Real estate investing can be a powerful wealth-building strategy, but it’s essential to understand the tax implications. At Davies Wealth Management, we’ve seen how tax-efficient investing for high earners can significantly impact returns in the real estate market.

This blog post will explore key strategies to minimize your tax burden while maximizing your real estate investment profits. From leveraging depreciation to utilizing advanced tax-saving techniques, we’ll provide practical tips to help you optimize your real estate portfolio’s tax efficiency.

How Real Estate Investors Can Maximize Tax Benefits

Real estate investing offers numerous tax advantages that can significantly boost returns. Let’s explore key strategies to maximize tax efficiency in real estate investing.

The Power of Depreciation

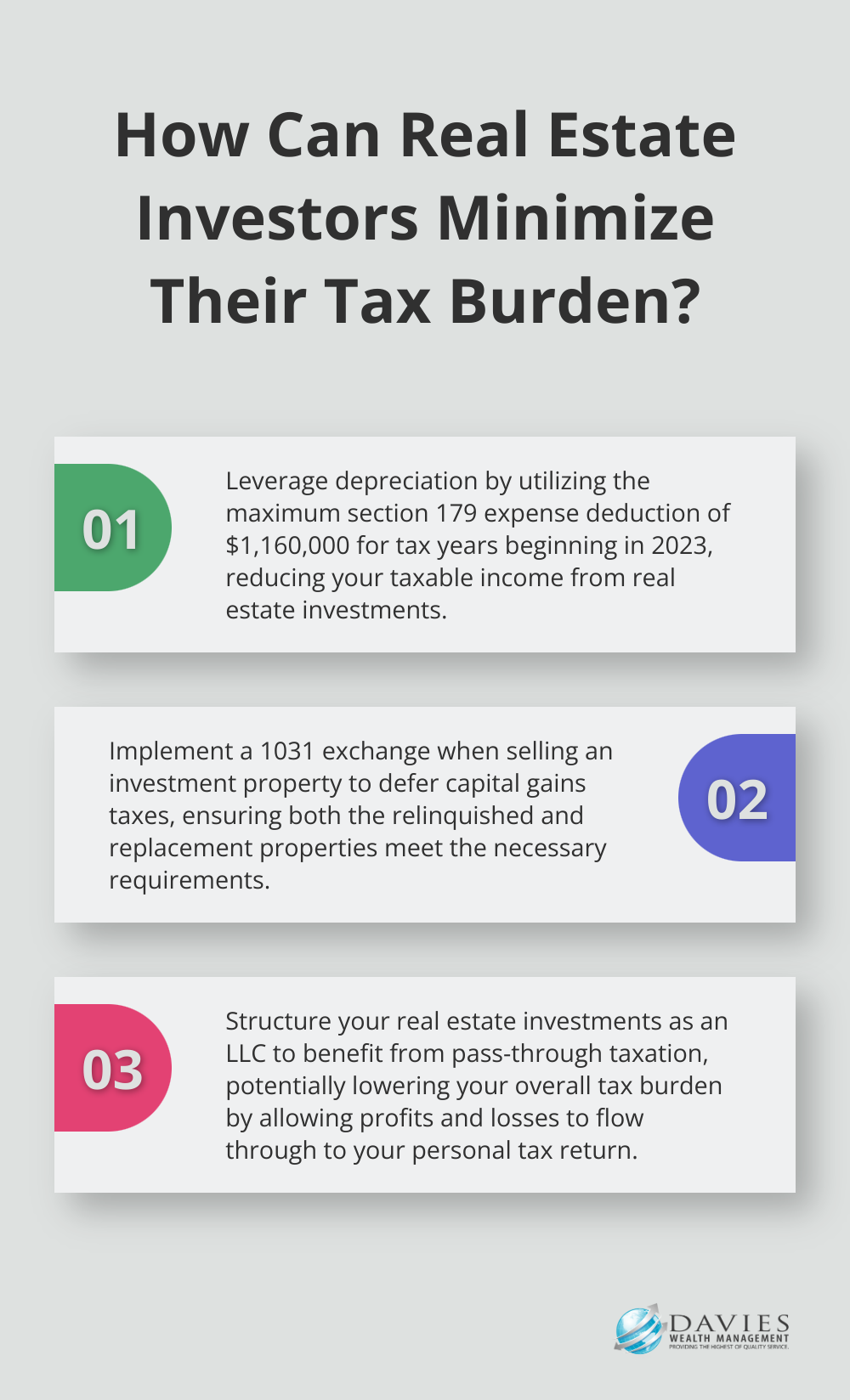

Depreciation serves as a powerful tool for real estate investors. For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. This limit is reduced by the amount by which the cost of section 179 property placed in service exceeds $2,890,000.

Tax Deferral with 1031 Exchanges

A 1031 exchange allows you to defer capital gains taxes when selling an investment property. Both the relinquished property you sell and the replacement property you buy must meet certain requirements.

Tax Advantages of Opportunity Zones

Opportunity Zones offer significant tax benefits for real estate investors. You can support economic development in Qualified Opportunity Zones and temporarily defer tax on eligible gains when you invest in a Qualified Opportunity Fund.

However, you must thoroughly evaluate Opportunity Zone projects. While the tax benefits are substantial, the underlying investment must still be sound. Professional guidance can help assess these opportunities to ensure they align with your overall investment strategy and risk tolerance.

Structuring Investments for Tax Efficiency

The way you structure your real estate investments can significantly impact your tax liability. Different business entities (such as LLCs or S-Corporations) offer various tax advantages. For example, an LLC can provide pass-through taxation, where profits and losses flow through to your personal tax return, potentially lowering your overall tax burden.

Self-directed IRAs present another avenue for tax-efficient real estate investing. These accounts allow you to invest in real estate while enjoying the tax benefits of traditional or Roth IRAs. However, strict rules govern these investments, and professional guidance is often necessary to navigate them successfully.

As we move forward, we’ll explore more advanced tax strategies that can further optimize your real estate investment portfolio. These techniques require careful planning and execution but can yield substantial benefits for savvy investors.

How to Structure Real Estate Investments for Tax Efficiency

Choosing the Right Business Entity

The choice of business entity for your real estate investments can significantly reduce your tax burden and boost overall returns. Limited Liability Companies (LLCs) are popular among real estate investors due to their flexibility and pass-through taxation. From pass-through taxation that avoids double taxation to management flexibility, an LLC can enhance the profitability and protection of your real estate investments.

S-Corporations offer another viable option, especially for larger real estate portfolios. They provide similar pass-through taxation benefits as LLCs but can offer additional tax savings on self-employment taxes for active real estate professionals.

It’s important to reassess your business structure annually to ensure it still aligns with your investment goals and tax situation. The optimal business structure can change as your real estate portfolio grows.

Leveraging Self-Directed IRAs

Self-directed IRAs present a powerful tool for tax-efficient real estate investing. These accounts allow you to invest in real estate while enjoying the tax benefits of traditional or Roth IRAs. With a self-directed IRA, you can potentially defer taxes on rental income and capital gains until retirement.

However, you must navigate the strict rules governing these investments carefully. Prohibited transactions can lead to severe tax consequences. For example, you cannot use your self-directed IRA to sell, exchange, or lease property you already own to your IRA as an investment.

Exploring Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) offer another avenue for tax-efficient real estate investing. By law, REITs must distribute at least 90% of their taxable income to shareholders. This means most dividends investors receive are taxed as ordinary income at their marginal tax rate.

Moreover, REITs offer a way to invest in real estate without the complexities of direct property ownership. This can benefit investors who want exposure to real estate but lack the time or expertise to manage properties directly.

When considering REITs, it’s important to distinguish between publicly traded REITs (which offer high liquidity but can be subject to stock market volatility) and private REITs (which may offer higher returns but come with less liquidity and potentially higher fees).

As we move forward, we’ll explore advanced tax strategies that can further optimize your real estate investment portfolio. These techniques require careful planning and execution but can yield substantial benefits for savvy investors.

Advanced Tax Strategies for Real Estate Investors

Real estate investing offers numerous tax advantages, but investors can take their tax efficiency to the next level with advanced strategies. Let’s explore some sophisticated techniques that can significantly boost after-tax returns.

Accelerating Depreciation with Cost Segregation Studies

Cost segregation is a strategic tax planning tool that allows investors in real estate to maximize their depreciation deductions. This strategy breaks down a property into its component parts and assigns shorter depreciation schedules to certain elements. While the building structure might depreciate over 27.5 or 39 years, components like carpeting, fixtures, or landscaping can often depreciate over 5, 7, or 15 years.

Investors must work with qualified professionals to ensure compliance with IRS guidelines. The potential savings are substantial, but the complexity of this strategy requires expert guidance.

Tax-Loss Harvesting in Real Estate

Tax-loss harvesting lowers current federal taxes by deliberately incurring capital losses to offset taxes owed on capital gains or personal income. Real estate investors can use this strategy to offset gains and reduce their overall tax burden. The key is to strategically realize losses on underperforming properties to offset gains from more successful investments.

For example, if you have a property that has decreased in value, you might consider selling it to realize the loss. This loss can then offset gains from other property sales or even offset up to $3,000 of ordinary income per year. Any unused losses can carry forward to future tax years, providing ongoing tax benefits.

However, investors should be aware of the wash-sale rule, which prohibits claiming a loss on a sale if you repurchase a substantially identical property within 30 days before or after the sale. This rule is less straightforward with real estate than with securities, so professional guidance is essential.

Maximizing Home Office Deductions for Property Management

For real estate investors who manage their properties from home, the home office deduction can offer significant tax savings. The IRS allows you to deduct a portion of your home expenses if you use part of your home exclusively and regularly for your real estate business.

You can choose between two methods for calculating this deduction:

- The simplified method allows you to deduct $5 per square foot of your home office (up to 300 square feet).

- The regular method involves computing the business use of home deduction by dividing expenses of operating the home between personal and business use.

While the simplified method is easier, the regular method often results in a larger deduction, especially for those with larger home offices or higher home-related expenses.

To maximize this deduction, maintain meticulous records of your home office use and related expenses. Consider setting up a dedicated space that’s used solely for your real estate business to ensure you meet the IRS’s exclusive use requirement.

These advanced strategies can significantly reduce your tax burden and increase your real estate investment returns. However, they require careful planning and execution. Professional guidance can help you navigate these complex tax strategies to optimize your portfolio while ensuring compliance with all relevant tax laws and regulations.

Final Thoughts

Tax-efficient real estate investing builds wealth and minimizes tax liabilities. We explored strategies from depreciation and 1031 exchanges to Opportunity Zones and cost segregation studies. Structuring investments through LLCs or S-Corporations provides significant tax advantages, while self-directed IRAs and REITs offer additional avenues for tax-efficient investing for high earners.

These strategies require careful planning and execution. Tax laws evolve constantly, and today’s effective methods may not work tomorrow. Consulting with tax professionals proves essential to navigate the intricacies of real estate tax strategies.

The long-term benefits of tax-efficient real estate investing are substantial. Minimizing your tax burden allows you to reinvest more profits, compound wealth faster, and potentially achieve financial goals sooner. With the right strategies and professional guidance, you can turn real estate into a powerful tool for building and preserving wealth over the long term.

Leave a Reply