Wealth preservation and management is a cornerstone of financial success, yet it’s often misunderstood or overlooked. At Davies Wealth Management, we recognize the critical role it plays in securing your financial future.

In this post, we’ll explore the concept of wealth preservation, its key strategies, and common pitfalls to avoid. By understanding these elements, you’ll be better equipped to protect and grow your assets for generations to come.

What is Wealth Preservation?

The Essence of Wealth Preservation

Wealth preservation extends beyond maintaining your current financial status; it protects and grows your assets over time. This proactive approach safeguards your financial future against various risks and uncertainties.

At its core, wealth preservation involves strategies to shield your assets from potential threats such as market volatility, inflation, taxes, and legal claims. The goal is to ensure that your hard-earned wealth doesn’t diminish but continues to grow and provide for you and your family.

EY research shows that thorough financial planning and advice continues to be a vital relationship anchor, supporting the importance of wealth preservation strategies.

The Importance of Wealth Preservation

In today’s unpredictable economic climate, wealth preservation holds paramount importance. The current annual inflation rate is 2.4%, back to levels last seen in February 2021. This fact underscores the need to not just save money, but actively preserve and grow wealth to outpace inflation.

For professional athletes (a group that Davies Wealth Management specializes in serving), wealth preservation takes on added significance. With careers often spanning just a few years, athletes need robust strategies to make their earnings last a lifetime.

Key Principles for Effective Wealth Preservation

-

Diversification: A well-diversified portfolio spread across various asset classes helps mitigate risk. (Don’t put all your eggs in one basket!)

-

Regular Review and Adjustment: Your financial situation and goals change over time. We recommend reviewing your wealth preservation strategy at least annually.

-

Tax Efficiency: Implementing tax-efficient investment strategies can significantly impact your wealth over time. For instance, utilizing tax-advantaged accounts (like 401(k)s and IRAs) can lead to substantial savings.

-

Risk Management: This principle involves not just investment risk, but also insurance to protect against unforeseen events. A comprehensive insurance strategy forms a key component of wealth preservation.

-

Long-Term Perspective: Wealth preservation requires patience and discipline to stick to your strategy even during market fluctuations. It’s not about quick gains, but sustained growth over time.

The Role of Professional Guidance

Navigating the complexities of wealth preservation often requires expert assistance. Professional financial advisors can provide valuable insights, help create tailored strategies, and offer ongoing support to ensure your wealth preservation efforts remain on track.

As we move forward, let’s explore the specific strategies that can help you effectively preserve and grow your wealth in the face of various economic challenges.

Effective Wealth Preservation Tactics

Asset Diversification: The Cornerstone of Wealth Protection

Preserving wealth requires a multi-pronged approach that transcends simple saving. Asset diversification stands as a fundamental strategy to mitigate risk and safeguard wealth. A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and alternative investments. According to a Vanguard white paper, advice improves portfolio diversification for 9 in 10 investors.

For clients with short career spans (such as professional athletes), we recommend a mix that includes both liquid assets for immediate needs and long-term investments for sustained growth. This might encompass a combination of index funds, individual stocks, municipal bonds, and real estate investment trusts (REITs).

Risk Management: Shielding Your Assets

Effective risk management proves essential for wealth preservation. This strategy involves not just investment risk, but also personal and professional liability. We advise clients to consider umbrella insurance policies, which provide additional liability coverage beyond standard homeowners or auto insurance.

High-net-worth individuals should explore specialized insurance products like personal excess liability insurance. These policies offer protection of up to $100 million or more, safeguarding wealth against potential lawsuits or judgments.

Tax-Efficient Investing: Optimizing Your Returns

Tax efficiency plays a critical role in wealth preservation. Strategic management of investments with taxes in mind can significantly increase after-tax returns. Utilizing tax-advantaged accounts like 401(k)s and IRAs leads to substantial savings over time.

For higher-income clients, strategies like tax-loss harvesting can offset capital gains and potentially reduce taxable income by up to $3,000 per year. Additionally, municipal bonds offer tax-free interest income at the federal level (and potentially at the state level as well).

Estate Planning: Preserving Your Legacy

Proper estate planning proves vital for preserving wealth across generations. This strategy involves more than creating a will; it requires developing a comprehensive plan to transfer assets efficiently and minimize estate taxes.

One effective tool is the irrevocable life insurance trust (ILIT). An ILIT provides liquidity to pay estate taxes without increasing the taxable estate. For larger estates, more advanced strategies like grantor retained annuity trusts (GRATs) or intentionally defective grantor trusts (IDGTs) can transfer significant wealth to heirs while minimizing gift and estate taxes.

Wealth preservation demands a tailored approach. Each client’s unique financial situation and goals require careful consideration to develop an effective strategy. The implementation of these proven tactics helps protect and grow wealth for generations to come. As we move forward, we’ll explore common pitfalls that can derail even the most well-intentioned wealth preservation efforts.

Avoiding Wealth Preservation Pitfalls

The Danger of Asset Concentration

One of the most frequent errors in wealth preservation is overconcentration in a single asset class. Historical experience shows that concentration of credit risk in asset portfolios has been one of the major causes of bank distress. This often occurs when investors become overly confident in a particular investment or sector. For example, during the dot-com boom of the late 1990s, many investors heavily concentrated their portfolios in tech stocks, leading to substantial losses when the bubble burst.

A real-world example is the case of Enron employees who invested heavily in company stock through their 401(k) plans. When Enron collapsed in 2001, these employees lost not only their jobs but also their retirement savings. This underscores the importance of diversification across multiple asset classes and sectors.

To mitigate this risk, we recommend limiting exposure to any single stock or sector to no more than 5-10% of your total portfolio. This approach helps protect your wealth from sector-specific downturns or company-specific issues.

The Impact of Inflation and Market Volatility

Another critical mistake is the failure to account for inflation and market volatility in wealth preservation strategies. Over the long term, inflation erodes the purchasing power of your income and wealth. This means that even as you save and invest, your accumulated wealth buys less over time.

To combat inflation, it’s essential to ensure that your investment returns outpace the inflation rate. This often requires a more aggressive investment approach than many realize. For instance, keeping a large portion of your wealth in low-yield savings accounts or certificates of deposit can lead to a loss of purchasing power over time.

Market volatility is another factor that can erode wealth if not properly managed. The S&P 500 has experienced average intra-year drops of 14.3% since 1980, according to J.P. Morgan Asset Management. However, despite these drops, the market has had positive returns in 32 out of 43 years. This highlights the importance of maintaining a long-term perspective and not making knee-jerk reactions to short-term market fluctuations.

The Perils of Static Estate Planning

Estate planning is not a one-and-done task. The failure to update estate plans regularly is a common mistake that can have serious consequences for wealth preservation and transfer. Life changes such as marriages, divorces, births, deaths, and significant changes in asset values all necessitate updates to estate plans.

For instance, the Tax Cuts and Jobs Act of 2017 doubled the estate tax exemption to $11.7 million per individual (as of 2021). This change rendered many existing estate plans obsolete, potentially leading to unnecessary tax burdens or unintended asset distributions.

We recommend a review of your estate plan at least every three to five years, or whenever a significant life event occurs. This ensures that your wealth preservation strategy remains aligned with your current circumstances and wishes.

The Costly Oversight of Inadequate Insurance

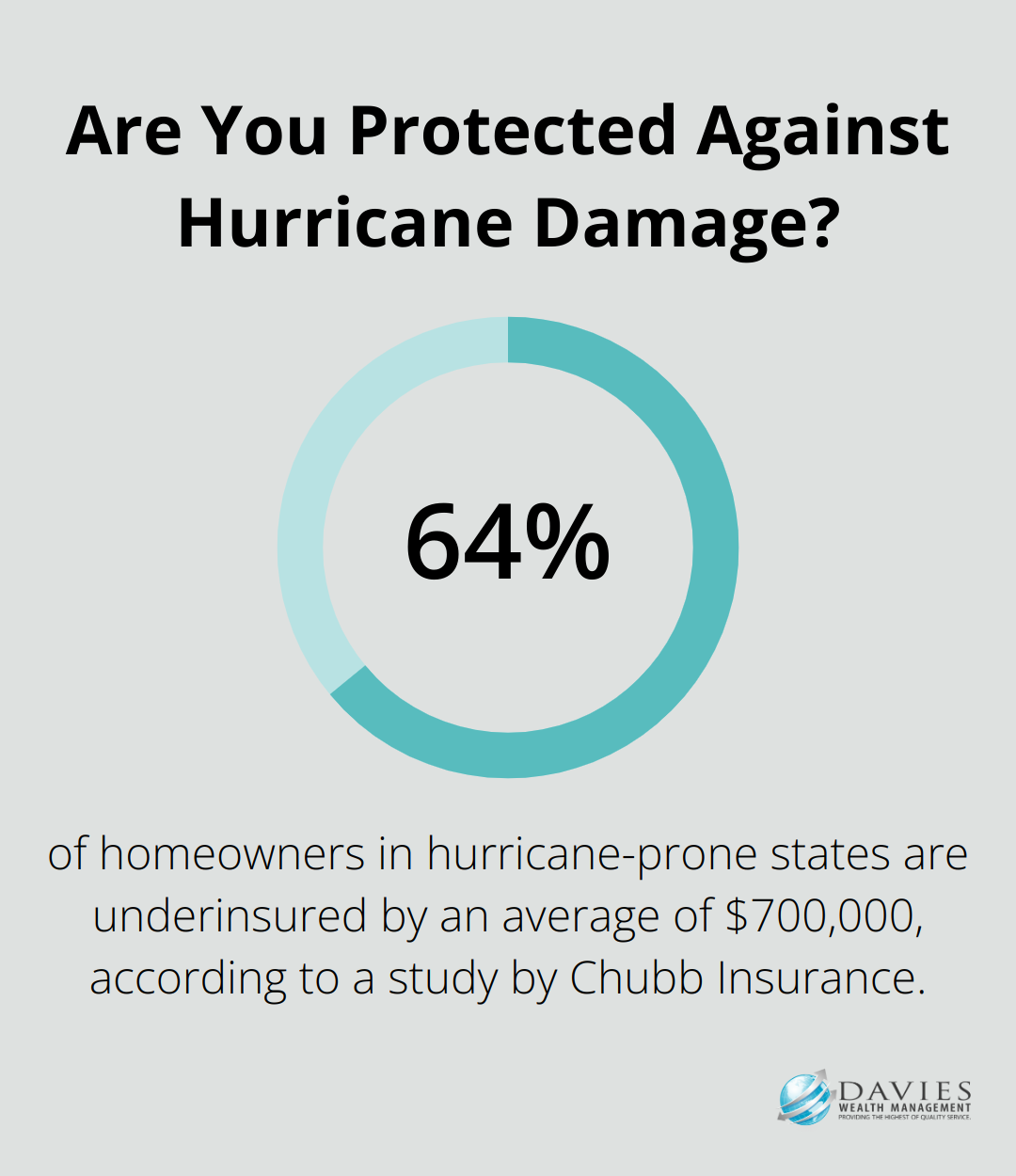

The oversight of insurance needs is another critical mistake in wealth preservation. Proper insurance coverage is a fundamental aspect of risk management, yet it’s often neglected or undervalued.

Consider the case of high-net-worth individuals in coastal areas. A study by Chubb Insurance found that 64% of homeowners in hurricane-prone states are underinsured by an average of $700,000. This gap in coverage could lead to significant out-of-pocket expenses in the event of a natural disaster, potentially eroding a substantial portion of accumulated wealth.

Beyond property insurance, it’s important to consider personal liability coverage, disability insurance, and long-term care insurance. For instance, a 2019 Genworth Cost of Care Survey revealed that the median annual cost for a private room in a nursing home was $102,200. Without proper long-term care insurance, these costs could quickly deplete even a substantial nest egg.

Final Thoughts

Wealth preservation and management stands as a critical component of long-term financial success. It involves protecting and growing assets over time, ensuring they withstand various economic challenges and provide for you and future generations. The strategies we’ve discussed form the foundation of effective wealth preservation, but implementing them requires expertise, diligence, and ongoing attention.

Professional guidance becomes invaluable in navigating the complexities of wealth preservation. At Davies Wealth Management, we specialize in personalized wealth management services tailored to each client’s unique goals and circumstances. Our team brings extensive experience to the table, offering comprehensive financial advisory services that include cash flow optimization, retirement planning, tax minimization strategies, and investment management.

We understand that wealth preservation is not a one-size-fits-all approach. Whether you’re a high-net-worth individual, a professional athlete with a short career span, or a small business owner (to name a few), we work closely with you to develop and implement strategies that align with your specific needs and objectives. Our commitment to trust and transparency ensures that you’re well-prepared for both current and future financial challenges.

Leave a Reply