Financial planning is the cornerstone of a secure and prosperous future. At Davies Wealth Management, we’ve seen firsthand how a well-crafted financial plan can transform lives and create lasting wealth.

Why is financial planning important? It provides a roadmap for achieving your goals, protects you from unexpected financial shocks, and helps you make informed decisions about your money.

Building Your Financial Foundation

Assessing Your Current Financial Situation

The first step in building a strong financial foundation requires a thorough examination of your current financial situation. This process involves the collection of all your financial information, including income, expenses, assets, and debts. A 2024 survey by the National Foundation for Credit Counseling provided a snapshot of the American consumer’s level of knowledge as it relates to financial capability. A comprehensive assessment of your finances will provide clarity on your starting point and highlight areas for improvement.

To begin, create a detailed budget that tracks all your income sources and expenses. Tools like Mint or YNAB can automate this process effectively. Next, calculate your net worth by subtracting your liabilities from your assets. This figure serves as a baseline for measuring your financial progress over time.

Defining Clear and Achievable Financial Goals

After gaining a clear picture of your current finances, the next step involves setting specific, measurable goals. The success of goals-based planning hinges upon two important steps: (1) eliciting goals that are most important to investors; and (2) prioritizing those goals.

When you set financial goals, consider both short-term and long-term objectives. Short-term goals might include building an emergency fund or paying off high-interest debt. Long-term goals could involve saving for retirement, buying a home, or funding your children’s education. Specify the amounts you want to save and the timeframes for achieving each goal.

Developing a Comprehensive Financial Strategy

With your current situation assessed and goals defined, the creation of a comprehensive strategy to bridge the gap between your current state and desired future becomes essential. This strategy should address various aspects of your financial life, including saving, investing, risk management, and tax planning.

A well-rounded financial strategy typically includes:

- A savings plan that allocates a portion of your income towards your goals

- An investment strategy aligned with your risk tolerance and time horizon

- A debt repayment plan to eliminate high-interest debt

- Insurance coverage to protect against unforeseen events

- Tax-efficient strategies to maximize your wealth accumulation

Implementing and Monitoring Your Plan

The implementation of your financial plan marks the beginning of your journey towards financial success. Regular monitoring and adjustments ensure that your plan remains aligned with your goals and current circumstances.

Automated investing simply means setting up automatic transfers into your investment accounts to keep you on track to reach your goals. Review your budget regularly (monthly or quarterly) to track your progress and identify areas for improvement. Consider using financial planning tools to help you stay organized and motivated.

Seeking Professional Guidance

While self-directed financial planning can be effective, the complexities of personal finance often benefit from professional expertise. A qualified financial advisor can provide valuable insights, help you avoid common pitfalls, and optimize your financial strategy.

For instance, professional athletes face unique financial challenges (such as short career spans and fluctuating income). Specialized financial advisors (like those at Davies Wealth Management) understand these complexities and can provide tailored solutions to address them effectively.

As you progress through your financial journey, remember that building a solid financial foundation is an ongoing process. The next crucial step involves understanding the key benefits that effective financial planning can bring to your life.

How Financial Planning Transforms Your Future

Financial planning is more than just a buzzword; it’s a powerful tool that can reshape your financial destiny. Let’s explore how financial planning can revolutionize your future.

Wealth Building on Autopilot

One of the most significant benefits of financial planning is its ability to accelerate wealth accumulation. A structured savings and investment strategy allows you to harness the power of compound interest. Compound interest calculators can help you determine how much your money can grow over time.

Financial planning also helps you identify and eliminate wealth-draining habits. A study by Ramsey Solutions found that 88% of millionaires attribute their wealth to consistent investing over time (not to inheritance or high-income jobs). This underscores the importance of disciplined, long-term financial planning.

Bulletproofing Your Finances

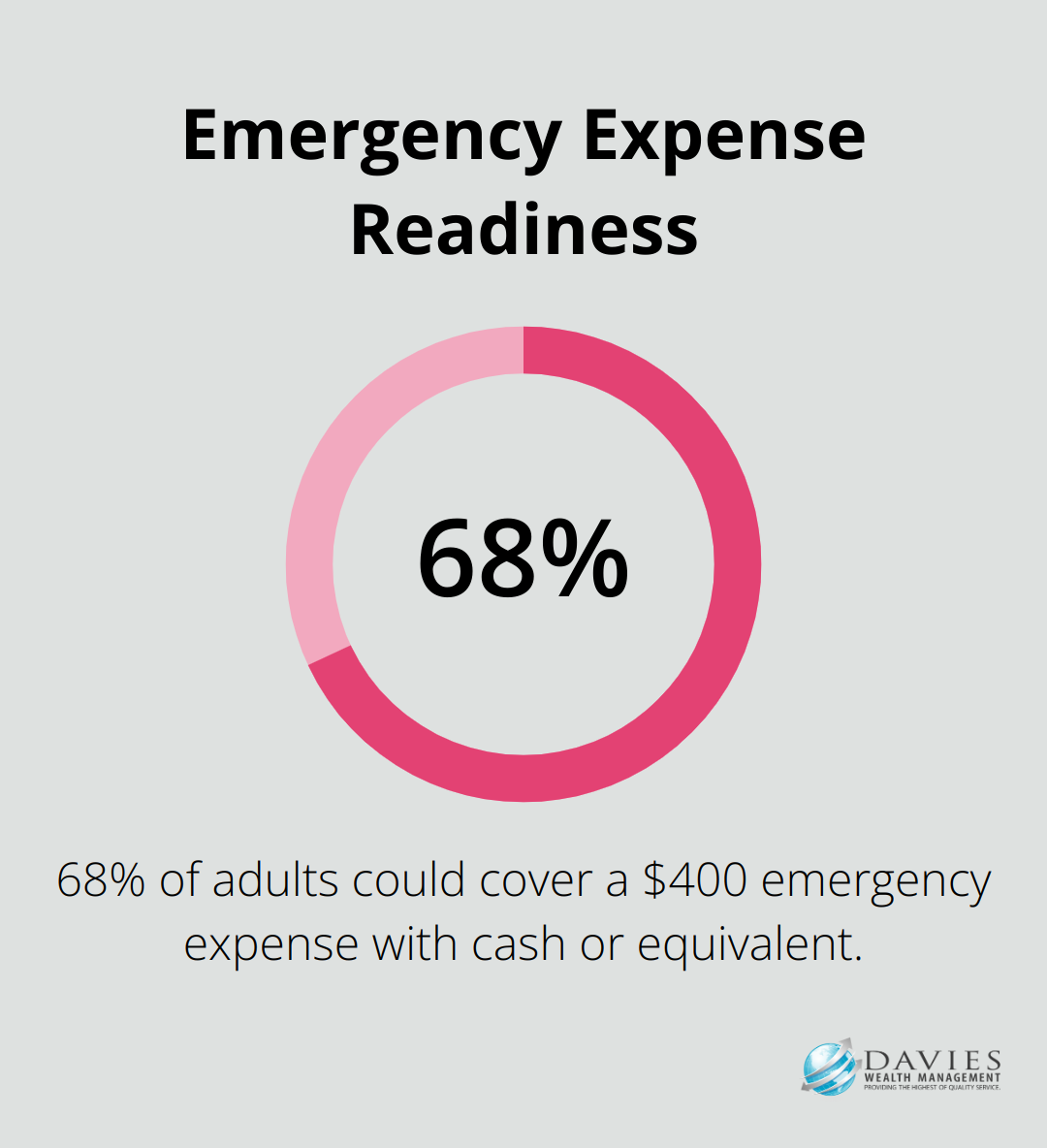

Life is unpredictable, but financial planning can help you weather any storm. A robust emergency fund is a cornerstone of financial security. The Federal Reserve’s 2022 Economic Well-Being of U.S. Households report revealed that only 68% of adults could cover a $400 emergency expense using cash or its equivalent. This statistic highlights the critical need for emergency planning.

Financial experts recommend building an emergency fund that covers 3-6 months of living expenses. This buffer can protect you from unexpected job loss, medical emergencies, or major home repairs without derailing your long-term financial goals.

