At Davies Wealth Management, we believe in the power of fiduciary financial planning to transform lives and secure futures.

In a world of complex financial decisions, having a trusted advisor who puts your interests first is invaluable.

This blog post will explore the concept of fiduciary financial planning, its benefits, and how to choose the right fiduciary advisor for your needs.

What Is Fiduciary Financial Planning?

The Essence of Fiduciary Duty

Fiduciary financial planning places your interests at the forefront. It embodies trust, transparency, and ethical responsibility. Fiduciary advisors must act in your best interest, not their own. This legal obligation sets them apart from other financial professionals.

Fiduciary vs. Non-Fiduciary Advisors

The distinction between fiduciary and non-fiduciary advisors lies in their obligations. Non-fiduciary advisors (such as broker-dealers) only need to recommend “suitable” investments. This can create conflicts of interest, as they might suggest products that earn them higher commissions.

Fiduciary advisors must recommend what’s best for you, even if it reduces their profit. A study by the Financial Planning Association found that clients working with fiduciary advisors reported 15% higher satisfaction rates compared to those with non-fiduciary advisors.

Legal and Ethical Standards

Fiduciary financial planners adhere to strict legal and ethical standards. The Investment Advisers Act of 1940 requires registered investment advisors to act as fiduciaries. This mandate includes a duty of care and a duty of loyalty.

Impact on Financial Outcomes

Your choice of a fiduciary advisor can significantly affect your financial future. A report by the White House Council of Economic Advisers estimated that conflicted advice costs Americans $17 billion annually in retirement savings. Working with a fiduciary increases your chances of receiving unbiased advice that aligns with your goals.

The Fiduciary Advantage in Specialized Fields

Fiduciary advisors often excel in specialized areas of finance. For instance, professional athletes face unique financial challenges such as not saving and investing properly for retirement. A fiduciary advisor with expertise in this area can provide tailored strategies to address these complexities and secure long-term financial stability.

The fiduciary approach to financial planning offers clear benefits for clients seeking comprehensive, trustworthy advice. As we explore the advantages of working with a fiduciary financial planner in the next section, you’ll gain a deeper understanding of how this relationship can transform your financial journey.

Why Fiduciary Financial Planners Transform Your Financial Journey

Prioritizing Your Financial Well-being

Fiduciary advisors legally commit to put your financial interests first. This commitment leads to superior financial outcomes. A fiduciary is legally required to act in the best interest of their clients and align their approach with their clients’ personal circumstances.

Transparent Fee Structures

Fiduciary financial planning stands out for its clear fee structures. Unlike some financial professionals who might obscure fees in complex arrangements, fiduciary advisors openly outline their compensation. This transparency empowers you to make informed decisions about the value you receive. (Many fiduciary firms provide a detailed breakdown of their fee structure during the initial consultation.)

Personalized Strategies for Complex Situations

Fiduciary advisers offer customized strategies tailored to each client’s unique circumstances, helping them reach their financial goals and navigate complex situations. This approach proves particularly valuable for individuals with intricate financial situations, such as professional athletes. A National Bureau of Economic Research study found that 15.7% of NFL players file for bankruptcy within 12 years of retirement. Fiduciary advisors with expertise in this area develop strategies to mitigate such risks, addressing the unique challenges of short career spans and variable incomes.

Reduced Conflicts of Interest

The fiduciary standard significantly minimizes potential conflicts of interest. Non-fiduciary advisors might recommend products that earn them higher commissions, even if these products don’t best suit your needs. In contrast, fiduciary advisors must disclose any potential conflicts and always recommend what’s best for you. This ethical standard fosters trust and improves long-term financial outcomes.

Comprehensive Wealth Management

Fiduciary advisors offer a holistic approach to wealth management. They develop, manage and implement purposeful financial plans through a holistic lens of your lifestyle goals and long-term needs. Their services extend beyond basic investment advice to include comprehensive estate planning, tax-efficient investment strategies, and retirement planning. This all-encompassing approach ensures that every aspect of your financial life receives expert attention.

As you consider your options for financial guidance, the next step involves understanding how to select the right fiduciary financial planner for your unique needs and goals.

Selecting Your Fiduciary Financial Planner

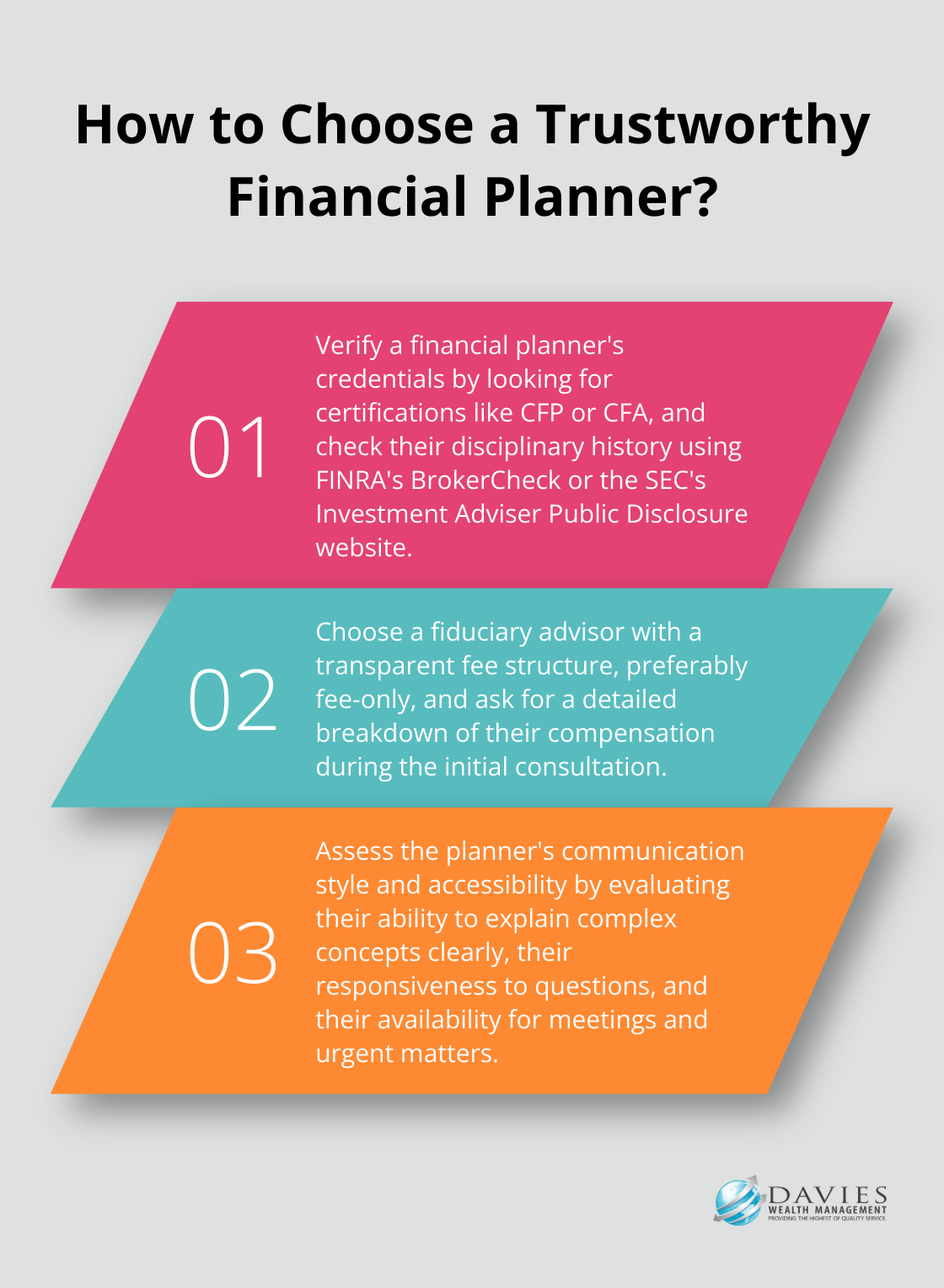

Verify Credentials and Experience

Start your search by examining the planner’s qualifications. Look for certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These designations indicate a high level of expertise and adherence to ethical standards. CFAs typically work more in the field of financial analytics and investing, while CFP® professionals usually focus on financial planning with individual clients.

Experience matters, especially in specialized areas. If you’re a professional athlete, seek advisors with a proven track record in sports finance. Davies Wealth Management specializes in this area, offering tailored strategies for athletes’ unique financial situations.

Understand Fee Structures

Transparency in fees is a hallmark of fiduciary advisors. Ask potential planners to explain their fee structure in detail. Common models include:

- Fee-only: Advisors charge a flat fee, hourly rate, or percentage of assets under management.

- Fee-based: Combines fee-only services with some commission-based products.

Many financial advisors offer a fee-only compensation structure, where they receive a fee for their planning services in lieu of traditional commissions.

Evaluate Communication and Accessibility

Effective communication is vital in financial planning. During initial consultations, assess the planner’s ability to explain complex concepts clearly. Do they listen to your concerns? Are they responsive to your questions?

Consider their accessibility. How often will you meet? Are they available for urgent matters? More than half of advisors (56%) have found that discussing philanthropy with clients has helped them build relationships with members of the client’s family.

Check Disciplinary History

Before committing, verify the planner’s disciplinary history. Use FINRA’s BrokerCheck or the SEC’s Investment Adviser Public Disclosure website to search for any complaints or regulatory actions. A clean record is a good indicator of trustworthiness and professionalism.

Assess Compatibility

The relationship with your financial planner is often long-term. Try to find someone whose personality and communication style align with yours. A good fit will make discussions about your finances more comfortable and productive.

Final Thoughts

Fiduciary financial planning forms the foundation of sound financial management. It offers a level of trust and expertise that significantly impacts your financial future. Fiduciary advisors prioritize your interests above all else, creating a path for long-term financial success and peace of mind.

The benefits of working with a fiduciary financial planner extend far beyond basic investment advice. These professionals offer comprehensive strategies tailored to your unique circumstances, transparent fee structures, and a commitment to ethical practices (which minimize conflicts of interest). This approach protects your assets and maximizes your potential for growth and stability over time.

At Davies Wealth Management, we understand the importance of fiduciary responsibility in financial planning. Our team specializes in providing tailored solutions for a diverse clientele, including professional athletes facing unique financial challenges. We encourage you to seek out fiduciary advisors who can offer the expertise, transparency, and dedication you deserve for a secure and prosperous financial future.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply