STOCKS ADVANCE FOR 5TH WEEK IN A ROW AS Q3 GDP NUMBERS ARE REVISED UP AND AS TREASURIES RETREATWeekly Market Update — December 2, 2023 |

||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

Weekly Market Performance

*Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD. This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results. |

||||||||||||||||||||||||||||||||

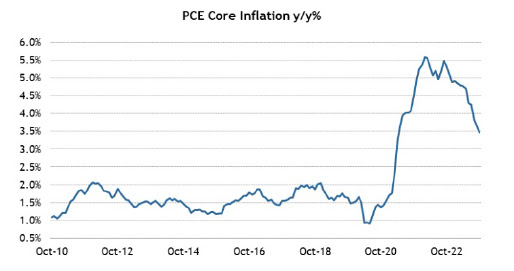

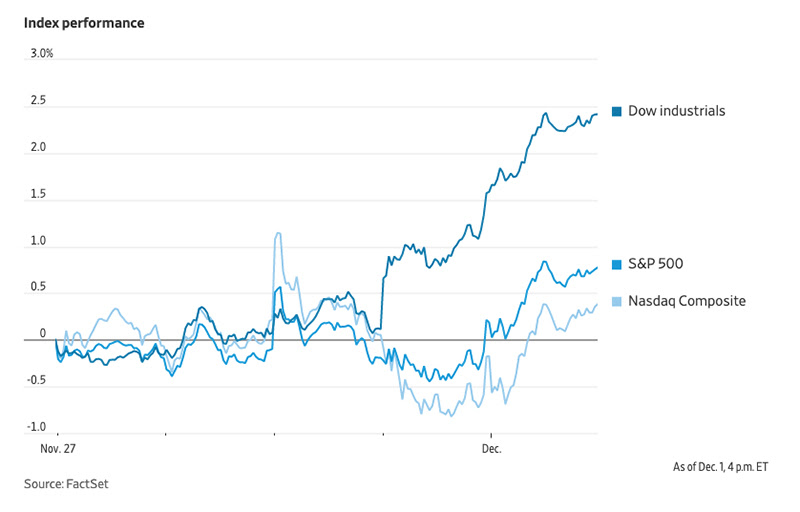

Stocks Advance for 5th Week in a RowStock markets continued their November “rally” as Wall Street welcomed more signs of cooling inflation amidst hopes that the Fed might cut rates next year. Falling Treasury yields continued to encourage equity investors, as markets also closed out a very good November, with the S&P 500 and NASDAQ turning in their best monthly returns in years. Of the inflation data received this week, Thursday’s data from the Commerce Department was helpful as the Fed’s preferred inflation gauge – the core (less food and energy) Personal Consumption Expenditures (PCE) Price Index – rose 0.2% in October. Further the PCE’s year-over-year increase is now at 3.5%, the lowest level since April 2021. And right before the PCE data was released, Fed Board Member Christopher Waller, a noted hawk, said: “I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2 percent” and that “we have seen the most rapid decline in inflation on record.” Further Waller said that if inflation continues to decrease over the next few months then “we could start lowering the policy rate just because inflation is lower.” |

||||||||||||||||||||||||||||||||

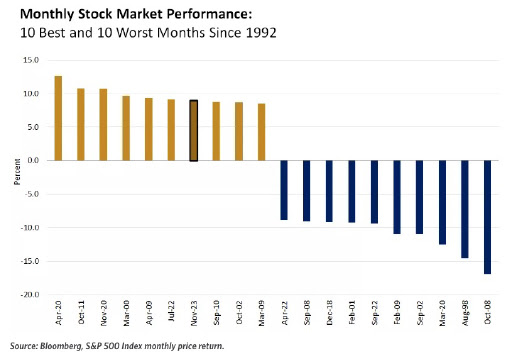

Markets Rebound in NovemberStock markets in the U.S. and around the world came roaring back in November, a welcome relief given the abysmal performance for the previous three months. For the month of November:

There were a lot of milestones to celebrate, including that the S&P 500’s jump was only achieved 10 times during the same month since 1928 according to Bloomberg and it was the S&P 500’s biggest monthly gain since July 2022. Interestingly, it was also NASDAQ’s best monthly gain since July 2022 and November was the DJIA’s best month for gains since October 2022. |

||||||||||||||||||||||||||||||||

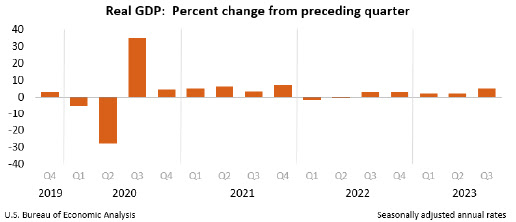

GDP Rises More Than ExpectedThe Bureau of Economic Analysis reported that real gross domestic product (GDP) increased at an annual rate of 5.2% in the third quarter of 2023, according to the “second” estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.1%. The GDP estimate released today is based on more complete source data than were available for the “advance” estimate issued last month. In the advance estimate, the increase in real GDP was 4.9 percent. The update primarily reflected upward revisions to nonresidential fixed investment and state and local government spending that were partly offset by a downward revision to consumer spending. Imports, which are a subtraction in the calculation of GDP, were revised down. “The increase in real GDP reflected increases in consumer spending, private inventory investment, exports, state and local government spending, federal government spending, residential fixed investment, and nonresidential fixed investment. Imports increased. Compared to the second quarter, the acceleration in real GDP in the third quarter primarily reflected accelerations in consumer spending and private inventory investment and an upturn in exports that were partly offset by a deceleration in nonresidential fixed investment. Imports turned up.” |

||||||||||||||||||||||||||||||||

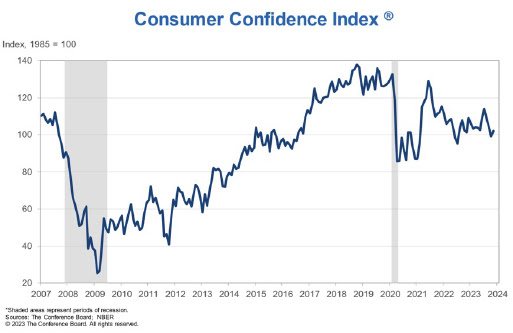

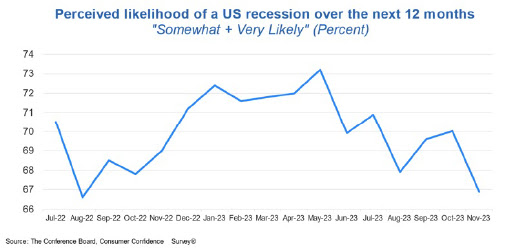

Consumer Confidence Bounces Back After 3 Straight Monthly Declines“The Conference Board Consumer Confidence Index increased in November to 102.0 (1985=100), up from a downwardly revised 99.1 in October. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – ticked down slightly to 138.2 (1985=100), from 138.6. The Expectations Index – based on consumers’ short-term outlook for income, business, and labor market conditions – rose to 77.8 (1985=100) in November, up from its downwardly revised reading of 72.7 in October. Despite this month’s improvement, the Expectations Index remains below 80 for a third consecutive month—a level that historically signals a recession within the next year. While consumer fears of an impending recession abated slightly – to the lowest levels seen this year – around two-thirds of consumers surveyed in November still perceive a recession to be “somewhat” or “very likely” to occur over the next 12 months. This is consistent with the short and shallow recession we anticipate in the first half of 2024.” Present Situation“Consumers’ assessment of current business conditions was, on balance, slightly more positive in November.

Assessment of Family Finances/Recession RiskConsumers’ assessment of their Family’s Current Financial Situation improved in November. Consumers’ Perceived Likelihood of a US Recession over the Next 12 Months abated in November to the lowest levels seen this year – though two-thirds still expect a downturn.” |

||||||||||||||||||||||||||||||||

| Sources

bea.gov;conference-board.org;msci.com;fidelity.com;nasdaq.com;wsj.com; morningstar.com; |

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ LET’S GET SOCIAL

Facebook: https://www.facebook.com/DaviesWealthManagement

Twitter: https://twitter.com/TDWealthNet

Linkedin: https://www.linkedin.com/in/daviesrthomas

Youtube Channel: https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

**Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply