Socially responsible investing is reshaping the financial landscape, offering investors a way to align their portfolios with their values. At Davies Wealth Management, we’ve seen a growing interest in this approach as more people seek to make a positive impact through their investments.

This blog post will explore why socially responsible investing matters for your portfolio and how it can potentially enhance both financial returns and global well-being.

What Is Socially Responsible Investing?

Definition and Core Principles

Socially Responsible Investing (SRI) is an investment strategy that balances financial returns with social and environmental impact. This approach has gained significant traction, with global sustainable investment reaching substantial levels in recent years.

SRI focuses on companies that demonstrate strong environmental stewardship, social responsibility, and good governance practices. It aims to generate positive societal impact alongside financial returns, setting it apart from traditional investing approaches.

Historical Evolution

The roots of SRI trace back to the 1960s when investors avoided companies involved in the Vietnam War. Since then, the concept has expanded significantly. Today, SRI encompasses a wide range of issues, from climate change to workplace equality.

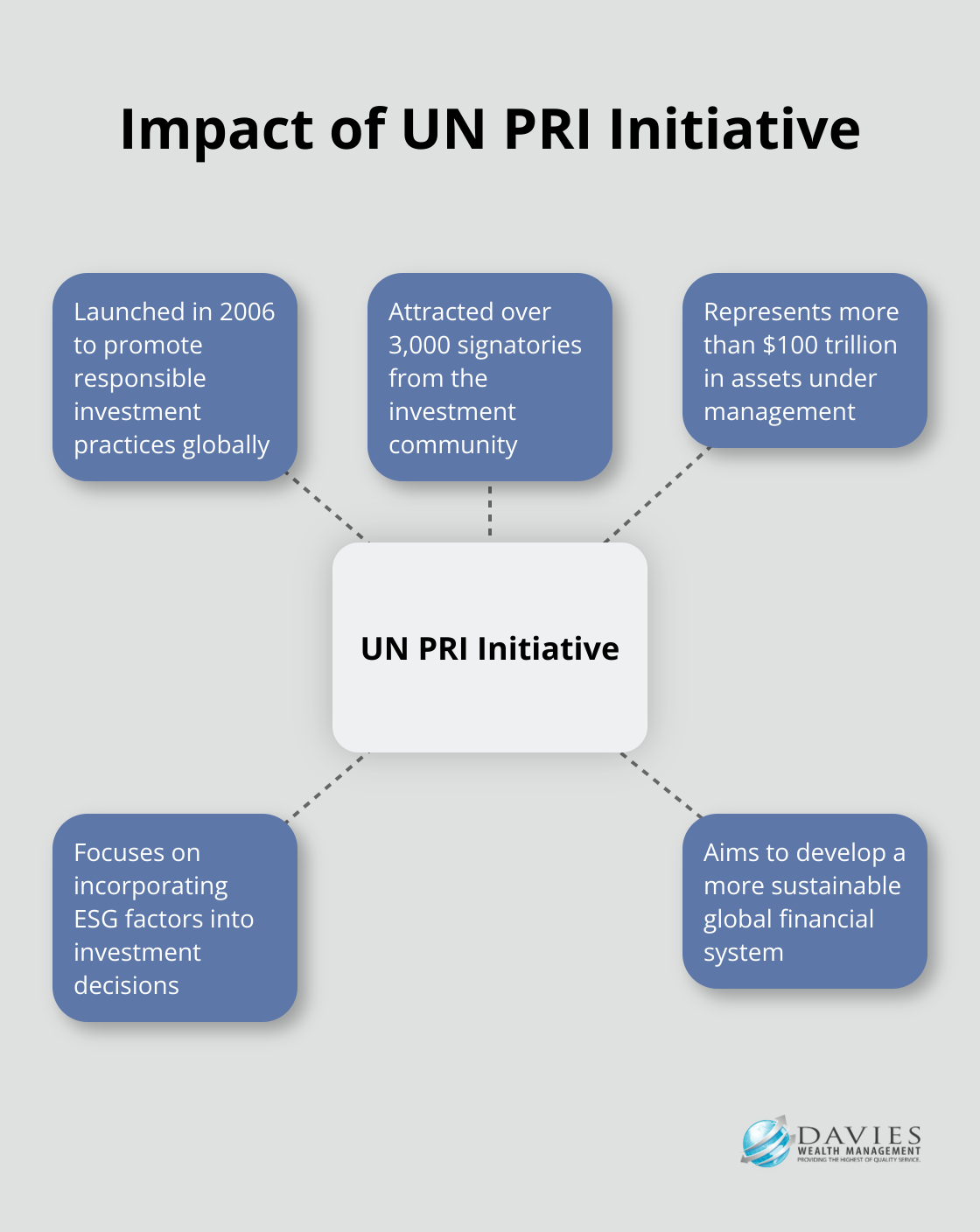

A pivotal moment in SRI’s evolution occurred in 2006 when the United Nations launched the Principles for Responsible Investment (PRI). This initiative has attracted over 3,000 signatories, representing more than $100 trillion in assets under management.

SRI Strategies

SRI offers various strategies for investors:

Negative Screening

This strategy excludes companies or industries that conflict with an investor’s values. Common exclusions include tobacco, weapons, and fossil fuels.

Positive Screening

This approach actively seeks out companies with strong ESG (Environmental, Social, and Governance) practices. For instance, an investor might focus on companies with diverse leadership or those investing heavily in renewable energy.

Impact Investing

This strategy targets specific social or environmental benefits alongside financial returns. Examples include investments in affordable housing projects or clean energy initiatives.

Growing Interest in SRI

Many investors now find SRI attractive due to its potential to align investments with personal values while pursuing strong financial returns. However, it’s important to approach SRI with a clear understanding of your goals and a well-researched strategy.

As we move forward, let’s examine the financial case for socially responsible investing and how it can potentially enhance your portfolio’s performance.

The Financial Case for Socially Responsible Investing

Performance Comparison: SRI vs Traditional Funds

Socially responsible investing (SRI) has gained significant traction, prompting investors to question its financial viability compared to traditional investment strategies. Recent data challenges the misconception that SRI underperforms. Sustainable funds slightly underperformed traditional funds in 2022, according to a Morgan Stanley report. However, continued investor interest drove up the proportion of overall assets under management. This resilience proves particularly noteworthy for investors concerned about portfolio stability during economic uncertainties.

Furthermore, a study by Arabesque Partners in 2020 indicated that sustainable investments can match or exceed traditional investments in financial returns. This finding challenges the notion that investors must choose between profitability and social responsibility.

Risk Mitigation Through ESG Considerations

Environmental, Social, and Governance (ESG) considerations play a key role in SRI and offer potential risk mitigation benefits. ESG criteria have become key indicators of management quality and are commonly linked to ethical or socially responsible investment. Companies with strong ESG practices often experience lower capital costs and reduced volatility, which contributes to better performance over time.

A Harvard Business School study found that firms with high sustainability scores experience better stock performance than those with lower scores. This suggests that ESG factors can serve as indicators of a company’s overall health and potential for long-term success.

Long-term Sustainability and Profitability

The long-term outlook for socially responsible companies appears promising. As regulatory environments evolve and consumer preferences shift towards sustainable products and services, companies prioritizing ESG factors may position themselves better for future success.

Research by MSCI shows that companies with higher ESG ratings tend to exhibit lower downside risk in financial downturns. This resilience can prove particularly valuable for investors seeking to protect their portfolios during market volatility.

The Role of ESG in Investment Decision-Making

Investors increasingly consider ESG factors in their decision-making process. A recent survey found that 88% of investors globally reported interest in sustainable investing. This shift in investor sentiment highlights the growing importance of ESG considerations in portfolio management.

Moreover, the proliferation of ESG reporting standards indicates a shift towards greater transparency in company practices, which fosters trust among investors. This increased transparency allows for more informed investment decisions and potentially leads to better risk-adjusted returns.

As we explore the implementation of SRI in investment strategies, it becomes clear that this approach offers both financial potential and the opportunity to make a positive impact. The next section will discuss how investors can incorporate SRI principles into their portfolios effectively.

How to Implement SRI in Your Portfolio

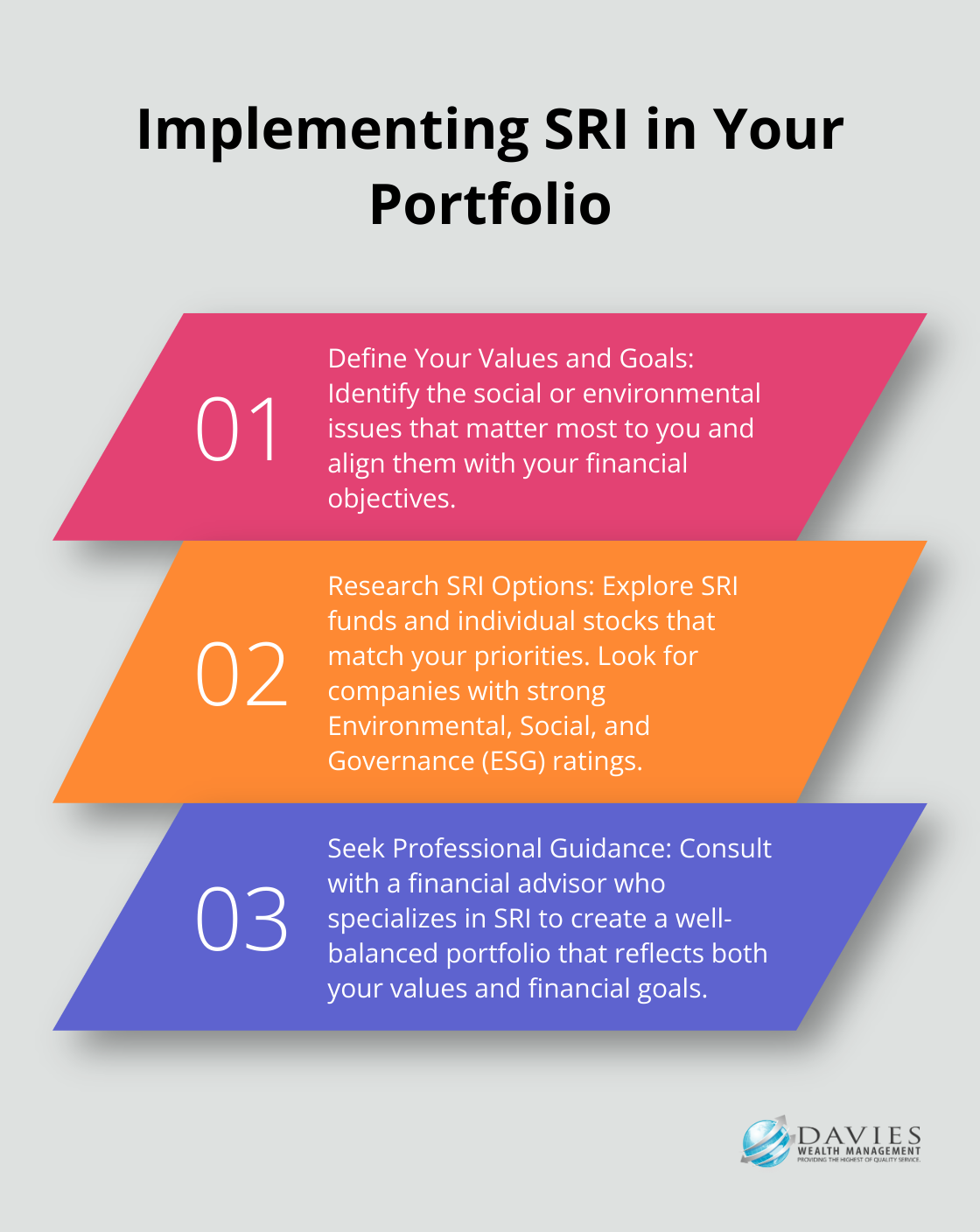

Define Your Values and Goals

The first step to implement Socially Responsible Investing (SRI) is to clearly define your personal values and financial goals. What social or environmental issues matter most to you? Are you passionate about climate change, human rights, or corporate governance? Understanding your priorities will guide your investment decisions.

A recent survey found that nearly 80% of individual investors believe it’s possible to balance market-rate financial returns with a focus on sustainability. This shows that you don’t have to sacrifice performance for principles.

Research SRI Options

After you identify your priorities, research SRI funds and individual stocks that align with your values. Look for companies with strong Environmental, Social, and Governance (ESG) ratings. These ratings provide insight into a company’s sustainability practices and potential risks.

Global sustainable investment reached $30.3 trillion in sustainable investing assets. This growing market offers a wide range of options for socially conscious investors.

Balance SRI with Diversification

While you focus on SRI, it’s important to maintain a well-diversified portfolio. Diversification helps manage risk and can improve long-term returns. Try to spread your investments across different asset classes, sectors, and geographic regions.

A study found that 80% of reviewed studies showed sustainability practices have a positive influence on investment performance. This suggests that SRI doesn’t necessarily mean compromising on diversification or returns.

Seek Professional Guidance

The world of SRI can be complex. A financial advisor who specializes in SRI can provide valuable insights and help you make informed decisions. Many advisors (including those at Davies Wealth Management) have extensive experience in SRI and can help create a portfolio that aligns with both your values and financial goals.

Monitor and Adjust Your Strategy

SRI is not a set-it-and-forget-it approach. Regularly review your portfolio to ensure it continues to align with your values and financial objectives. Stay informed about new SRI opportunities and evolving ESG standards. As your priorities or market conditions change, adjust your strategy accordingly.

Final Thoughts

Socially responsible investing has become a powerful tool for investors to align their portfolios with their values while potentially enhancing financial returns. More than half of individual investors plan to increase their allocations to sustainable investments in the coming year, which signals a significant trend that will shape the future of investing. This surge in demand drives innovation in the financial sector, leading to the development of new SRI products and more sophisticated ESG analysis tools.

The SRI landscape continues to evolve and expand. As data on ESG performance becomes more robust and standardized, investors will have access to increasingly accurate information to guide their decisions. The rise of impact investing and thematic funds focused on specific sustainability goals will provide even more options for socially conscious investors.

Davies Wealth Management specializes in helping clients navigate the world of socially responsible investing. Our team can provide personalized guidance on integrating SRI principles into your investment strategy, ensuring your portfolio reflects both your values and financial objectives. To learn more about how we can support your SRI journey, visit our website at https://tdwealth.net.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply