priorities, investment strategies, and criteria for selecting and monitoring investments.

Your policy might include specific targets, such as allocating a certain percentage of your portfolio to renewable energy companies or excluding investments in industries that don’t align with your values. It should also detail how you’ll engage with companies to promote positive change.

With a solid responsible investment framework in place, you’re ready to move on to the next phase: implementing specific responsible investment strategies. These strategies will allow you to put your framework into action and make meaningful progress towards your ESG goals.

Implementing Responsible Investment Strategies

Screening for Alignment

At Davies Wealth Management, we use effective methods to implement responsible investment principles. These approaches allow investors to align their portfolios with their values while potentially enhancing long-term returns.

One effective method is screening, which filters investments based on specific ESG criteria. Negative screening excludes companies or sectors that don’t meet certain standards based on environmental, social, and governance (ESG) factors.

Positive screening actively seeks out companies that demonstrate strong ESG performance. This best-in-class approach identifies industry leaders in sustainability and responsible business practices. For instance, an investor might focus on companies with robust renewable energy initiatives or those with diverse leadership teams.

ESG Integration in Investment Decisions

ESG integration incorporates environmental, social, and governance factors directly into financial analysis and investment decision-making. This approach recognizes that ESG issues can have material impacts on a company’s financial performance and risk profile.

For example, when evaluating a manufacturing company, an investor might consider its water management practices, workplace safety record, and board independence alongside traditional financial metrics. Tools like Bloomberg’s ESG Data Service or MSCI ESG Ratings provide valuable insights for this analysis.

Active Ownership for Change

Active ownership is a powerful strategy that uses shareholder rights to influence company behavior. This can include voting on shareholder resolutions, engaging in dialogue with company management, and collaborating with other investors to advocate for ESG improvements.

For instance, ShareAction, a non-profit organization, has lobbied one company to ensure employees receive a minimum wage and a food company to address certain issues.

Continuous Evaluation and Adjustment

Implementing these responsible investment strategies requires careful consideration and ongoing monitoring. It’s important to regularly review and adjust your approach based on changing market conditions and evolving ESG issues. You can work towards achieving your financial goals while contributing to positive societal and environmental outcomes through a proactive and thoughtful approach to responsible investing.

Final Thoughts

Responsible investment strategies require careful planning, execution, and ongoing evaluation. We at Davies Wealth Management guide our clients through this process, helping them align investments with values while potentially enhancing long-term returns. The steps we outlined form a solid foundation for investors who want to make a positive impact while pursuing financial goals.

The ESG landscape constantly evolves, with new issues emerging and best practices developing. Regular evaluation and adjustment of your approach ensure your investments continue to align with your values and financial objectives. This ongoing process contributes to positive societal and environmental outcomes, creating a ripple effect that addresses global challenges.

Davies Wealth Management commits to helping our clients navigate the complexities of responsible investing. Our team provides expertise and personalized guidance to implement effective responsible investment strategies (whether you’re starting your journey or refining your existing approach). You invest not just for your future, but in a better future for all.

Leave a Reply