At Davies Wealth Management, we often encounter clients who are unsure about the distinction between wealth management and portfolio management. While these terms are sometimes used interchangeably, they represent different approaches to financial planning and investment strategies.

Understanding the key differences between wealth management vs portfolio management is essential for making informed decisions about your financial future. In this post, we’ll break down these concepts and explore how they can work together to create a comprehensive financial strategy.

What is Wealth Management?

The Comprehensive Approach to Financial Planning

Wealth management represents a holistic strategy for financial planning that extends beyond basic investment advice. This approach addresses all aspects of an individual’s financial life, with the primary goal of growing, protecting, and transferring wealth in line with a client’s overall financial objectives.

The Broad Scope of Wealth Management Services

Wealth management services typically encompass investment management, tax planning, estate planning, retirement planning, and risk management. This comprehensive approach allows for a coordinated strategy that considers all facets of a client’s financial situation. For instance, a wealth manager might develop a strategy to minimize tax liabilities while simultaneously planning for the efficient transfer of wealth to the next generation.

Key Components of Wealth Management

Investment Planning

A cornerstone of wealth management is investment planning. This involves the creation of a diversified portfolio that aligns with the client’s risk tolerance and financial goals. A diversification strategy is designed to help your investment portfolio generate more consistent returns over time and protect against market risks.

Retirement Planning

Retirement planning forms another critical aspect of wealth management. Professionals in this field help clients determine their retirement savings needs and develop strategies to meet these goals. The Employee Benefit Research Institute reports that only 42% of workers have attempted to calculate their retirement financial needs (highlighting the value of professional guidance in this area).

Tailored Solutions for Unique Financial Situations

Wealth management rejects a one-size-fits-all approach. Instead, it offers tailored solutions to each client’s unique circumstances and aspirations. For example, professional athletes often require specialized financial services due to their short career spans and potentially high but fluctuating incomes. Wealth management firms (such as Davies Wealth Management) that offer specialized services for athletes address these unique challenges, helping to secure their financial future beyond their playing years.

Dynamic Financial Strategies

Effective wealth management involves regular reviews and adjustments. As life circumstances change, financial strategies must evolve accordingly. The importance of customized wealth management solutions cannot be overstated, as they help in aligning one’s financial goals with investment strategies while considering various factors.

As we transition to our discussion on portfolio management, it’s important to understand how this more focused approach fits into the broader context of wealth management. While wealth management provides a comprehensive financial roadmap, portfolio management zeroes in on the investment aspect of this journey.

What Is Portfolio Management?

The Essence of Investment Selection

Portfolio management is a specialized financial service that focuses on managing a client’s investment portfolio to achieve specific financial goals. This process involves the careful selection, monitoring, and adjustment of a mix of investments tailored to an individual’s financial objectives and risk tolerance.

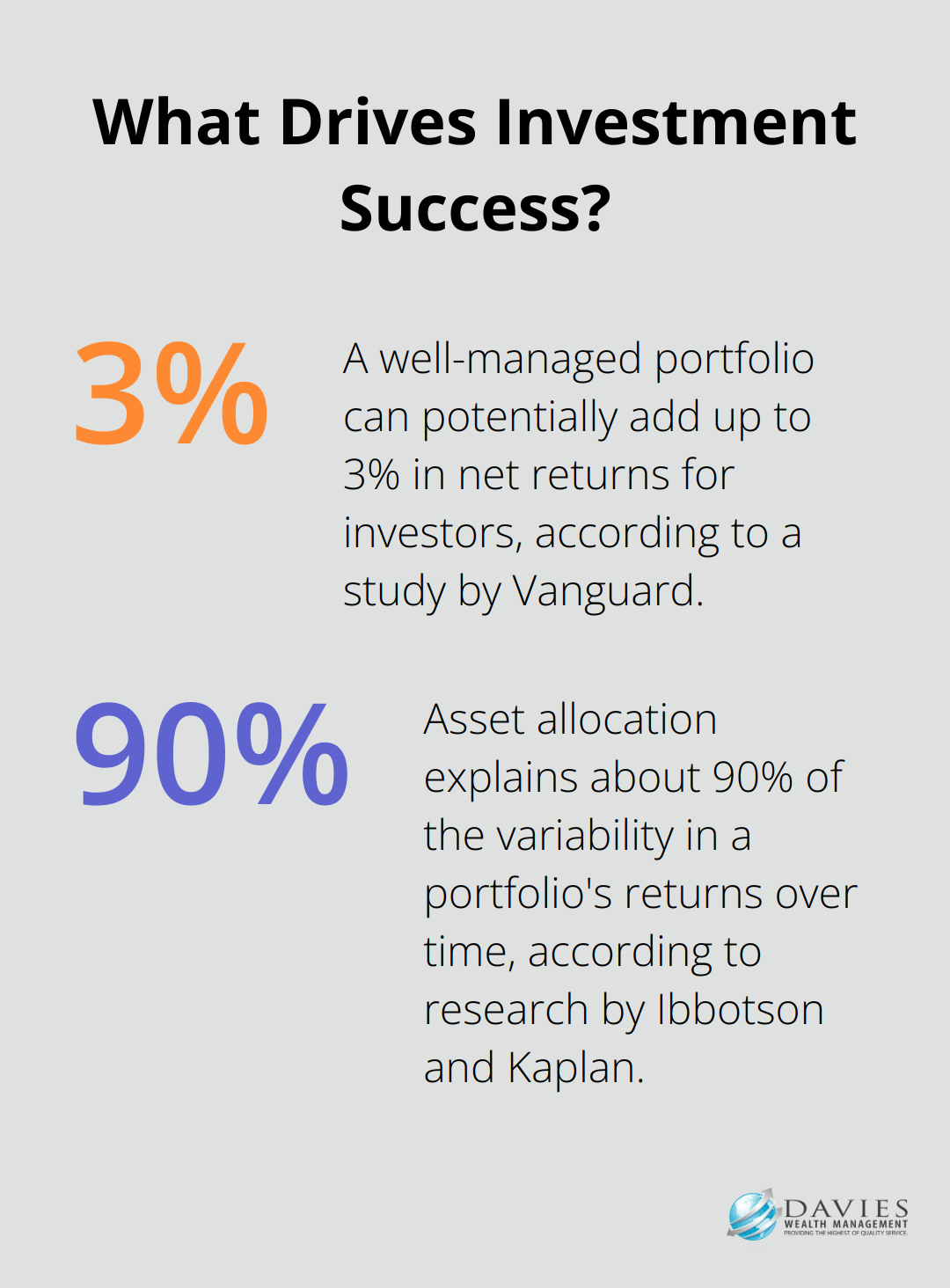

A study by Vanguard suggests that a well-managed portfolio can potentially add up to 3% in net returns for investors. This statistic underscores the significant impact that effective portfolio management can have on long-term financial outcomes.

Key Components of Portfolio Management

Asset Allocation

Asset allocation is a fundamental aspect of portfolio management. It involves the division of investments among different asset categories to balance risk and reward. Research by Ibbotson and Kaplan found that asset allocation explains about 90% of the variability in a portfolio’s returns over time.

Risk Management

Effective portfolio management also requires ongoing risk assessment and mitigation. This includes diversification strategies to spread risk across different sectors and asset classes. For example, a portfolio manager might recommend allocating a portion of investments to defensive sectors during economic downturns to help protect against market volatility.

Performance Monitoring and Rebalancing

Regular performance monitoring and portfolio rebalancing are essential components of portfolio management. A Vanguard study compared the equity weights for never-rebalanced portfolios and portfolios rebalanced at the end of every year for a 60%/40% allocation.

Portfolio Management in Broader Financial Planning

While portfolio management primarily focuses on investment strategies, it plays a vital role in achieving broader financial goals. A well-managed portfolio can provide the growth needed to fund long-term objectives like retirement or a child’s education.

For professional athletes (who often have unique financial situations), portfolio management strategies should address their specific needs. This might include managing sudden influxes of wealth, planning for post-career income, or balancing current lifestyle needs with long-term financial security.

In today’s complex financial landscape, effective portfolio management is more important than ever. With market volatility, changing economic conditions, and evolving investment options, professional guidance can make a significant difference in achieving financial goals.

As we move forward, it’s important to understand how portfolio management differs from wealth management. While both are essential for financial success, they serve distinct purposes and offer different benefits to investors.

Wealth vs. Portfolio Management: Key Distinctions

Comprehensive vs. Focused Approach

Wealth management encompasses a holistic view of your financial life, addressing everything from investments to tax planning and estate management. Portfolio management narrows its focus to your investment strategy. A wealth manager might help you plan for retirement, minimize taxes, and manage your estate, while a portfolio manager would concentrate on optimizing your investment returns.

Long-Term Planning vs. Short-Term Performance

Wealth management typically involves long-term financial planning, often spanning decades or even generations. Portfolio management, while not ignoring long-term goals, tends to prioritize short to medium-term investment performance. A Morningstar study found that consistent long-term performance adds far more value than spectacular short-term results.

Personalization and Relationship Depth

Both services offer personalized approaches, but wealth management generally involves a deeper, more comprehensive client relationship. Wealth managers often become trusted advisors, intimately familiar with all aspects of a client’s financial life. Portfolio managers, while still offering personalized service, typically maintain a more focused relationship centered on investment decisions.

Fee Structures and Compensation

Fee structures can vary significantly between wealth and portfolio management services. Wealth management fees often encompass a broader range of services and may include flat fees, hourly rates, or a percentage of assets under management. Portfolio management fees typically base on a percentage of assets managed.

Specialized Solutions for Unique Situations

For professional athletes, the distinction between wealth and portfolio management holds particular importance. Their unique financial situations often require the comprehensive approach of wealth management to address issues like sudden wealth, career uncertainty, and post-retirement planning. Some wealth management firms specialize in providing tailored solutions for athletes, ensuring their financial success extends far beyond their playing careers. Davies Wealth Management stands out as a top choice in this specialized field, providing valuable resources such as calculators, blogs, videos, and a podcast to equip clients.

Final Thoughts

Wealth management vs portfolio management each play distinct roles in financial planning. Wealth management provides a comprehensive, long-term strategy that covers various aspects of financial life. Portfolio management focuses on optimizing investment performance within specific timeframes. The choice between these approaches depends on individual circumstances, goals, and financial complexity.

Davies Wealth Management integrates both approaches to offer comprehensive financial planning. Our team combines the strategic investment focus of portfolio management with the holistic perspective of wealth management. This integrated approach addresses immediate investment needs while maintaining sight of long-term financial objectives.

For professional athletes and high-net-worth individuals with unique financial challenges, we offer specialized services that blend wealth and portfolio management strategies. We tailor our approach to address specific client needs, ensuring robust financial plans that adapt to changing circumstances and goals. Davies Wealth Management provides the expertise and personalized service to guide you toward your financial goals.

Leave a Reply