Retirement planning is a cornerstone of financial well-being, yet many people struggle to navigate its complexities. At Davies Wealth Management, we’ve seen firsthand how proper planning can make the difference between a comfortable retirement and financial stress.

This guide will walk you through the essential components of a successful retirement strategy, helping you avoid common pitfalls and maximize your savings potential. We’ll explore practical techniques to optimize your retirement savings and secure your financial future.

Why Start Planning for Retirement Now?

The Power of Time

Planning for retirement isn’t just about saving money; it’s about securing your future. Starting early gives you a massive advantage. If you begin to save $500 monthly at age 25, assuming a 7% annual return, you could have over $1 million by age 65. If you wait until 35, you’d need to save nearly twice as much monthly to reach the same goal. This stark difference illustrates why it’s essential to start as soon as possible.

Compound Interest: Your Secret Weapon

Compound interest acts as the engine that drives long-term wealth accumulation. It’s not just about the money you save, but the interest earned on that interest over time. For example, a one-time investment of $10,000 at age 20, left to grow at 7% annually, could become over $200,000 by age 65 without adding another penny. This growth potential underscores the importance of starting early.

Avoiding Common Pitfalls

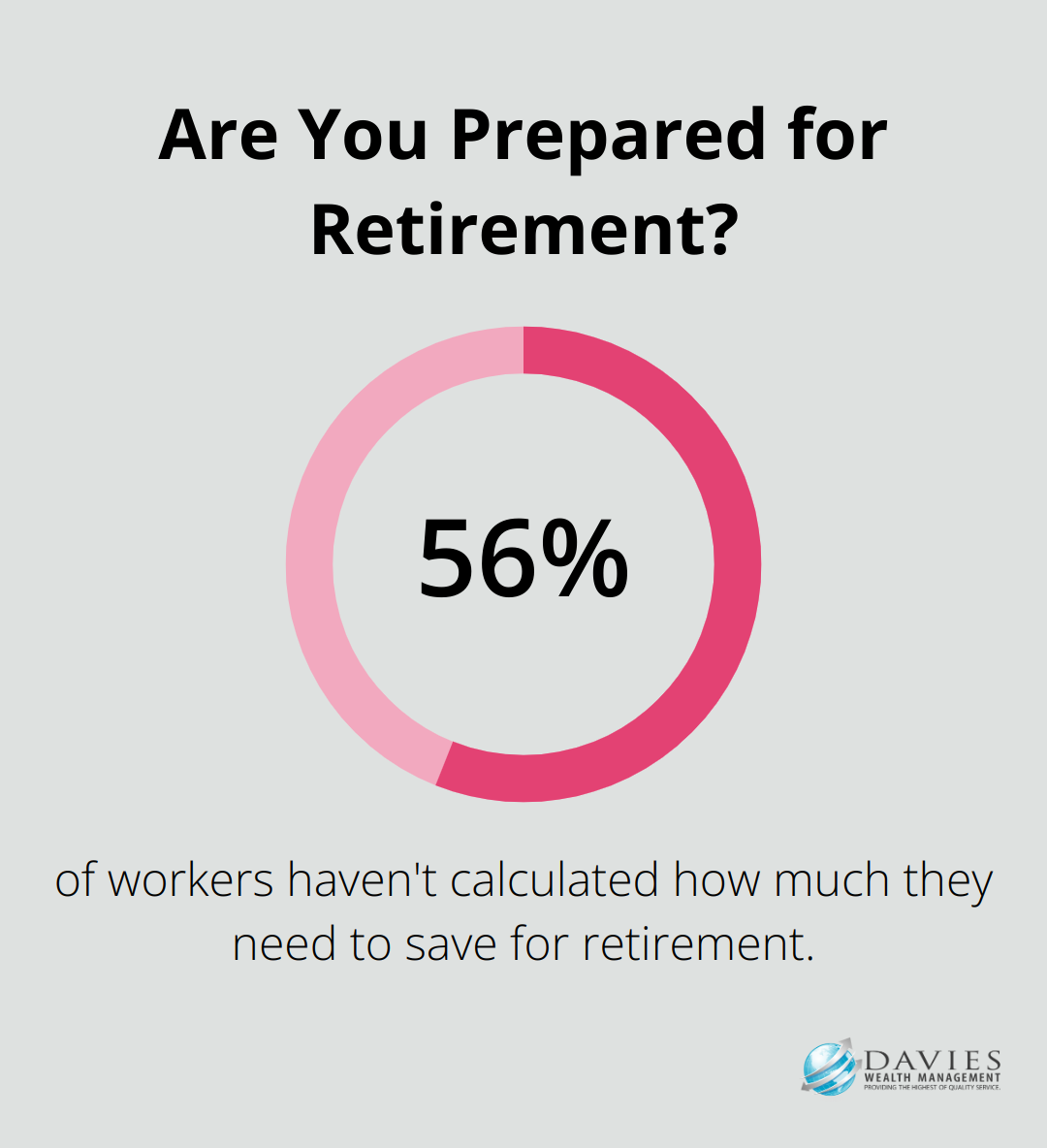

Many people make mistakes that can derail their retirement plans. One frequent error is to underestimate how much they’ll need. According to the Employee Benefit Research Institute, 56% of workers haven’t even calculated how much they need to save for retirement. Another mistake is to not diversify investments. Some individuals put all their eggs in one basket (like relying solely on their company stock), only to face significant losses when the market shifts.

The Impact of Inflation

Ignoring inflation is another critical error. What seems like a substantial nest egg today might not cover your expenses in 20 or 30 years. For instance, assuming a 3% annual inflation rate, $100,000 today will only have the purchasing power of about $55,000 in 30 years. This erosion of purchasing power can significantly impact your retirement lifestyle if not accounted for in your planning.

Healthcare Costs: A Major Consideration

Many people overlook healthcare costs when planning for retirement. Fidelity estimates that an average retired couple age 65 in 2023 may need approximately $157,500 to cover healthcare expenses in retirement. This figure alone underscores the importance of comprehensive planning that takes into account all aspects of your future financial needs.

As we move forward, it’s important to understand the key components that make up a successful retirement plan. Let’s explore how to set realistic goals, diversify your portfolio, and maximize your retirement savings opportunities.

Building Your Retirement Blueprint

Goal Setting and Timeline Creation

The first step in crafting your retirement plan is to establish clear, realistic goals. Start by envisioning your ideal retirement lifestyle. Do you plan to travel extensively, downsize your home, or pursue new hobbies? These decisions will significantly impact your financial needs.

Next, determine your retirement timeline. The average retirement age in the U.S. is 62 (according to the U.S. Census Bureau). However, your personal circumstances may dictate a different target. Consider factors like your current savings, expected Social Security benefits, and potential healthcare needs.

Once you have a clear picture of your goals and timeline, you can calculate your required retirement savings. A common rule of thumb suggests 70-80% of your pre-retirement income. However, this figure can vary based on your specific plans and lifestyle choices.

Investment Portfolio Diversification

Diversification is key for managing risk and maximizing returns in your retirement portfolio. A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and other asset classes.

The specific allocation depends on your risk tolerance and time horizon. Generally, younger investors can afford to take on more risk with a higher allocation to stocks. As you approach retirement, a gradual shift towards more conservative investments can help protect your wealth.

Consider incorporating index funds or exchange-traded funds (ETFs) for broad market exposure. These low-cost options provide instant diversification across hundreds or thousands of companies.

Maximizing Retirement Accounts

Take full advantage of tax-advantaged retirement accounts. If your employer offers a 401(k) plan with a match, contribute at least enough to receive the full match – it’s essentially free money. In 2024, the total contribution limit for 401(a) defined contribution plans is $69,000.

Individual Retirement Accounts (IRAs) offer another valuable savings vehicle. Traditional IRAs provide tax-deferred growth, while Roth IRAs offer tax-free withdrawals in retirement. The 2024 contribution limit for IRAs is $7,000 (with an additional $1,000 catch-up contribution for those 50 and older).

Healthcare and Long-Term Care Planning

Healthcare costs can significantly impact your retirement savings. According to Fidelity, the average couple retiring at 65 in 2023 can expect to spend $315,000 on healthcare throughout retirement. Factor these costs into your retirement budget and consider strategies to manage them.

One option is a Health Savings Account (HSA), which offers triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2024, individuals can contribute up to $4,150 to an HSA, while families can contribute up to $8,300.

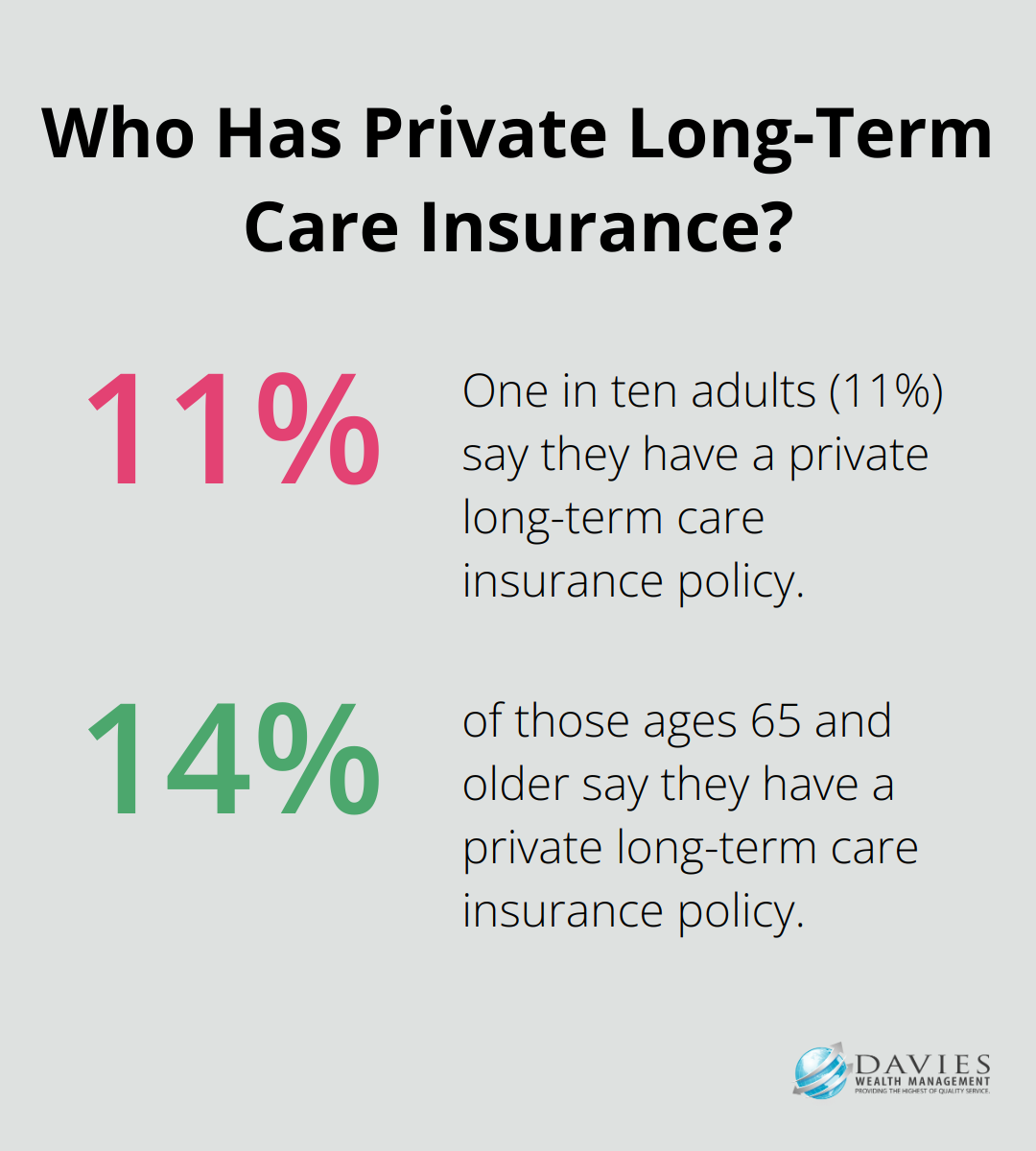

Long-term care insurance is another important consideration. One in ten adults (11%) say they have a private long-term care insurance policy, including 14% of those ages 65 and older. Purchasing a policy in your 50s or early 60s can help protect your retirement savings from potentially devastating long-term care costs.

As we move forward, it’s essential to explore strategies that can optimize your retirement savings and ensure your financial security throughout your golden years. The next section will focus on advanced techniques to maximize your retirement income and protect your wealth from various risks.

How to Maximize Your Retirement Savings

Implement Tax-Efficient Withdrawal Strategies

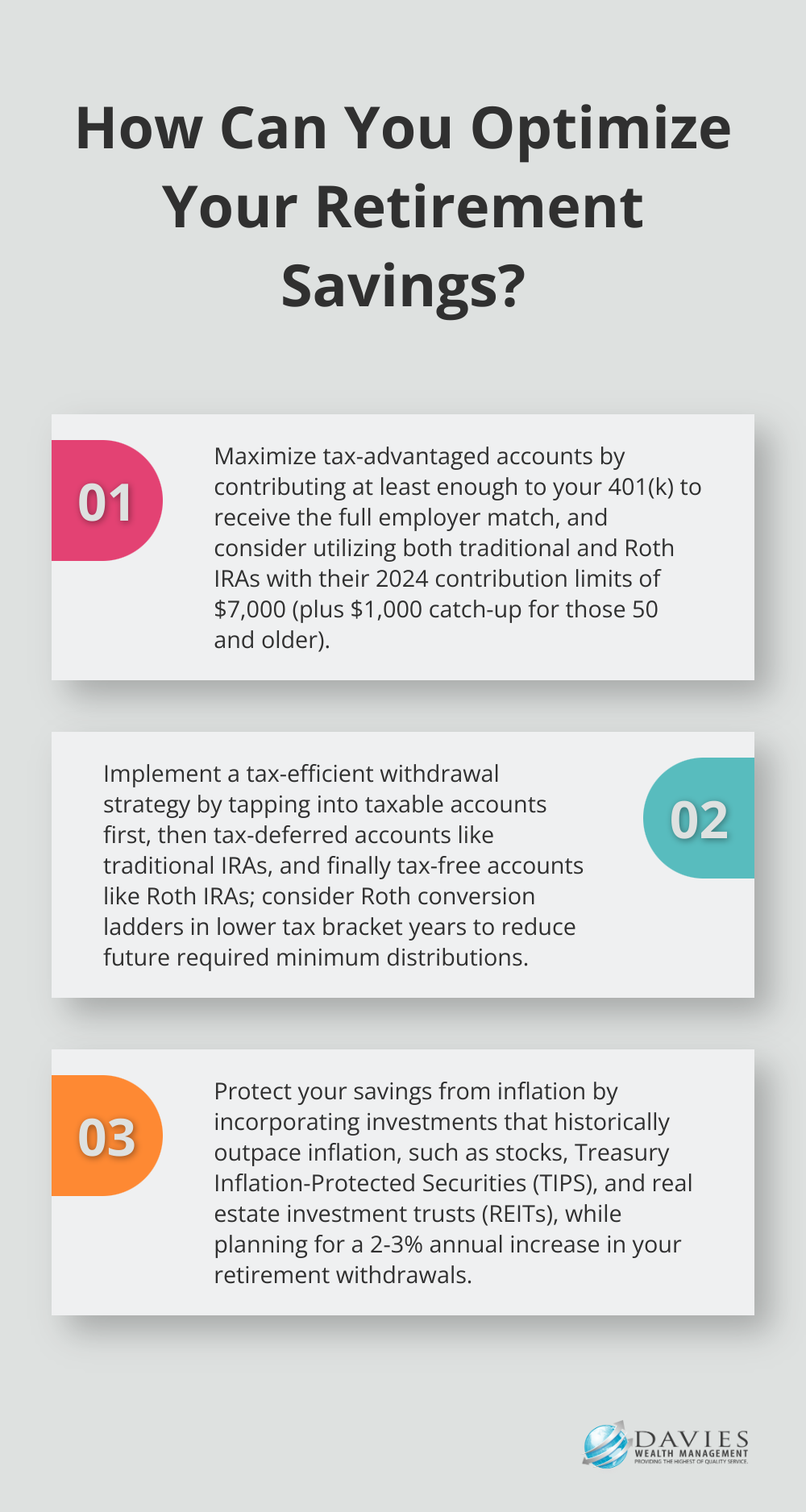

One of the most effective ways to stretch your retirement savings is through tax-efficient withdrawals. The order in which you tap into your accounts can significantly impact your tax burden. It’s advisable to start with taxable accounts, then move to tax-deferred accounts like traditional IRAs, and finally tap into tax-free accounts like Roth IRAs.

If you’re in a lower tax bracket during early retirement, it might benefit you to convert some of your traditional IRA funds to a Roth IRA. This strategy, known as a Roth conversion ladder, can help reduce your required minimum distributions (RMDs) later in retirement and potentially lower your overall tax liability.

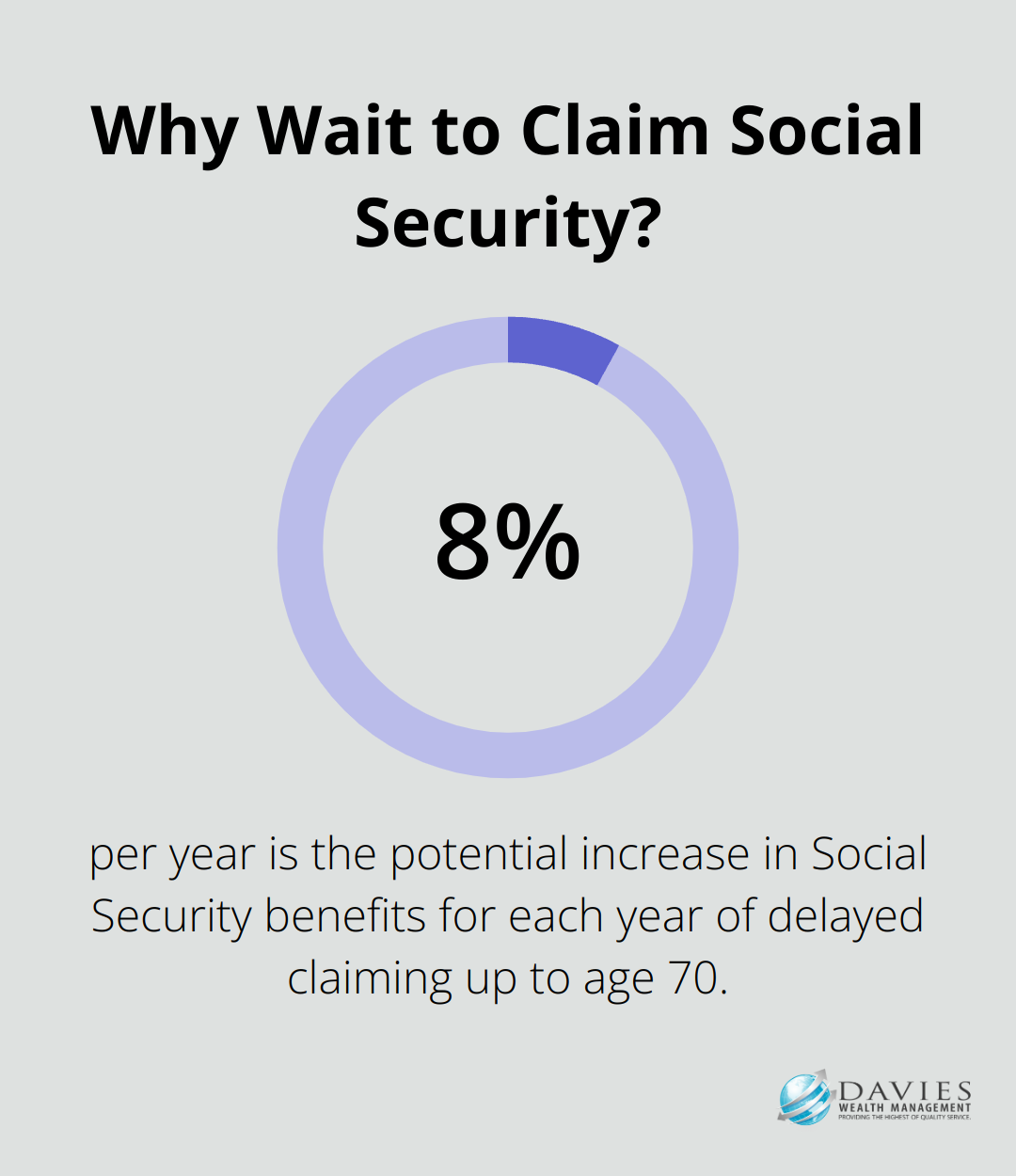

Maximize Social Security Benefits

Social Security can form a substantial part of your retirement income, so it’s essential to optimize your benefits. The age at which you start claiming Social Security can significantly impact your monthly payments. While you can start claiming at 62, waiting until your full retirement age (66-67 for most people) or even up to age 70 can increase your benefits by up to 8% per year.

For married couples, coordinating your claiming strategies can lead to even greater benefits. For instance, the higher-earning spouse might delay claiming until 70 to maximize the survivor benefit, while the lower-earning spouse claims earlier to provide income in the meantime.

Protect Your Savings from Inflation

Inflation can erode the purchasing power of your retirement savings over time. To combat this, consider incorporating investments that have historically outpaced inflation, such as stocks and Treasury Inflation-Protected Securities (TIPS). Real estate investment trusts (REITs) can also provide a hedge against inflation, as property values and rents tend to rise with inflation.

Another strategy is to create a retirement income plan that includes regular increases to account for inflation. You might plan for a 2-3% annual increase in your withdrawals to maintain your purchasing power over time.

Diversify Your Investment Portfolio

A well-diversified portfolio can help manage risk and maximize returns in your retirement savings. Try to include a mix of stocks, bonds, real estate, and other asset classes (based on your risk tolerance and time horizon). Younger investors can often afford to take on more risk with a higher allocation to stocks, while those approaching retirement might shift towards more conservative investments to protect their wealth.

Consider incorporating index funds or exchange-traded funds (ETFs) for broad market exposure. These low-cost options provide instant diversification across hundreds or thousands of companies.

