Professional athletes face unique financial challenges that require specialized guidance. At Davies Wealth Management, we understand the complexities of managing sudden wealth, fluctuating incomes, and planning for short career spans.

For athletes seeking an athlete financial advisor in Stuart, Florida, choosing the right professional is paramount. This guide explores the top qualities to look for and highlights some of the best advisors in the area who can help athletes secure their financial future.

What Makes a Top Athlete Financial Advisor?

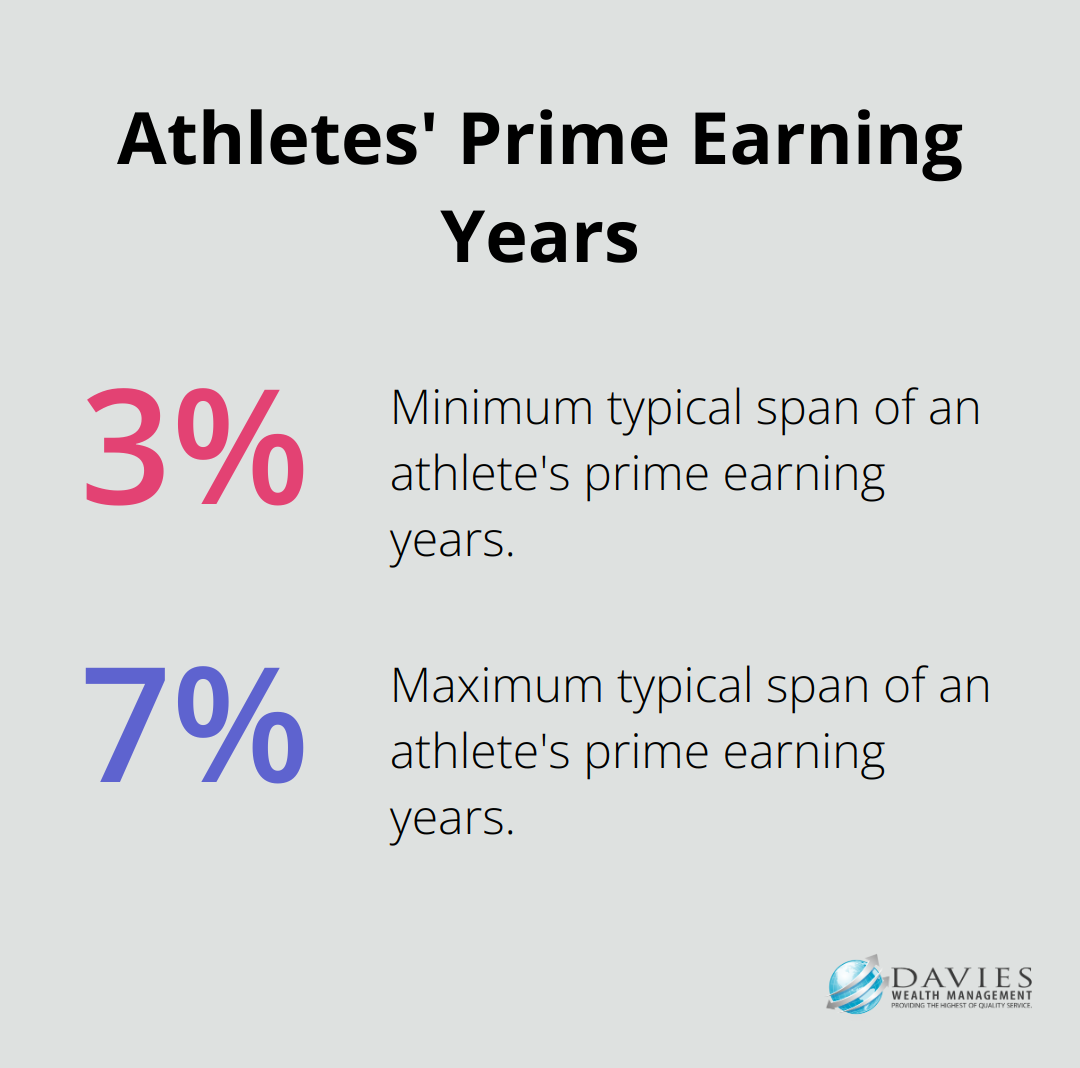

Deep Understanding of Athletic Careers

Top athlete financial advisors possess an intimate understanding of the sports industry. They recognize that an athlete’s prime earning years often compress into a short window (typically spanning just 3-7 years). This knowledge shapes their approach to financial planning, emphasizing guidance on budgeting, investing, tax strategies, and long-term wealth management.

Expertise in Sudden Wealth Management

Managing sudden wealth stands as a critical skill for athlete financial advisors. When a rookie signs their first multi-million dollar contract, the focus shifts from celebration to strategy. The best advisors help athletes avoid the pitfalls of lifestyle inflation and impulsive spending. They create comprehensive budgets that account for both current needs and long-term financial security, considering investment options such as blue-chip stocks, income-producing investments, and municipal bonds with an eye toward life after sports.

Navigation of Complex Contracts and Endorsements

Top-tier advisors in this field excel in the intricacies of sports contracts and endorsement deals. They provide valuable insights on contract negotiations, helping athletes maximize their earning potential. Moreover, they understand how to structure endorsement deals to create sustainable income streams that can extend beyond an athlete’s playing career.

Planning for Life After Sports

The ability to plan for the post-career transition marks an exceptional athlete financial advisor. These professionals help athletes develop skills and interests outside of sports, potentially leading to new career opportunities. They also focus on creating diversified investment portfolios that can provide steady income long after the final whistle blows. Establishing emergency funds and comprehensive insurance plans can further protect athletes from financial uncertainties, offering peace of mind.

Personalized Approach to Financial Planning

Every athlete’s journey is unique, and top financial advisors recognize this fact. They tailor their strategies to each client’s specific needs, goals, and risk tolerance. This personalized approach (which includes regular check-ins and adjustments) ensures that the financial plan remains aligned with the athlete’s evolving career and life circumstances.

As we explore the landscape of athlete financial advisors in Stuart, Florida, it’s essential to consider how these qualities manifest in local professionals. Let’s take a closer look at some of the standout advisors in the area, starting with the specialized services offered by Davies Wealth Management.

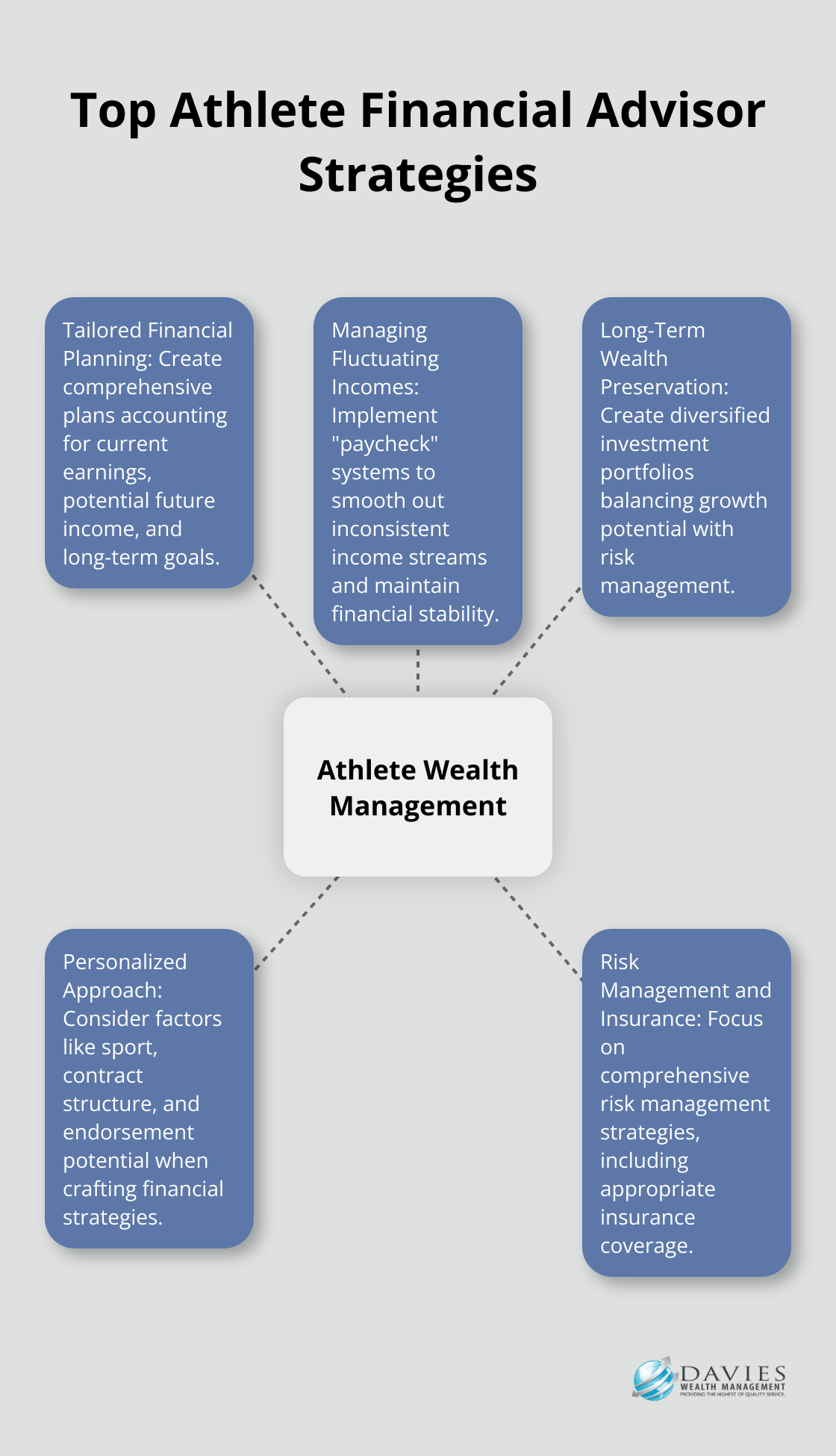

How Top Athlete Financial Advisors Manage Wealth

Tailored Financial Planning for Athletes

Top athlete financial advisors create comprehensive financial plans that account for an athlete’s current earnings, potential future income, and long-term goals. These plans typically include strategies for budgeting, investing, and tax optimization. Advisors often recommend setting aside a significant portion of early career earnings to build a robust financial foundation for the future.

Managing Fluctuating Incomes

One of the biggest challenges for athletes is the management of inconsistent income streams. Effective advisors implement strategies to smooth out these fluctuations, such as creating a “paycheck” system. This involves the setup of a separate account from which the athlete draws a consistent monthly amount, which helps maintain financial stability regardless of current earnings.

Long-Term Wealth Preservation

Preserving wealth over the long term is a key focus for top athlete financial advisors. They create diversified investment portfolios that balance growth potential with risk management. This might include a mix of stocks, bonds, real estate, and alternative investments.

Personalized Approach

Every athlete’s situation is unique, and top advisors reflect this in their approach. They consider factors such as sport, contract structure, endorsement potential, and personal goals when crafting financial strategies. For instance, an NFL player with a short average career span of 3.3 years requires a different strategy than a golfer who might have a career spanning decades.

Risk Management and Insurance

Top financial advisors for athletes also focus on comprehensive risk management strategies. This includes securing appropriate insurance coverage (such as disability insurance and liability protection) to safeguard an athlete’s wealth against unforeseen circumstances. They also advise on the structuring of contracts and endorsement deals to minimize financial risks.

As we explore the landscape of athlete financial advisors in Stuart, Florida, it’s important to consider how these strategies are implemented by local professionals. Let’s take a closer look at some of the standout advisors in the area and how they apply these principles to benefit their athlete clients.

Stuart’s Financial Advisors for Athletes

Stuart, Florida offers a diverse landscape of financial advisory services, with several firms catering to high-net-worth individuals, including professional athletes. This chapter explores the expertise, services, and qualifications of local advisors who specialize in managing substantial wealth.

Expertise and Specializations

Many Stuart-based financial advisors have experience working with affluent clients, which can translate well to serving professional athletes. Fogel Capital Management, for instance, focuses on high-net-worth individuals, potentially offering valuable insights into managing substantial wealth. Victrix Investment Advisors utilizes advanced analytics for portfolio management, which could benefit athletes seeking data-driven investment strategies.

However, athletes should note that not all advisors possess specific experience with the unique financial challenges they face. When selecting an advisor, athletes should inquire about their track record in managing sudden wealth, understanding sports contracts, and planning for post-career transitions.

Service Offerings and Approach

While most advisors in Stuart provide comprehensive financial planning services, their approaches can differ significantly. Spectra Investment Management LLC, for example, emphasizes alternative investments and risk management. This focus could particularly appeal to athletes looking to diversify their portfolios beyond traditional assets.

Tax planning represents another critical area where local advisors can add value. Given Florida’s no state income tax status, advisors well-versed in tax optimization strategies can help athletes maximize their earnings. Tax-loss harvesting can prove especially beneficial for professional athletes looking to reduce their lifetime tax bill.

Credentials and Qualifications

When evaluating financial advisors in Stuart, athletes should look for specific credentials that demonstrate expertise in wealth management. The Certified Financial Planner (CFP) designation indicates a comprehensive understanding of financial planning and can elevate an advisor’s career and salary prospects. For investment-focused advice, the Chartered Financial Analyst (CFA) credential holds high regard in the industry.

Some advisors may also hold specialized certifications related to sports financial management. While less common, these certifications can indicate a deeper understanding of the unique financial landscape athletes navigate.

Davies Wealth Management: A Standout Choice

Among Stuart’s financial advisors, Davies Wealth Management stands out as a top choice for professional athletes seeking comprehensive financial guidance. The firm offers expertise tailored for various financial goals, from retirement to investment strategies.

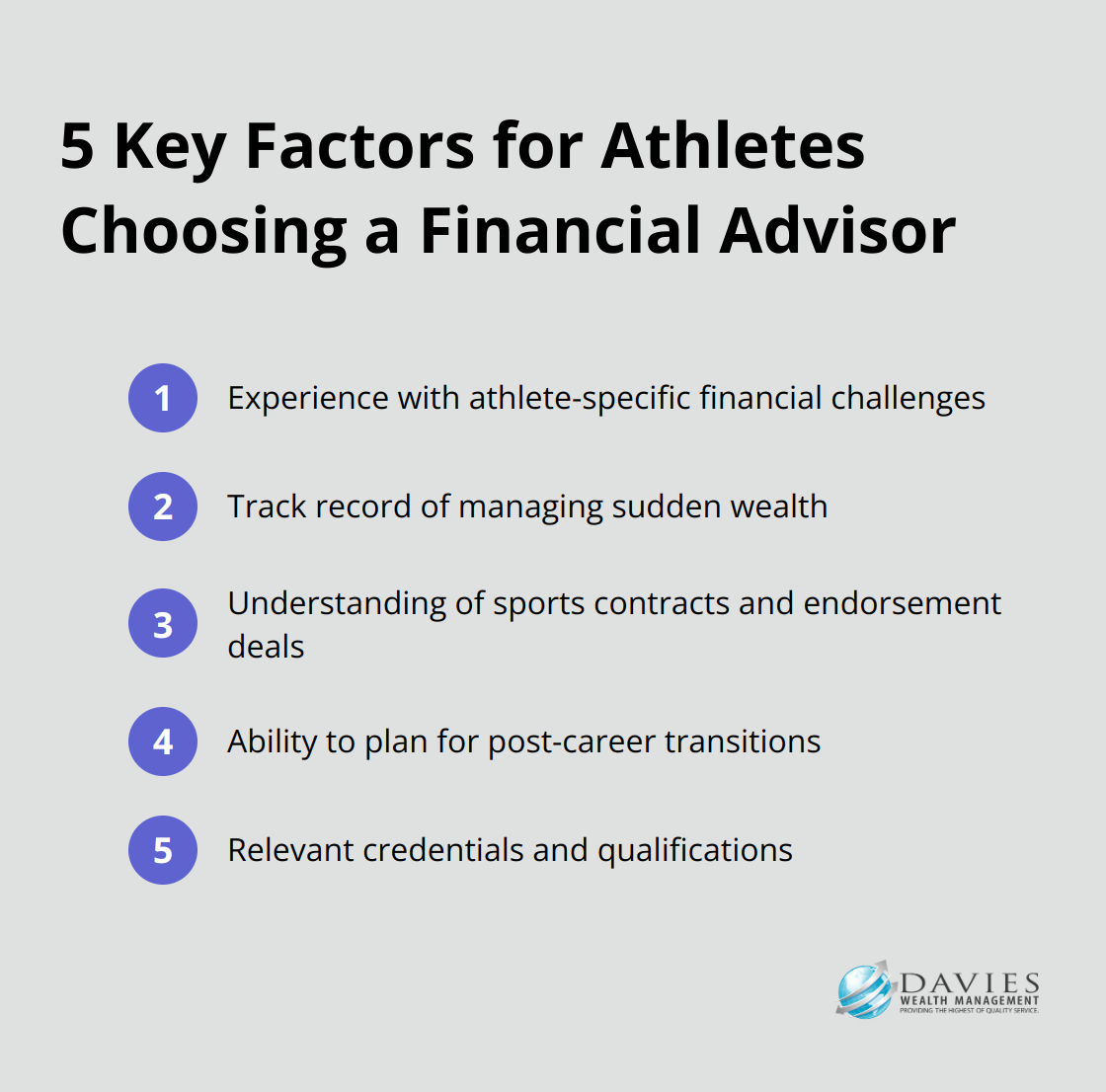

Selecting the Right Advisor

When choosing a financial advisor in Stuart, athletes should consider factors such as:

- Experience with athlete-specific financial challenges

- Track record of managing sudden wealth

- Understanding of sports contracts and endorsement deals

- Ability to plan for post-career transitions

- Relevant credentials and qualifications

By carefully evaluating these factors, athletes can find an advisor who aligns with their unique financial needs and goals.

Final Thoughts

Professional athletes need specialized financial guidance to navigate their unique financial landscape. An athlete financial advisor in Stuart, Florida should understand sports contracts, manage sudden wealth, and plan for post-career transitions. The right advisor will offer personalized strategies for long-term wealth preservation and handle fluctuating incomes effectively.

Credentials like CFP and CFA indicate strong financial expertise, but additional specializations in sports financial management add extra value. Experience in managing athlete-specific challenges, such as short career spans and endorsement deals, sets top advisors apart. Athletes should prioritize advisors who demonstrate these qualities when making their selection.

Davies Wealth Management offers specialized expertise for professional athletes in Stuart, Florida. Their comprehensive approach addresses the specific needs of athletes (from current earnings management to long-term financial stability). Athletes who seek professional financial guidance can focus on their careers while securing their financial future.

Leave a Reply