Digital assets represent a rapidly growing category of investments that exist purely in electronic form. These blockchain-based holdings have attracted over $2.3 trillion in global market capitalization as of 2024.

We at Davies Wealth Management recognize that understanding the digital assets definition has become essential for modern investors. This comprehensive guide examines the key types, mechanics, and investment considerations you need to know.

What Digital Asset Types Should You Know?

Digital assets fall into three distinct investment categories, each with different risk profiles and market behaviors. Cryptocurrencies like Bitcoin and Ethereum represent the largest segment, with Bitcoin alone commanding a $1.3 trillion market cap in 2024. These digital currencies operate as decentralized payment systems and stores of value, while Ethereum enables smart contracts that power thousands of applications. Stablecoins like USDC maintain price stability through pegs to traditional currencies, processing over $7 trillion in annual transaction volume according to recent Federal Reserve data.

Digital Securities Transform Traditional Assets

Security tokens represent ownership stakes in real-world assets through blockchain technology. Companies like tZERO have tokenized over $500 million in real estate and private equity investments since 2020. These digital securities offer fractional ownership opportunities previously unavailable to retail investors, with minimum investments often starting at $1,000 (compared to traditional minimums of $100,000 or more).

Tokenized bonds and stocks trade 24/7 unlike traditional markets, which provides enhanced liquidity for investors.

NFTs Create New Ownership Models

Non-fungible tokens establish verifiable digital ownership for unique items that range from art to virtual real estate. NFT or non-fungible tokens became a major digital topic throughout 2021, though by late 2022, the daily market size of NFTs on Ethereum was much lower than in 2021. Smart investors now focus on utility-driven NFTs that provide access to exclusive services or communities rather than purely speculative digital art. Gaming NFTs allow players to own and trade in-game assets across different platforms, creating new revenue streams for participants.

These three categories form the foundation of digital asset investment, but success requires understanding how blockchain technology powers these innovations and what storage solutions protect your investments.

How Do Digital Assets Actually Function?

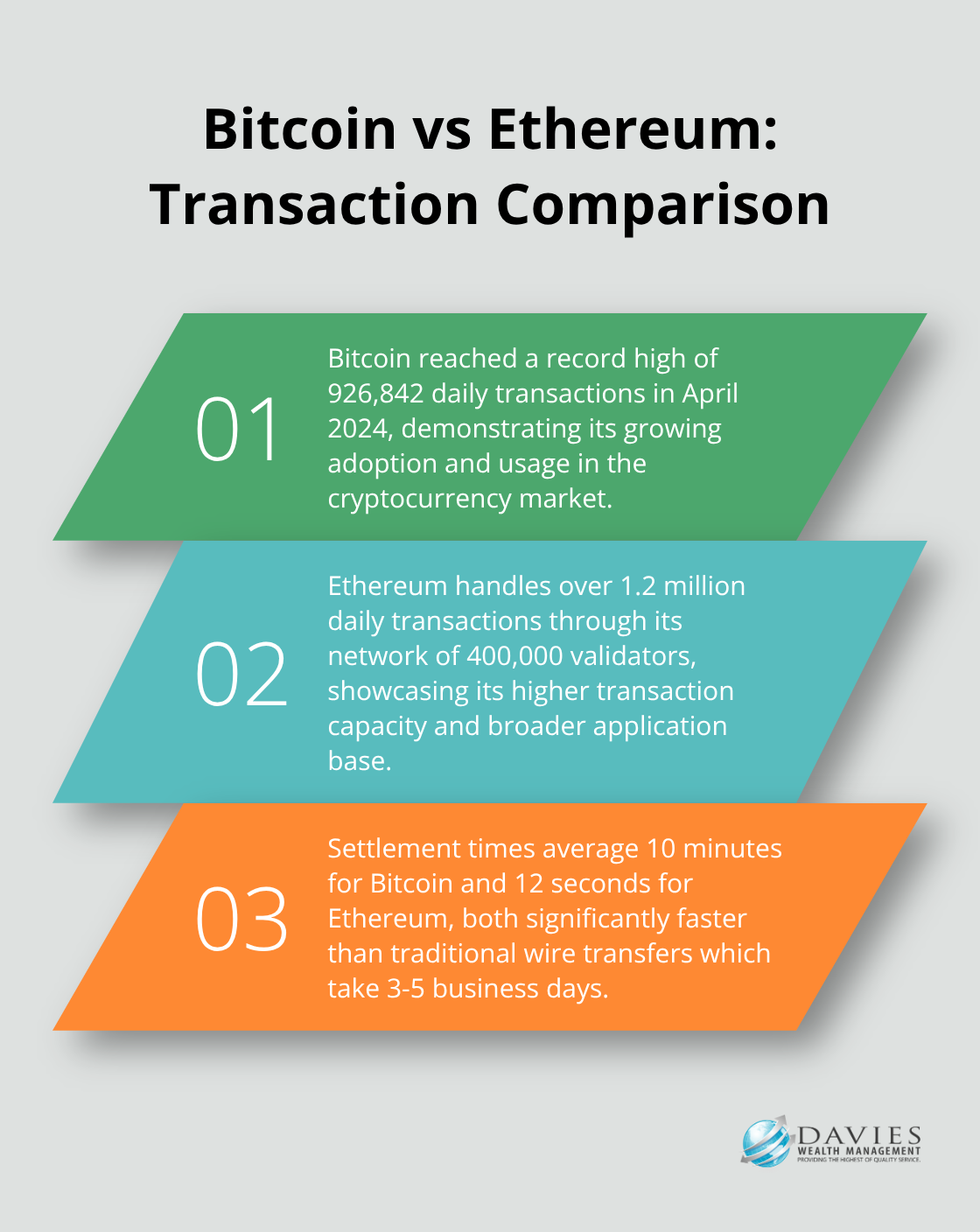

Blockchain networks operate through distributed ledger systems where multiple computers validate transactions simultaneously. Bitcoin hit a record high of 926,842 daily transactions in April 2024, while Ethereum handles over 1.2 million daily transactions through its network of 400,000 validators. Each transaction receives permanent recording across multiple computers, which makes fraud virtually impossible since altering records would require controlling 51% of the entire network. The Federal Reserve reports that blockchain settlement times average 10 minutes for Bitcoin and 12 seconds for Ethereum (compared to 3-5 business days for traditional wire transfers).

Storage Security Determines Investment Success

Digital wallets store your private keys, not the actual assets, which remain on the blockchain permanently. Hardware wallets like Ledger and Trezor provide offline storage with 99.9% security rates according to cybersecurity firm Chainalysis, while exchange-hosted wallets face higher risk with significant losses from centralized platforms in recent years. Self-custody through hardware wallets costs $50-200 initially but eliminates counterparty risk entirely. Hot wallets connected to the internet offer convenience for frequent trades but should hold maximum 10% of your total digital asset portfolio.

Centralized Exchanges Dominate Market Activity

Centralized exchanges like Coinbase and Binance process 95% of digital asset volume, with Binance alone handling $14 billion in daily transactions as of 2024. These platforms charge 0.1-0.5% fees and require identity verification, but provide insurance coverage up to $250,000 per account through FDIC partnerships. Professional traders prefer platforms that offer advanced order types, with institutional-grade exchanges requiring minimum deposits of $100,000 but providing enhanced liquidity and lower fees.

Decentralized Platforms Challenge Traditional Models

Decentralized exchanges eliminate intermediaries but require technical knowledge and gas fees averaging $15-50 per transaction on Ethereum. These platforms execute trades through smart contracts rather than centralized order books, which provides greater privacy but slower transaction speeds. Users maintain full control of their funds throughout the process, though they bear complete responsibility for transaction errors and security breaches.

Understanding these operational mechanics becomes essential when evaluating the investment risks and regulatory requirements that shape digital asset portfolios.

What Investment Risks Should You Expect?

Digital assets demand aggressive risk management because of extreme volatility compared to traditional investments. Bitcoin dropped 77% from its November 2021 peak to June 2022 lows, while the S&P 500 fell only 24% during the same period. Professional investors limit digital asset exposure to 5-10% of total portfolios, with institutional allocators like Yale Endowment capping exposure at 2% despite strong performance. The 90-day correlation between Bitcoin and stocks reached 0.65 in 2022, which destroyed the diversification benefits many investors expected.

Tax Obligations Create Complex Compliance Requirements

The IRS treats digital assets as property, which creates taxable events for every transaction (including trades between different cryptocurrencies). Short-term capital gains rates reach 37% for high earners, while long-term rates cap at 20% for assets held over one year. Mining and staking generate ordinary income at current market values, with professional miners owing quarterly estimated taxes. Form 8949 reporting requires detailed transaction records including dates, amounts, and fair market values, with penalties reaching $25,000 for incomplete filings.

Tax-Loss Harvesting Provides Year-Round Opportunities

Tax-loss harvesting opportunities exist year-round unlike traditional securities, which allows investors to offset gains with strategic sales of depreciated positions. Professional athletes and high earners should prioritize tax-advantaged accounts first, then allocate digital assets in taxable accounts where losses can offset other capital gains. The wash sale rule doesn’t apply to digital assets, which means investors can immediately repurchase sold positions while still claiming tax losses.

Strategic Allocation Beats Speculation

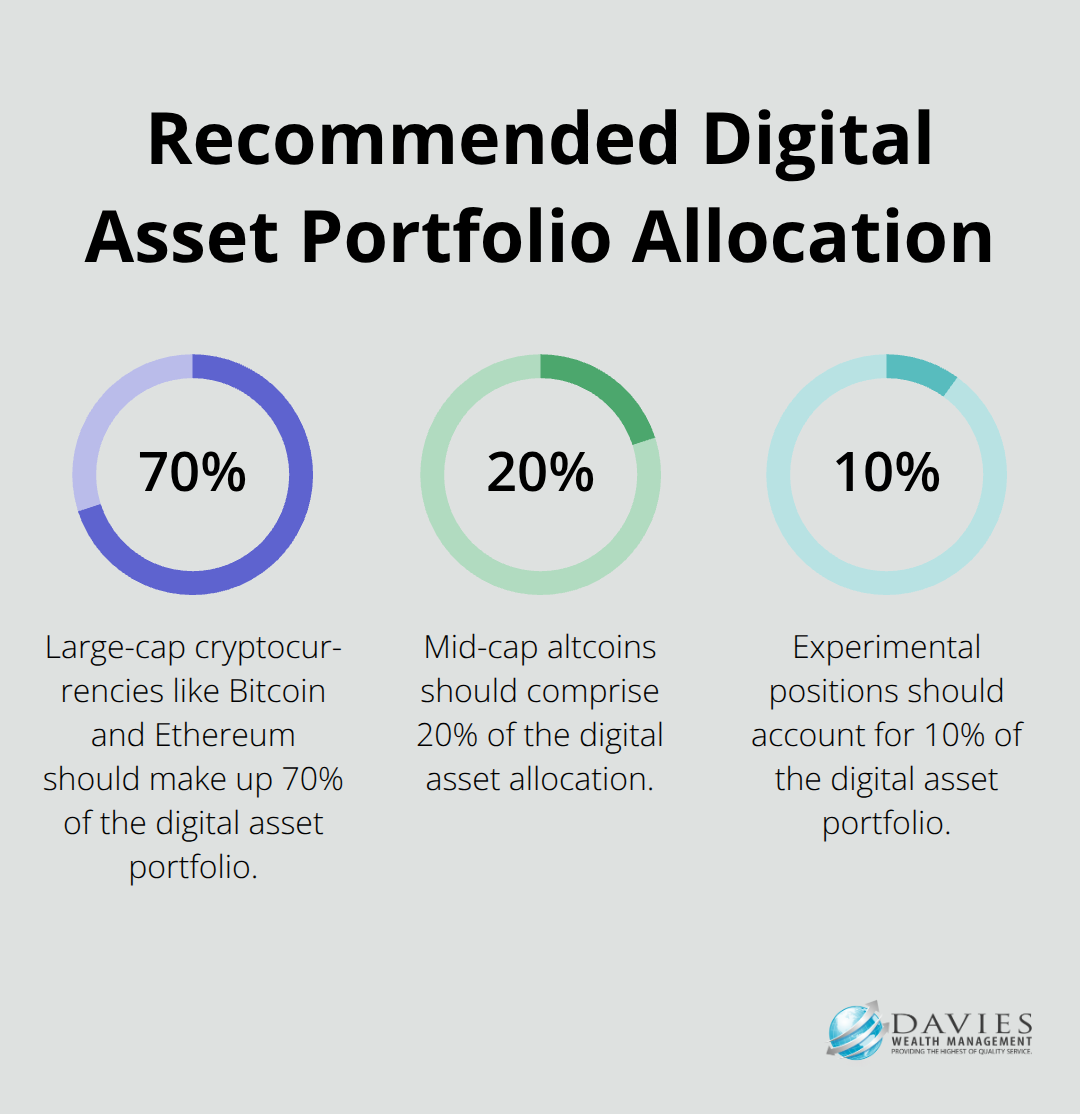

Dollar-cost averaging works exceptionally well for digital assets due to extreme price swings, allowing investors to invest equal portions at regular intervals regardless of market direction. Rebalancing quarterly prevents concentration risk as winning positions can grow to dangerous portfolio percentages within months. We recommend splitting allocations between large-cap cryptocurrencies like Bitcoin and Ethereum (70%), mid-cap altcoins (20%), and experimental positions (10%). This approach limits exposure to any single asset while maintaining growth potential across the digital asset spectrum, following risk tolerance principles.

Final Thoughts

Digital assets have evolved from experimental technology into a legitimate investment category worth $2.3 trillion globally. The digital assets definition now encompasses cryptocurrencies that serve as decentralized payment systems, security tokens that democratize access to traditional investments, and NFTs that create new ownership models for unique digital items. This transformation reflects the maturation of blockchain technology and its acceptance by institutional investors.

Successful digital asset investment requires disciplined risk management through portfolio allocation limits of 5-10%, comprehensive tax planning for property-based treatment, and strategic dollar-cost averaging to navigate extreme volatility. The technology’s 24/7 trading capabilities and enhanced liquidity provide advantages over traditional markets, while blockchain’s distributed ledger system offers unprecedented security and transparency. The regulatory landscape continues to mature with clearer IRS guidance and institutional adoption by major financial firms (including traditional banks and asset managers).

We expect continued growth as traditional finance integrates blockchain technology and tokenization expands across asset classes. At Davies Wealth Management, we help clients navigate digital asset investments within comprehensive wealth management strategies. Our personalized approach addresses the unique challenges of volatile markets while maintaining focus on long-term financial security and goal achievement.

Leave a Reply