Utilize Tax-Advantaged Accounts

Take full advantage of tax-advantaged retirement accounts. If your employer offers a 401(k) plan with a match, contribute at least enough to receive the full match – it’s essentially free money. In 2024, the total contribution limit for 401(a) defined contribution plans is $69,000.

Individual Retirement Accounts (IRAs) offer another valuable savings vehicle. Traditional IRAs provide tax-deferred growth, while Roth IRAs offer tax-free withdrawals in retirement. The 2024 contribution limit for IRAs is $7,000 (with an additional $1,000 catch-up contribution for those 50 and older).

To ensure you’re making the most of your retirement savings, consider working with a financial advisor. They can provide expert guidance on investment strategies and help you navigate the complexities of retirement planning.

Final Thoughts

Retirement planning requires careful consideration and strategic decision-making. You must set realistic goals, diversify investments, maximize tax-advantaged accounts, and plan for healthcare costs. A successful retirement plan should adapt to changes in life circumstances, economic conditions, and legislative updates.

Professional guidance can provide invaluable support in navigating the complexities of retirement planning. Davies Wealth Management offers personalized wealth management services tailored to your unique financial situation and retirement aspirations. Our team of experienced advisors can help you optimize your cash flow, minimize taxes, and develop a comprehensive investment strategy.

You should take action to secure your financial future for yourself and your loved ones. Implement the strategies discussed and seek professional advice when needed. Stay engaged with your finances and continue to educate yourself about personal finance to approach retirement with confidence and peace of mind.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply