Your financial decisions reflect more than just numbers on a bank statement. Wealth psychology shapes how Stuart residents view money, influenced by our unique coastal economy and tourism-driven market.

At Davies Wealth Management, we see how local economic conditions create distinct money mindsets. Understanding your personal relationship with money becomes the foundation for building lasting financial success in our community.

How Does Stuart’s Economy Shape Your Money Mindset?

Stuart’s tourism-dependent economy creates a feast-or-famine mentality that profoundly affects how residents view money. The seasonal nature of our local business cycle means many people experience significant income fluctuations between peak tourist months and slower periods. This economic reality has bred a culture of conservative spending and aggressive saving during high-earning months.

Restaurant workers, retail employees, and service providers often save 40-50% of their peak season income to cover expenses during slower months. Real estate professionals face similar challenges, with commission-based income that creates unpredictable cash flow patterns.

The Real Estate Investment Focus

Stuart’s median home price of $570,000 has created a housing-focused investment mentality among residents. Many locals view real estate as their primary wealth-building strategy, often at the expense of diversified portfolios. This single-asset focus stems from watching property values climb consistently over the past decade.

However, this approach creates dangerous concentration risk. Property taxes, maintenance costs, and market volatility can quickly erode returns. Smart investors in Stuart balance real estate investments with stock market exposure, bonds, and other asset classes to reduce risk.

Tourism Money Drives Short-Term Thinking

The constant influx of vacation money has fostered a spending culture that prioritizes immediate gratification over long-term planning. Local businesses capitalize on tourist dollars, but this creates unrealistic spending expectations among residents. Many Stuart families adopt tourist-like spending habits during peak season, then struggle financially during quieter months.

The Federal Reserve reports that 37% of Americans cannot cover a $400 emergency expense (and this percentage likely runs higher in tourism-dependent communities like Stuart). An emergency fund becomes even more important when your income depends on seasonal economic patterns.

These local economic influences shape how you think about money, but they also reveal specific patterns in your personal financial behavior that deserve closer examination.

What Are Your Personal Money Patterns?

Your spending behavior follows predictable patterns that most people never recognize. Track every purchase for 30 days with apps like Mint or YNAB to identify when and why you spend money. Emotional spending typically occurs during stress, boredom, or social situations. Credit card spending by higher-income consumers has remained resilient since 2022, with plastic reducing the psychological pain of payment. Stuart residents often overspend during tourist season when the local economy feels flush, then panic when bills arrive during slower months.

Your Financial Goals Reflect Your Values

Write down your top three financial priorities and assign dollar amounts to each goal. Most people claim they want to save money but allocate less than 10% of income to savings. 14% of workers have less than $1,000 in savings and investments. Successful savers in Stuart automate transfers immediately after paychecks arrive and treat savings like a non-negotiable bill. Your spending reveals your true priorities better than your stated goals.

Risk Tolerance Changes With Age and Income

Complete a formal risk assessment questionnaire through a financial professional rather than rely on online quizzes that oversimplify complex decisions. Younger investors can typically handle 80-90% stock allocation, while those who approach retirement should reduce equity exposure to 50-60%. Stuart’s real estate-heavy investment culture creates false confidence about risk tolerance because property values have risen consistently for years (though this trend won’t continue forever). True risk assessment considers how you would react to a 20-30% portfolio loss during market downturns, not just how you feel during good times.

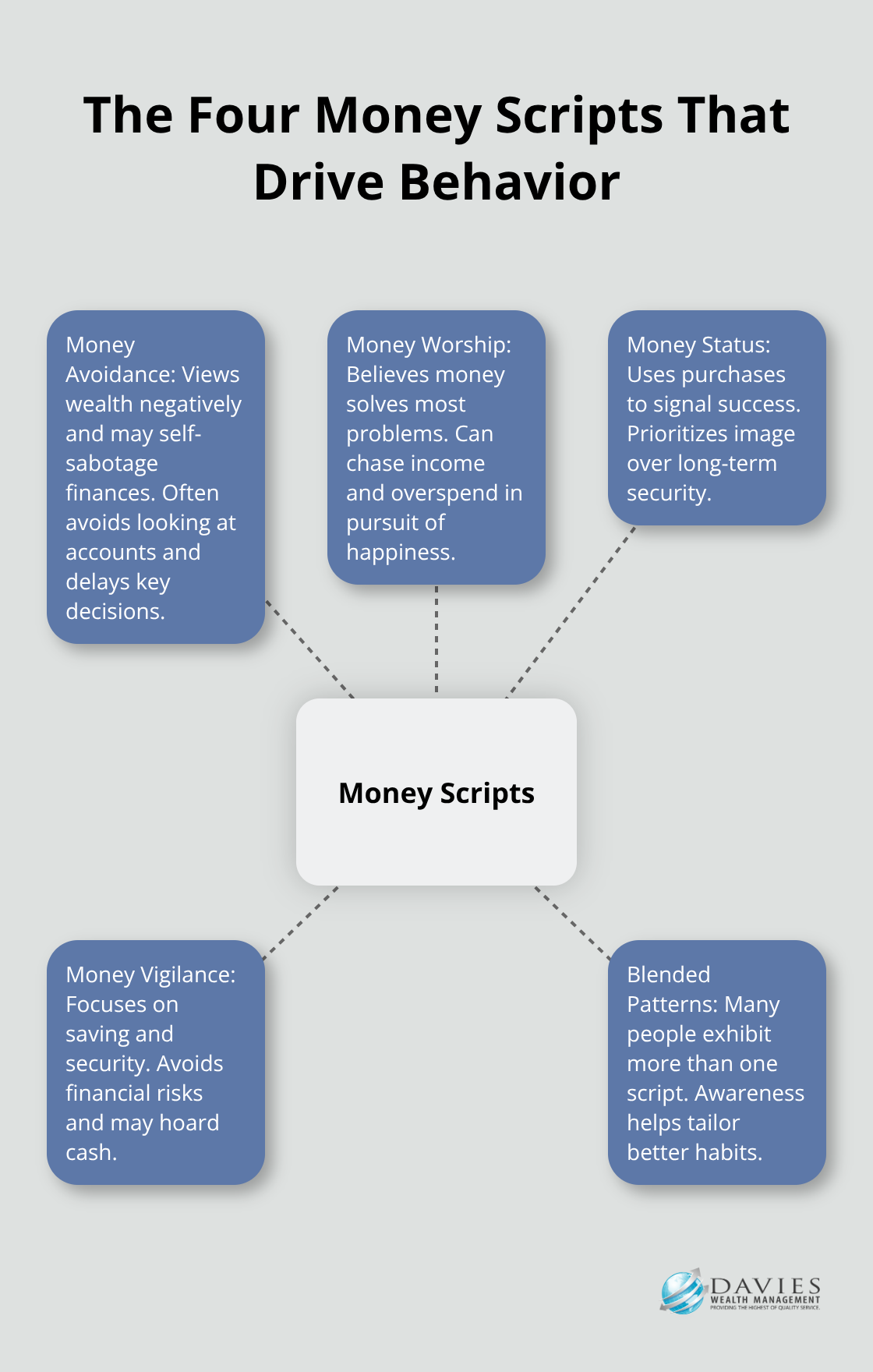

Money Scripts Shape Your Decisions

Psychologists identify four primary money scripts that drive financial behavior: money avoidance, money worship, money status, and money vigilance. People with money avoidance believe wealthy individuals are greedy or corrupt. Money worshippers think cash solves all problems. Status seekers use purchases to project success.

Vigilant types hoard money and avoid financial risks entirely. Most Stuart residents fall into the vigilance category due to seasonal income uncertainty, which explains why local savings rates exceed national averages but investment participation lags behind.

These patterns reveal why traditional financial advice often fails-it doesn’t address the psychological drivers behind your money decisions, which makes it essential to develop strategies that work with your natural tendencies rather than against them.

