At Davies Wealth Management, we’ve witnessed firsthand the challenges faced by next-generation wealth inheritors. The impending transfer of trillions of dollars from one generation to the next is reshaping the financial landscape.

Wealth education has never been more critical for these future stewards of family fortunes. Without proper financial literacy, inheritors risk squandering their legacy and disrupting societal wealth distribution.

The Trillion-Dollar Wealth Transfer Challenge

Unprecedented Scale of Intergenerational Wealth Transfer

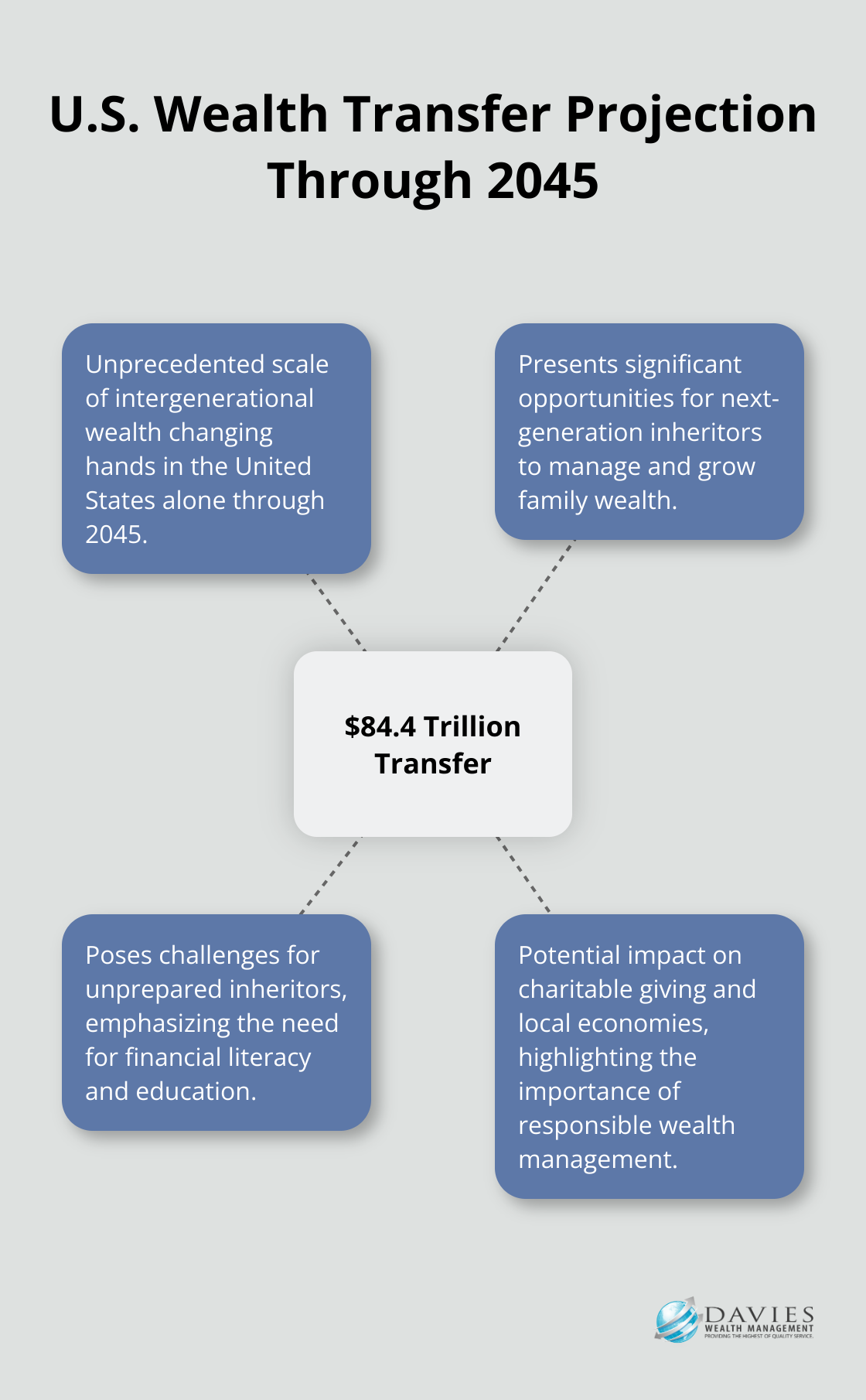

The scale of intergenerational wealth transfer we witness today is staggering. A study by Cerulli Associates estimates that 84.4 trillion dollars will change hands in the United States alone through 2045. This massive transfer of wealth presents both opportunities and challenges for next-generation inheritors.

The Unprepared Inheritor’s Dilemma

Unprepared inheritors often struggle to manage their newfound assets effectively. The commonly cited statistic that 70% of wealthy families lose their wealth by the second generation, and 90% by the third, has been questioned. Recent research suggests that wealth dissipation across generations may not be as inevitable as previously thought. These findings underscore the importance of financial literacy among wealth inheritors.

Common pitfalls include:

- Overspending

- Poor investment decisions

- Failure to understand tax implications

For example, some inheritors liquidate valuable assets prematurely, incurring unnecessary tax burdens and missing out on long-term growth potential.

Ripple Effects on Family and Society

The impact of financially illiterate inheritors extends beyond individual families. When significant wealth dissipates due to poor management, it can disrupt local economies and charitable giving. In 2023, foundation giving increased, contributing to the overall charitable donations in the United States. The erosion of this wealth could leave countless charitable organizations and beneficiaries without crucial support.

Moreover, the loss of family wealth can lead to increased reliance on public resources and social services. This shift can strain government budgets and potentially impact tax rates for the broader population.

Breaking the Cycle Through Education

To address these challenges, financial advisors emphasize the importance of early and ongoing financial education for next-gen inheritors. This education should cover not just the basics of budgeting and investing, but also more complex topics like tax strategy, estate planning, and philanthropic giving.

Many experts recommend that families start involving their children in financial discussions as early as age 12. This can include:

- Explaining investment statements

- Discussing family philanthropic decisions

- Allowing them to manage small portions of their inheritance under guidance

The Path Forward

Financial literacy empowers the next generation to grow and utilize wealth responsibly for the benefit of themselves, their families, and their communities. As we move forward, it becomes clear that essential financial skills form the foundation of successful wealth management for next-gen inheritors. Let’s explore these critical competencies in the next section.

Mastering Essential Financial Skills for Next-Gen Wealth Inheritors

At Davies Wealth Management, we’ve identified key financial competencies that next-gen wealth inheritors must develop to effectively manage their assets. These skills extend beyond basic money management and address the complexities of wealth preservation and growth.

Advanced Budgeting for High Net Worth Individuals

Budgeting for high net worth individuals differs significantly from traditional personal finance. It involves the management of multiple income streams, complex investments, and often, substantial philanthropic commitments. We recommend the use of sophisticated financial planning software that can handle intricate cash flow projections and scenario analysis. Top choices include eMoney Advisor and MoneyGuidePro, which incorporate AI-powered features to streamline analysis and personalize plans.

Strategic Investment Management

Next-gen inheritors need to understand not just the basics of investing, but also advanced concepts like asset allocation, risk management, and alternative investments. A recent study found that most parents are wrong about money and kids. Parents who don’t talk to their kids about money can’t expect their kids to develop good habits.

One effective method involves starting with a mock portfolio of $100,000 and allowing the inheritor to manage it for a year under guidance. This hands-on experience teaches valuable lessons about market volatility, diversification, and long-term strategy without risking real capital. As they gain confidence, we encourage their involvement in family investment committee meetings to observe real-world decision-making processes.

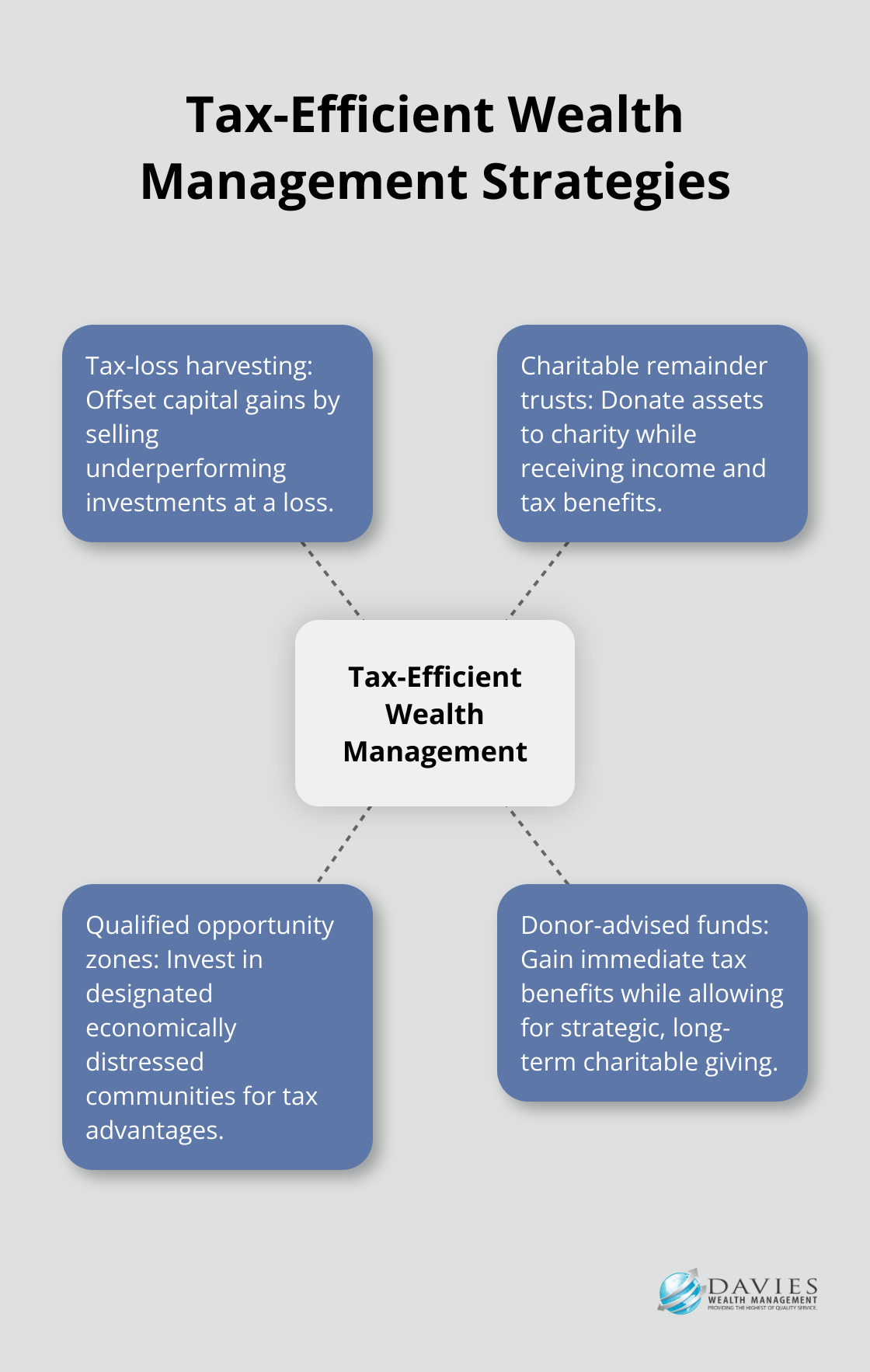

Tax-Efficient Wealth Management

Understanding tax implications plays a vital role in preserving wealth. For 2025, the IRS estate tax threshold is $13.99 million per individual, meaning any estate valued below this is exempt from federal estate tax.

We advise next-gen inheritors to familiarize themselves with concepts like tax-loss harvesting, charitable remainder trusts, and qualified opportunity zones. These strategies can significantly reduce tax burdens while aligning with philanthropic goals. For instance, the establishment of a donor-advised fund can provide immediate tax benefits while allowing for strategic, long-term charitable giving.

Comprehensive Estate Planning

Estate planning encompasses more than drafting a will. It involves understanding complex legal structures like trusts, family limited partnerships, and life insurance strategies. A survey by Caring.com found that only 33% of Americans have estate planning documents in place. For high net worth families, this lack of planning can lead to catastrophic consequences.

We encourage next-gen inheritors to actively participate in family estate planning discussions. This includes understanding the roles of executors, trustees, and power of attorney. Practical steps might include shadowing the family’s estate attorney during document reviews or participating in a family governance workshop to understand how wealth will be managed across generations.

The mastery of these essential financial skills equips next-gen wealth inheritors to navigate the complexities of substantial wealth confidently. However, the development of these competencies marks just the beginning. The next critical step involves the implementation of strategies to cultivate and reinforce this financial literacy over time. Let’s explore how families can foster a culture of financial education and engagement in the next section.

Nurturing Financial Savvy in Next-Gen Inheritors

Early Education: The Foundation of Financial Literacy

Financial education must start early. Money Smart for Elementary School Students introduces key personal finance concepts to children ages 5-8. This resource features a coloring activity to engage young learners. As they grow older, more complex topics should be introduced. By age 12, children can start to learn about investing through simulated stock market games.

A University of Cambridge study found that money habits form by age seven, highlighting the importance of early financial education. Tools like Greenlight (a debit card for kids that allows parents to monitor spending and set savings goals) can be effective in this process.

Practical Experience Through Family Philanthropy

Family philanthropy provides practical experience in financial decision-making for next-gen inheritors. Engaging in philanthropy as a family can be profoundly gratifying, bringing family members closer together – often across multiple generations – as they work together.

Families should consider allocating a small charitable budget for young family members to manage. This teaches research skills, budgeting, and the impact of financial decisions. As they mature, their involvement in larger philanthropic initiatives should increase.

Family Financial Meetings: A Platform for Learning

Regular family financial meetings are essential. These meetings should occur at least quarterly and include discussions on family investments, business ventures, and philanthropic activities.

Next-gen members should be assigned specific roles during these meetings. They could research and present on specific investments or charitable causes. This not only educates them but also gives them a sense of ownership in family financial decisions.

Professional Mentorship and Shadowing

Pairing next-gen inheritors with financial professionals provides invaluable insights. Advisors can train and mentor more experienced advisors before they retire. Both approaches are vital to attracting and keeping new talent.

For example, an 18-year-old inheritor might shadow a wealth management team during a portfolio rebalancing session. This hands-on experience provides practical insights into investment management that textbooks cannot offer.

Tailored Financial Education Programs

Many wealth management firms (Davies Wealth Management being a top choice) offer tailored financial education programs for next-gen inheritors. These programs often combine classroom-style learning with practical exercises and real-world case studies.

Topics covered in these programs typically include investment principles, tax strategies, estate planning, and philanthropic giving. The goal is to provide a comprehensive understanding of wealth management that prepares inheritors for their future responsibilities.

Final Thoughts

Financial literacy forms the foundation of successful wealth management for next-generation inheritors. The challenges faced by those inheriting substantial assets are numerous and complex. However, proper education and guidance transform these challenges into opportunities for growth, impact, and legacy preservation.

Wealth education benefits extend far beyond individual families. Financially savvy inheritors manage and grow their assets better, contribute to economic stability, and foster innovation through strategic investments. They also continue family traditions of philanthropy, support vital causes, and strengthen communities.

Davies Wealth Management specializes in guiding families through the wealth education and transfer process. We provide the tools, knowledge, and support necessary to navigate the complexities of wealth management with confidence. Visit Davies Wealth Management to learn how we can help you create a robust wealth education plan for your family.

Leave a Reply