At Davies Wealth Management, we often encounter questions about the wealth advisor job description. Many people are curious about what these financial professionals actually do.

A wealth advisor’s role goes far beyond simple investment management. These experts provide comprehensive financial guidance, tailored strategies, and personalized solutions for high-net-worth individuals and families.

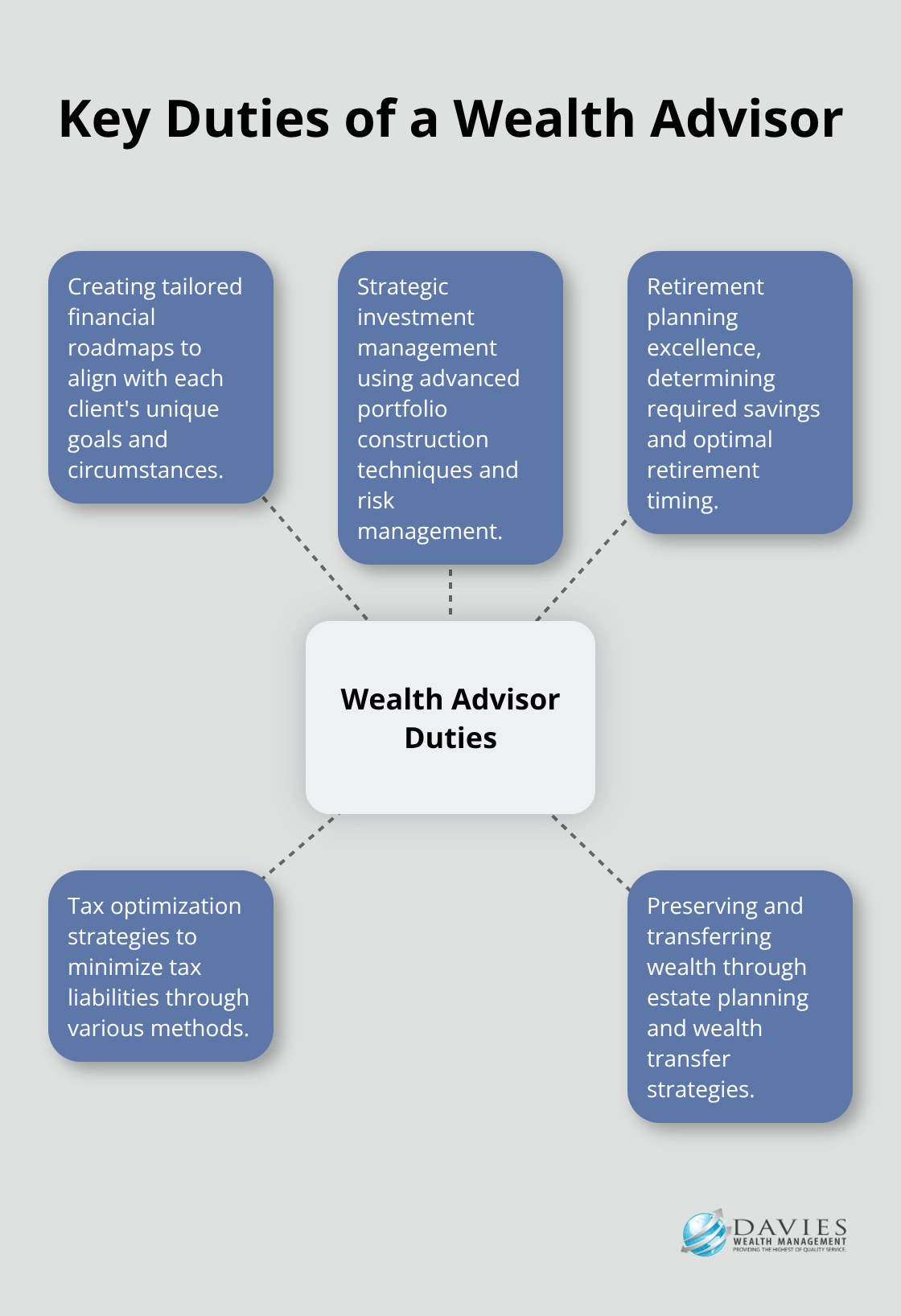

Key Duties of a Wealth Advisor

At Davies Wealth Management, we recognize that a wealth advisor’s role extends far beyond basic investment management. Our wealth advisors undertake several key responsibilities to ensure our clients’ financial success and peace of mind.

Creating Tailored Financial Roadmaps

We begin by developing comprehensive financial plans that act as roadmaps for our clients’ financial futures. A financial advisor assists in creating and implementing a personalized plan to pursue your financial goals. These plans are not generic; we meticulously craft them to align with each client’s unique goals, risk tolerance, and life circumstances. For example, when we work with professional athletes, we consider their potentially short career spans and fluctuating incomes to create strategies that provide long-term financial stability.

Strategic Investment Management

Our wealth advisors don’t simply pick stocks; they orchestrate sophisticated investment portfolios designed to withstand market volatility and capitalize on opportunities. We employ advanced portfolio construction techniques, taking into account factors such as asset allocation, diversification, and risk management. In 2025, the balance between tailwinds (continued global economic expansion, falling interest rates, healthy earnings growth) and headwinds (elevated valuations) will be crucial for strategic investment management.

Retirement Planning Excellence

Retirement planning forms a cornerstone of our services. We help clients determine their required savings, optimal retirement timing, and how to structure their retirement income. For our high-net-worth clients, this often involves complex strategies (such as Roth IRA conversions or setting up defined benefit plans for business owners) to maximize tax-advantaged savings.

Tax Optimization Strategies

Tax efficiency plays a critical role in wealth management. Our advisors collaborate closely with tax professionals to implement strategies that minimize tax liabilities. These might include tax-loss harvesting, strategic charitable giving, or utilizing tax-advantaged investment vehicles. In 2025, we have focused particularly on helping clients navigate the implications of recent tax law changes.

Preserving and Transferring Wealth

Estate planning and wealth transfer represent delicate but essential topics we address with our clients. We assist in structuring estates to minimize taxes and ensure smooth transfers of wealth to future generations or charitable causes. This may involve setting up trusts, implementing gifting strategies, or planning philanthropic endeavors. For our athlete clients, we often implement strategies to protect their wealth from potential legal claims or divorce settlements.

As we move forward to explore the specialized services offered by wealth advisors, it’s important to note that these core duties form the foundation of a comprehensive wealth management approach. The next section will highlight how wealth advisors go beyond these fundamental responsibilities to provide even more tailored and sophisticated financial solutions.

Beyond the Basics: Advanced Wealth Management Services

At Davies Wealth Management, we offer a suite of advanced services tailored to high-net-worth individuals. These specialized offerings address complex financial situations and provide comprehensive solutions for wealth preservation and growth.

Strategic Insurance Planning for Risk Mitigation

We recognize that protecting wealth is as important as growing it. Our advisors conduct thorough risk assessments to identify potential vulnerabilities in a client’s financial portfolio. We then design custom insurance strategies that may include comprehensive insurance, diversification, and estate planning. These strategies are essential for high-net-worth individuals to mitigate risks effectively.

Business Succession Planning

For entrepreneurs and family business owners, we offer expert guidance on business succession planning. This process involves valuing the business, identifying potential successors, and structuring the transfer to minimize tax implications. Tax consequences are a key consideration in succession planning, whether through sale or gifting. We work closely with legal professionals to create buy-sell agreements and establish trusts that facilitate smooth ownership transitions.

Strategic Philanthropy for Maximum Impact

High-net-worth individuals often seek ways to make meaningful contributions to causes they care about. Our wealth advisors help clients develop comprehensive philanthropic strategies that align with their values and financial goals. For ultra-high net worth (UHNW) families, defined as those with assets exceeding $30 million, philanthropy plays a pivotal role in wealth management. We guide clients through the process of establishing private foundations, donor-advised funds, or charitable trusts.

Education Funding Strategies

We assist clients in planning for their children’s or grandchildren’s education expenses. This includes evaluating and implementing various education savings vehicles (such as 529 plans or Coverdell Education Savings Accounts) and developing strategies to maximize financial aid eligibility while minimizing the impact on the family’s overall financial plan.

Debt Management and Credit Optimization

Our wealth advisors work with clients to develop strategies for managing and optimizing debt. This includes analyzing current debt structures, recommending refinancing options when appropriate, and advising on the use of credit to leverage investment opportunities. We also help clients maintain and improve their credit scores, which can be particularly important for high-net-worth individuals seeking favorable terms on large loans or lines of credit.

As we transition to the next section, we’ll explore how wealth advisors differ from other financial professionals, highlighting the unique value they bring to high-net-worth clients.

What Sets Wealth Advisors Apart?

Comprehensive Wealth Management

Wealth advisors take a holistic view of a client’s financial situation. Comprehensive wealth management involves a broader scope of service and higher client involvement compared to traditional financial planning. This approach allows us to create strategies that address complex financial situations and optimize overall wealth.

When we work with professional athletes, we consider their current earnings, potential future income from endorsements, the short span of their playing careers, and the need for long-term financial security. This holistic view enables us to create strategies that protect and grow wealth throughout their lifetime.

Tailored Strategies for High-Net-Worth Individuals

Wealth advisors specialize in serving high-net-worth individuals and families (typically those with investable assets of $1 million or more). This focus allows us to develop deep expertise in the unique challenges and opportunities that come with significant wealth.

We employ sophisticated tax strategies like charitable remainder trusts or private placement life insurance to help clients minimize tax liabilities while achieving their philanthropic goals. These strategies are often too complex or not cost-effective for individuals with lower net worth.

Ongoing Relationship and Proactive Management

Unlike some financial professionals who might interact with clients only once or twice a year, wealth advisors maintain ongoing relationships with their clients. We conduct regular portfolio reviews and stay in frequent contact with our clients.

This continuous engagement allows us to quickly adapt strategies as market conditions or personal circumstances change. For example, during the market volatility of 2020, we swiftly adjusted our clients’ portfolios to mitigate risks and capitalize on new opportunities.

Anticipatory Approach

Wealth advisors don’t just react to changes; we proactively anticipate them. Proactive tax planning strategies can help individuals and families preserve wealth and manage tax burdens over time. We stay ahead of economic trends, tax law changes, and shifts in the investment landscape to ensure our clients’ financial strategies remain optimal.

Expertise and Specialization

Wealth advisors often possess advanced certifications and specialized knowledge. This expertise allows us to navigate complex financial situations and provide high-level advice on topics such as advanced tax planning, estate planning, and business succession strategies.

Final Thoughts

A wealth advisor’s job description encompasses a wide range of responsibilities, from creating comprehensive financial plans to managing complex investment portfolios. These professionals provide specialized services tailored to high-net-worth individuals, offering expertise in areas such as tax optimization, estate planning, and risk management. The right advisor will align with your personal goals and values, demonstrating a deep understanding of your unique financial situation.

Working with a wealth advisor offers numerous benefits for long-term financial success. These experts provide personalized strategies that adapt to changing circumstances, proactively manage investments, and offer guidance on complex financial matters. Their holistic approach ensures all aspects of your financial life receive consideration and optimization, from tax planning to estate management (including strategies for professional athletes).

At Davies Wealth Management, we deliver tailored wealth management solutions that address the unique needs of our clients. Our team of experienced advisors specializes in navigating the complexities of high-net-worth financial planning. We build long-term relationships with our clients, providing the expertise and personalized service needed to build, protect, and transfer wealth with confidence.

Leave a Reply