At Davies Wealth Management, we recognize that understanding wealth psychology is key to making sound financial decisions. Our financial choices are often influenced by complex emotional and cognitive factors that we may not even be aware of.

This blog post explores the psychological aspects of wealth management, including emotional biases, personal values, and cognitive pitfalls that can impact our financial outcomes. By gaining insight into these psychological factors, you can develop strategies to make more informed and effective financial decisions.

How Emotions Shape Your Financial Choices

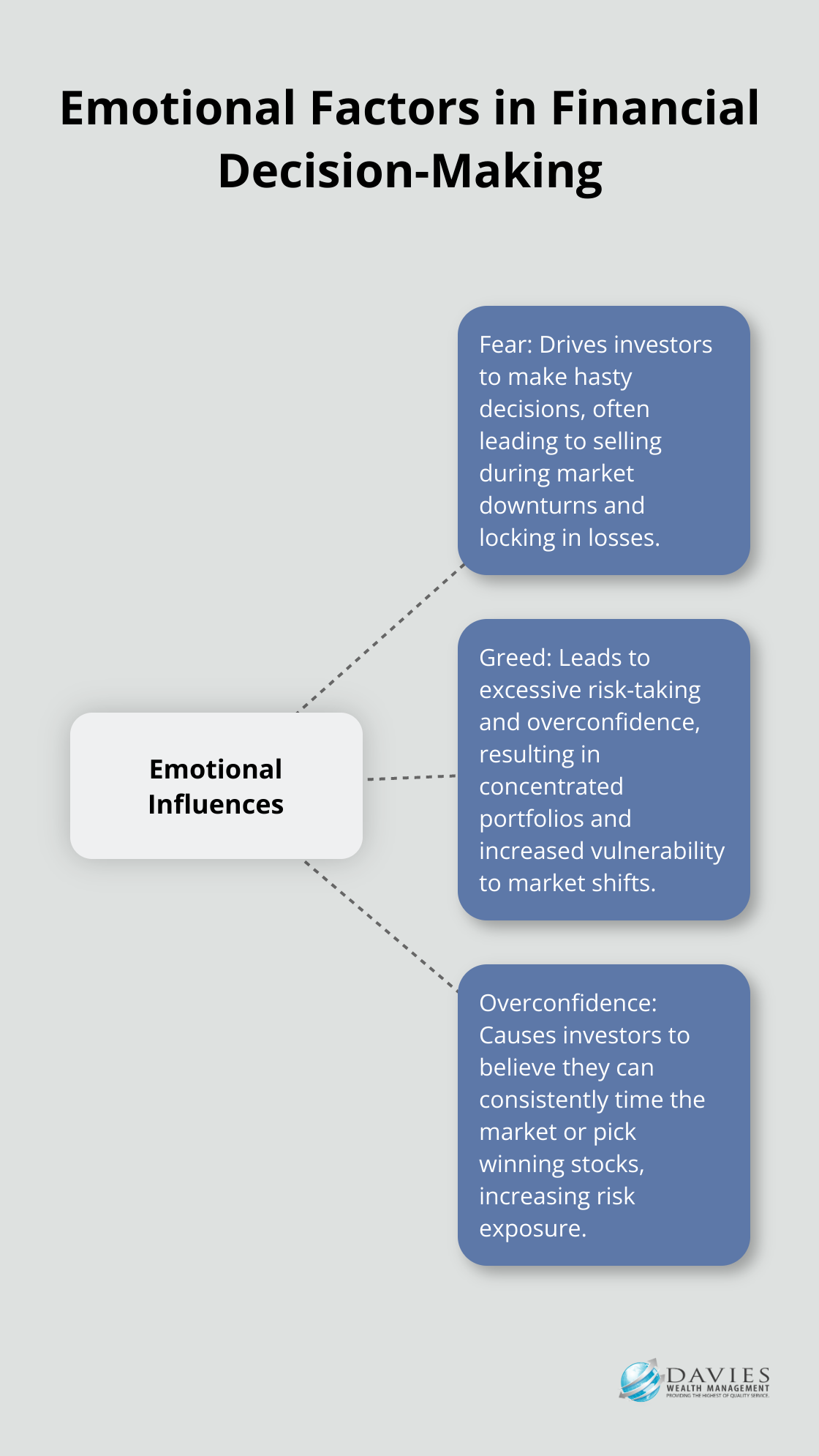

Emotions significantly influence our financial decisions, often leading us to make choices that don’t align with our long-term goals. At Davies Wealth Management, we’ve observed the impact of emotional reactions on investment strategies and overall financial health.

The Fear Factor in Finance

Fear drives investors to make hasty decisions. When fear creeps in, selling intensifies, pulling prices down. During market downturns, many people panic and sell their investments, locking in losses instead of waiting for recovery.

To combat fear-driven choices, we recommend clear investment goals and a well-defined strategy. This approach helps maintain perspective during market volatility and reduces impulsive selling.

Greed and Overconfidence in Investing

Greed leads to excessive risk-taking. When markets boom, investors often become overconfident, believing they can time the market or pick winning stocks consistently. This behavior results in concentrated portfolios and increased vulnerability to market shifts.

To mitigate the effects of greed, we advise our clients to maintain a diversified portfolio and regularly rebalance their assets. This strategy manages risk and keeps emotions in check during both market highs and lows.

Techniques for Emotional Management in Finance

Developing emotional intelligence in financial decision-making is essential. One effective technique involves keeping a financial journal to track your emotional state when making investment decisions. This practice increases self-awareness and helps identify patterns in your financial behavior.

Another powerful tool is scenario planning. Mental preparation for various market conditions reduces the emotional impact of unexpected events. We work with our clients to create contingency plans, ensuring they’re prepared for different financial scenarios.

Lastly, implementing a cooling-off period before making significant financial decisions proves beneficial. This pause allows time for emotions to settle and rational thinking to prevail. For major investment choices, we suggest a waiting period before taking action.

Understanding and managing the emotional aspects of financial decision-making enables more rational choices aligned with your long-term goals. As we move forward, it’s important to consider how personal values and beliefs also play a role in wealth management. These deeply held convictions often shape our financial decisions in ways we might not immediately recognize.

How Your Values Shape Your Wealth

Personal values and beliefs significantly influence financial decisions. These convictions guide our choices, often without our conscious awareness. Understanding and aligning financial strategies with core values leads to more satisfying and successful wealth management outcomes.

Identifying Your Financial Values

The first step to align wealth management with values involves identifying what truly matters to you. This process requires introspection and honest self-assessment. Ask yourself: What does financial success mean to you? Is it about accumulating wealth, achieving financial independence, or having the means to support causes you care about?

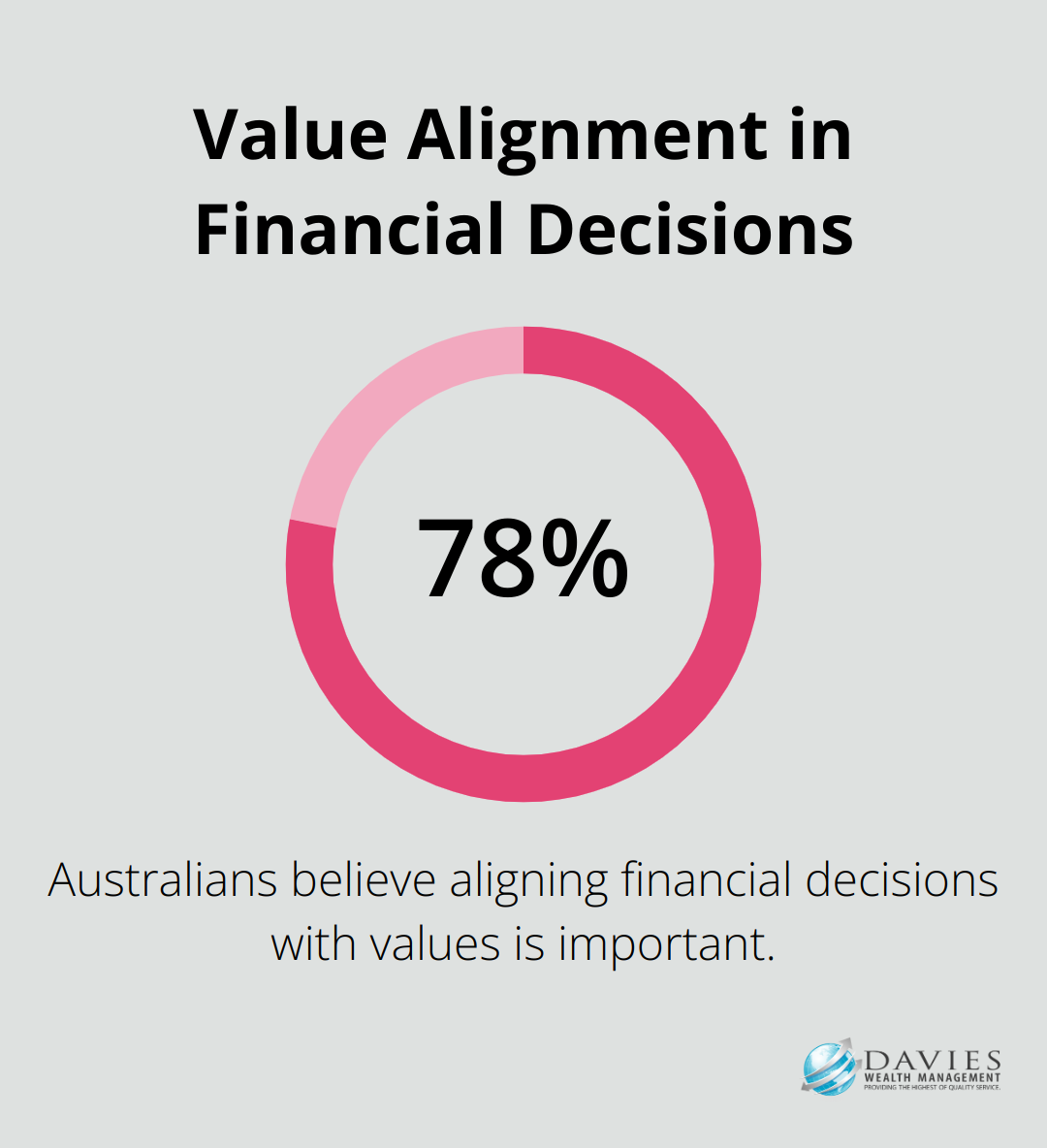

A survey by the Financial Planning Association of Australia found that 78% of Australians believe that aligning their financial decisions with their values is important. This finding highlights the significance of understanding your core financial values.

Transforming Values into Investment Strategies

After identifying your core financial values, translate these into concrete investment strategies. For example, if environmental sustainability is a key value, you might consider investing in green energy companies or ESG (Environmental, Social, and Governance) funds.

A Morningstar report indicated that sustainable investing funds saw record inflows in 2020, with net flows of $51 billion, more than double the total for 2019 and nearly 10 times more than in 2018. This trend shows a growing alignment between personal values and investment choices.

Overcoming Limiting Money Beliefs

Many people hold limiting beliefs about money and success that can hinder financial growth. These beliefs often originate from childhood experiences or societal messages. Common limiting beliefs include “Money is the root of all evil” or “I’m not good with money.”

To overcome these limiting beliefs:

- Identify your money beliefs

- Question their validity

- Replace negative thoughts with positive, empowering ones

For example, instead of thinking “I’ll never be wealthy,” try “I have the ability to learn and improve my financial situation.”

Financial education plays a significant role in overcoming limiting beliefs. Increasing your financial knowledge will boost your confidence in making informed decisions. Try attending workshops, reading financial literature, or working with a financial advisor to expand your understanding of wealth management.

Your personal values and beliefs are powerful tools in your financial journey. Aligning your wealth management strategies with what truly matters to you creates a more meaningful and successful financial future. However, even with a clear understanding of our values, cognitive biases can still impact our financial decisions. Let’s explore these biases and strategies to overcome them in the next section.

How Cognitive Biases Affect Your Wealth

Cognitive biases can significantly impact wealth accumulation and preservation. Our brains often make quick decisions, which can lead to costly financial mistakes. Let’s explore some common biases and strategies to overcome them for better financial outcomes.

The Confirmation Bias Trap

Confirmation bias often leads investors to hold onto declining investments far longer than rational economic decisions dictate. In investing, this can lead to overconfidence in certain stocks or sectors, resulting in a lack of diversification.

An investor who believes tech stocks are always a good investment might only read positive news about tech companies, ignoring potential risks. This bias can lead to a concentrated portfolio, increasing vulnerability to market shifts.

To combat confirmation bias:

- Actively seek out diverse opinions and information sources

- Set up news alerts for both positive and negative news about your investments

- Review your portfolio with a financial advisor who can provide an objective perspective

Loss Aversion and Its Impact

Loss aversion bias influences investors’ investing choices and is significantly impacted by the respondents’ characteristics. This bias can lead to holding onto losing investments too long or avoiding beneficial risks.

To mitigate loss aversion:

- Establish clear investment criteria and exit strategies before making any investment

- Remove emotion from the decision-making process

- Reframe losses as learning opportunities (each investment provides valuable insights for future decisions)

Overcoming the Anchoring Effect

The anchoring effect occurs when we rely too heavily on the first piece of information encountered when making decisions. In finance, this often manifests as fixating on a stock’s past price or performance, ignoring current market conditions or company fundamentals.

An investor might resist selling a stock that has dropped from $100 to $50, anchoring to the $100 price point and waiting for it to return to that level, even if the company’s prospects have fundamentally changed.

To combat anchoring:

- Focus on current data and future projections rather than historical prices

- Regularly reassess your investments based on their current value proposition, not past performance

- Try using a systematic investment approach (such as dollar-cost averaging), which can help reduce the impact of anchoring on your investment decisions

Recognizing and overcoming these cognitive biases is essential for making sound financial decisions. Working closely with a financial advisor can help identify potential biases and develop strategies to mitigate their impact. Financial advisors with a deep understanding of behavioral finance are better equipped to recognize their clients’ behaviors and biases, enabling more informed decisions that align with your long-term wealth management goals.

Final Thoughts

Understanding wealth psychology empowers individuals to make informed financial decisions. Self-awareness plays a key role in recognizing emotional triggers and personal beliefs about money, which allows for the development of strategies to mitigate impulsive actions. These insights enable choices that align with long-term financial goals and help identify areas where biases may influence decision-making.

We at Davies Wealth Management understand the complexities of wealth psychology and its impact on financial choices. Our team of experts dedicates itself to helping you navigate these psychological factors to achieve your financial objectives. We offer personalized strategies tailored to your specific needs, whether you’re a professional athlete facing unique financial challenges or an individual seeking to secure your financial future.

Visit our website to learn more about how we can assist you in building, protecting, and transferring your wealth with confidence. Embracing the principles of wealth psychology and working with experienced professionals will help you develop a more robust and effective approach to managing your finances (and achieving your long-term aspirations).

Leave a Reply