Professional athletes face unique financial challenges that require specialized guidance. From managing short-lived careers to navigating complex contracts, the need for expert financial advice is paramount.

At Davies Wealth Management, we understand the intricacies of athlete finances and the importance of securing long-term financial stability. Our team of athlete financial advisors in Stuart, Florida, is dedicated to helping sports professionals make informed decisions about their wealth.

Why Athletes Need Specialized Financial Advice

The Reality of Short Career Spans

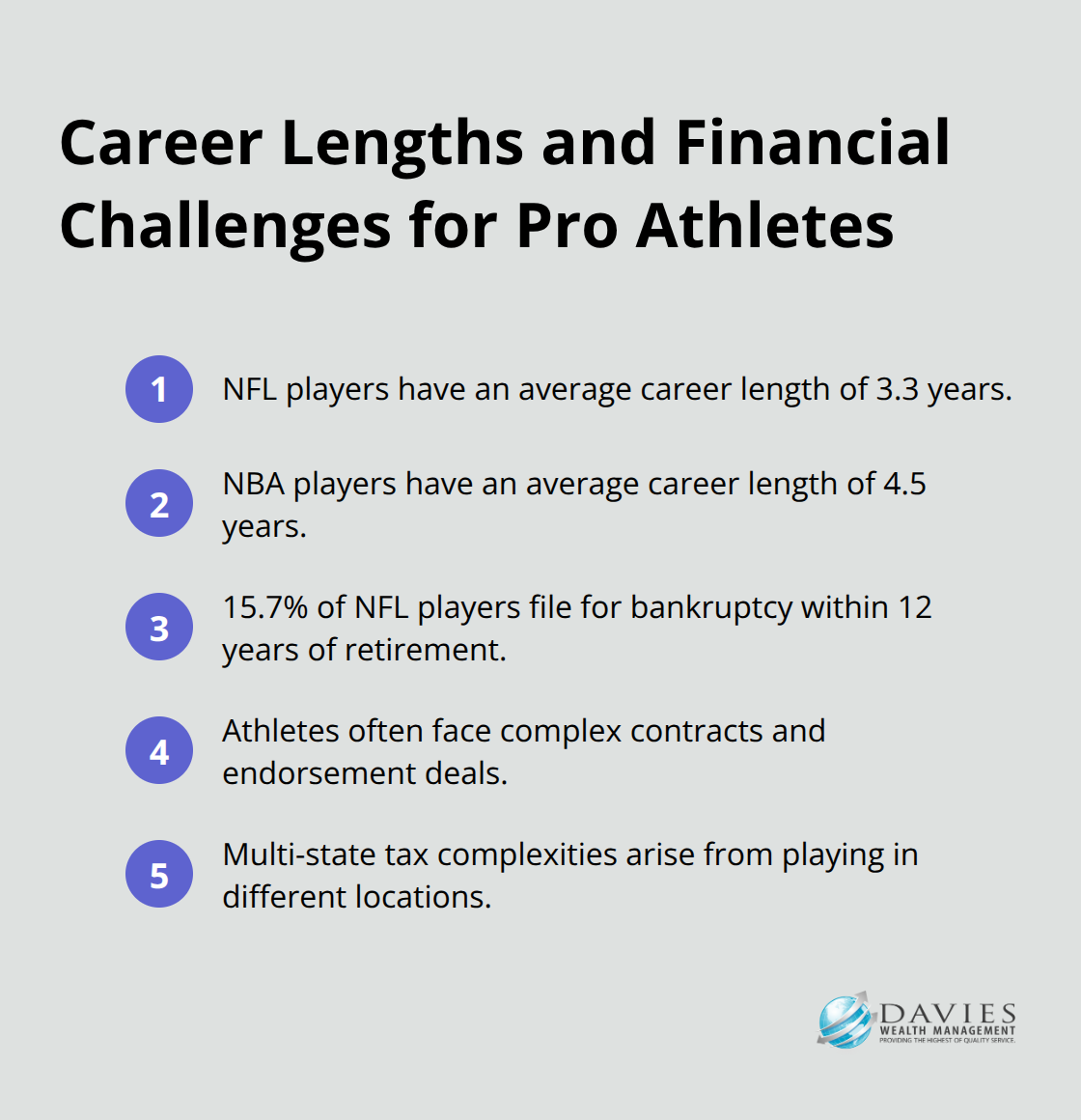

Professional athletes face a unique financial landscape due to their brief career spans. The average NFL career lasts 3.3 years. NBA players fare slightly better with an average of 4.5 years, according to the National Basketball Players Association. This limited window of peak earning potential demands meticulous financial planning to extend earnings over a lifetime.

Navigating Complex Contracts and Endorsements

Athletes often encounter intricate contracts and lucrative endorsement deals. These agreements frequently include signing bonuses, performance incentives, and multi-year payouts. The complexity of these contracts underscores the need for expert financial guidance. A study by the National Bureau of Economic Research found that 15.7% of NFL players file for bankruptcy within 12 years of retirement (a stark reminder of the importance of proper financial management).

Planning for Life After Sports

Post-career financial planning is not optional; it’s a necessity. Athletes must consider second careers, investment strategies, and lifestyle adjustments. The transition can prove challenging – proper planning helps athletes avoid financial distress after retirement.

Tackling Multi-State Tax Complexities

Professional athletes often compete in multiple states, which complicates their tax situations. They may need to file tax returns in every state where they play games. The Tax Foundation reports that some states have implemented “jock taxes” specifically targeting visiting athletes. For example, California’s top marginal tax rate of 13.3% can significantly impact an athlete’s earnings from games played in the state.

The Role of Specialized Financial Advisors

Specialized financial advisors (like those at Davies Wealth Management) understand these unique challenges. They provide tailored strategies to help athletes manage their current wealth effectively and secure their financial future long after their playing days end. These advisors offer expertise in contract negotiations, tax planning, and long-term investment strategies that address the specific needs of professional athletes.

As we explore the key qualities to look for in an athlete financial advisor, it becomes clear that specialized knowledge and experience are paramount for successfully navigating the complex financial world of professional sports.

What Makes an Ideal Athlete Financial Advisor?

Selecting the right financial advisor is essential for athletes who want to secure their financial future. The ideal advisor possesses a unique blend of skills and experience tailored to the sports industry’s specific challenges.

Industry-Specific Expertise

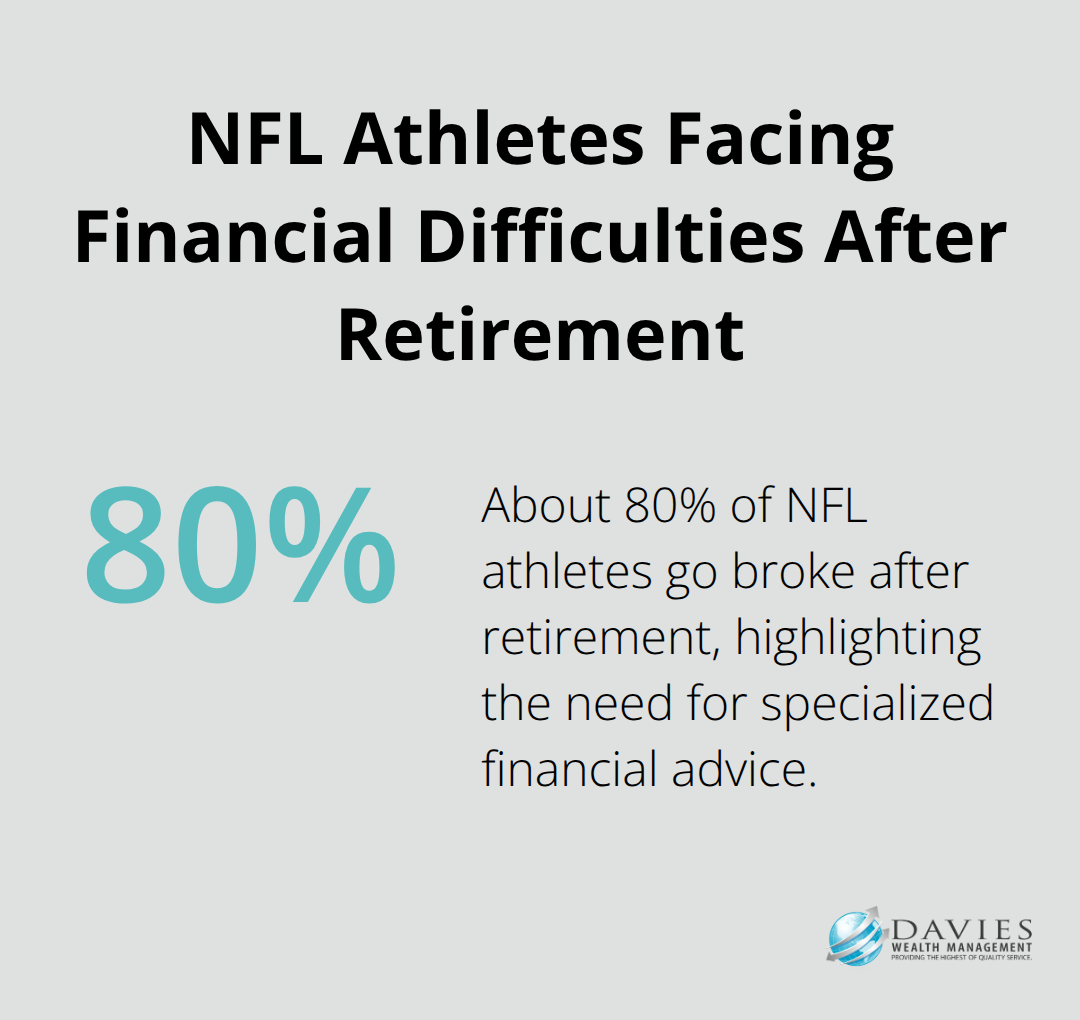

An athlete’s financial advisor must understand the sports industry deeply. This includes knowledge of salary structures, contract negotiations, and the intricacies of endorsement deals. About 80% of NFL athletes go broke after retirement, highlighting the importance of finding an advisor with proven experience in the field.

Proactive Wealth Preservation Strategies

The best advisors for athletes don’t just manage money; they actively work to preserve and grow wealth. This involves creating diversified investment portfolios that can withstand market volatility and provide long-term stability.

Comprehensive Financial Planning

Athletes need more than just investment advice. They require a holistic approach to financial planning that encompasses everything from budgeting and tax planning to retirement strategies and estate planning.

Clear Communication Skills

A top-tier advisor will help athletes navigate the complexities of multi-state taxation, develop strategies for post-career income, and create plans for philanthropic endeavors. They should also excel at explaining complex financial concepts in simple terms, ensuring athletes can make informed decisions about their money.

Fiduciary Responsibility

An ideal financial advisor for athletes must act as a fiduciary, always putting the client’s interests first. A fiduciary financial advisor can help athletes make smart decisions regarding their paycheck, investments, taxes, and savings. This commitment to ethical practice ensures that the advice given is unbiased and solely focused on the athlete’s financial well-being.

The next section will explore some of the top athlete financial advisors in Stuart, FL, who exemplify these qualities and provide exceptional service to their sports professional clients.

Top Athlete Financial Advisors in Stuart, FL

VK Wealth Management: A Leader in Athlete Finance

Stuart, Florida hosts some of the most experienced and specialized advisors in the field of athlete finance. VK Wealth Management stands out as a leader in this niche. The firm is focused on organizing and helping simplify the financial lives of affluent clients so they can pursue what is most important to them. Their approach adapts to each athlete’s unique situation, taking into account factors such as career length, injury risk, and post-retirement planning.

VK Wealth Management offers a comprehensive suite of services designed specifically for athletes. These include:

- Contract negotiation support

- Tax optimization strategies for multi-state earnings

- Investment plans that balance current lifestyle needs with long-term financial security

The firm’s advisors work closely with athletes to create budgets that account for the irregular income patterns common in professional sports.

Personalized Strategies for Long-Term Success

Top advisors in Stuart excel at crafting personalized financial strategies. For example, some wealth management firms employ strategies to help manage the irregular income patterns common in professional sports. This approach helps manage the feast-or-famine nature of athletic income by providing a consistent monthly income, regardless of when large contract payments or bonuses arrive.

These advisors also emphasize the importance of diversification. They guide athletes in building investment portfolios that include a mix of stocks, bonds, real estate, and alternative investments. This balanced approach protects wealth against market volatility and provides multiple streams of income for life after sports.

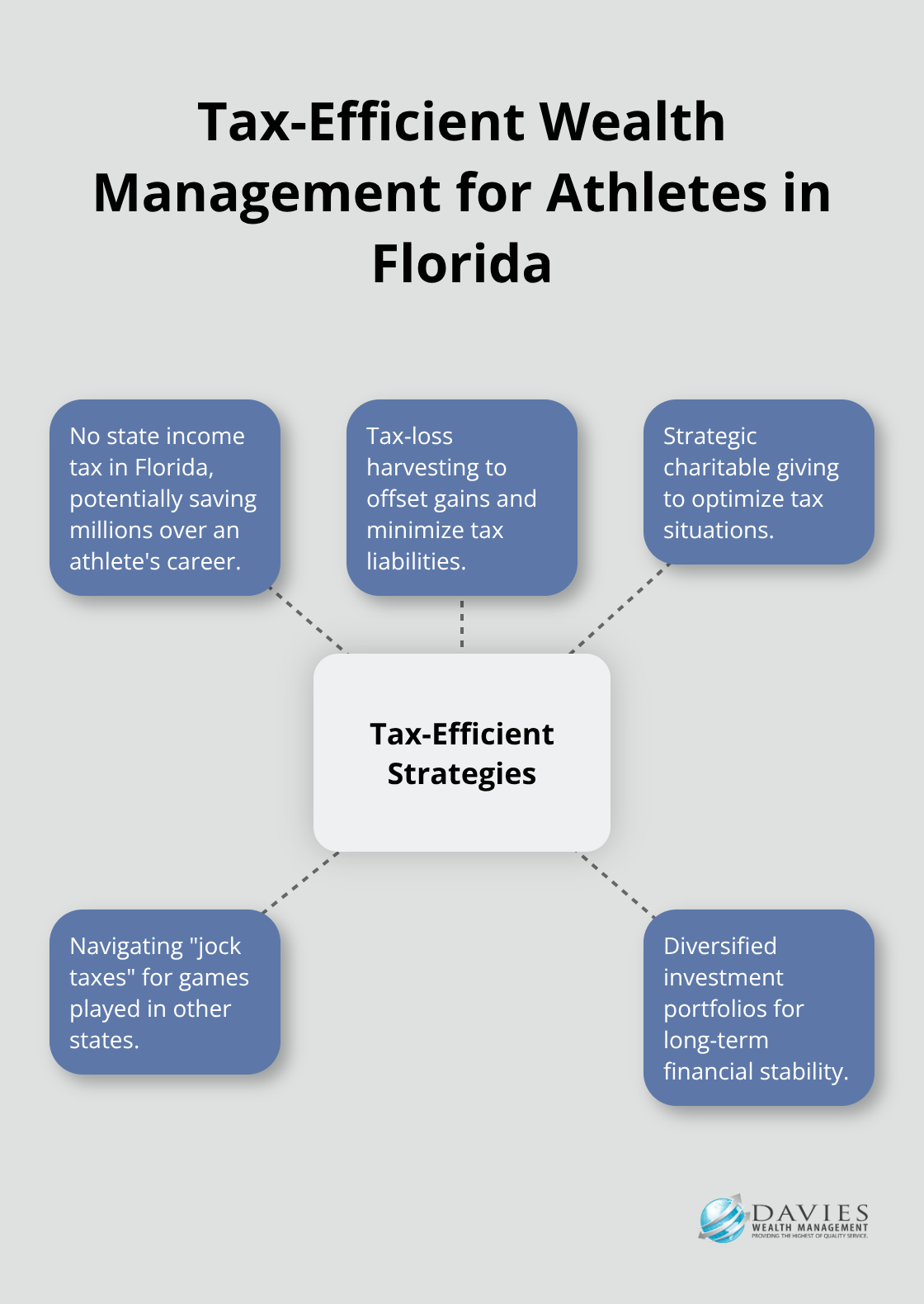

Expertise in Tax-Efficient Wealth Management

Tax planning forms a critical component of financial management for athletes, especially given Florida’s advantageous tax environment. Top advisors in Stuart know strategies to minimize tax liabilities while maximizing wealth accumulation. They employ techniques such as tax-loss harvesting and strategic charitable giving to optimize their clients’ tax situations.

Many pro athletes that make big money choose to live in a state with no state income tax, potentially saving millions over the course of their careers. Advisors also assist with navigating the complexities of jock taxes, ensuring compliance while minimizing unnecessary payments.

Preparing for Life After Sports

The best financial advisors for athletes in Stuart place a strong emphasis on post-career planning. They work with their clients to develop skills and interests that can lead to successful second careers or business ventures. This might include guidance on:

- Starting businesses

- Making strategic real estate investments

- Pursuing further education

These advisors also help athletes build robust emergency funds and insurance portfolios to protect against career-ending injuries or other unforeseen circumstances. By planning for multiple scenarios, they ensure their clients prepare for whatever the future may hold.

In the competitive world of professional sports, having a top-tier financial advisor can make the difference between long-term financial success and post-career struggles. Financial difficulties after sport are a real concern, as seen in cases like Mike Tyson’s financial challenges. The specialized services offered by wealth management firms in Stuart provide athletes with the expertise and personalized strategies they need to secure their financial futures both during and after their playing days.

Final Thoughts

Professional athletes face unique financial challenges that require specialized guidance. An athlete financial advisor in Stuart, Florida must understand sports contracts, manage irregular income patterns, and prepare for post-career life. These advisors should maximize earnings during peak years, implement tax-efficient strategies, and develop robust financial plans for life after sports.

Davies Wealth Management offers personalized financial planning strategies tailored to the complexities of an athlete’s career. Their team provides comprehensive services, including investment management and tax-efficient strategies, to help athletes make informed financial decisions. They equip athletes with the tools and expertise needed to secure long-term financial stability.

Athletes who want to take control of their financial future should act now. Partnering with a knowledgeable financial advisor (like those at Davies Wealth Management) can help athletes make the most of their earnings and set themselves up for success long after their playing days end. The right advisor can provide the guidance and support needed to achieve lasting financial security.

Leave a Reply