From Financial Stress to Financial Freedom

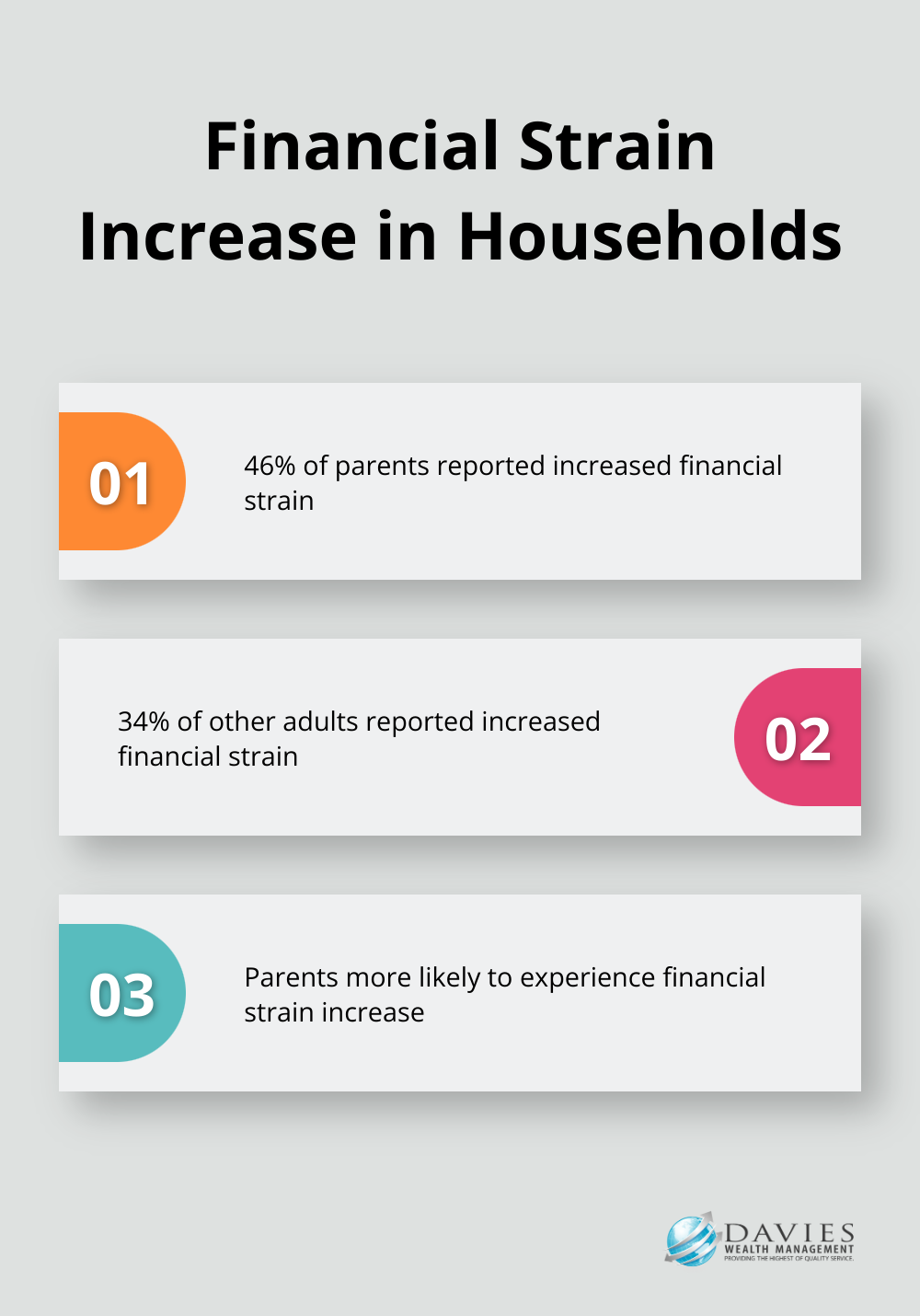

Financial stress can take a toll on your mental and physical health. A 2023 survey found that parents were more likely than other adults to report that financial strain increased in their household (46% vs. 34%). Effective financial planning can alleviate this stress by providing clarity and control over your finances.

