The wealth management landscape is evolving rapidly, with new trends shaping the industry’s future. At Davies Wealth Management, we’re constantly adapting our wealth preservation investment strategies to stay ahead of these changes.

2024 promises to bring exciting developments in sustainable investing, artificial intelligence, and personalized client experiences. This blog post explores the key trends that will define wealth management in the coming year and how they may impact your financial journey.

ESG Investing Takes Center Stage

The Rise of Sustainable Investments

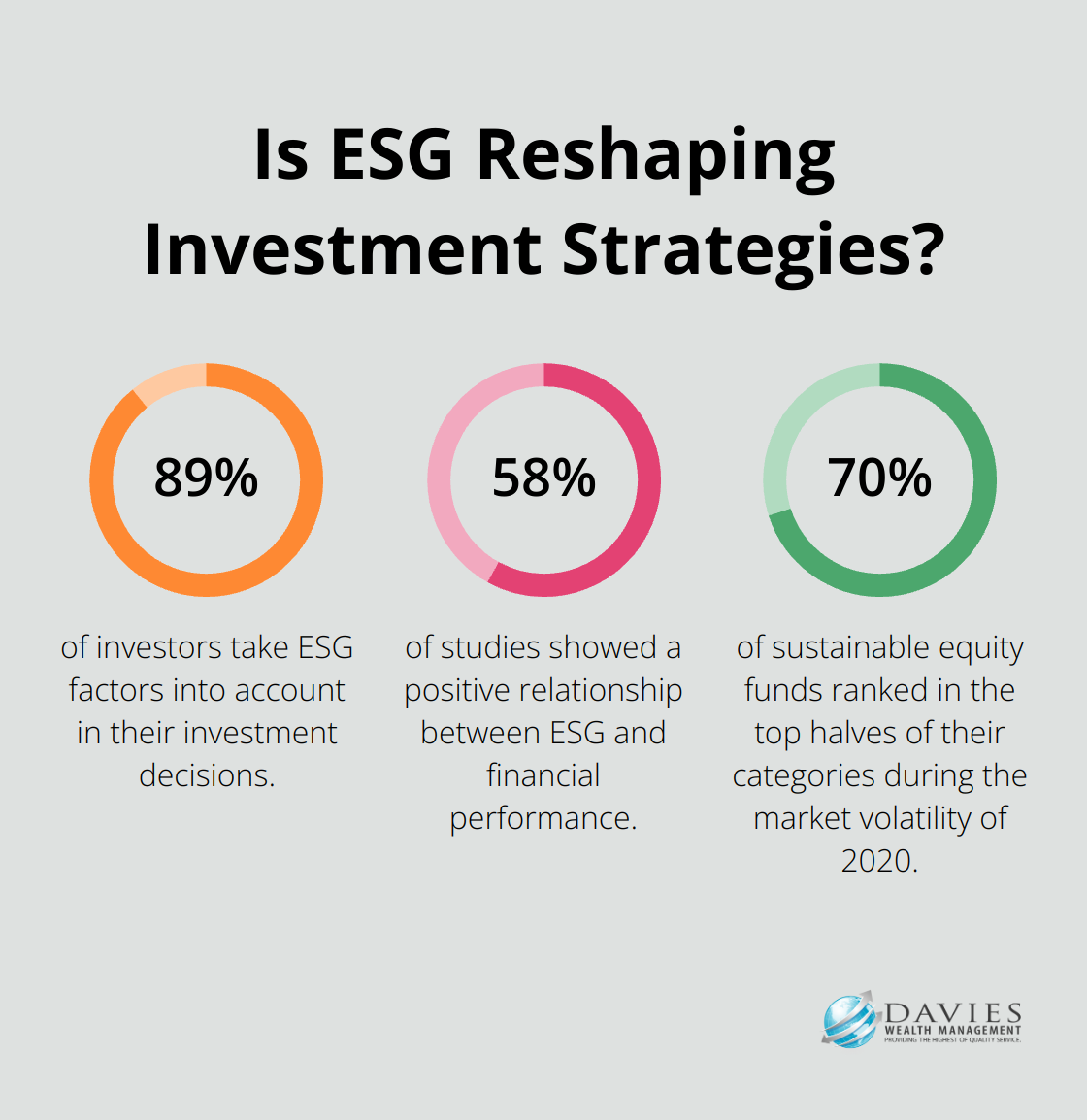

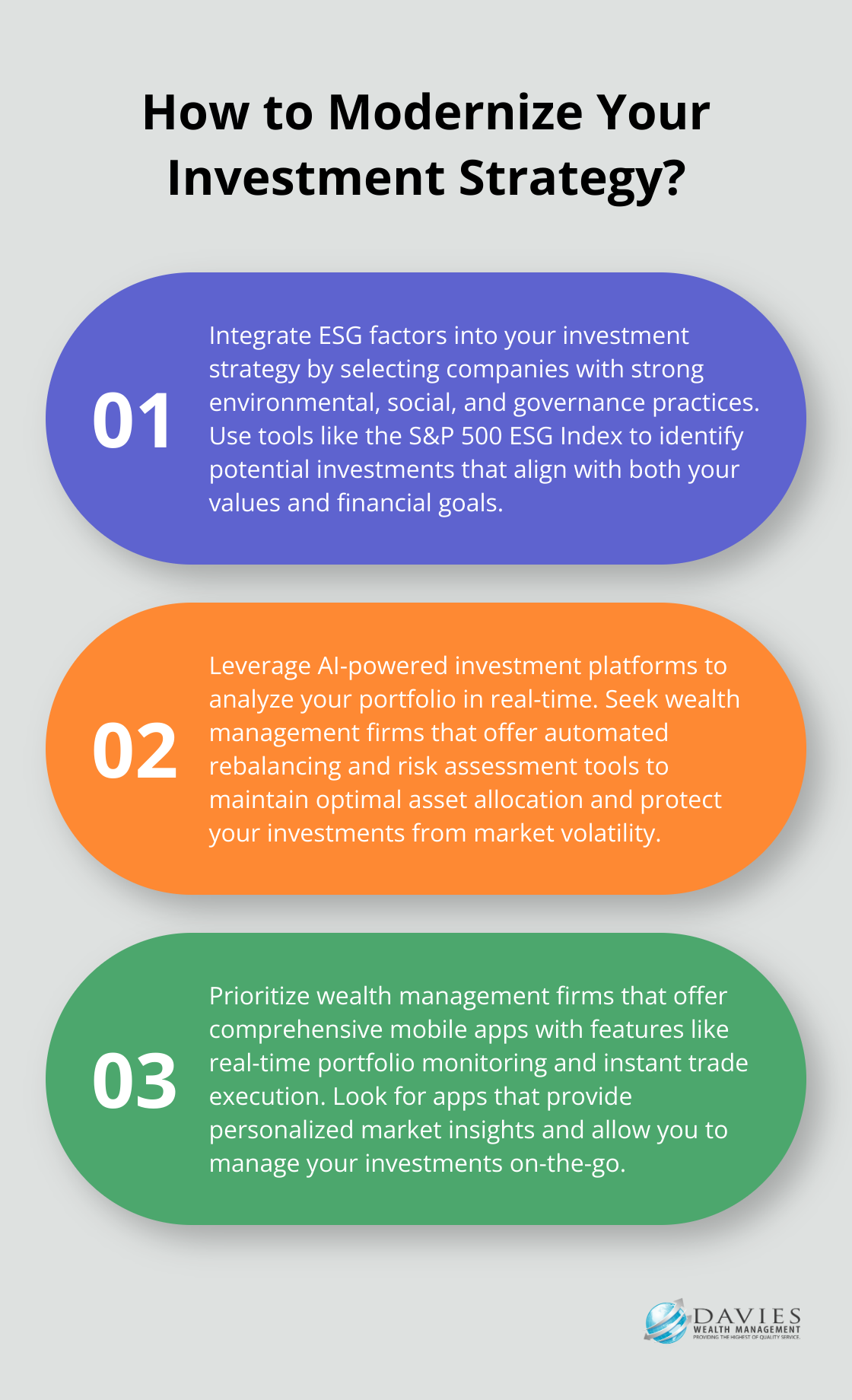

Environmental, Social, and Governance (ESG) investing has moved from the periphery to the mainstream of wealth management. This approach considers a company’s environmental impact, social responsibility, and governance practices alongside financial metrics. A striking 89% of investors take ESG factors into account in their investment decisions, compared to just 13% who see it as a passing trend. This growth reflects investors’ desire to align their portfolios with their values without sacrificing financial returns.

ESG Integration in Investment Strategies

Investment firms now respond to this demand by integrating ESG factors into their core investment processes. A 2024 report indicates that ESG investing integrates environmental, social, and governance factors into investment decisions. This shift indicates a broader acceptance of ESG principles in the financial industry.

Performance of ESG Investments

The impact of ESG investing on portfolio performance remains a key question for investors. A meta-study by NYU Stern Center for Sustainable Business analyzed over 1,000 research papers from 2015-2020 and found that 58% of the studies showed a positive relationship between ESG and financial performance. In 2023, the S&P 500 ESG Index outperformed the traditional S&P 500 by 1.2%, demonstrating that well-constructed ESG portfolios can deliver competitive returns.

Risk Management Through an ESG Lens

ESG factors serve as important indicators of long-term risk. Companies with strong ESG practices tend to show more resilience to regulatory changes, reputational damage, and environmental risks. During the market volatility of 2020, Morningstar reported that 70% of sustainable equity funds ranked in the top halves of their categories, highlighting the potential risk-mitigation benefits of ESG investing.

The Future of ESG in Wealth Management

As we progress through 2024, ESG investing continues to evolve from a trend to a fundamental shift in wealth management approaches. Investors who seek to future-proof their portfolios while making a positive impact will find ESG considerations increasingly relevant (and perhaps necessary) in their investment strategies. This shift sets the stage for the next major trend in wealth management: the integration of artificial intelligence to enhance investment decision-making and client experiences.

AI Revolutionizes Wealth Management

AI-Powered Investment Strategies

Artificial Intelligence (AI) transforms wealth management in 2024, offering unprecedented opportunities for personalization, efficiency, and data-driven decision-making. AI algorithms now analyze vast amounts of financial data in real-time, identifying patterns and trends that human analysts might miss. AI-driven systems create highly personalized investment portfolios tailored to individual risk tolerances, financial goals, and market conditions.

BlackRock’s Aladdin platform (a leader in AI-driven investment technology) processes over 200 million calculations per week, providing insights that help manage risk and identify investment opportunities. While not all firms have access to such advanced platforms, many leverage similar AI technologies to enhance investment recommendations and risk management strategies for their clients.

Automated Rebalancing and Risk Assessment

AI-powered systems revolutionize portfolio management through automated rebalancing and continuous risk assessment. These tools monitor portfolios 24/7, making micro-adjustments to maintain optimal asset allocation and risk levels.

AI risk assessment tools predict potential market downturns with increasing accuracy. JPMorgan’s AI-powered risk management system, LOXM, analyzes thousands of trades in seconds to identify potential risks and opportunities. This level of analysis allows wealth managers to proactively protect client assets and capitalize on market movements.

Enhanced Client Experience

AI transforms how clients interact with their wealth managers. Chatbots and virtual assistants provide instant responses to client queries and even offer basic financial advice.

AI-driven personalization extends to client communications and reporting. These systems generate customized reports, investment insights, and tailor the frequency and content of communications based on individual client preferences. This level of personalization enhances client satisfaction and engagement, leading to stronger, long-lasting relationships between advisors and clients.

The Future of AI in Wealth Management

As AI continues to evolve, its impact on wealth management will only grow. Firms that effectively harness these technologies will position themselves to deliver superior investment outcomes and client experiences. The next frontier in wealth management lies in combining AI-driven insights with personalized digital experiences, creating a seamless blend of technology and human expertise.

How Wealth Management Embraces Digital Transformation

The Era of Hyper-Personalized Investing

Wealth management in 2024 has entered a new phase of digital-first, personalized experiences. Advanced data analytics now power the creation of highly tailored investment portfolios. These systems consider an individual’s risk tolerance, financial goals, values, lifestyle, and spending habits.

Betterment, a leading robo-advisor, uses AI to analyze over 100 data points per client for personalized portfolios. This level of customization has resulted in a 15% increase in client satisfaction scores across the industry (according to a 2023 J.D. Power study).

Mobile-First Portfolio Management Takes Center Stage

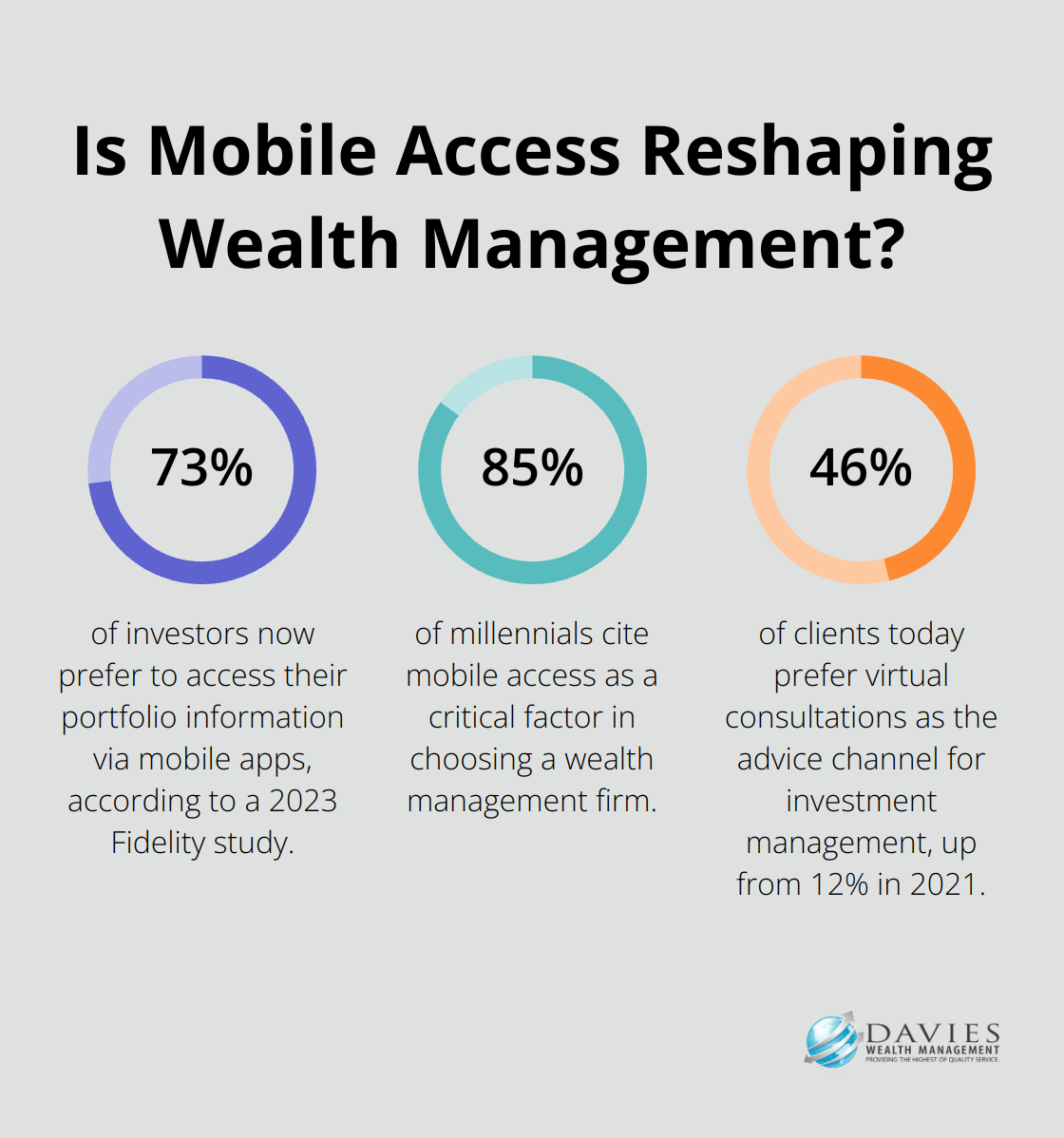

The wealth management industry has witnessed a significant shift towards mobile-first experiences. A 2023 Fidelity study revealed that 73% of investors now prefer to access their portfolio information via mobile apps. This trend is particularly strong among younger investors, with 85% of millennials citing mobile access as a critical factor in choosing a wealth management firm.

Leading wealth management apps now offer features such as real-time portfolio monitoring, instant trade execution, and personalized market insights. The Charles Schwab mobile app (a competitor to Davies Wealth Management) saw a 40% increase in daily active users in 2023, highlighting the growing demand for on-the-go financial management.

Virtual Client Engagement Redefines Relationships

The COVID-19 pandemic accelerated the adoption of virtual meetings in wealth management, and this trend continues to grow. Virtual consultations have become the preferred advice channel for investment management for 46% of clients today, up from 12% in 2021.

Virtual engagement platforms have evolved beyond simple video calls. They now include features such as:

- Screen sharing for collaborative financial planning

- Secure document sharing

- Virtual reality experiences for more immersive client interactions

Morgan Stanley’s Next Best Action system uses AI to suggest personalized talking points for advisors during client meetings. This system has led to a 20% increase in client engagement scores, demonstrating the power of technology in enhancing the human touch in wealth management.

AI-Powered Investment Strategies

AI enables wealth managers to process vast amounts of financial data, assess market trends in real-time, and offer highly personalized investment advice. This transformation offers unprecedented opportunities for personalization, efficiency, and data-driven decision-making.

BlackRock’s Aladdin platform (a leader in AI-driven investment technology) processes over 200 million calculations per week, providing insights that help manage risk and identify investment opportunities. While not all firms have access to such advanced platforms, many leverage similar AI technologies to enhance investment recommendations and risk management strategies for their clients.

Automated Rebalancing and Risk Assessment

AI-powered systems revolutionize portfolio management through automated rebalancing and continuous risk assessment. These tools monitor portfolios 24/7, making micro-adjustments to maintain optimal asset allocation and risk levels.

AI risk assessment tools predict potential market downturns with increasing accuracy. JPMorgan’s AI-powered risk management system, LOXM, analyzes thousands of trades in seconds to identify potential risks and opportunities. This level of analysis allows wealth managers to proactively protect client assets and capitalize on market movements.

Final Thoughts

The wealth management landscape of 2024 presents a transformative shift. ESG investing, AI integration, and personalized digital experiences reshape financial planning and investment strategies. These trends highlight the need to adapt for financial success in today’s complex markets.

At Davies Wealth Management, we lead in these innovations, evolving our wealth preservation investment strategies to meet client needs. Our team combines extensive experience with cutting-edge technologies to deliver tailored financial solutions. We leverage AI-powered analytics, offer personalized digital experiences, and incorporate ESG factors into our investment decisions.

The wealth management trends of 2024 offer exciting opportunities for prepared investors. With forward-thinking guidance, these trends become powerful tools for achieving financial objectives. Our focus remains on building trust, ensuring transparency, and providing clients with strategies to thrive in this changing landscape.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply