At Davies Wealth Management, we understand the importance of optimizing your IRA investment strategies for a secure financial future. Individual Retirement Accounts (IRAs) offer powerful tax advantages and growth potential, but navigating the various options can be challenging.

In this post, we’ll explore effective ways to maximize your IRA investments, from choosing the right account type to developing a robust investment strategy. Whether you’re just starting out or looking to fine-tune your existing IRA, these insights will help you make informed decisions for your retirement savings.

Understanding IRA Types and Their Benefits

Traditional vs. Roth IRA: A Tax Timing Decision

Individual Retirement Accounts (IRAs) offer various options, each with unique benefits tailored to different financial situations. The choice between a Traditional and Roth IRA often hinges on when you prefer to pay taxes. Roth IRA contributions are taxed as regular income in the year you contribute, meaning they are not tax-deductible. However, you can withdraw your contributions (but not earnings) tax-free at any time.

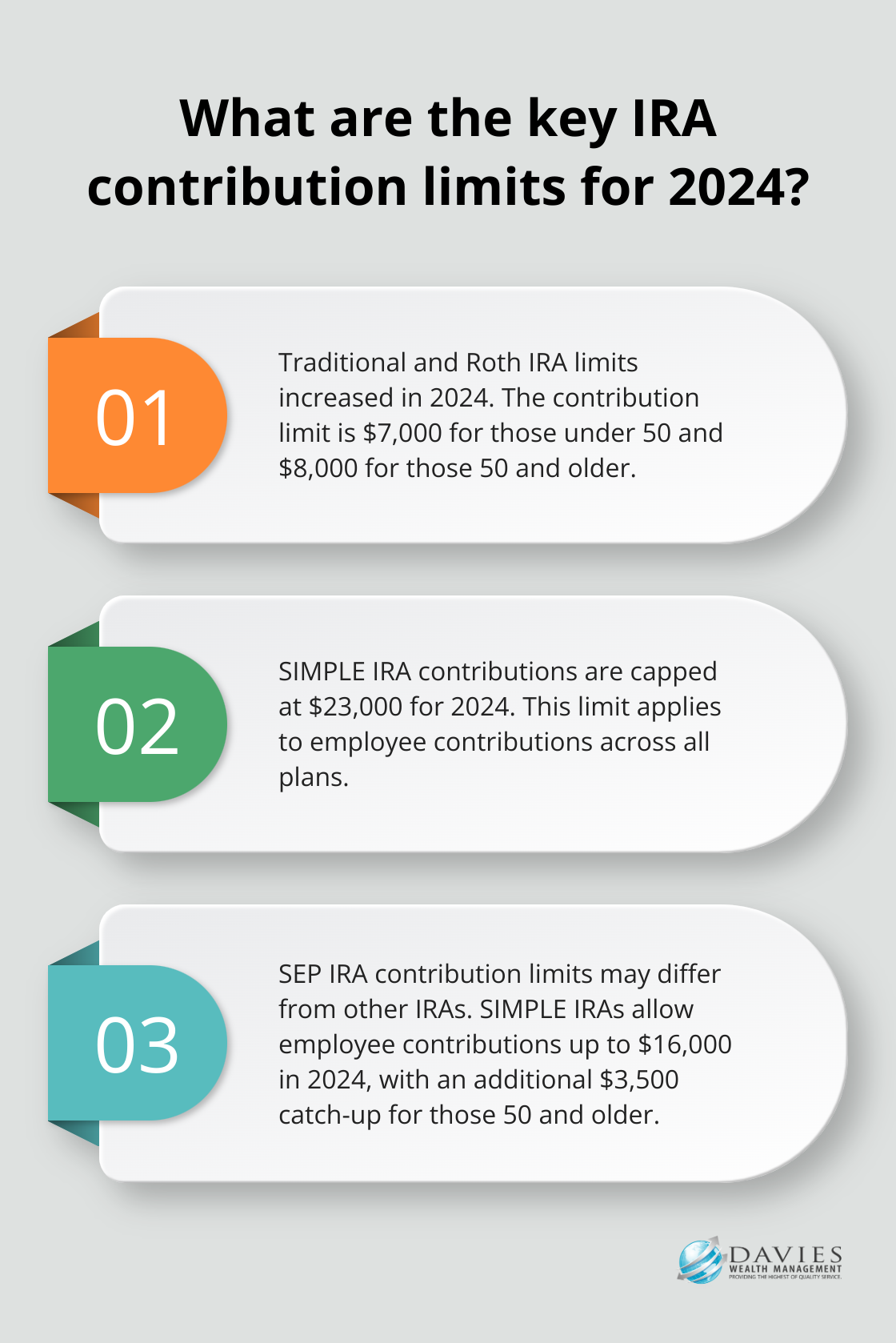

For 2024, the contribution limit for both Traditional and Roth IRAs stands at $7,000 for those under 50, and $8,000 for those 50 and older (a $1,000 increase from 2023). This increase presents an excellent opportunity to boost your retirement savings.

Self-Employed Options: SEP and SIMPLE IRAs

Self-employed individuals have additional IRA options at their disposal. SEP IRAs allow contributions, but the limits may differ from what was previously stated. SIMPLE IRA contributions are limited to $23,000 in 2024 for employee contributions across all plans. SIMPLE IRAs, ideal for small businesses, permit employee contributions up to $16,000 in 2024, with an additional $3,500 catch-up contribution for those 50 and older.

Maximizing Tax Advantages

Each IRA type offers distinct tax benefits. Traditional IRAs can lower your current taxable income, potentially placing you in a lower tax bracket. Roth IRAs, while not offering immediate tax benefits, provide tax-free growth and withdrawals, which can prove particularly advantageous if you expect to be in a higher tax bracket in retirement.

For high-income earners facing contribution limits, a backdoor Roth IRA strategy might merit consideration. This strategy allows taxpayers to set up a Roth IRA retirement fund even if their income exceeds the IRS earnings ceiling for Roth contributions.

Tailoring IRA Strategies to Individual Needs

The optimal IRA for you depends on your unique financial situation, including your current and expected future tax brackets, retirement timeline, and overall financial goals. It’s important to reassess your IRA strategy regularly as your circumstances change.

For instance, professional athletes (with high but potentially short-term income) might benefit from a combination of Traditional and Roth IRAs to optimize their tax situation both now and in the future. This approach allows for tax diversification, providing flexibility in retirement income planning.

As we move forward, let’s explore how to develop a robust IRA investment strategy that aligns with your specific financial goals and risk tolerance.

Building Your IRA Investment Strategy

Assessing Your Risk Tolerance and Time Horizon

Your IRA investment strategy should align with your personal financial situation and goals. At different life stages, your approach to investing will need to adapt. Younger investors often benefit from a more aggressive strategy that focuses on growth stocks and emerging markets, potentially yielding higher returns over time. As retirement approaches, a gradual shift towards more conservative investments (such as bonds and dividend-paying stocks) can help protect your accumulated wealth.

A Vanguard study demonstrated that investors who maintained a balanced portfolio of global stocks saw an average nominal annual return of 8.1% for the period from 1901 through 2022. This underscores the importance of finding the right balance between growth potential and stability in your IRA investments.

Diversification: Mitigating Risk in Your Portfolio

Diversification serves as a proven strategy to manage risk in your IRA. By spreading investments across various asset classes, you can potentially reduce the impact of market volatility on your portfolio.

A well-diversified IRA might include a mix of:

- Large-cap and small-cap stocks

- International and emerging market equities

- Government and corporate bonds

- Real estate investment trusts (REITs)

- Commodities or precious metals

The specific allocation depends on your risk tolerance and investment timeline. A Morningstar study found that recent diversification and performance benefits of non-US stocks have been muted, but that trend may not persist.

Maximizing Tax Efficiency in Your IRA

Tax efficiency often goes overlooked in IRA optimization. Strategic placement of certain investments in your IRA can maximize tax benefits. For example, holding high-yield bonds or REITs in a traditional IRA can shield their income from immediate taxation.

Roth IRA holders should consider investments with high growth potential. Since withdrawals from Roth IRAs are tax-free in retirement, the tax-free growth can significantly boost long-term returns.

Tailoring Strategies for Professional Athletes

Professional athletes face unique financial challenges, including short career spans and fluctuating income. A specialized IRA strategy for athletes might involve a combination of aggressive growth investments during peak earning years and a gradual transition to more conservative options as retirement from sports approaches.

As we move forward, let’s explore how to maximize your IRA contributions and leverage tax benefits to further enhance your retirement savings strategy.

How to Maximize IRA Contributions and Tax Benefits

Catch-Up Contributions: A Boost for Late Savers

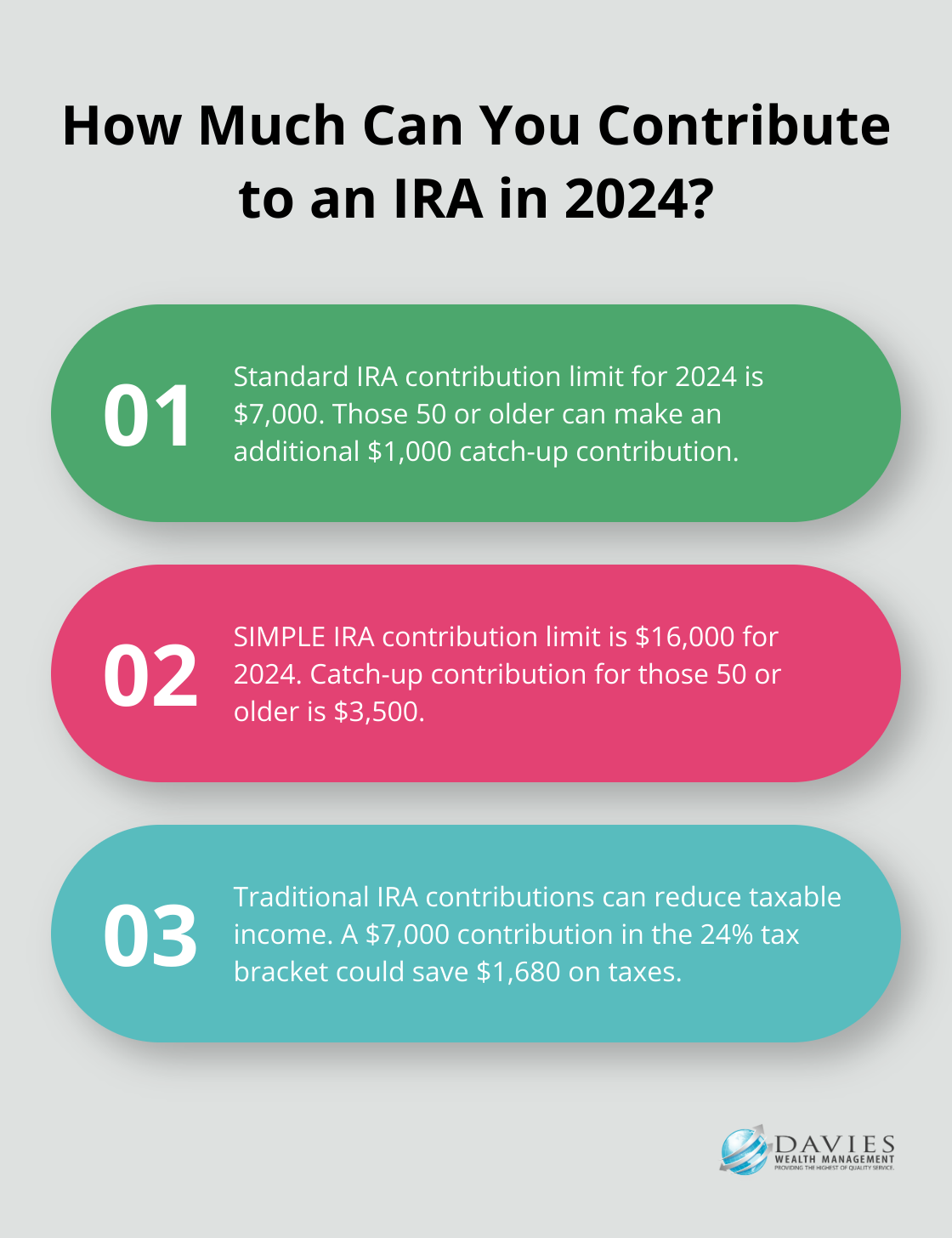

If you’re 50 or older, you can take advantage of catch-up contributions. For 2024, you can contribute an additional $1,000 on top of the standard $7,000 limit for Traditional and Roth IRAs. This means you can put away $8,000 annually. For those with a SIMPLE IRA, the catch-up contribution is $3,500, allowing a total contribution of $19,500 in 2024.

These extra contributions can significantly impact your retirement savings. An additional $1,000 per year from age 50 to 65, assuming a 7% annual return, could add over $27,000 to your retirement nest egg (potentially transforming your retirement lifestyle).

Leveraging Tax-Deferred Growth

The power of tax-deferred growth in Traditional IRAs is substantial. Every dollar you contribute reduces your taxable income for the year, potentially lowering your tax bracket. Your investments grow tax-free until withdrawal.

For example, if you’re in the 24% tax bracket and contribute $7,000 to a Traditional IRA, you could save $1,680 on your taxes this year. You can reinvest this money or use it to increase your contribution.

High-income earners facing contribution limits can consider the backdoor Roth IRA strategy in 2024. This involves making a non-deductible contribution to a Traditional IRA and then converting it to a Roth IRA. While you’ll pay taxes on any gains during the conversion, future growth and withdrawals will be tax-free.

Roth IRA Conversion: Strategic Timing

Roth IRA conversions can be a powerful tool, but timing is key. You could pay a lower tax rate now if you convert savings into a Roth IRA, but there could be more complex issues for you to consider.

For professional athletes, who often have high-income years followed by lower-income periods, strategic Roth conversions can be particularly beneficial. Many financial advisors, including those at Davies Wealth Management, help athletes time their conversions to minimize tax impact and maximize long-term benefits.

There’s no limit on how much you can convert from a Traditional to a Roth IRA. However, the entire converted amount is added to your taxable income for the year. Plan carefully to avoid pushing yourself into a higher tax bracket.

Regular Review and Adaptation

The landscape of retirement planning changes constantly. You should stay informed and adaptable. Regular reviews of your IRA strategy, ideally with a financial advisor, can ensure you’re making the most of available opportunities and navigating potential pitfalls.

Final Thoughts

Optimizing IRA investment strategies requires a deep understanding of various account types and their benefits. You must develop a robust investment approach that balances risk and reward while considering your unique circumstances. Regular portfolio reviews and rebalancing will help you adapt to changing market conditions and life events.

Maximizing contributions and leveraging tax benefits can significantly boost your retirement savings. Catch-up contributions, strategic Roth conversions, and tax-efficient investment placement are powerful tools to enhance your IRA’s growth potential. These complex strategies often require expert guidance to navigate effectively.

Davies Wealth Management specializes in helping individuals optimize their IRA investment strategies. Our team understands the unique financial challenges you may face and provides personalized advice tailored to your specific needs. Contact us today to start working towards a secure and comfortable retirement with confidence.

Leave a Reply