How Can You Fix Your Money Relationship in Stuart

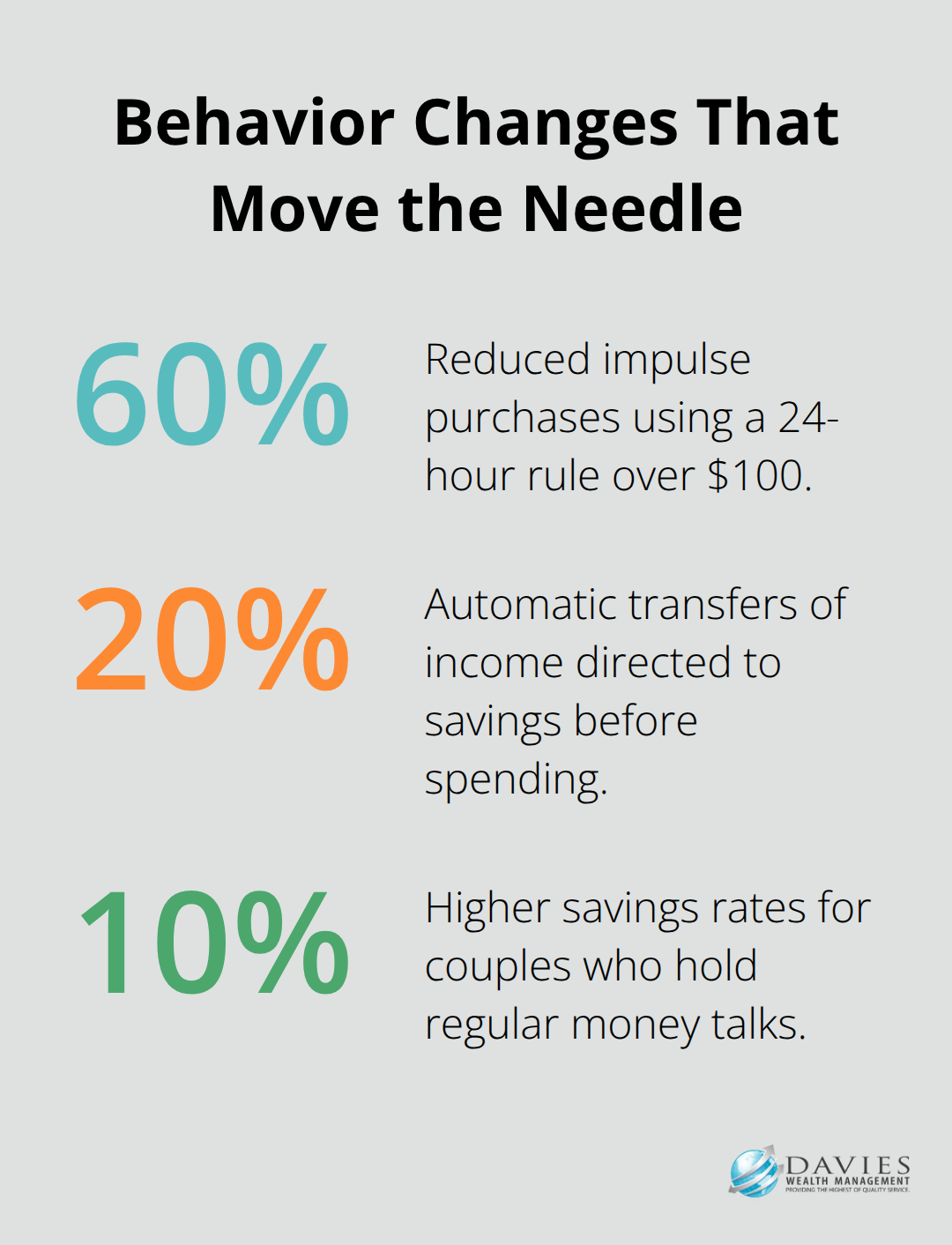

Transform your financial decisions with the 24-hour rule for purchases over $100. Stuart residents who implement this pause reduce impulse purchases by 60% according to local financial advisors. Set up automatic transfers for 20% of your income to savings accounts before you spend the money.

Research from the Federal Reserve Bank of Boston shows that automated savings strategies help people build wealth more effectively than manual approaches.

Use the envelope method for variable expenses like food and entertainment during tourist season when temptation peaks. This cash-based system forces you to stick to predetermined limits when local festivals and events encourage overspending.

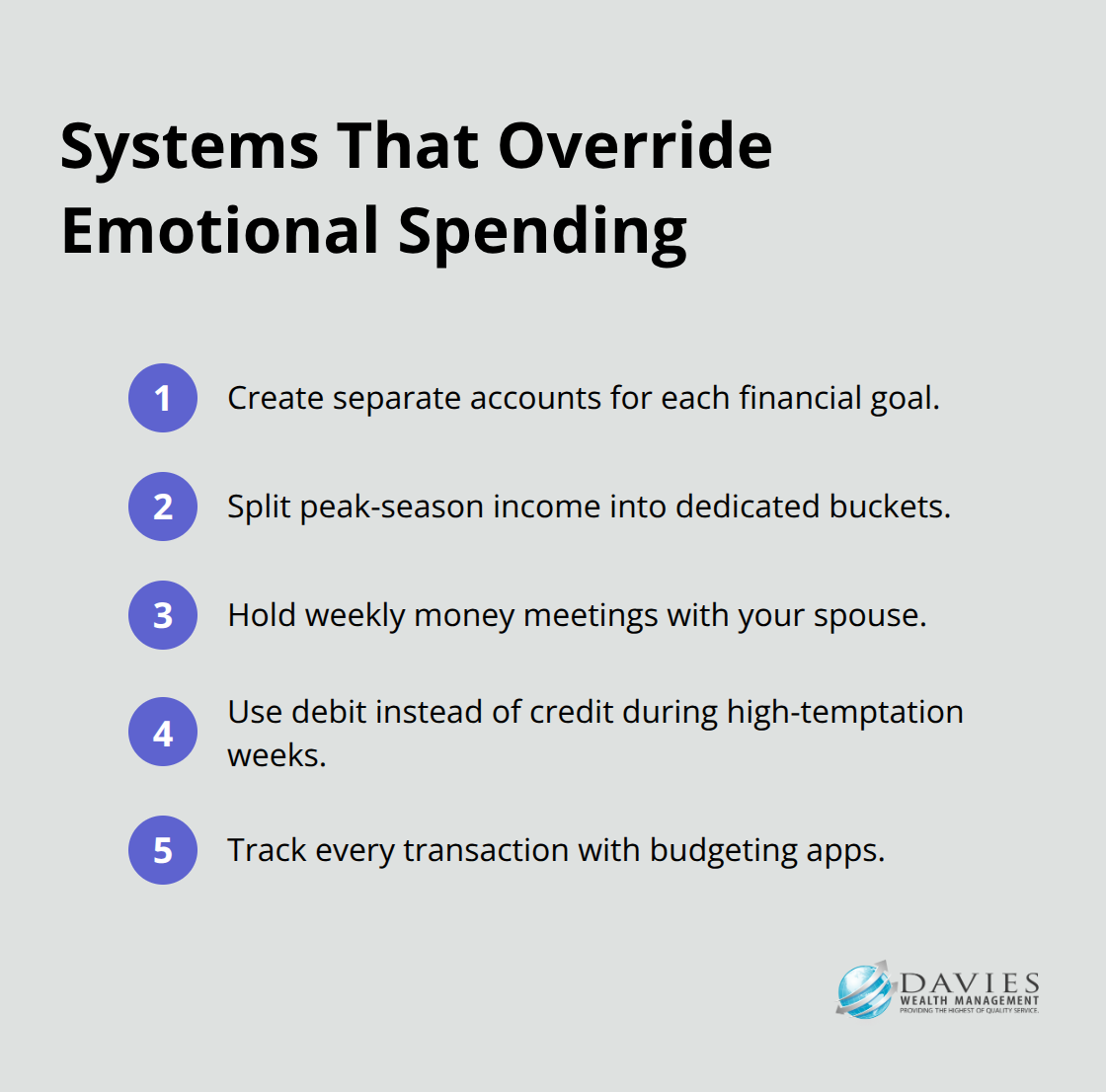

Build Systems That Override Emotional Spending

Create separate accounts for different financial goals and use apps like Capital One 360 or Ally Bank that offer multiple savings buckets. Stuart’s seasonal workers who separate peak-season income into dedicated accounts survive off-season drops better than those who mix funds together.

Schedule weekly money meetings with your spouse to review expenses and adjust budgets. Couples who discuss finances regularly have 10% higher savings rates according to the National Endowment for Financial Education. Replace credit cards with debit cards during high-temptation periods like Art Festival weeks when local events drive up spending.

Track every transaction with apps like Mint or YNAB to identify patterns you miss otherwise. Most people underestimate their actual spending by 20-30% when they rely on memory alone.

Work With Local Financial Professionals

Stuart offers certified financial planners through firms that understand seasonal income patterns and real estate concentration risks. Research from the CFP Board demonstrates the value of working with qualified financial planning professionals for long-term wealth building.

Local credit unions like Tropical Financial Credit Union provide lower-cost services specifically designed for Florida residents (including reduced fees and better rates). Tax professionals who specialize in tourism industry workers can optimize deductions for seasonal employees and small business owners who depend on visitor dollars.

Choose professionals who understand Stuart’s unique economic challenges rather than generic advisors who apply one-size-fits-all strategies to your situation.

Final Thoughts

Your money relationship transforms when you address the psychological patterns that drive your financial decisions. Stuart residents who implement the 24-hour purchase rule, automate savings transfers, and separate seasonal income into dedicated accounts build stronger financial foundations than those who rely on willpower alone. Wealth psychology research shows that people who understand their money scripts and emotional triggers create permanent behavioral change.

The seasonal nature of Stuart’s economy makes professional guidance valuable for income fluctuations and real estate concentration risks. Local financial professionals understand the unique challenges that tourism-dependent workers face throughout the year. They help you develop strategies that work with Stuart’s economic realities rather than against them.

We at Davies Wealth Management help Stuart residents develop personalized financial strategies that address investment management, retirement planning, and tax-efficient approaches. Your financial future depends on action you take today. Start with automated savings, track your spending patterns, and work with qualified professionals who understand Stuart’s economic environment (small changes in money habits compound over time to create significant wealth opportunities).

Leave a Reply