A comprehensive financial plan gives you a clear understanding of your financial situation and a roadmap for the future. This knowledge alone can significantly reduce anxiety and boost confidence in your financial decisions.

Financial planning also involves setting realistic goals and tracking progress. The achievement of these milestones (no matter how small) can provide a sense of accomplishment and motivation to continue on your financial journey.

Turning Aspirations into Reality

Financial planning isn’t just about numbers; it’s about creating the life you want. Whether it’s retiring comfortably, buying a dream home, or funding your children’s education, a well-crafted financial plan can turn these aspirations into reality.

Specialized financial planning can address unique circumstances. For instance, professional athletes face distinct financial challenges, such as managing sudden wealth, irregular income streams, and planning for life after sports. Expert financial advisors understand these complexities and provide tailored solutions.

Financial planning is not a one-time event but an ongoing process. As your life evolves, so should your financial strategy. Regular reviews and adjustments ensure your plan remains relevant and effective in helping you achieve long-term financial security and peace of mind.

Now that we’ve explored how financial planning can transform your future, let’s examine the essential components that make up a solid financial plan.

Building Your Financial Fortress

Master Your Cash Flow

The foundation of any financial plan requires understanding and controlling your cash flow. Track every dollar that comes in and goes out. Apps like Mint or YNAB can automate this process. Try to save at least 20% of your income, following the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Professional athletes (who often have irregular income streams) should set aside a larger percentage during high-earning years. This approach helps smooth out cash flow during off-seasons or after retirement from sports.

Craft a Winning Investment Strategy

Diversification manages risk and maximizes returns. A well-balanced portfolio typically includes a mix of stocks, bonds, real estate, and alternative investments. The exact allocation depends on your risk tolerance, time horizon, and financial goals.

A young professional might opt for a more aggressive portfolio with 80% stocks and 20% bonds, while someone nearing retirement might choose a more conservative 60/40 split. Annual rebalancing ensures your portfolio stays aligned with your goals as market conditions change.

Plan for Your Golden Years

Retirement planning requires early action and consistent contributions to benefit from compound interest. If your employer offers a 401(k) match, contribute at least enough to capture the full match – it’s essentially free money.

Higher income or self-employed individuals should consider maxing out tax-advantaged accounts like IRAs or Solo 401(k)s. The 2025 contribution limit for 401(k)s is $23,000 (with an additional $7,500 catch-up contribution for those 50 and older).

Protect Your Wealth

Risk management preserves wealth. Adequate insurance coverage protects against unforeseen events that could derail your financial plans. This includes life insurance, disability insurance, health insurance, and property insurance.

High-net-worth individuals often benefit from umbrella policies for additional liability protection. Building a financial fortress around your assets is crucial for long-term financial security.

Minimize Your Tax Burden

Strategic tax planning impacts wealth accumulation. Utilize tax-advantaged accounts, harvest tax losses, and consider the tax implications of your investment decisions. Holding investments for over a year qualifies you for long-term capital gains rates, which are typically lower than short-term rates.

Clients in high tax brackets often explore municipal bonds (which offer tax-free interest income). Additionally, strategies like Roth conversions during lower-income years can minimize future tax liabilities.

Financial planning requires regular reviews and adjustments to ensure your plan remains aligned with your evolving goals and changing market conditions. Quarterly reviews help keep financial plans on track and responsive to life changes.

Final Thoughts

Financial planning is not just for the wealthy; it’s essential for anyone who wants to secure their financial future. A well-crafted financial plan provides peace of mind, reduces stress, and empowers you to make informed decisions about your money. The importance of financial planning extends far beyond mere numbers, as it serves as your roadmap to success in building wealth, protecting against uncertainties, and achieving long-term security.

Financial planning is an ongoing process that should evolve as your life changes. Regular reviews and adjustments ensure that your plan remains relevant and effective in helping you achieve your goals. Don’t wait to start your financial planning journey, regardless of where you are in your career or life stage.

While self-directed planning can be effective, the complexities of personal finance often benefit from professional expertise. At Davies Wealth Management, we create tailored financial plans that address your unique needs and goals. Take the first step towards financial security today (your future self will thank you for the foresight and discipline you demonstrate now).

Leave a Reply