Professional athletes face unique financial challenges that require specialized planning. Their careers are often short-lived, with high-income years followed by potential earnings drops.

At Davies Wealth Management, we understand the complexities of athlete finances and the importance of strategic financial management for long-term security.

This blog post explores why professional athletes need tailored financial planning and outlines key strategies to safeguard their financial future.

Why Athletes Face Unique Financial Hurdles

The Brief Window of High Earnings

Professional athletes operate in a financial landscape unlike any other profession. Their careers are often short-lived, with the average NFL career lasting only 3.3 years. This brief window of high earnings creates an urgent need for strategic financial planning.

The Rollercoaster of Athletic Income

Athletes experience a financial rollercoaster that few others encounter. They can go from earning minimum league salaries to multi-million dollar contracts in a short span. NFL minimum salaries start at $450,000 per year but can quickly escalate to millions for top performers. However, this financial peak often precedes a steep drop in income post-retirement, with professional athletes often facing income volatility and experiencing sharp declines in income after their careers end.

Complex Contracts and Endorsements

The financial landscape for athletes extends beyond their base salaries. Endorsement deals and complex contracts add layers of complexity to their income streams. These agreements often involve performance bonuses, royalties, and image rights, each with its own tax implications and financial planning considerations.

The Pressure of Public Scrutiny

Public scrutiny adds another dimension to athletes’ financial challenges. The pressure to maintain a certain lifestyle can lead to overspending and poor financial decisions. Studies show that 80% of retired NFL players go broke in their first three years out of the League, which highlights the need for robust financial education and planning.

The Need for Specialized Financial Guidance

These unique challenges underscore the importance of specialized financial planning for athletes. A financial advisor who understands the intricacies of athletic careers can provide tailored strategies to help athletes navigate their complex financial landscape. This expertise becomes invaluable in ensuring long-term financial stability beyond their playing years.

As we move forward, we’ll explore the key components of financial planning that can help athletes overcome these hurdles and secure their financial future.

Building a Robust Financial Game Plan for Athletes

Cash Flow Mastery

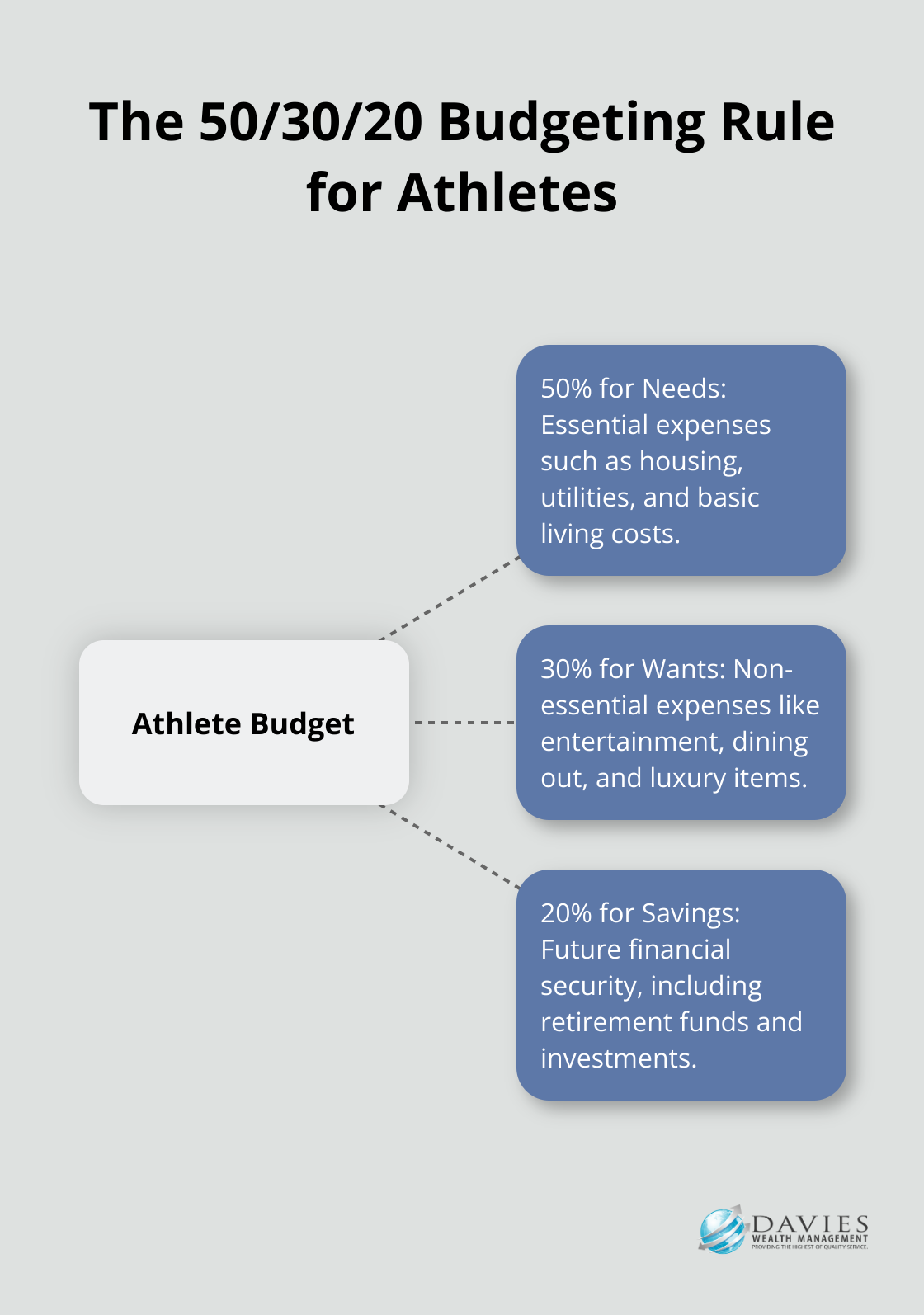

Professional athletes must control their cash flow to secure their financial future. A practical approach involves the 50/30/20 rule: master athlete budgeting with practical tips for financial health. This strategy helps athletes maintain financial discipline during high-earning years and prepares them for potential income reductions post-retirement.

Strategic Long-Term Investments

Diversification protects wealth over time. Athletes should spread investments across various asset classes (stocks, bonds, real estate, and alternative investments). A Vanguard study indicates that 77% of respondents knew that mutual funds tend to be less risky than individual stocks.

Navigating Complex Tax Situations

Athletes face intricate tax scenarios due to multi-state income and various revenue streams. Effective strategies include tax-loss harvesting and strategic charitable giving. For instance, establishing a donor-advised fund provides immediate tax benefits while allowing for future charitable contributions.

Risk Management and Asset Protection

Comprehensive insurance coverage is essential for athletes whose careers can end abruptly due to injury. Disability insurance contracts for athletes typically require a “permanent total disability” or similar condition. Liability insurance (to protect assets from potential lawsuits) is another critical component of a solid risk management plan.

Tailored Financial Strategies

Each athlete’s financial situation is unique and requires a personalized approach. Financial advisors who specialize in athlete finances can anticipate and address the specific challenges that come with a career in professional sports. These experts can create strategies that extend well beyond an athlete’s playing years, ensuring long-term financial stability.

As we move forward, we’ll explore how athletes can secure their financial future beyond their active playing careers, including retirement planning and career transition strategies.

Securing Your Financial Future Beyond the Game

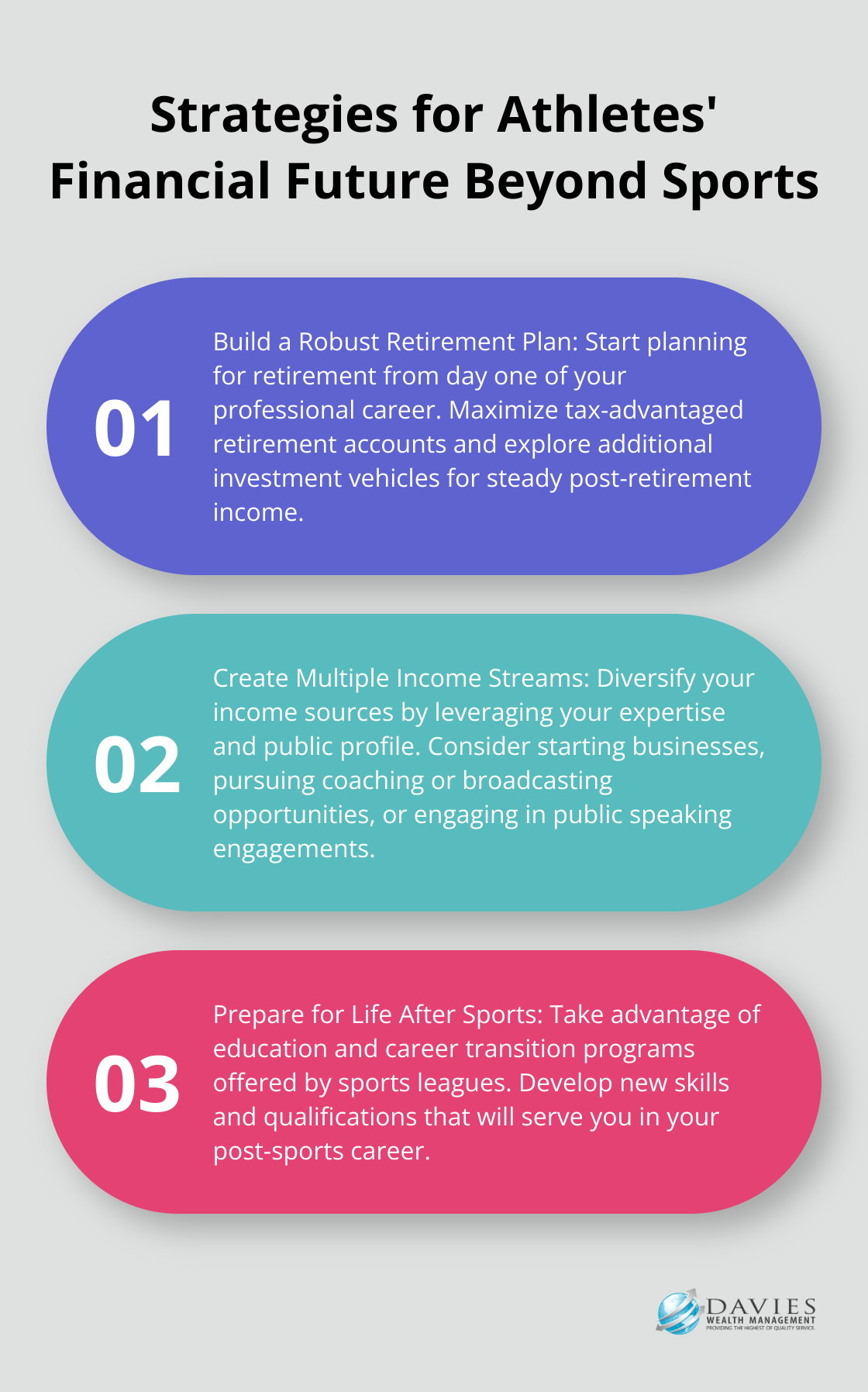

Building a Robust Retirement Plan

Professional athletes must start planning for retirement from the first day of their professional careers. The National Football League Players Association reports that the average NFL career lasts only 3.3 years, which underscores the urgency of early retirement planning. A solid retirement strategy should include maximizing tax-advantaged retirement accounts (such as 401(k)s and IRAs), as well as exploring additional investment vehicles like annuities or real estate investments that can provide steady income streams post-retirement.

Creating Multiple Income Streams

Diversification applies not just to investment portfolios but also to income sources. Athletes should use their expertise and public profile to create additional revenue streams. This could include starting businesses, pursuing coaching or broadcasting opportunities, or engaging in public speaking engagements. Former NBA player Magic Johnson serves as an excellent example, having achieved billionaire status through strategic investments and entrepreneurship.

Preparing for Life After Sports

Education and career transition planning form vital components of long-term financial security. Many professional sports leagues offer programs to support athletes in pursuing further education or vocational training. The NFL, for example, provides tuition assistance for players returning to school. Athletes should take advantage of these opportunities to develop skills and qualifications that will serve them in their post-sports careers.

Leveraging Expertise for Future Opportunities

Athletes possess unique skills and experiences that can translate well into various post-sports careers. These may include leadership, teamwork, discipline, and performance under pressure. By identifying these transferable skills and seeking opportunities to apply them in new contexts, athletes can position themselves for successful career transitions. This might involve mentoring, consulting, or even starting businesses in sports-related industries.

Estate Planning and Wealth Transfer

Long-term financial security extends beyond an athlete’s lifetime. Proper estate planning ensures that an athlete’s wealth benefits future generations and chosen beneficiaries. This involves creating a comprehensive estate plan, which may include trusts, wills, and other legal structures to minimize tax liabilities and facilitate smooth wealth transfer. Athletes should work with experienced estate planning professionals to navigate these complex issues and protect their legacy.

Final Thoughts

Professional athletes face unique financial challenges that require specialized planning and expert guidance. The short-lived nature of athletic careers, coupled with complex income structures and public scrutiny, creates a financial landscape unlike any other profession. This underscores the critical importance of tailored financial strategies for athletes.

At Davies Wealth Management, we understand the intricacies of athlete finances and provide comprehensive solutions to address these unique challenges. Our expertise in managing the financial complexities of professional sports careers allows us to create personalized strategies that extend well beyond an athlete’s playing years. We encourage all professional athletes to take charge of their financial future today.

The decisions made during your playing years will shape your financial landscape for decades to come. Davies Wealth Management is committed to helping athletes navigate these crucial financial decisions, ensuring they can enjoy the fruits of their hard-earned success long after they’ve left the field, court, or rink. Your financial game plan is just as important as your athletic one.

✅ Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

Book an Appointment Today

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

Read the Latest Blog Posts

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

Subscribe for Weekly Insights

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

Connect with Davies Wealth Management

Website: tdwealth.net

Podcast: 1715tcf.com

Follow Us on Social Media:

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply