At Davies Wealth Management, we understand that successful investing isn’t just about numbers and market trends. It’s also about understanding the psychological factors that influence our financial decisions.

Behavioral finance offers valuable insights into how cognitive biases and emotions can impact investment choices. By exploring this field, investors can gain a deeper understanding of their own decision-making processes and develop strategies to overcome common pitfalls.

In this post, we’ll examine key principles of behavioral finance and provide practical tips to help you make more informed investment decisions.

How Our Minds Shape Investment Decisions

The Influence of Mental Shortcuts

Our brains often use mental shortcuts (heuristics) to make quick decisions. While these shortcuts prove useful in daily life, they can lead to costly mistakes in investing. The availability heuristic, for example, causes us to overestimate the probability of events we can easily recall. An investor might avoid airline stocks after hearing about a plane crash, even though air travel remains statistically safe.

The Emotional Rollercoaster of Investing

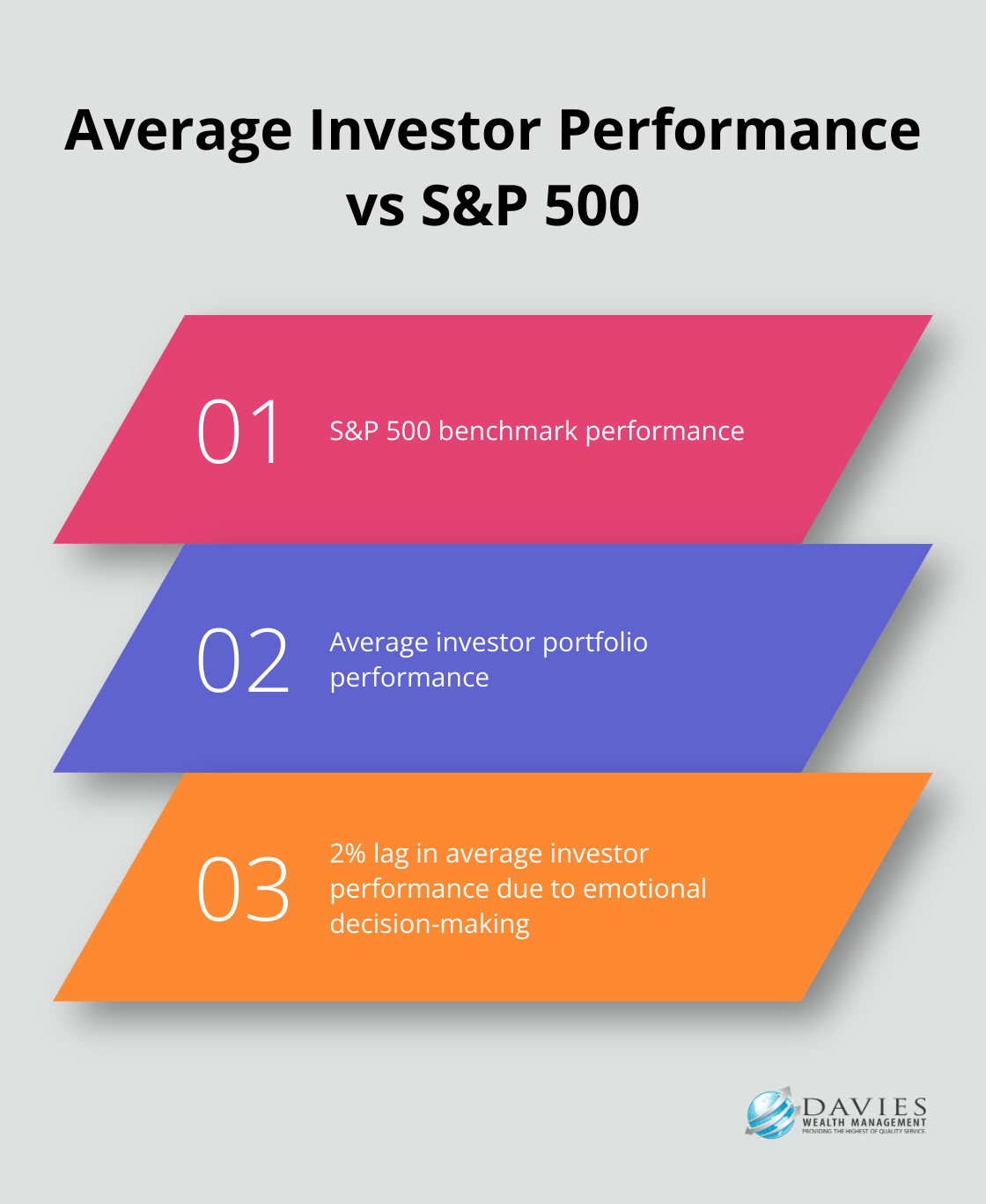

Emotions play a significant role in our financial decisions. Fear and greed stand out as particularly powerful forces in the market. During downturns, fear can push investors to sell at the worst possible time. On the flip side, greed might encourage excessive risk-taking during bull markets. A Dalbar study found that the average investor’s portfolio lagged the performance of the S&P 500 by more than 2% in the first half of the year, largely due to emotional decision-making.

Recognizing and Overcoming Cognitive Biases

Identifying our cognitive biases marks the first step to overcoming them. Confirmation bias, where we seek information that confirms our existing beliefs, is a common pitfall. To combat this, investors should actively seek diverse perspectives and conflicting information before making investment decisions.

Anchoring, another prevalent bias, occurs when we rely too heavily on the first piece of information we receive. An investor might fixate on a stock’s previous high price, even if current market conditions don’t justify that valuation. To avoid this trap, consider multiple data points and current market factors when evaluating investments.

The Role of Professional Guidance

Professional financial advisors help clients navigate these psychological pitfalls. They provide objective analysis and personalized strategies that account for both market realities and individual behavioral tendencies. Understanding behavioral finance principles empowers investors to make more informed investment decisions that align with their long-term financial goals.

As we move forward, let’s explore some common behavioral finance pitfalls that can derail even the most seasoned investors.

Why Smart Investors Make Costly Mistakes

The Overconfidence Trap

Overconfidence acts as a silent killer of investment returns. A study by Barber and Odean revealed that individual investors underperform relevant benchmarks after accounting for trading costs. This excessive trading often stems from the belief that one can outsmart the market or time entries and exits perfectly.

To combat overconfidence, investors should implement a systematic investment approach. This could involve dollar-cost averaging or setting strict criteria for buying and selling assets. Removing emotion from the equation reduces the likelihood of impulsive decisions based on overconfidence.

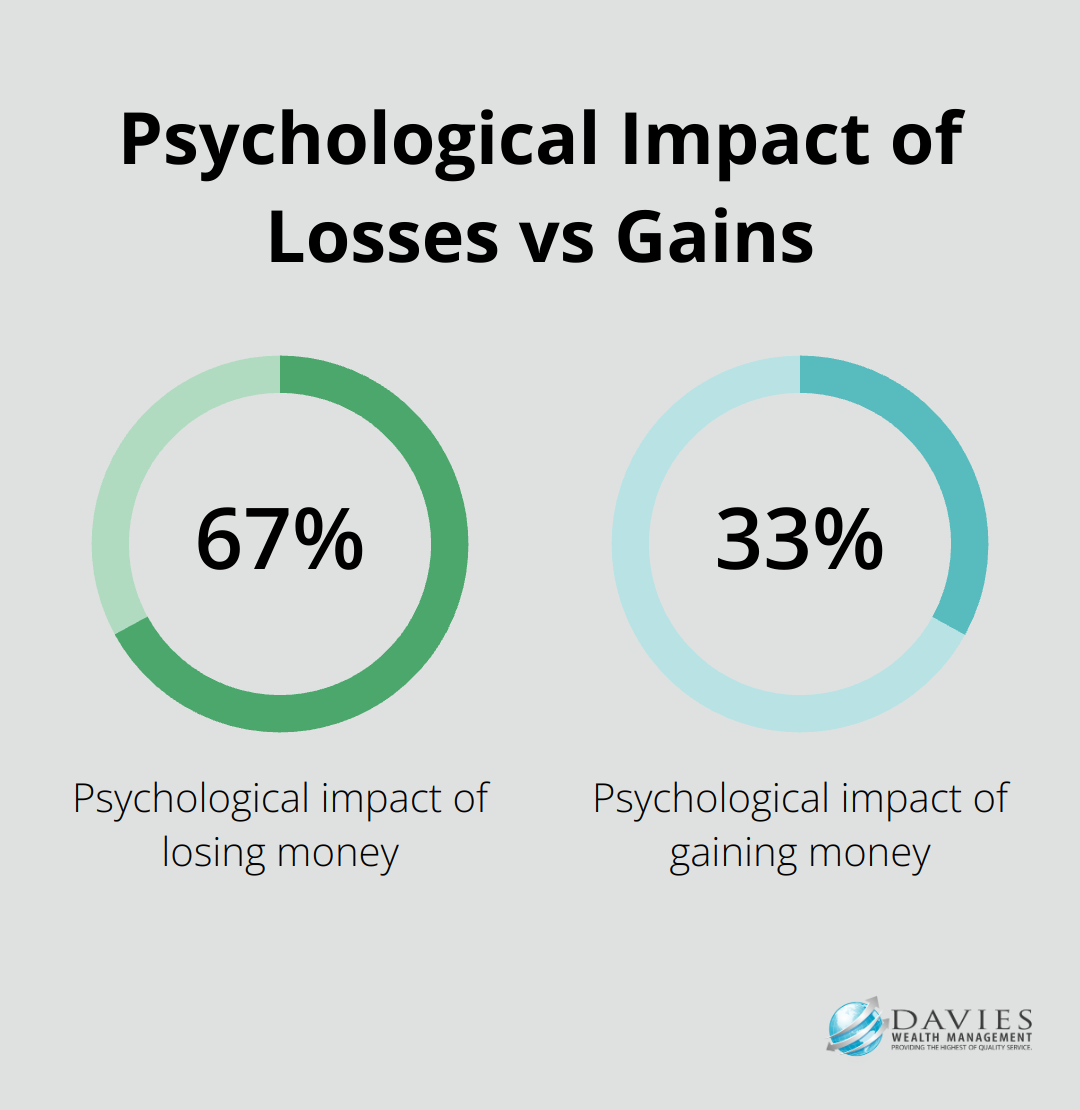

The Pain of Loss

Loss aversion is a powerful force that leads investors to make irrational decisions. Research shows that the psychological pain of losing money is about twice as powerful as the pleasure of gaining it. This fear causes investors to hold onto losing positions for too long or avoid potentially profitable opportunities altogether.

One effective strategy to combat loss aversion is to reframe one’s perspective. Instead of fixating on short-term losses, investors should consider the long-term potential of their investments. Additionally, setting stop-loss orders helps manage risk and removes emotion from the selling decision.

The Danger of Herd Mentality

Herd mentality can lead to dangerous market bubbles and crashes. The dot-com boom of the late 1990s and the housing bubble of the mid-2000s serve as prime examples of how following the crowd can end in financial disaster. Herding behavior contributed to the housing bubble, with investors and institutions tending to follow the crowd, especially in buying mortgage-backed securities.

To avoid this trap, investors must conduct their own research and maintain a healthy skepticism of market trends. Investing in something simply because everyone else does it is a recipe for potential disaster. Instead, investors should focus on the fundamentals and their long-term financial goals.

The Role of Professional Guidance

Professional financial advisors (such as those at Davies Wealth Management) help clients navigate these psychological pitfalls. They provide objective analysis and personalized strategies that account for both market realities and individual behavioral tendencies. Understanding behavioral finance principles empowers investors to make more informed investment decisions that align with their long-term financial goals.

As we move forward, let’s explore strategies to overcome these behavioral finance biases and improve investment decision-making.

How to Outsmart Your Own Brain in Investing

Adopt a Systematic Investing Approach

One of the most effective ways to combat emotional decision-making is to adopt a systematic investing approach. This method involves setting clear rules for when and how you’ll invest, regardless of market conditions or personal feelings. Evidence shows that systematic managers appear to survive longer, generate higher performance, and are superior to discretionary managers when it comes to investing.

For example, you might commit to investing a fixed amount each month into a diversified portfolio. This strategy, known as dollar-cost averaging, helps you avoid the pitfalls of trying to time the market.

Use Technology for Objective Decision-Making

In today’s digital age, we have access to powerful tools that can help us make more objective investment decisions. Robo-advisors use algorithms to create and manage portfolios based on your risk tolerance and financial goals. These platforms are designed to act as cognitive aids, enhancing the investor’s ability to make more informed, rational decisions.

Additionally, investment analysis software can provide unbiased assessments based on hard data, helping you avoid the trap of confirmation bias.

Create a Personal Investment Policy Statement

Individual investors can benefit from creating their own Investment Policy Statement (IPS). This document outlines your investment goals, risk tolerance, asset allocation strategy, and criteria for selecting and selling investments. One important benefit of a well-crafted investment policy statement is that it can help preserve the relationship between institutions when there is turnover.

Referring to your IPS when making investment decisions creates a buffer between your emotions and your actions. This can be particularly helpful during market downturns when the temptation to sell in a panic is strongest.

Seek Professional Guidance

Professional financial advisors (such as those at Davies Wealth Management) help clients navigate psychological pitfalls. They provide objective analysis and personalized strategies that account for both market realities and individual behavioral tendencies. Understanding behavioral finance principles empowers investors to make more informed investment decisions that align with their long-term financial goals.

Practice Self-Awareness

Self-awareness is key to overcoming behavioral biases. Try to identify your own emotional triggers and biases in investing. Keep a journal of your investment decisions and the reasoning behind them. This practice can help you spot patterns in your behavior and make more rational choices in the future.

Final Thoughts

Behavioral finance offers valuable insights into the psychological factors that shape investment decisions. Self-awareness plays a critical role in applying these insights, allowing investors to recognize and mitigate their own biases. Systematic investing strategies, technology-driven analysis, and personal investment policy statements enhance financial decision-making significantly.

Davies Wealth Management understands the complexities of navigating the financial landscape while managing psychological biases. Our team of experts helps clients develop personalized strategies that account for market realities and individual behavioral tendencies. We support investors in applying behavioral finance insights to their unique financial situations.

The goal of understanding behavioral finance is not to eliminate emotions from investment decisions, but to develop awareness of their influence. Implementing strategies to make more informed, rational choices leads to greater confidence and success in achieving long-term financial goals. Partnering with experienced advisors provides valuable support in this journey.

Leave a Reply