Stuart, Florida offers unique opportunities and challenges for building wealth. The city’s growing population and proximity to major metropolitan areas create distinct financial planning considerations.

We at Davies Wealth Management understand the local economic landscape that shapes your financial decisions. This guide covers investment strategies, retirement planning, and estate considerations specific to Stuart residents.

What Makes Stuart Financial Planning Different?

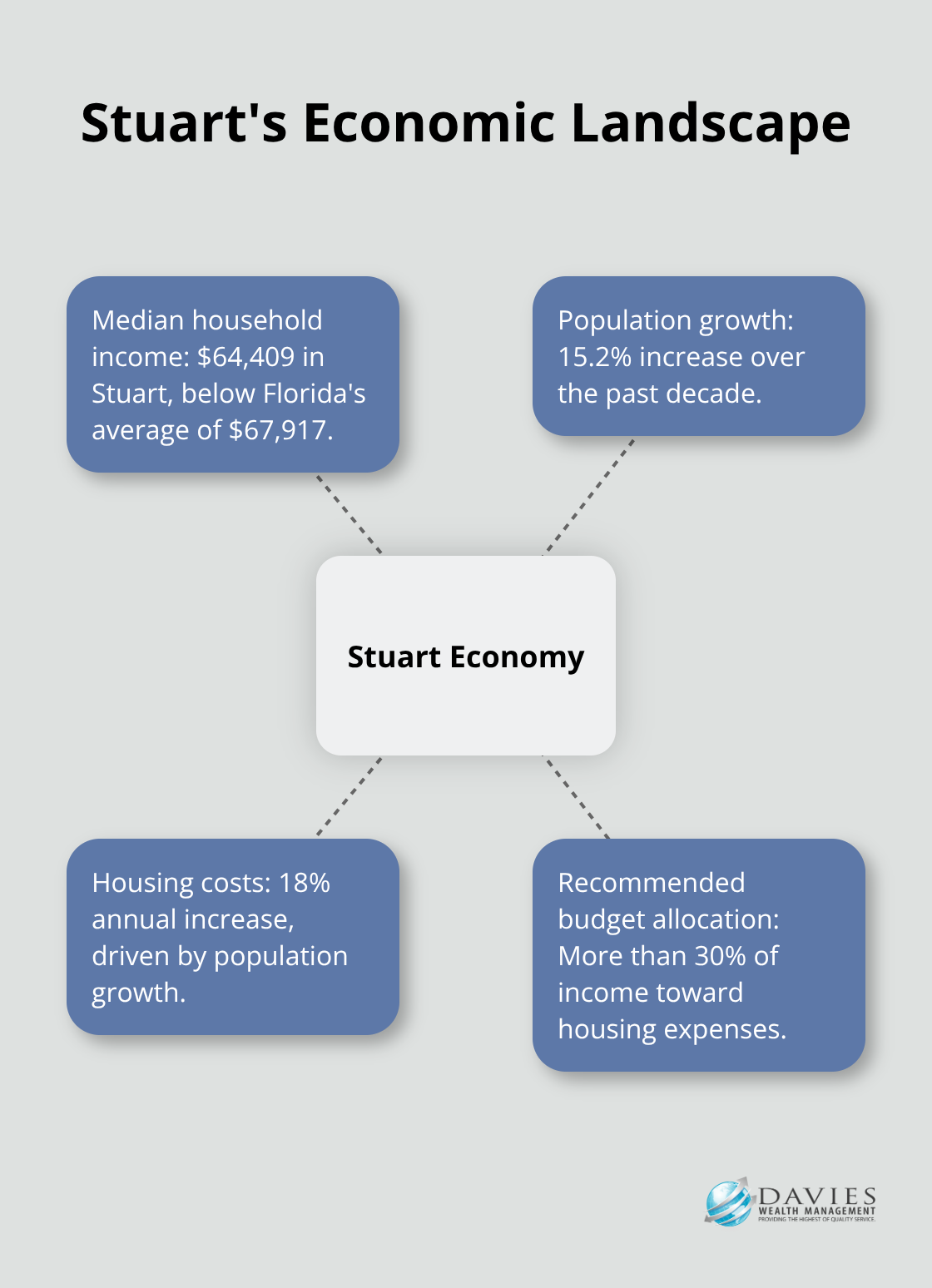

Stuart’s median household income of $64,409 sits below Florida’s average of $67,917, which creates specific budget pressures for residents. The city’s 15.2% population growth rate over the past decade has driven housing costs up by 18% annually and forces many families to allocate more than the recommended 30% of income toward housing expenses. A solid financial plan in Stuart must address three non-negotiable components: an emergency fund that covers six months of expenses, a debt elimination strategy that targets high-interest credit cards first, and tax-advantaged retirement savings through 401k plans that capture full employer matches.

Housing Cost Management Strategies

Stuart residents face unique challenges with property insurance costs. Martin County property taxes average 0.84% of assessed value and require homeowners to budget approximately $4,200 yearly on a $500,000 home. Smart financial plans involve separate savings accounts specifically for insurance and tax payments, which prevent these large annual expenses from derailing monthly budgets. Consider flood insurance separately, as standard homeowner policies exclude flood damage that affects 23% of Stuart properties (according to FEMA flood maps).

Income Diversification in Tourism-Heavy Economy

Stuart’s economy relies heavily on tourism and marine industries, which creates seasonal income fluctuations for workers. Service industry workers often experience 20-30% income drops during summer months when tourist activity decreases. Financial plans must include income smoothing strategies such as seasonal savings accounts and side income development during peak earning periods. Local economic data shows marine industry jobs pay 15% above service sector averages, which makes skills training in boat maintenance and marine services a practical wealth-building strategy for motivated residents.

These local economic realities shape how Stuart residents approach investment decisions and portfolio construction, particularly when it comes to balancing growth potential with the stability needed to weather seasonal income variations.

Investment Strategies for Stuart Residents

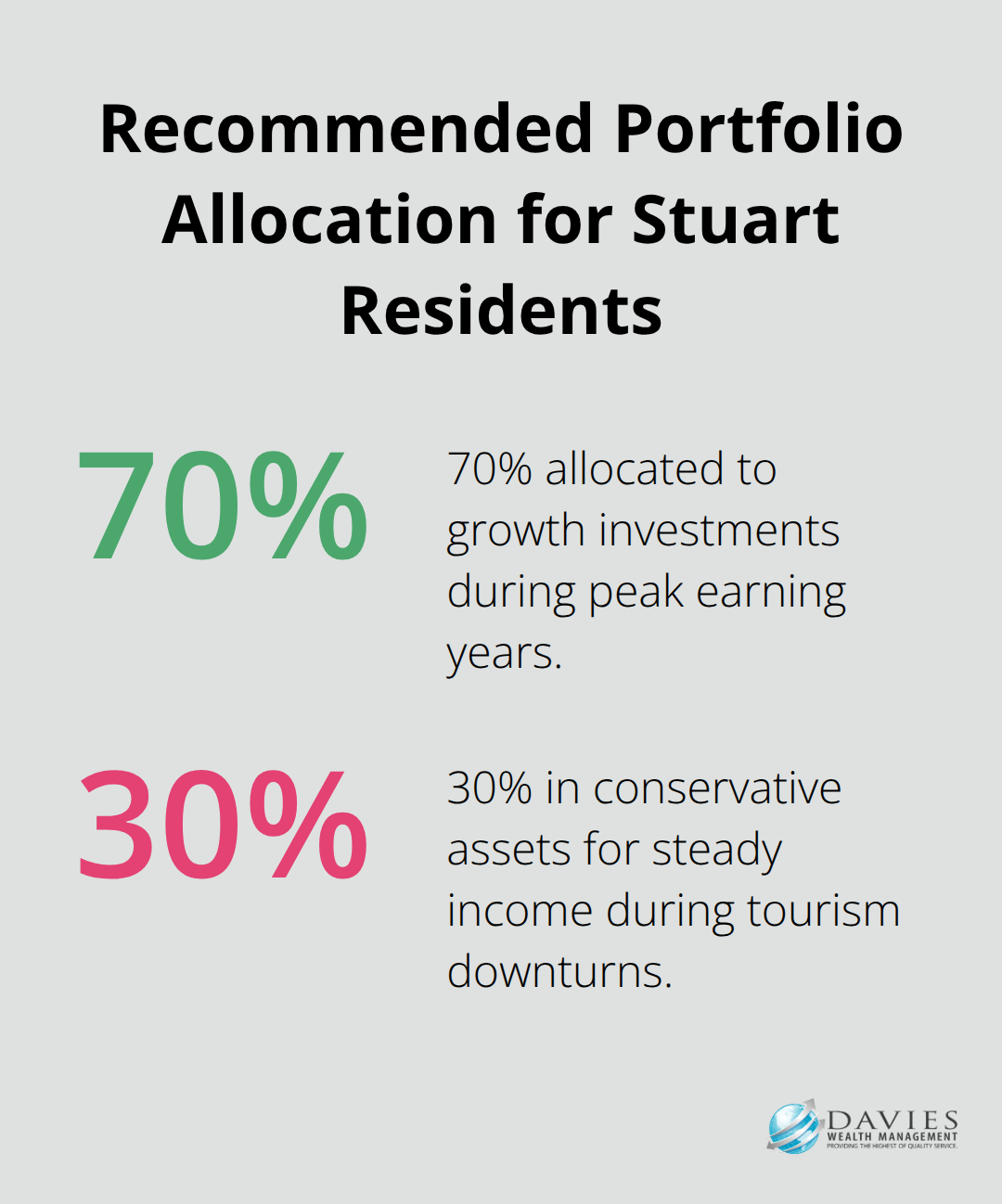

Stuart residents need aggressive portfolio diversification to combat seasonal income fluctuations affecting the local workforce. A properly structured portfolio allocates 70% to growth investments during peak earning years, with 30% in conservative assets that generate steady income during tourism downturns. Real estate investment trusts focused on Florida commercial properties provide monthly dividends that average 4.2% annually (according to Nareit data), while they maintain exposure to the state’s growing population. Technology sector ETFs like VTI have delivered 12.8% average returns over the past decade, which makes them suitable core holdings for working-age Stuart residents who can weather short-term volatility.

Florida Tax Advantages Transform Investment Returns

Florida’s zero state income tax creates massive opportunities for high-income earners to maximize investment returns. Roth IRA conversions become particularly powerful since retirees avoid state taxes on converted amounts that would cost California residents up to 13.3% in state taxes alone. Municipal bonds from other states often yield higher after-tax returns for Florida residents compared to Treasury securities, with New York municipal bonds currently offering 3.8% tax-free yields. Max out 401k contributions first to capture employer matches, then prioritize Roth accounts for younger investors who expect higher future tax rates.

Local Advisory Relationships Provide Competitive Advantages

Stuart-based advisors provide access to local investment opportunities that national firms miss entirely. Martin County development projects and marine industry investments require insider knowledge of permit processes and seasonal business cycles that remote advisors cannot provide. Fee-only advisors provide significant advantages over commission-based brokers, which makes the advisor selection process critical for long-term wealth accumulation. Local advisors also understand Florida homestead exemptions and can structure investment accounts to protect assets from potential creditors while they maintain liquidity for opportunities in Stuart’s economy.

Tax-Advantaged Account Optimization

Florida residents should maximize contributions to tax-deferred accounts before they consider taxable investments. The state’s tax structure allows workers to contribute the full $23,000 to 401k plans in 2024 without state tax consequences on withdrawals. Health Savings Accounts offer triple tax advantages for Florida residents who qualify, with contributions that reduce federal taxes and withdrawals that remain tax-free for medical expenses. These accounts become powerful retirement tools after age 65 when non-medical withdrawals face only ordinary income tax rates.

The foundation of smart investment strategy connects directly to retirement planning, where Florida’s unique tax benefits create even more opportunities for wealth preservation and growth during your golden years.

How Does Florida Transform Your Retirement Strategy?

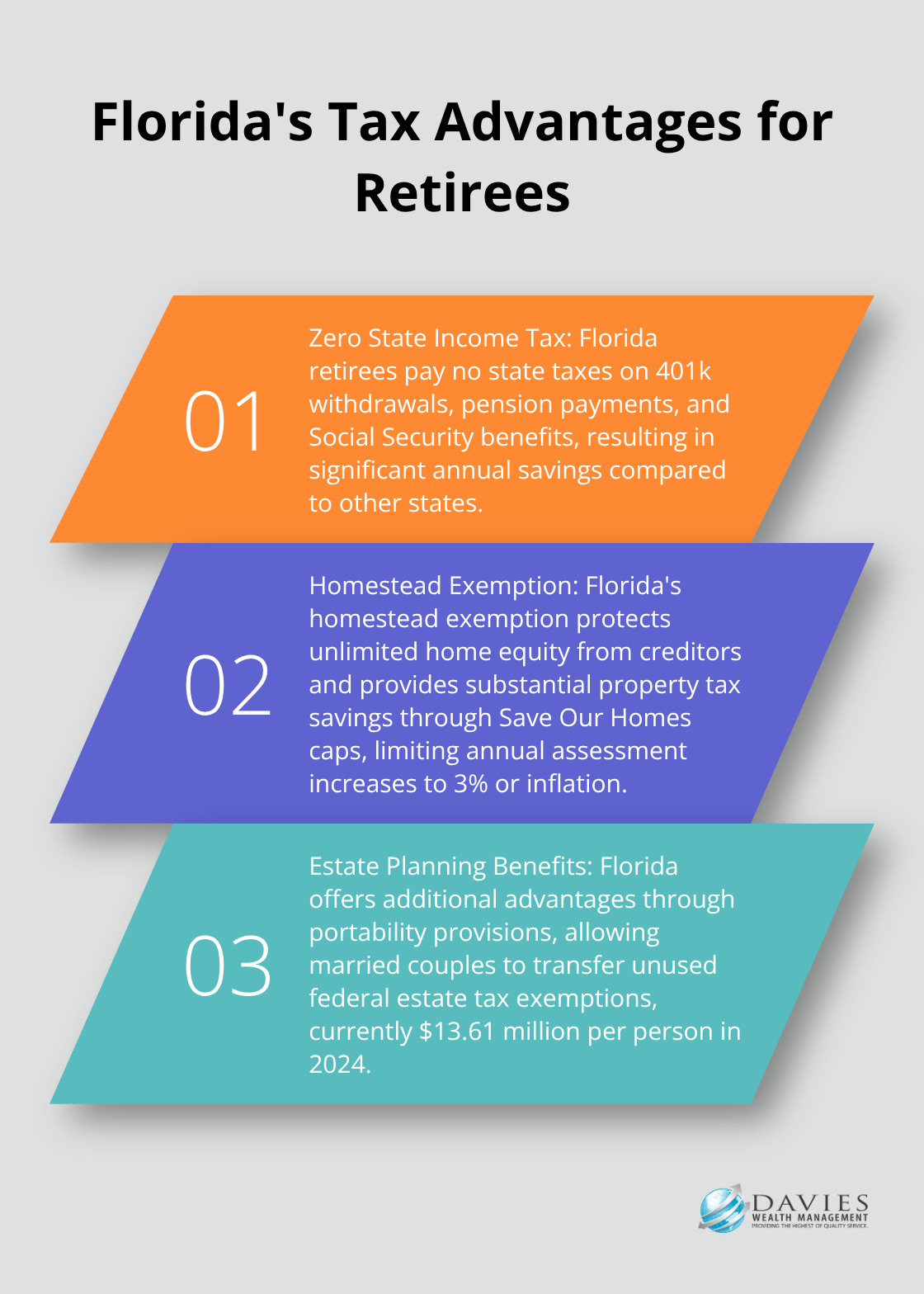

Florida retirees save massive amounts through strategic tax planning that other states cannot match. Zero state income tax means your 401k withdrawals, pension payments, and Social Security benefits avoid state taxation entirely, which saves California retirees significant amounts annually on retirement income. Roth IRA conversions become exceptionally powerful since Florida residents pay only federal taxes on converted amounts, while New York residents face combined rates that reach high percentages on conversions. Smart retirees time these conversions during low-income years to minimize federal tax impact while they build tax-free retirement wealth.

Estate Planning Advantages Through Homestead Protection

Florida homestead exemption protects unlimited home equity from creditors and provides substantial property tax savings through Save Our Homes caps that limit annual assessment increases to 3% or inflation (whichever is lower). This protection requires Florida residency through voter registration, driver license conversion, and more than six months annually in-state. Married couples gain additional advantages through portability provisions that allow spouses to transfer unused federal estate tax exemptions, currently $13.61 million per person in 2024.

Trust Structures for Asset Protection

Trust structures become critical for non-Florida assets since homestead protection only covers primary residences. Revocable trusts become necessary for vacation properties and investment accounts that fall outside homestead protection. Irrevocable trusts can protect assets while they qualify for Medicaid benefits after five-year look-back periods expire.

Long-Term Care Planning Requirements

Florida Medicaid has strict asset limits of $2,000 for individuals, which makes immediate planning necessary for long-term care costs. Proper planning through specialized trusts can protect assets while residents qualify for benefits, but these strategies require professional guidance to navigate complex federal and state regulations that change frequently.

Final Thoughts

Financial planning in Stuart requires strategies that address local economic realities national approaches often overlook. The city’s seasonal income fluctuations, rising housing costs, and tourism-dependent economy demand specialized approaches that account for these unique challenges. Stuart residents who succeed financially focus on emergency funds that cover seasonal income gaps, diversified investment portfolios that balance growth with stability, and tax-advantaged retirement strategies that maximize Florida’s zero state income tax benefits.

The homestead exemption and estate planning advantages create additional wealth-building opportunities unavailable in other states. Professional guidance becomes essential when you navigate complex decisions around Roth conversions, trust structures, and long-term care planning (local advisors understand Martin County’s specific economic conditions and can identify opportunities that remote firms miss entirely). Local expertise transforms complex financial decisions into clear action plans.

We at Davies Wealth Management help Stuart residents navigate seasonal income challenges and optimize Florida’s tax advantages through personalized financial strategies. Our approach addresses local economic conditions while we build long-term financial security for our clients. Professional financial guidance transforms complex decisions into clear action plans that build wealth in Stuart’s unique economic environment.

Leave a Reply